Looking to ensure your M&A delivers results? It all boils down to identifying the right target and avoiding common pitfalls. With over 60% of deals failing to meet expectations, focusing on key factors can make all the difference.

Here’s what matters most:

- Complementary Operations: Find overlaps in resources, supply chains, and processes to cut costs quickly.

- Alignment with Business Goals: Ensure the acquisition supports your long-term vision and growth strategy.

- Financial Health: Evaluate financial stability, revenue trends, and growth potential to avoid overpaying.

- Organizational Fit: Understand decision-making styles and workplace dynamics to prevent friction.

- IT Systems Compatibility: Align technology platforms to support integration and synergy goals.

- Supply Chain Efficiency: Combine vendor contracts and distribution networks for cost savings.

- Customer and Revenue Opportunities: Focus on cross-selling and market expansion for growth.

- Integration Risks: Address potential challenges like regulatory hurdles and mismatched systems early.

Key takeaway: Successful M&A requires thorough due diligence, realistic synergy estimates, and early involvement of key stakeholders. The right preparation can turn potential challenges into measurable success.

M&A Prosperity – Predicting Deal Success from Cultural Fit, Synergy, and Financial Unity

1. Complementary Operations

One of the fastest ways to unlock value in any acquisition is by identifying operational overlaps – those areas where both companies perform similar functions that can be streamlined post-merger. Take the merger of Exxon and Mobil in November 1998, for example. It wasn’t just about becoming the world’s largest oil company. The real value came from eliminating inefficiencies: 2,400 duplicate service stations, overlapping refineries, and 16,000 redundant jobs. The result? Over $5 billion in cost savings.

To find these opportunities, start by looking for resource redundancies. This includes multiple headquarters, overlapping executive roles, and duplicated administrative departments. Redundant manufacturing plants in the same region, extra distribution centers, and duplicate IT systems are also areas where companies can achieve quick cost savings, often within the first year of integration.

Another key area to examine is supply chain alignment. If both companies work with similar vendors, the combined entity can leverage its increased purchasing power to negotiate better deals. Procurement consolidation and volume discounts often become significant sources of cost efficiency.

However, not all overlaps generate value. Sometimes, they can backfire. Consider Quaker Oats’ acquisition of Snapple. While both were in the consumer goods space, their distribution models couldn’t have been more different. Quaker relied on large supermarket chains, while Snapple thrived in gas stations and small, independent stores. The mismatch in sales channels led to negative synergies rather than added value.

To avoid such pitfalls, start by mapping out true operational overlaps – not just those that look similar on the surface. Administrative areas like HR, finance, and legal often consolidate smoothly. But don’t stop there. Dive deeper into how each company’s products reach customers, the vendors they rely on, and whether one company’s "best practices" can realistically fit the other’s operations. This groundwork is essential before moving on to broader strategic alignment in the next phase.

2. Alignment with Business Goals

While operational overlaps can bring quick cost savings, aligning strategically with your business goals is what ensures lasting growth. Here’s the key question: Does this acquisition push you closer to your long-term vision, like where you see your company in five years? Strategic alignment isn’t just about numbers on a balance sheet – it’s about making sure the target company’s direction and growth potential match your broader goals.

Take Pixar’s acquisition by Disney as an example. This wasn’t just about adding an animation studio to Disney’s portfolio. Pixar’s creative excellence paired perfectly with Disney’s massive distribution network. Together, they unlocked opportunities neither could have achieved alone – like Pixar merchandise filling Disney stores and theme parks. The result? A significant boost in both revenue and market reach.

But strategic fit isn’t just about being in the same industry. It’s about understanding whether the target company’s customers genuinely need what you bring to the table. For instance, when two major consumer electronics companies merged in 2017, they saw a 4% increase in gross margins within nine months. How? One company’s disciplined pricing strategy replaced the other’s lenient discounting practices, creating immediate value.

It’s also worth noting that cost savings often materialize within two years, while revenue synergies may take up to five years – and even then, they only hit about 77% of initial projections. This is why it’s crucial to go beyond surface-level assumptions. Dive deep into customer segments, assess whether your sales team can effectively market the target’s offerings, and ensure the target’s market position truly opens new doors.

Finally, involve decision-makers early in the process. The executives responsible for delivering results need to validate your strategic assumptions during due diligence – not after the deal is signed. Skipping this step could leave your integration plan on shaky ground.

