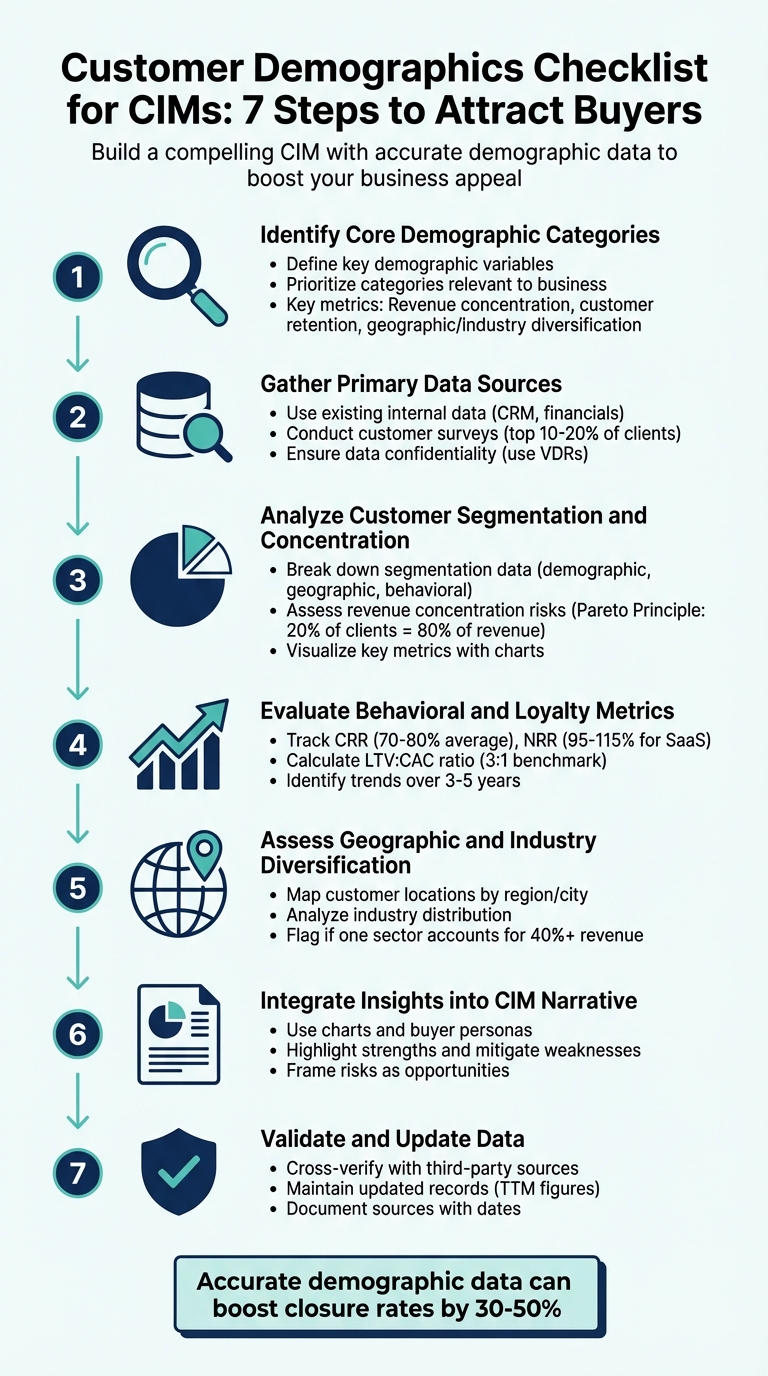

Want to create a CIM that attracts buyers? Start with your customer demographics.

Buyers care about stability, growth potential, and risk. By analyzing customer demographics like revenue concentration, retention rates, and geographic diversity, you can showcase your business’s strengths and address risks upfront. Here’s how to do it:

- Focus on key metrics: Revenue from top customers, customer retention rates, and geographic/industry diversification.

- Use internal data and surveys: Leverage CRM records, financials, and customer feedback to build a clear profile.

- Segment your customer base: Group by revenue, location, and behavior to identify trends and opportunities.

- Highlight risks and solutions: Address customer concentration or declining metrics with clear strategies.

- Visualize data effectively: Use charts and personas to make insights accessible to buyers.

A well-prepared CIM with accurate demographic data can boost your business’s appeal and help you secure the best deal. Let’s dive into the details.

7-Step Customer Demographics Checklist for CIM Creation

Step 1: Identify Core Demographic Categories

Define Key Demographic Variables

The first step in crafting a compelling customer profile for your CIM is pinpointing the demographic variables that matter most to potential buyers. For B2B companies, focus on factors that directly impact business operations rather than traditional demographics. For example, buyers often want to see customer concentration data, such as the revenue share generated by the top 5–10 customers. A heavily concentrated revenue base can signal higher risk compared to a more diversified income stream.

