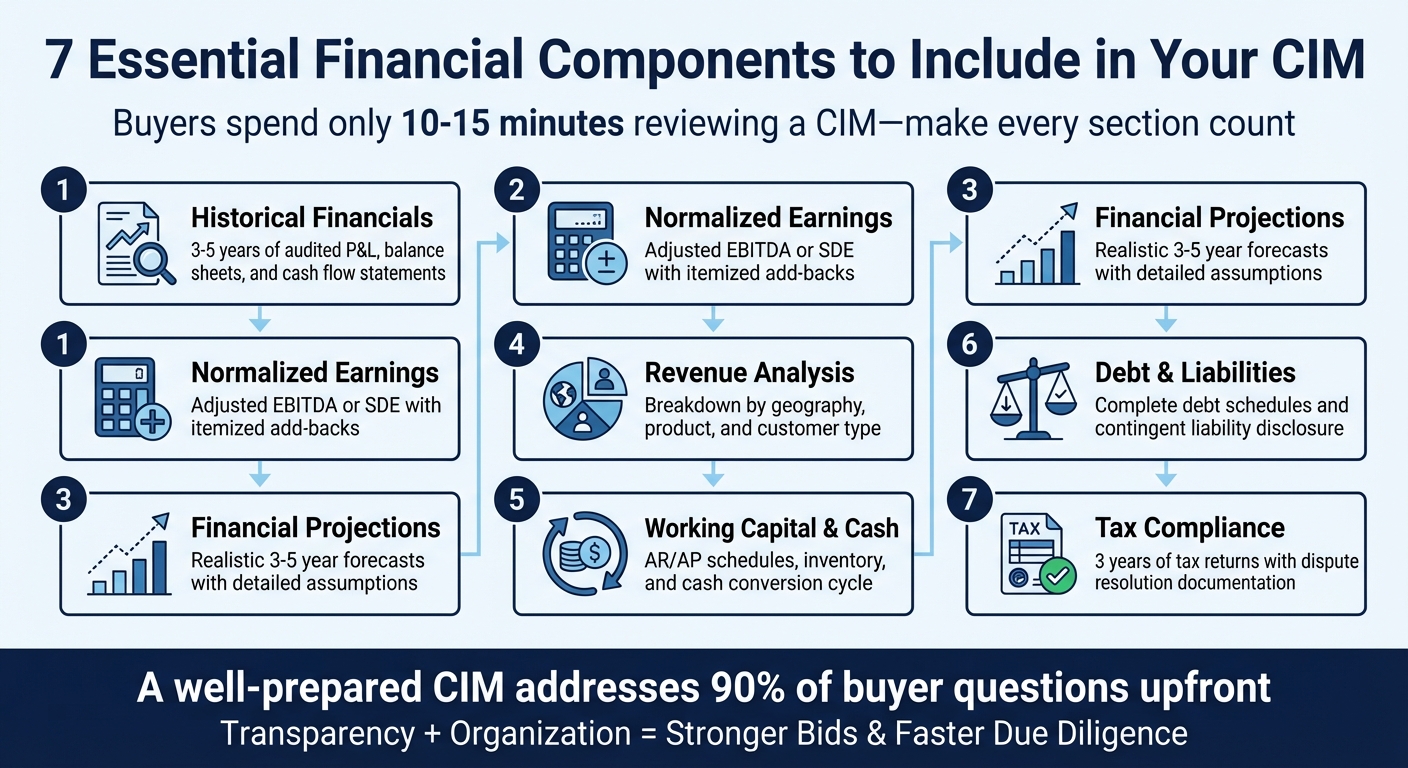

When creating a Confidential Information Memorandum (CIM), the financial section is the most critical part – it shapes buyer decisions and builds trust. Buyers typically spend only 10–15 minutes on a CIM, so clarity and accuracy are essential. Here’s a quick breakdown of what matters most:

- Historical Financials: Include 3–5 years of audited profit and loss statements, balance sheets, and cash flow statements. Explain trends and adjustments clearly.

- Normalized Earnings: Provide Adjusted EBITDA or Seller’s Discretionary Earnings (SDE) to reflect recurring earning potential. Itemize all adjustments.

- Projections: Offer realistic 3–5 year forecasts with detailed assumptions. Avoid overly optimistic growth without evidence.

- Revenue Analysis: Break down revenue by geography, product, and customer type. Address customer concentration risks openly.

- Working Capital & Cash Flow: Show working capital needs, accounts receivable/payable schedules, and cash conversion cycle.

- Debt & Liabilities: Disclose all debt, repayment schedules, and contingent liabilities. Transparency is key.

- Tax Compliance: Include 3 years of tax returns and address any past disputes or audits upfront.

A well-prepared CIM reduces buyer concerns, accelerates due diligence, and increases the likelihood of strong bids. Transparency and organization are non-negotiable.