3. Financial Performance and Growth Prospects

A solid financial foundation is a cornerstone of any successful acquisition. To truly understand a target’s potential, it’s essential to go beyond the surface and take a closer look at key financial indicators like revenue trends, profit margins, and cash flow stability. These metrics provide insight into whether the acquisition can generate lasting value – especially considering that, on average, there’s a 23% gap between projected and actual revenue synergies. Among these indicators, cash flow stability plays a particularly important role.

Stable cash flow can be a game-changer. It enables the combined company to secure better borrowing terms and lower capital costs. Since achieving synergies often takes one to three years, having a reliable cash flow buffer helps cover integration expenses and short-term inefficiencies. A critical part of this analysis is comparing the target’s free cash flow to its EBITDA. If the company has heavy capital expenditure demands, it may struggle to generate free cash flow, which can limit its ability to repay debt and reinvest in the necessary changes to realize synergies.

Once the financials are in order, assessing growth prospects becomes the next step in refining the target’s valuation. This involves a data-driven evaluation of three key areas: where to sell (expanding into new markets or customer segments), what to sell (offering bundled products or developing joint innovations), and how to sell (leveraging better pricing strategies or sales processes). A real-world example of this approach is Martin Marietta’s $2.7 billion acquisition of TXI in 2014. The deal aimed for $70 million in annual pretax synergies by 2017, but just nine months post-closing, the company had exceeded its original estimates by 40%, delivering a shareholder return that outpaced the industry index by 8.3 percentage points.

To ensure financial diligence translates into successful integration, it’s crucial to involve the right people early. Business unit heads, who will ultimately be responsible for delivering results, should participate during the due diligence phase – not after the deal is finalized. This approach allows for setting evidence-based targets, which have historically been shown to drive cost synergies 10% higher than projected.

Quantitative tools can further strengthen the financial evaluation. One useful metric is the "P/E of synergies", which is calculated by dividing the control premium paid by the expected annual pretax synergies. This helps determine whether the price paid for future growth is justified. Given that acquirers typically pay an average control premium of 34% and that EV/EBITDA ratios below 10 are often considered attractive, a clear and thorough analysis is essential to avoid overpaying for growth opportunities.

4. Organizational Culture Match

When it comes to mergers and acquisitions (M&A), aligning on operations and finances is just part of the equation. A strong cultural fit is equally crucial for achieving seamless integration. In fact, poor cultural alignment is a deal killer – 44% of M&A leaders identify it as a top reason for integration failures. On the flip side, companies that actively manage cultural alignment are 40% more likely to hit cost synergy goals and 70% more likely to meet revenue targets.

But what exactly defines culture? It’s not flashy mission statements or office perks. Culture lives in the day-to-day practices – like how decisions are made. For instance, a company where the CEO makes quick calls might clash with one that relies on consensus-driven decision-making. Such mismatches can slow integration efforts and even drive away key talent.

To truly understand cultural compatibility, you need to dig deeper than surface-level traits. Look at how quickly decisions are made, whether the company sets bold goals or takes a conservative approach, and how clearly roles and accountability are defined. For example, organizations with complex matrix structures often struggle to align with those operating under clear vertical hierarchies. Even differences in how companies define their customers or prioritize impact can expose deeper cultural divides.

During due diligence, don’t rely on gut feelings. Use tools like employee surveys, management interviews, and focus groups to build a fact-based understanding of the target company’s culture. Pay attention to how their leadership interacts with your deal team – it can reveal a lot about their management style. You can also use independent "clean teams" before the deal closes to safely analyze sensitive data, such as pricing strategies or R&D processes, and uncover hidden cultural differences.

Getting cultural integration right isn’t just a nice-to-have – it’s a value driver. Acquirers who excel in this area see 6%–12% higher total returns. And since 70% of value erosion in failed deals happens during post-integration, treating culture as a priority from day one can make all the difference. Plus, a solid understanding of cultural alignment sets the stage for tackling another critical factor: technological and systems compatibility.

5. Technology and Systems Compatibility

Once you’ve aligned organizational culture, the next hurdle is technology. Seamless integration of IT systems is critical for achieving the operational benefits of a deal. In fact, technology can either be the glue that holds everything together or the roadblock that derails the entire process. If IT systems don’t align, other business functions can’t integrate effectively – and those synergy estimates? They’ll quickly lose their meaning. In many industries, IT plays a pivotal role, with more than half of deal synergies tied directly to the technology blueprint.

