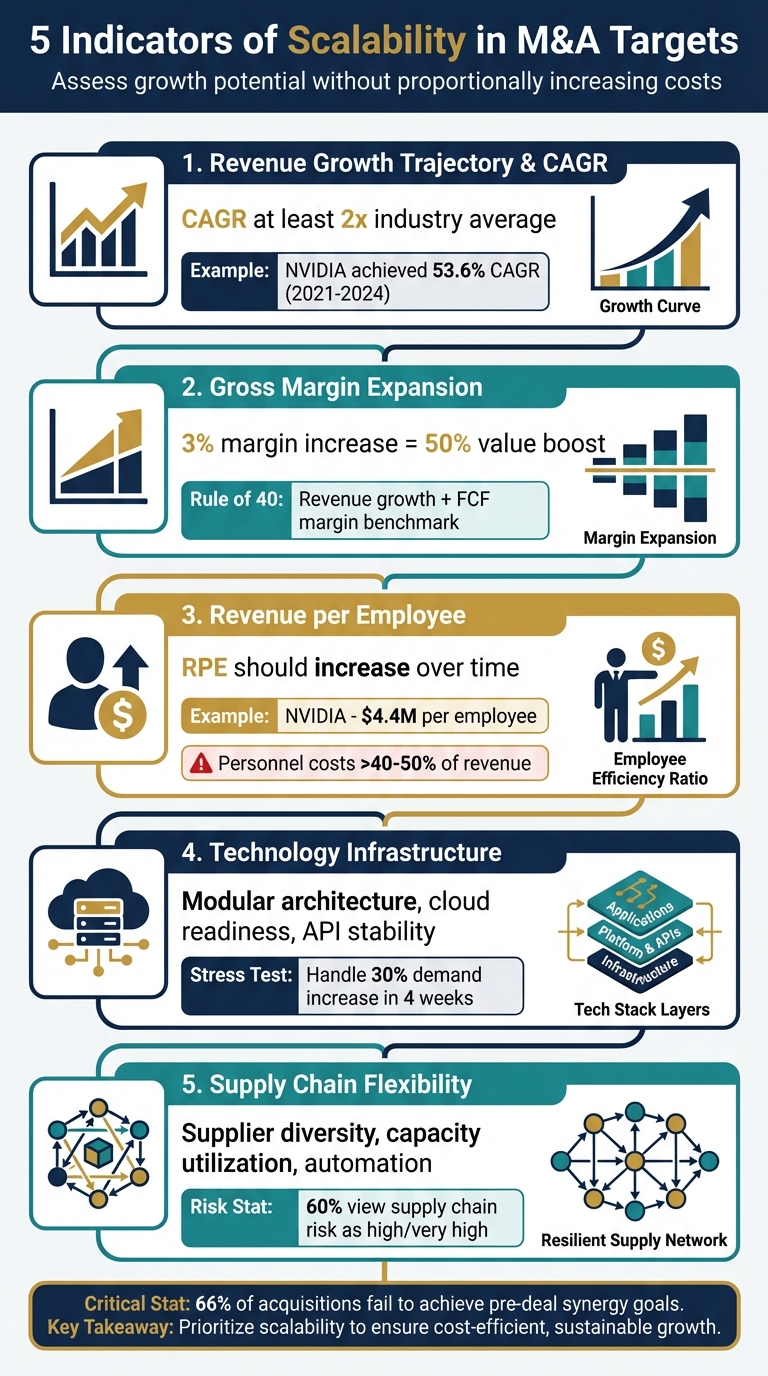

When evaluating M&A (mergers and acquisitions) targets, scalability is a critical factor for ensuring growth without proportionally increasing costs or complexity. A scalable business can grow revenue efficiently, making it a more attractive and profitable acquisition. Here are the five key indicators to assess scalability:

- Revenue Growth Trajectory and CAGR: Consistent revenue growth and a strong compound annual growth rate (CAGR) compared to industry benchmarks indicate potential for sustained expansion.

- Gross Margin Expansion: Improving gross margins show the ability to grow revenue faster than costs, reflecting pricing power and operational efficiency.