7 Essential Financial Components for CIM Documents

How To Analyze M&A Broker CIMs for Business Buyers

Historical Financial Statements

Historical financial statements are the backbone of a Confidential Information Memorandum (CIM). Buyers typically expect at least three years of audited financial statements to evaluate trends and verify consistent performance over time.

A lack of sufficient historical data can signal potential issues like declining growth, narrowing margins, or prior setbacks – red flags that can immediately concern buyers. Once trust is lost, it’s incredibly difficult to recover.

Profit and Loss (P&L) Statements

P&L statements should span 3–5 years, breaking down revenue by key segments to demonstrate stable earning power and support valuation adjustments. It’s crucial to explain any one-time adjustments through clear footnotes, giving buyers a transparent view of your financial history.

"The entire point of presenting adjusted historical financial statements is to establish a basis for future profitability".

Buyers are looking for evidence of consistent, repeatable earning potential. If margins have declined, address the reasons directly and outline your plan to address the issue, rather than hiding the data. Consistency across the 3–5 year period is essential.

Balance Sheets

Balance sheets provide a snapshot of your assets, liabilities, and equity over the same 3–5 years. Buyers analyze this information to gauge financial stability, assess working capital requirements, and understand your debt structure. They’ll also review a three-year history of bank statements, credit lines, and loan agreements to evaluate your ability to manage debt.

Consistency is critical here – monthly financial closes should align with bank statements, and your inventory accounting method (whether FIFO, LIFO, or standard) must be clearly documented. Maintaining uniform accounting practices over this period reinforces your credibility.

Once these financial snapshots are in place, cash flow statements provide deeper insight into liquidity.

Cash Flow Statements

Cash flow statements highlight your company’s liquidity and operational efficiency. They reveal whether your business generates enough cash to sustain operations, reduce debt, and invest in growth. Buyers closely examine these statements to ensure that reported profits translate into actual cash flow. If strong profits are paired with weak cash flow, buyers will dig deeper to identify the cause.

Every figure must be accurate – any discrepancies can erode buyer confidence and jeopardize the deal.

Normalized Earnings: Adjusted EBITDA and SDE

When buyers evaluate a business, they need a clear picture of its recurring earning potential. This is where normalized earnings come into play. By stripping out one-time, owner-specific, and non-operational expenses, the normalization process – often called "recasting" – provides a cleaner, more accurate representation of what a buyer can expect in the future. It essentially eliminates the financial "noise", paving the way for a fair valuation discussion. Two key metrics that anchor these assessments are Adjusted EBITDA and Seller’s Discretionary Earnings (SDE).

Adjusted EBITDA

Adjusted EBITDA builds on the foundation of accurate historical financials, focusing on a business’s recurring performance. It starts with standard EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and then adds back certain expenses that aren’t part of the business’s regular operations. These "add-backs" often include non-recurring costs or discretionary spending. Common examples include:

- Excessive owner compensation (e.g., paying yourself more than a market-rate salary)

- Personal expenses (like travel unrelated to the business)

- One-time legal fees (e.g., a $50,000 litigation expense in Q2 2024)

- Restructuring costs

- Non-cash items (like inventory impairments).

For instance, if you’re paying yourself $250,000 annually, but a replacement manager would cost $120,000, the $130,000 difference would be added back as an adjustment.

To ensure a solid Quality of Earnings analysis, it’s crucial to itemize every adjustment and provide brief explanations for each.

As a rule of thumb, an EBITDA margin above 10% is considered strong, while anything over 20% is exceptional. Adjusted EBITDA serves as the valuation cornerstone, directly influencing the purchase multiple and forming the basis for negotiations.

Seller’s Discretionary Earnings (SDE)

For smaller, owner-operated businesses, SDE is the go-to metric. Unlike Adjusted EBITDA, which is more relevant for larger businesses with management teams, SDE focuses on the financial benefits a single owner-operator derives from the business annually.

Here’s the formula:

Pre-Tax Net Income + Owner’s Compensation + Interest + Depreciation & Amortization + Non-Recurring Expenses + Discretionary Expenses.

This metric is critical because it provides a snapshot of the total cash flow available to a new owner-operator. If you’re running the business yourself and benefiting from a salary, perks, and discretionary expenses, SDE shows buyers exactly what they can expect to earn if they step into your role.

Typical SDE add-backs include:

- Owner salary

- Insurance and 401(k) contributions

- Personal vehicle expenses

- One-time legal settlements.