Another critical metric is the length of customer relationships, which offers insight into retention rates. A loyal, long-term client base indicates stability and reduces acquisition risks. Additionally, breaking down revenue by geography, product type, and business segment can help identify key revenue drivers. These variables should be tailored to align with the specific concerns of buyers within your industry.

Prioritize Categories Relevant to the Business

Not all demographic categories hold equal importance. The key is to align your focus with what matters most to potential buyers. For SaaS and tech companies, this often means highlighting user types, geographic revenue breakdowns, technology stack details, and subscription tiers. In manufacturing, the emphasis might shift to client locations, product line diversity, and the industries served by your end markets.

"The banker prepares the CIM and uses it as a marketing document, which is intended to make the company look attractive as the objective is ‘not just to sell, but to sell for maximum value.’" – Tim Vipond, FMVA

Different buyers prioritize different metrics. Strategic buyers may focus on market share and how well the business integrates with their own operations, while financial buyers are more concerned with recurring revenue and cash flow stability. By tailoring your demographic categories to align with the preferences of your target buyer type, you create a narrative that truly resonates. For instance, if your business primarily serves large enterprises rather than a high volume of smaller customers, this distinction should be clearly outlined in your customer segmentation. Such clarity helps potential buyers quickly evaluate scalability and operational compatibility. This targeted approach ensures that the foundation is set for gathering precise and actionable data in the next steps.

Step 2: Gather Primary Data Sources

Use Existing Internal Data

Your internal systems are a treasure trove of reliable demographic information. CRM platforms and sales records offer insights into revenue trends, customer retention, and churn rates – metrics that potential buyers pay close attention to. Financial statements can further break down revenue by geography, product lines, and customer segments, providing a detailed picture of your business performance.

Management interviews are equally important. Investment bankers often kick off the process by meeting with top executives to uncover qualitative insights that raw numbers can’t provide. These conversations can shed light on customer behavior patterns and competitive standing, helping to round out the data. By combining these leadership insights with hard numbers, you can create a well-rounded customer profile. Just make sure the demographic projections in your Confidential Information Memorandum (CIM) align with historical sales data to maintain credibility.

Don’t stop there – enhance your internal data by collecting direct feedback from your customers.

Conduct Customer Surveys

Customer surveys can fill in the gaps that internal data might miss. Focus on your top revenue-generating customers, typically the top 10-20% of your client base. Ask targeted questions about their buying triggers, decision-making processes, and pain points. For example, questions like "What prompted you to seek a solution like ours?" or "Who makes the final purchasing decisions at your company?" can uncover patterns that refine your understanding of your customer demographics.

A great example of the power of customer surveys comes from Spotify. In 2017, they conducted an in-depth listener persona study to understand why users were willing to pay for music. They started by analyzing song preferences and then expanded their research to include surveys and interviews covering factors like age, income, family structures, and lifestyles. This comprehensive approach helped Spotify grow to 172 million paid subscribers by pinpointing the unique value users saw in their service.

To streamline the survey process, use CRM tools to automate deployment and data collection. But don’t rely solely on survey results – always cross-check feedback with internal CRM data and web analytics to ensure accuracy.

Once you’ve gathered these insights, it’s critical to protect the data you’ve collected.

Ensure Data Confidentiality

Safeguarding sensitive CIM data is non-negotiable. Instead of using email or generic cloud storage, opt for virtual data rooms (VDRs) to securely handle documents. These platforms give you control over who can access specific information and when. Implement a phased disclosure strategy: start with an anonymous teaser, progress to a redacted CIM after an NDA is signed, and save highly sensitive details – like customer names or tax records – for post-LOI (Letter of Intent) due diligence.

"The moment word gets out that your company might be for sale, you risk destabilizing the very asset you’ve worked so hard to build." – Doreen Morgan, Sunbelt Atlanta

To further protect your CIM, include a footer on every page stating that the document is governed by an NDA. Configure VDR settings to allow read-only previews in the early stages, preventing downloads or printing. Assign a unique ID to each CIM copy to track its distribution and identify potential leaks. When describing customer demographics, focus on the "economic moat" – the reasons customers remain loyal – rather than sharing raw data that competitors could exploit. Additionally, ensure your NDA includes non-solicitation clauses to prevent buyers from targeting your clients or employees with the information provided.

What Tools Do We Use to Segment a Market?

Step 3: Analyze Customer Segmentation and Concentration

After gathering your data, the next step is to dive into customer segmentation to uncover both risks and opportunities.