- Revenue per Employee: Higher revenue per employee signals efficient use of resources and systems that support growth without adding excessive headcount.

- Technology Infrastructure: Scalable technology systems, such as modular architecture and cloud readiness, ensure the business can handle increased demand without performance issues or cost spikes.

- Supply Chain Flexibility: A resilient supply chain with diverse suppliers and the capacity to manage demand surges without disruptions is essential for growth.

These metrics help identify businesses that can scale efficiently, avoid stagnation, and deliver long-term value. By focusing on these indicators during due diligence, acquirers can make informed decisions and improve the likelihood of achieving revenue and cost synergy goals.

5 Key Indicators of Scalability in M&A Targets

1. Revenue Growth Trajectory and CAGR

A steady climb in revenue is a strong indicator that a company has the potential to scale. Revenue growth reflects increasing demand, a loyal customer base, and the ability to meet market needs effectively. By examining several years of revenue data, you can uncover trends in market behavior and gauge a company’s ability to sustain and predict future growth.

One of the most reliable metrics for this analysis is the compound annual growth rate (CAGR), which helps smooth out year-to-year fluctuations. For instance, NVIDIA Corporation’s stock surged from $29.36 per share in December 2021 to $134.26 per share in December 2024, achieving a CAGR of 53.6%. This kind of growth showcases a company’s ability to maintain long-term momentum.

Compare the target’s CAGR to industry benchmarks. In M&A evaluations, a standout growth profile often means a historical CAGR that is at least twice the industry average. For example, if a company grows at 25% while its industry peers average 30%, it falls short of expectations. Companies pursuing programmatic M&A strategies – those making five or more acquisitions annually – tend to grow at twice the rate of selective acquirers. Understanding what constitutes strong performance in your target’s sector is essential, and this evaluation should also consider operational costs alongside revenue growth.

Ensure that costs don’t grow in lockstep with revenue. If costs rise at the same rate as revenue, scalability is compromised. Instead, look for metrics like increasing revenue per employee over time, which signals efficient scaling without simply adding headcount. For early-stage, high-growth companies, revenue growth remains the key measure of scalability.

2. Gross Margin Expansion and Profitability Metrics

Gross margin expansion is a key indicator of whether a company can grow revenue faster than its costs. When a business manages to improve margins as it scales, it demonstrates strong pricing power, efficient cost management, and the ability to distribute fixed costs over a larger revenue base. This is what sets apart scalable businesses from those that merely grow expenses and headcount in direct proportion to revenue.

The impact of margin improvements is substantial: a 3% increase in operating margin – from 6% to 9% – can raise company value by 50%. In private-equity acquisitions, operating-profit margins typically grow by an average of 2.5 percentage points more than comparable companies. These gains often justify higher acquisition prices.

"A scalable business model enables disproportionate growth without a linear increase in costs." – Viaductus

Stronger margins often reflect automation and better cost control. When operational metrics improve alongside margins, it shows a company can scale without requiring a proportional increase in labor costs. For software and subscription-based businesses, the Rule of 40 – the sum of revenue growth and free cash flow margin – has become a critical valuation benchmark. Companies surpassing this threshold achieved a 9.7x revenue multiple as of July 2023.

During due diligence, it’s essential to conduct a gross-margin bridge-to-EBIT analysis to separate one-time items and identify the true drivers of profitability. Simulate cost trajectories under different growth scenarios to assess scalability; if costs rise linearly with revenue, scalability may be limited. Ideally, look for businesses with high fixed costs and low variable costs, where additional revenue contributes directly to profits after reaching the break-even point. This detailed analysis works hand-in-hand with other scalability metrics to assess operational efficiency and growth potential.

3. Revenue per Employee and Operational Efficiency

Revenue per employee (RPE) measures how much income a company generates per worker, offering a clear view of whether the business can grow without needing to expand its workforce at the same pace. A scalable business should see its RPE increase over time, signaling that revenue growth is outpacing headcount expansion. This metric cuts through superficial figures, highlighting whether a company has implemented systems, automation, and processes to operate efficiently with fewer resources. Let’s look at some examples that bring this concept to life across different industries.