During due diligence, take a deep dive into the target company’s system landscape. Review key platforms like ERP, CRM, MES, and cloud systems. Look for opportunities to consolidate software licenses and pinpoint integration gaps. For example, in 2025, a software company successfully integrated a US$1 billion acquisition and achieved over US$100 million in cost synergies within its first year. How? By prioritizing an integrated development roadmap and resolving organizational design issues in just three months. A thorough evaluation of cybersecurity and software licenses can further refine your integration strategy.

Cybersecurity is non-negotiable. Assess the target’s security maturity using frameworks like NIST or ISO 27001, and scrutinize their incident history from the last three years. A weak cybersecurity posture could lead to regulatory fines – up to 10% of revenue – if sensitive data is mishandled before regulatory approval. To mitigate risks, use independent clean teams to analyze sensitive IT data behind secure firewalls. This approach speeds up integration planning without crossing legal boundaries.

Don’t overlook software licenses and vendor contracts. Conduct audits to identify renewal schedules, consolidation opportunities, and potential migration challenges. Incompatible systems can create "blind spots" in customer data, blocking cross-selling efforts and undermining the creation of a unified lead-to-order process.

"Some functions, such as IT systems or human resources, can enable or block integration, which renders synergy estimates meaningless." – Jeff Rudnicki, Partner, McKinsey

Be prepared to spend upfront to save later. Achieving US$1 in synergies may require up to US$1.50 in one-time integration costs, including system migrations and software licenses. If technology integration is poorly executed, redundant systems may linger, or manual workarounds could become permanent fixtures, driving up costs. With only 13% of executives reporting strong success in capturing revenue synergies and just 10% for cost synergies, prioritizing technology compatibility isn’t just smart – it’s essential for protecting deal value.

sbb-itb-798d089

6. Supply Chain and Vendor Overlaps

After integrating technology, the next big opportunity for cost savings lies in optimizing the supply chain. Shared suppliers and distribution networks can deliver 25% to 40% of a merger’s total cost-saving potential. When two companies rely on the same vendors, combining their purchase volumes can lead to better pricing, larger rebates, and improved contract terms – almost instantly.

Start by mapping out spending using a standardized classification system. This can highlight price discrepancies. For example, one healthcare merger uncovered a 30% price difference on identical items. Simply switching to the lower price point can generate immediate savings. Beyond aligning prices, merging purchasing volumes allows for discounts across various categories, such as:

- Direct procurement: 3% to 12% savings

- Corporate indirect spend: 5% to 10% savings

- Factory indirect spend: 1% to 4% savings

These savings come from leveraging supplier costs through detailed analysis of vendor pricing and contract terms, rather than just reducing operational redundancies.

Distribution networks also offer major opportunities. By analyzing customer locations in relation to combined warehouses and distribution centers, companies can cut shipping costs and speed up delivery times. Identifying underutilized assets – like trucks, planes, or delivery routes – can further boost efficiency. A great example is a 2017 merger between two major US retailers, which achieved $740 million in savings, far exceeding the original estimate of $300 million to $500 million. This was made possible by using clean teams to meticulously plan vendor and category strategies before the deal even closed.

"Procurement represents on average 25 to 40 percent of a merger’s total cost-saving potential." – Enno de Boer, Aasheesh Mittal, and Andy West, McKinsey & Company

To maximize these gains, deploy specialized teams to refine supplier contracts. Clean teams – independent third-party specialists – can analyze sensitive data like supplier prices, volumes, and contracts without violating antitrust "gun-jumping" regulations. This approach ensures savings can be captured right from Day 1. In fact, consolidated supplier contracts can often generate significant savings within the first 100 days. However, achieving these synergies does come with upfront costs. On average, capturing $1.00 in savings requires $1.10 to $1.20 in one-time integration expenses. Be sure to budget for contract migrations and logistics adjustments to fully realize these benefits.

7. Customer Base and Revenue Expansion

While cost synergies often grab the spotlight, the real driver of merger success lies in revenue growth from a combined customer base. Cross-selling alone accounts for about 20% of revenue synergy potential. Yet, fewer than 20% of companies hit their targets, with a typical 23% gap between projections and actual results. This shortfall usually becomes evident over three to five years. These figures highlight the importance of a well-thought-out cross-selling strategy.