Break Down Segmentation Data

Once your data is in hand, sort it into meaningful categories. Start with demographic segmentation, where you group customers by key characteristics. For B2B scenarios, include firmographics such as industry type, company size, and annual revenue figures. Follow this with geographic segmentation, categorizing customers by location – whether by country, region, city, or even climate zone. Finally, layer in behavioral segmentation, which looks at factors like purchase history, buying frequency, and online activity.

By combining these data points, you can identify distinct customer groups, such as high-value frequent buyers or segments at risk of churn. A useful tool for this process is RFM analysis – a scoring system based on Recency (last purchase date), Frequency (how often purchases are made), and Monetary value (total spending). This method helps you pinpoint your "Best Customers" and those who may need attention. Ultimately, this analysis doesn’t just highlight who your customers are but also how they engage with your business.

Assess Revenue Concentration Risks

Revenue concentration is a critical factor for buyers, as it can indicate risk. A helpful framework here is the Pareto Principle, which often shows that 20% of your clients generate 80% of your revenue. To better understand this, create a tiered account structure:

- Tier 1: Top 10% of clients contributing the most revenue.

- Tier 2: The next 10% of clients in terms of revenue share.

- Tier 3: The remaining 80% of your customer base.

If a single client or a small group accounts for more than 40% of your revenue, it’s a potential red flag for buyers.

"20% of your clients generate 80% of your revenue. Your ICP should be based on these clients." – Andrei Zinkevich, Founder, Fullfunnel.io

If you identify high concentration risks, address them directly in your Confidential Information Memorandum (CIM). Include a brief explanation of mitigation strategies, such as diversifying your customer base or highlighting long-term contracts that reduce churn risk. Buyers value transparency, especially when paired with a proactive plan.

Visualize Key Metrics

Visual representations make it easier to communicate concentration risks and trends. Use pie charts to show customer diversification and bar charts to illustrate revenue and EBITDA trends over the last three to five years. For customer concentration, a simple table can be effective. List your top 5–10 customers, their revenue contribution percentages, and the length of your relationships.

These visuals should support your narrative, helping buyers quickly assess whether your revenue is spread across regions and industries or concentrated among a few key clients. When done effectively, this analysis strengthens your story of customer stability and overall market position.

Step 4: Evaluate Behavioral and Loyalty Metrics

Once you’ve segmented your customers, it’s time to dive into behavioral and loyalty metrics. These numbers offer a clear picture of long-term revenue potential, showing how well your business retains customers and drives repeat revenue.

Key Metrics to Track

Start with Customer Retention Rate (CRR) – this tells you the percentage of customers who stick around year after year. To calculate it, use the formula:

(Ending Customers – New Customers) ÷ Starting Customers × 100.

Most industries see averages between 70% and 80%, so aim to stay within or above that range.

Next up is Net Revenue Retention (NRR), which highlights changes in customer spending – whether they’re spending more, less, or the same. For SaaS businesses, an NRR between 95% and 115% is typical, with top-tier companies surpassing 115%. Keep in mind that 70% to 95% of SaaS revenue often comes from existing customers through renewals and upsells.

Another critical metric is Customer Lifetime Value (CLV), which represents the total revenue a customer generates minus the cost of acquiring them. Pair this with Customer Acquisition Cost (CAC) to calculate the LTV:CAC ratio. A healthy benchmark is 3:1, meaning for every $1,000 spent to acquire a customer, they should generate $3,000 in profit. This ratio is a strong indicator of a scalable business model.

You should also measure Net Promoter Score (NPS), which reflects how likely customers are to recommend your business on a scale of 0–10. Research shows that 70% of consumers are more loyal to brands that understand their needs, and even a 5% boost in retention can increase profits by 25% to 95%.

Once you’ve gathered these metrics, the real value lies in analyzing them over time.

Identify Trends Over Time

Tracking metrics is just the first step – examining trends over several years is where you’ll uncover the bigger picture. Look at data spanning 3–5 years to evaluate consistency and momentum. For example, if your retention rate has held steady at 85% for four years, that signals stability. On the other hand, if your NRR has climbed from 98% to 112% over three years, it demonstrates growth.

If any metrics show a decline, address it head-on. Briefly explain the cause and outline the steps you’ve taken to fix the issue. Buyers value transparency, especially when paired with evidence that challenges have been resolved. Presenting a mix of stability and growth indicators gives potential buyers a clear and balanced view of your customer base’s health.

sbb-itb-798d089

Step 5: Assess Geographic and Industry Diversification

Geographic and industry diversification plays a big role in how buyers assess risk. A business heavily dependent on one region or industry is more exposed to external market fluctuations. Your CIM should highlight the diversity of your customer base and explain any strategies you’ve put in place to address customer concentration risks. This builds on earlier segmentation insights and prepares you to weave these findings into your CIM story.