Take NVIDIA, for instance. In January 2025, the company reported an impressive RPE of $4,408,784, with 29,600 employees generating $130.5 billion in annual revenue. NVIDIA achieved this by outsourcing manufacturing and concentrating its internal workforce on high-value tasks like AI chip design. This focus allowed the company to scale revenue by 78% year-over-year while keeping its team lean. On the other hand, VICI Properties reported an astonishing $142,592,593 in RPE in 2024, with just 27 employees. This real estate investment trust operates as a landlord for casino properties, where tenants manage their own operations. By decoupling revenue from internal labor, VICI created a highly efficient business model.

If a company’s personnel costs exceed 40–50% of its revenue or if headcount grows in direct proportion to revenue, it indicates a lack of automation and scalable processes. When evaluating RPE, it’s crucial to focus on trends rather than just the raw numbers, comparing the company’s trajectory to its industry peers. For example, over a 15-year span ending in 2025, Quanta Services demonstrated its scalability by growing revenue at twice the rate of its headcount. This success was driven by strategic workforce development initiatives, showcasing how thoughtful operational design can drive efficiency. Aligning revenue growth with workforce efficiency is a clear indicator of a business’s ability to scale effectively.

4. Technology Infrastructure and Systems Compatibility

When evaluating scalability, it’s not just about financial and operational metrics – technology infrastructure plays a critical role too. A target’s technology stack can either fuel growth or become a roadblock when demand surges. The real question isn’t whether the systems work today, but whether they can handle a sustained 30% increase in demand (say, over a four-week period) without sacrificing performance or driving up costs. Acquirers must assess the product architecture, cloud infrastructure maturity, and the ease of integrating the target’s systems with their own. These factors are key to determining how smoothly the acquisition will merge into existing operations.

"Technical due diligence is the single biggest differentiator of deals done well – or poorly." – McKinsey

Start by scrutinizing product architecture and extensibility. Scalable systems often feature modular designs, stable APIs, well-defined domain boundaries, and multi-tenant readiness. These attributes allow for faster deployments and the ability to handle increased traffic without costly overhauls. On the infrastructure side, cloud maturity is another critical factor. Stress-test the system’s response during demand spikes – if a 30% increase in concurrency over four weeks leads to missed service-level objectives or steep cost hikes, that’s a red flag. Pay attention to metrics like costs per API call, account, or order, and compare on-demand versus reserved cloud pricing to protect profit margins during growth.

Systems compatibility is crucial for realizing operational synergies after the deal closes. Assess how well the target’s core platforms, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems, will integrate with your own infrastructure. Poor integration can lead to expensive delays or even force you to rebuild incompatible systems, consuming both time and resources. Worse, overlooked gaps in intellectual property can surface, creating additional challenges.

Don’t overlook data management and cybersecurity readiness during your evaluation. Scalable companies tend to have unified identifiers, governed data lakes, and high-quality data to enable analytics and decision-making at scale. On the security side, confirm that the target’s defenses are solid – cyberattacks often spike after acquisition announcements. Smaller companies are particularly at risk, so check for SOC 2 or ISO certifications and review their incident response strategies.

"Technology is the scaffolding that holds your growth story up – or the hairline crack that gives way under load."

– Umbrex Commercial Due Diligence Playbook

sbb-itb-798d089

5. Supply Chain Flexibility and Operational Readiness

While financial and technological metrics highlight scalability, the supply chain is where the rubber meets the road. A flexible supply chain can handle sudden demand spikes or unexpected disruptions without compromising quality or inflating costs. The ability to double output without breaking under pressure often boils down to factors like supplier diversity, production capacity, and overall operational flexibility. To gauge this, acquirers should stress-test the supply chain with simulated challenges: What happens if a critical supplier goes offline? Can the company manage a surge in orders without stockouts or skyrocketing freight costs?

Start by evaluating supplier dependency and diversification. Relying too much on a single supplier for critical components can spell trouble. For instance, between 2020 and 2022, Physicians Choice experienced prolonged lead times and stockouts, underscoring the importance of dual-sourcing for essential items. Having multiple suppliers for key components isn’t just a luxury – it’s a necessity to safeguard against potential disruptions.