To meet these ambitious goals, a structured approach is essential. The key to success in cross-selling can be summed up in the "Six Cs": Complementarity, Connection, Capacity, Capability, Compensation, and Commitment. Focusing on these elements has been shown to improve performance by over 20%.

Real-world examples illustrate how impactful effective cross-selling can be. For instance, after acquiring Lessonly, Seismic trained its entire sales team on specific cross-selling strategies in just one week. The result? A pipeline that surpassed its first-year revenue targets. Similarly, Sika leveraged Parex‘s distributor network in China to introduce flagship products, achieving swift revenue growth.

However, don’t assume customers will automatically embrace bundled offerings. Conduct targeted due diligence to confirm customer demand. Additionally, ensure that both sales teams are aligned and targeting the same decision-makers to avoid miscommunication and inefficiencies. To make cross-selling a priority, integrate it into base quotas. Without proper commercial planning, sales growth can decline by an average of 7 percentage points over three years. By embedding cross-selling into the overall strategy, companies can unlock greater revenue potential and maximize the benefits of the merger.

8. Integration Complexity and Risk Factors

When it comes to mergers and acquisitions, integration complexity can make or break a deal. In fact, 83% of failed acquisitions blame integration issues as a primary cause. To safeguard the value of synergies, it’s crucial to identify and address potential obstacles like cultural differences, mismatched company sizes, and incompatible IT systems.

One major challenge is cultural misalignment, which can lead to talent loss and dips in productivity. A great example is Hitachi’s acquisition of GlobalLogic. Aware of the risks, Hitachi deployed cross-cultural teams early in the process to address potential conflicts. This strategy allowed them to maintain GlobalLogic’s innovative culture while successfully integrating it into their larger corporate structure.

Another growing concern is regulatory approval. Deals now take, on average, three months longer to close than they did in 2015, and over 40% of deals require more than a year to secure regulatory clearance. A recent example involves the European Commission fining Illumina €432 million (10% of its revenue) in July 2023 for prematurely closing its Grail acquisition without regulatory approval – a misstep known as "gun-jumping". To avoid such pitfalls, companies can use independent "clean teams" to review sensitive data, like pricing and supplier overlaps, before finalizing the deal. These teams help ensure compliance while mitigating legal risks.

IT integration, though previously discussed, remains a critical factor due to its significant impact on costs and user experience. IT systems account for over 50% of deal synergies in many industries. However, incompatible platforms or redundant supply-chain infrastructures can frustrate both employees and customers. The financial burden is significant, with integration costs typically ranging from 70% to 160% of run-rate synergies, averaging around 120%. Dell’s $67 billion acquisition of EMC highlights how focusing on key decisions – like enabling separate sales teams to cross-sell early – can generate billions in revenue synergies within the first year.

Quick, decisive leadership is also essential to prevent the loss of both talent and customers. Setting ambitious internal synergy targets – 30% to 100% higher than public forecasts – can make a big difference. Companies that hit these targets within the first two years post-merger are 2.6 times more likely to succeed and deliver 40% higher total returns to shareholders.