Map Customer Locations

Break down your customer base by region, state, city, and zip code to identify patterns in income and spending habits. Grouping by zip code can reveal high-value clusters or areas with potential concentration risks.

You can also categorize customers based on population density – urban, suburban, or rural – since each group often has unique buying behaviors and communication preferences. If there are relevant external factors, such as environmental conditions, be sure to note them.

Leverage your CRM to map out key customer clusters. Overlaying this data with your shipping capabilities and logistics constraints can demonstrate operational efficiency and pinpoint areas with significant revenue concentration.

Analyze Industry Distribution

Beyond geographic segmentation, industry diversity is another critical factor in assessing risk. Calculate the percentage of revenue generated by your top five industries to identify potential vulnerabilities. If one sector accounts for 40% or more of your revenue, you’ll want to include a strategy in your CIM to address that risk.

For each major industry, provide an overview of its market trends. If your business serves industries that are cyclical, openly discuss these dynamics. Highlight positive trends in the end markets or explain any one-off factors that may have caused past volatility. Buyers value this level of transparency and the proactive steps you’re taking to manage challenges.

Use these insights to strengthen your CIM, showing both the diversity of your customer base and the strategies in place to mitigate risk.

Step 6: Integrate Insights into CIM Narrative

Creating a CIM (Confidential Information Memorandum) that combines analytical depth with a compelling story is crucial. By now, you’ve gathered and analyzed demographic data – it’s time to weave those insights into your narrative. A strong CIM shapes how buyers perceive the business from the outset. Your task is to showcase demographic strengths while addressing any weaknesses with practical solutions. This approach connects raw data to actionable buyer intelligence.

Use Charts and Personas

Visual elements can make your data more accessible and engaging. Infographics are especially effective because they turn complex data into digestible stories. Choose the right type of chart for your data:

- Pie or donut charts: Great for showing proportions, such as the split between new and returning customers.

- Bar graphs: Useful for comparing different demographic groups.

- Heat maps: Ideal for visualizing customer density across geographic areas.

- Sankey plots: Best for illustrating customer journeys, highlighting where users transition between stages or drop off.

Follow the "3 C’s" when designing visuals: clarity, consistency, and context. Keep visuals clean by avoiding unnecessary lines or borders, use uniform colors and fonts, and include benchmarks or historical data to show trends.

To add a human touch, incorporate buyer personas into your narrative. These personas transform raw data into relatable profiles of ideal customers. They provide context by outlining motivations, values, and lifestyles. Including psychographic details – like interests or purchasing history – helps paint a fuller picture of customer behavior.

Highlight Strengths and Mitigate Weaknesses

Once you’ve presented your visuals, your narrative should clearly articulate strengths while addressing weaknesses head-on. For example, if your business faces challenges like customer concentration, bring them up early in the CIM. This approach helps control the buyer’s perspective and reduces the impact of potential concerns.

"Every business, even the most successful, has areas of weakness… A skilled advisory team will actively market around these issues by uncovering remedies, counterbalancing opportunities, and crafting ‘one-time’ explanations." – TKO Miller

For every risk, provide a straightforward mitigation strategy. For instance, if there’s a high customer concentration, highlight a diversification plan already underway. Frame weaknesses as opportunities: a lack of recent marketing investment, for example, could be positioned as a chance for buyers to boost revenue. Support your value drivers with solid data – like retention rates, customer satisfaction scores, or evidence of a competitive edge. Buyers tend to trust a measured, data-driven narrative over one that feels overly optimistic.

Step 7: Validate and Update Data

Once you’ve gathered and analyzed your data, the next step is to validate and update your demographic information. This ensures the credibility of your Confidential Information Memorandum (CIM). Accurate data is the backbone of a strong CIM and must hold up under the scrutiny of due diligence. As Brian DeChesare, Founder of Mergers & Inquisitions, explains:

"Buyers will always do their due diligence and confirm or refute everything in the CIM before acquiring the company".

Sellers are often required to formally certify the accuracy of the information they provide before a deal is finalized.

Cross-Verify Data Sources

Begin by cross-checking your internal customer data with reliable third-party reports from sources like Gartner, IDC, Forrester, Bloomberg, Reuters, or the World Bank. This process helps identify any discrepancies or overly optimistic projections that might raise concerns. Additionally, verify internal records against supporting documents like bank statements and monthly financial closes. Claims of market leadership should be backed by external validations, such as media mentions, industry awards, or endorsements from analysts. As LexisNexis advises:

"Data should come from approved, premium content with clear and reliable sourcing".