"A supply chain that relies too heavily on a single supplier or faces logistical challenges could create vulnerabilities post-acquisition." – Umbrex

Next, assess capacity utilization and the readiness for automation. Comparing actual production rates to theoretical maximum capacity can reveal bottlenecks. Companies poised for growth often leverage automation to scale efficiently, reducing reliance on manual labor. In contrast, businesses where personnel costs exceed 40–50% of revenue may struggle to scale without significant cost increases.

Operational metrics also provide key insights into scalability. Metrics like accurate order picking, high order fill rates, and robust inventory controls are hallmarks of a supply chain ready for growth. Companies with strong supply chain performance tend to outpace industry revenue growth 79% of the time.

External resilience is equally crucial. By 2025, over 60% of businesses surveyed viewed global supply chain risk as high or very high, with nearly a third of disruptions costing more than $5 million each. The 2021 Suez Canal blockage – a six-day event that disrupted $9.6 billion in daily trade – highlights how a single incident can ripple through global supply chains. To mitigate such risks, ensure the target has updated continuity plans, diversified sourcing strategies, and real-time systems for detecting disruptions. By aligning supply chain resilience with financial and operational metrics, acquirers can gain a complete picture of scalability.

Evaluating Scalability Across Target Types

Different types of acquisition targets demand tailored evaluation criteria. A weighted scorecard is a practical tool for objectively ranking these targets by converting strategic signals into numerical scores. As Umbrex highlights in their M&A Execution Toolkit:

"A robust scorecard translates corporate strategy into a ranked list of ‘fit’ signals and ‘kill’ signals, converted into numbers so personal bias has nowhere to hide".

The metrics you choose for your scorecard should reflect the maturity of the target company. For early-stage businesses, focus on factors like revenue growth and gross margin. For more mature companies, prioritize metrics such as ROIC, ROE, EBITDA margins, and free cash flow. Early-stage, high-growth companies might not yet be profitable, but their trajectory and unit economics often tell a more compelling story. McKinsey’s Alok Bothra explains:

"Using ROIC or ROE as primary indicators of performance… may make sense when assessing a mature target but not so much when evaluating a high-growth, early-stage company".

To make your scorecard effective, use clear definitions for each score, and assign weights to each criterion based on your strategic goals. For example, a "5" for growth might mean a historical CAGR at least twice the industry average, while a "3" could represent industry-average growth. Typical weightings might include 25% for strategic adjacency, 15% for growth profile, and 10% for technology quality. Begin with binary gates for essential criteria before moving into weighted scoring.

If you’re evaluating tech-focused targets, consider a Weighted Digital Maturity Score. This score measures elements like architecture, data capabilities, and platform reliability on a 0–5 scale. The weighting will depend on the business model. For instance, in B2B SaaS, architecture might carry a 20% weight, while marketplaces may prioritize ecosystem strength and trust mechanisms at 15% each. Collaboration across functional teams is crucial to ensure accurate scoring and consensus.

This structured approach not only helps rank targets but also sets the stage for identifying integration synergies during due diligence. By aligning the scorecard with scalability goals, you can streamline the acquisition process and make informed decisions.

Integration Readiness and Scalability Synergies

Once scalability metrics are confirmed, the next step is integrating operations to maximize potential. Integration planning should start during the due diligence phase to ensure synergy estimates align with real-world operations. Companies that prioritize integration see shareholder returns that are 6 to 12 percentage points higher compared to those that treat it as an afterthought.

Scalable acquisitions typically deliver four key synergies: revenue growth, cost savings, operational improvements, and financial benefits. A standout example is Dell‘s $67 billion acquisition of EMC, which generated multibillion-dollar revenue synergies in its first year by immediately cross-selling products.

Addressing technology integration early is crucial, as 83% of failed acquisitions cite integration challenges as a primary issue. Start by assessing system compatibility and consolidating customer-facing platforms before tackling back-office systems. Using digital clean rooms can help streamline processes for Day 1 readiness. This proactive approach can also prevent the common 8% sales dip that often occurs in the quarter following a deal announcement, while laying the groundwork for supply chain benefits.