Comparison Table

Three Types of M&A Synergies: Revenue, Cost, and Financial

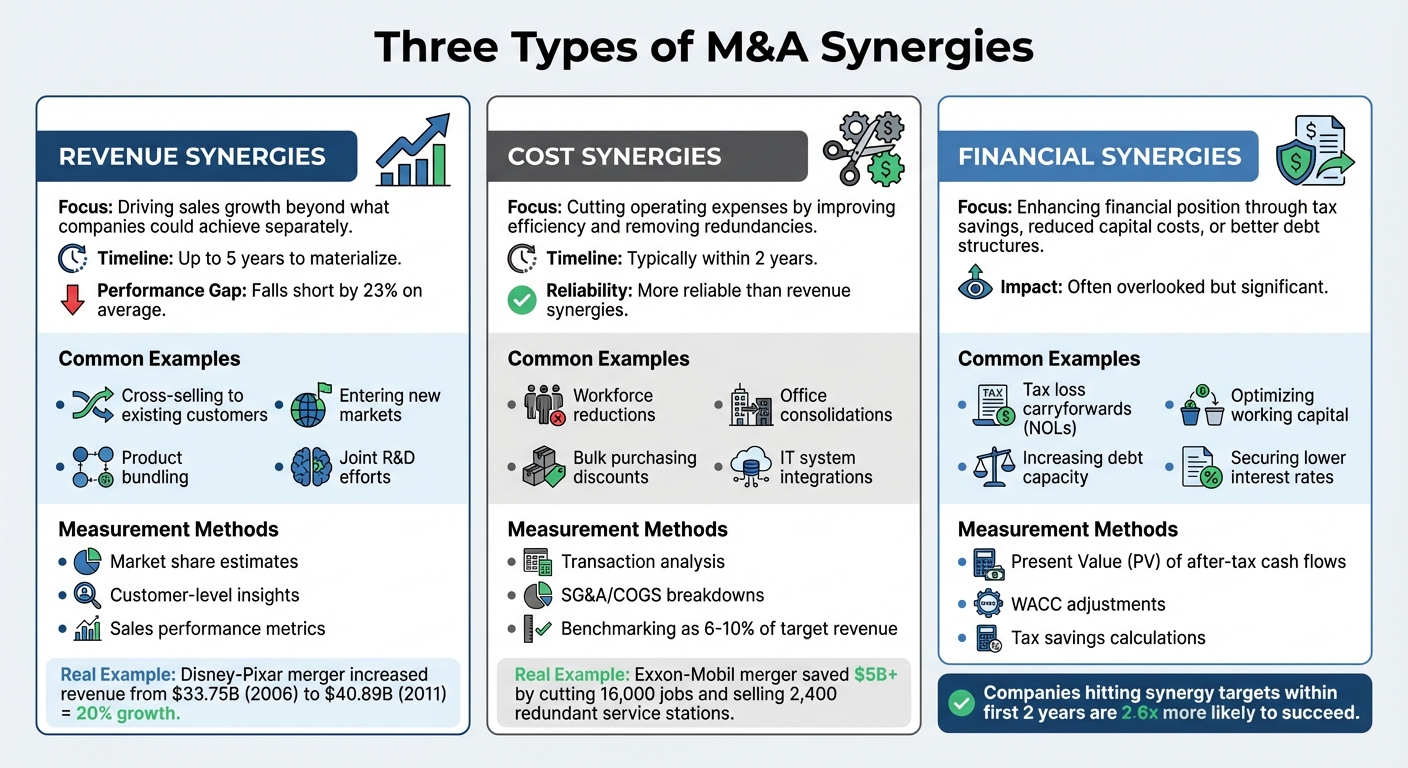

Looking back at the earlier discussion on operational and financial integration, it’s helpful to break down synergies into three main categories. These categories highlight different ways a merger or acquisition can create value, each with its own focus and measurement approach.

Revenue synergies aim to boost sales but often underperform expectations, falling short by about 23% and taking up to five years to fully materialize. This consistent shortfall underscores the challenges tied to achieving these synergies. On the other hand, cost synergies are more reliable. They’re a common target in deals and typically come to fruition within two years.

Financial synergies, though less discussed, can have a big impact by enhancing tax benefits and improving the overall financial structure of the combined entity. Below is a table summarizing the key aspects of these synergy types, along with examples and measurement methods:

| Synergy Type | Focus | Common Examples | Measurement Methods |

|---|---|---|---|

| Revenue | Driving sales growth beyond what the two companies could achieve separately. | Cross-selling to existing customers; entering new markets; product bundling; joint R&D efforts. | Market share estimates; customer-level insights; sales performance metrics. |

| Cost | Cutting operating expenses by improving efficiency and removing redundancies. | Workforce reductions; office consolidations; bulk purchasing discounts; IT system integrations. | Transaction analysis; SG&A/COGS breakdowns; benchmarking as 6-10% of target revenue. |

| Financial | Enhancing the financial position through tax savings, reduced capital costs, or better debt structures. | Tax loss carryforwards (NOLs); optimizing working capital; increasing debt capacity; securing lower interest rates. | Present Value (PV) of after-tax cash flows; WACC adjustments; tax savings calculations. |

Real-world examples highlight how these synergies play out. Take the Disney-Pixar deal: it’s a textbook case of revenue synergy. Disney leveraged its global distribution channels and theme parks to elevate Pixar’s profile, increasing revenue from $33.75 billion in 2006 to $40.89 billion by 2011 – a growth of over 20% during a period when the S&P 500 dropped by 1%. On the cost side, the Exxon-Mobil merger is a standout. The deal saved over $5 billion by cutting 16,000 jobs and selling off redundant assets, including 2,400 service stations.