Stick to verified data sources with transparent origins. Once internal and external data align, maintain strict documentation to reflect the latest market conditions.

Maintain Updated Records

After validating your data, make it a priority to keep it up to date. Link demographic metrics to monthly financial closes and include Trailing Twelve Months (TTM) figures to ensure accuracy. Update the CIM within one week of the business being listed, so potential buyers receive the most current information.

For every demographic data point, clearly document the source and date (using the MM/DD/YYYY format). This level of transparency builds trust during due diligence and provides a solid foundation for valuation discussions. Utilize Virtual Data Rooms (VDRs) to manage document versions and ensure all potential buyers have access to the same, most up-to-date information. Additionally, assign a unique identification number to each CIM copy to monitor the distribution of sensitive data. Regular updates are key to maintaining the accuracy and reliability of your CIM, ensuring it reflects the freshness and precision established in earlier steps.

Conclusion

A well-prepared customer demographics checklist for your Confidential Information Memorandum (CIM) not only strengthens your valuation but also reinforces your credibility. Precise demographic insights form the backbone of your investment thesis, showcasing revenue reliability and helping you address potential concentration risks head-on.

Tammie Miller, an Investment Banker at TKO Miller, emphasizes the importance of a carefully crafted CIM:

"A deliberately constructed CIM will control the initial story that buyers receive at the most impressionable stage. A poorly constructed CIM will do the exact opposite, and there is zero room for error".

This checklist’s seven steps help you create a buyer-focused narrative that highlights your business’s strengths while addressing potential risks. Using conservative, grounded data builds trust far more effectively than overly optimistic projections. Incorporating visual tools like pie charts and bar graphs simplifies complex information, making your narrative easier to understand and more persuasive. By following these steps, you ensure that every piece of demographic data contributes to maximizing your deal’s value.

These insights lay the groundwork for a CIM that sets your deal up for success. If the process feels daunting, professional services can make it easier. Deal Memo offers tailored CIM packages, seller interviews, and customized sell-side materials delivered within just 72 hours. Their dedicated account teams manage the details, allowing you to focus on closing the deal. Plus, unlimited revisions ensure your data stays accurate and impactful.

Accurate demographic data can boost closure rates by 30–50%. By following this checklist and seeking professional support when necessary, you’ll craft a CIM that withstands scrutiny and positions your business for the best possible outcome.

FAQs

What key customer demographics should be included in a Confidential Information Memorandum (CIM)?

When creating a Confidential Information Memorandum (CIM), including customer demographic data is essential for showcasing the business’s target audience. Here are some key factors to address:

- Age groups: Identify the primary customer age ranges to provide clarity on the business’s core audience.

- Geographic location: Detail specific areas, cities, or regions where the customer base is most concentrated.

- Income levels: Outline the typical income brackets of the customers, if this information is relevant.

- Gender distribution: Highlight any noticeable trends in gender representation within the customer base.

- Buying behavior: Share insights into customer purchasing habits or preferences to give a clearer picture of demand.

Providing this information helps potential buyers or investors assess the business’s market reach and potential for growth. Make sure the data is both precise and directly aligned with the business being represented in the CIM.

How can I keep customer demographic data secure in a Confidential Information Memorandum (CIM)?

To keep customer demographic data safe within a CIM, consider these key measures:

- Require NDAs: Ensure all potential buyers sign a non-disclosure agreement. This document should spell out clear limits on how data can be used and include penalties for any misuse.

- Anonymize sensitive details: Instead of sharing personal information like names or addresses, provide aggregated stats (e.g., "30% of customers fall within the 35-44 age range"). This reduces the risk of re-identification.

- Use secure platforms: Opt for a virtual data room (VDR) to store and share the CIM. Features like view-only access, multi-factor authentication, and activity tracking add layers of protection.

- Restrict access: Share the CIM exclusively with pre-screened, qualified buyers to limit unnecessary exposure.

By taking these precautions, you can protect customer data while still giving buyers the insights they need to assess the opportunity.

Why is it crucial to address revenue concentration risks in a Confidential Information Memorandum (CIM)?

Addressing revenue concentration risks in a CIM is crucial because it gives potential buyers a clear picture of any financial dependencies or vulnerabilities. Transparency in this area not only builds trust but also shows that you have a solid grasp of the business’s financial landscape.

When buyers see that risks have been identified and tackled head-on, it boosts their confidence in the investment. Plus, discussing revenue concentration allows you to showcase the steps the business takes to manage these risks, making the opportunity even more attractive.