Supply chain consolidation is another area where scalability can deliver immediate results. For instance, Exxon and Mobil saved over $5 billion by eliminating 2,400 overlapping assets, which increased their purchasing power and capacity. Setting ambitious targets for these synergies pays off – acquirers who do so achieve cost synergies that are 10% higher than their internal estimates and 18% above publicly announced guidance.

Quick wins are essential. Focus on integrating sales channels, consolidating vendors, and optimizing facilities right away. Involving business leaders early ensures synergy estimates are aligned with operational realities, supporting both immediate results and long-term scalability. Strong integration planning is the foundation for achieving the scalable growth identified in earlier stages.

Conclusion

Scalability plays a key role when it comes to driving sustainable business growth. It allows companies to increase revenue without a matching rise in costs, creating a pathway to long-term success. The five indicators discussed – revenue growth trajectory, gross margin expansion, revenue per employee, technology infrastructure, and supply chain flexibility – are critical in shifting a business from being overly reliant on its founders to a system-focused operation.

"Scalability, in the context of buying and selling a business, refers to a company’s ability to add significant revenue and not be constrained by its own structure and resources." – Divestopedia

Assessing these factors can help buyers steer clear of the "revenue ceilings" that often hinder private companies lacking the systems to handle rapid growth. A scalable business not only lowers operational risks but also ensures stability during leadership transitions or sudden demand spikes. These metrics are essential for identifying acquisition targets with the potential for sustainable and efficient growth.

Interestingly, nearly 66% of acquisitions fail to achieve their pre-deal goals for revenue and cost synergies, underscoring the importance of focusing on scalability during mergers and acquisitions. Prioritizing scalability isn’t just about spotting opportunities for growth – it’s about ensuring those opportunities can support cost-efficient expansion that delivers real, lasting value over time.

FAQs

What should you look for to determine if a potential M&A target is scalable?

Scalability is all about a company’s capacity to increase revenue and overall value without being held back by its existing resources – like workforce, processes, or technology. Businesses that are scalable typically have well-organized systems, efficient operations, and a leadership team equipped to handle growth. This makes them especially appealing to potential buyers.

Here are some key elements to consider:

- Strong leadership: A team with the expertise to drive strategic growth and maintain solid financial performance.

- Efficient operations: Standardized processes and cohesive branding that streamline workflows and improve productivity.

- Advanced technology: A reliable tech setup that enables automation and delivers real-time insights into performance.

- Adaptable supply chains: Flexible production and supply systems that can handle growth without hitting major roadblocks.

Deal Memo’s on-demand Confidential Information Memorandum (CIM) services can help articulate these scalability strengths, making it easier to highlight the growth potential of your business to investors and buyers.

Why is technology infrastructure crucial for scaling a business in M&A?

Technology infrastructure is a critical factor in determining how well an acquisition target can handle growth. A solid IT framework allows businesses to expand without driving up costs unnecessarily. Tools like cloud-based platforms, advanced data systems, and robust cybersecurity measures help streamline operations, automate workflows, and manage increasing demand – all while maintaining efficiency.

When evaluating a potential acquisition, due diligence often includes a close look at the target’s IT systems. This process helps identify both challenges in integration and opportunities for scalability. For instance, a unified and efficient system with features like real-time performance tracking and clearly documented processes can make mergers smoother and reduce complications. On the flip side, outdated or disjointed technology can lead to bottlenecks, higher expenses, and a lower overall deal value. In essence, strong technology infrastructure is not just about supporting immediate growth – it’s also about setting the stage for long-term success across the combined organization.

Why is supply chain flexibility important for scaling a business after an acquisition?

A flexible supply chain plays a critical role in scaling a business. It enables companies to respond swiftly to shifts in demand, sidestep potential disruptions, and align effortlessly with the operations of an acquiring company. By adjusting shipment routes, changing suppliers, or managing inventory levels, a well-structured supply chain ensures smooth operations and keeps costs under control during periods of growth.

For businesses involved in acquisitions, having a supply chain that can adjust to changing circumstances minimizes integration risks. It also supports the combined entity’s ability to scale efficiently, helping maintain profitability and service quality while tackling post-acquisition challenges or entering new markets.