This breakdown underscores the importance of focusing on all three areas – revenue, cost, and financial synergies – when evaluating mergers and acquisitions. Each requires a tailored strategy to unlock its full potential.

Conclusion

Choosing the right M&A target goes beyond just evaluating financial stability – it’s about uncovering where real synergy potential exists. The criteria we’ve discussed work together to form a comprehensive picture: complementary operations and supply chain overlaps offer clear cost-saving opportunities, while strategic alignment and customer base analysis point to potential revenue growth. Meanwhile, factors like cultural compatibility and technology integration act as essential safeguards against potential risks.

Rather than treating these as a simple checklist, think of them as an interconnected framework. When teams from IT, HR, and Sales collaborate during due diligence, they help transform synergy estimates into actionable commitments. This collaborative process doesn’t just refine synergy goals – it also strengthens deal presentations. In fact, deals are 2.6 times more likely to succeed when they hit synergy targets within the first two years.

But identifying synergies is only part of the equation – communicating them effectively is just as important. Acquirers often pay premiums exceeding 40% above market value, and they need a compelling case to justify this investment to shareholders. Interestingly, companies that disclose specific synergies in deal announcements see an average six-percentage-point boost in two-year excess returns compared to those that don’t.

To support this, professional offering documents play a critical role. Deal Memo’s CIM and OM services break down cost, capital, and revenue synergies into a clear, compelling narrative that strategic buyers can use to assess the target’s fit. Delivered in just 72 hours with unlimited revisions, these documents ensure that synergy opportunities are presented with the clarity and precision needed to drive competitive bids.

FAQs

How can companies evaluate and ensure cultural alignment in M&A deals?

Cultural alignment plays a crucial role in the success of mergers and acquisitions. To achieve a seamless fit, businesses should evaluate cultural factors right from the start of the target identification process. This means examining elements like management styles, decision-making approaches, and strategies for talent development. Key traits such as leadership, collaboration, and risk-taking should also be assessed to spot potential mismatches early on.

When gaps become apparent, companies can take proactive steps like crafting a shared vision, developing joint onboarding programs, and setting up clear communication channels. Including cultural assessments in a Confidential Information Memorandum (CIM) can further help negotiation teams focus on cultural priorities. By addressing these aspects early and weaving them into integration plans, businesses can minimize friction and unlock operational efficiencies after the merger.

How does technology contribute to successful M&A integration?

Technology plays an essential role in making M&A integration smoother and more effective by turning massive amounts of deal-related data into actionable insights. Tools like advanced analytics and AI are particularly useful – they help map out cost and revenue synergies, pinpoint overlaps, and set achievable goals even before the deal is finalized. This ensures that decisions are grounded in solid data, and integration plans are carried out with precision.

Digital platforms also simplify repetitive tasks such as merging financial systems, standardizing HR processes, and tracking progress. This frees up teams to focus on more strategic, high-impact work. For acquisitions that are heavily reliant on technology, using specialized software and data-focused due diligence is critical for minimizing risks and speeding up the process of capturing value. By weaving technology into every phase of the M&A process, businesses can work faster, with greater accuracy, and achieve measurable results.

What’s the best way to evaluate potential synergies in M&A deals?

To properly assess synergies in M&A deals, it’s crucial to weave due diligence into the early planning stages. Start by crafting a detailed deal model that highlights potential cost savings, revenue growth, and financial benefits. Break these opportunities into specific categories – such as workforce reductions, cross-selling opportunities, or procurement efficiencies – and back them up with realistic assumptions and scenario analyses.

Look beyond surface-level estimates to uncover additional value drivers, like untapped distribution networks or complementary product offerings. Involving leadership from the target company early in the process can help refine these strategies and ensure everyone is on the same page. When paired with well-prepared, thorough Confidential Information Memorandums (CIMs), this approach enables businesses to develop synergy forecasts that are grounded in data and achievable, increasing the likelihood of delivering measurable outcomes.