As with Adjusted EBITDA, every adjustment must be carefully documented. Unsupported adjustments can cause issues with banks or lenders, potentially derailing a buyer’s financing.

| Metric | Best Use Case | Owner Compensation |

|---|---|---|

| Adjusted EBITDA | Mid-sized to large businesses with management teams | Treated as an operating expense |

| SDE | Small, owner-operated "Main Street" businesses | Added back to earnings |

Financial Projections

Historical financials tell the story of where a business has been, but projections paint a picture of where it’s headed. These forecasts are crucial for determining a company’s value, serving as the backbone for Discounted Cash Flow (DCF) models and helping buyers justify their investment. Without solid projections, buyers are likely to dismiss overly optimistic growth scenarios. Projections also lay the groundwork for analyzing revenue, expenses, and working capital in detail.

It’s essential to keep projections grounded in reality. Avoid overly ambitious "hockey stick" growth unless you can back it up with concrete evidence, such as a significant contract or strategic partnership. As Michael Hofer, Ph.D., emphasizes, projections should rely on reasonable and defensible assumptions.

5-Year Revenue and Expense Projections

Prepare a 3-to-5-year forecast broken down by product line, geographic region, and customer segment. Include detailed projections for Cost of Goods Sold (COGS) and operating expenses (OpEx), along with any planned cost-saving measures.

Incorporate projected balance sheets and cash flow statements to give a clear picture of liquidity and working capital needs. Highlight Adjusted EBITDA or SDE with a clear reconciliation from GAAP figures to normalized earnings. Provide a "working capital peg" baseline and account for any seasonal fluctuations so buyers can accurately model cash flow requirements.

Supporting Assumptions

Strong projections need a solid foundation. Clearly explain the logic behind your forecasts, including market conditions, competitive positioning, anticipated sales growth, and cost structures. For instance, you might specify, "We plan to hire three sales representatives in Q2 2026 to expand into the healthcare sector". Support these assumptions with reliable market data. Be transparent about any past challenges and how they were resolved. This level of detail builds trust and minimizes surprises during due diligence.

Additionally, highlight "blue sky" opportunities – such as untapped markets, cross-selling possibilities, or upcoming product launches – that could justify a higher valuation. These opportunities can provide buyers with a compelling vision of future growth.

Revenue Analysis and Customer Concentration

Breaking down revenue sources by geography, product lines, business segments, and customer types offers a clear picture of stability and diversification. For instance, you can showcase revenue splits by region (e.g., Northeast vs. Southwest), product categories (e.g., Product A vs. Product B), and customer profiles (e.g., enterprise clients vs. small businesses). This segmentation not only highlights diversification but also helps potential buyers pinpoint areas of growth. It’s the foundation for deeper analysis down the line.

Additionally, include the revenue contributions from your Top 5 or Top 10 customers, along with details like customer tenure and the type of revenue (e.g., recurring contracts versus competitive bidding).

"By showing the information in this manner [Geo, Product, Business Segments], buyers can see where the major revenue comes from and if it is aligned with their business strategy".

Visual tools like pie charts and bar graphs can further emphasize your diversification story.

Revenue Segmentation

Segmenting revenue by product or service line, geographic footprint, and customer type helps clarify how income is generated. Include details like gross margins, contract types, and retention rates. For service-oriented businesses, make sure to differentiate between revenue models such as Fixed Price contracts and Time and Material arrangements.

It’s also essential to disclose your revenue recognition policy and any multi-element arrangements to maintain data accuracy. If your business relies on subscription or recurring revenue models, provide details on retention rates and a breakdown of recurring revenue versus one-time sales. If you’ve strategically offboarded low-margin customers, explain this in your lost account analysis. This can shift what might seem like a negative into a narrative about improving profitability.

Customer Concentration Risks

High customer concentration can be a significant risk, and it’s crucial to address it transparently. For example, if a single customer accounts for 40% of your revenue, that’s a material risk that must be acknowledged. Quantify this concentration by showing the percentage of revenue from your Top 5 and Top 10 customers, along with the tenure of these relationships. Clarify whether these accounts are secured through long-term contracts or competitive bidding, as the latter tends to carry more risk.

"It is far better to address weaknesses head-on in the CIM with a clear mitigation plan." – Doreen Morgan, Sunbelt Atlanta

If concentration is an issue, outline a diversification strategy. For instance, highlight efforts like securing three new clients that will reduce a top customer’s share from 40% to 28% within the next year. Buyers value transparency and proactive risk management. A well-prepared CIM (Confidential Information Memorandum) can address 90% of a buyer’s initial concerns, cutting down on repetitive follow-up questions.

sbb-itb-798d089

Working Capital and Cash Flow Analysis

Working capital and cash flow metrics reveal how effectively a company turns earnings into cash. Buyers pay close attention to these figures to evaluate operational liquidity and determine whether the business can sustain its daily operations without needing additional capital. A healthy cash conversion cycle, combined with well-managed working capital elements, signals financial stability and lowers perceived risks during due diligence. These metrics pave the way for a closer look at specific areas like receivables, inventory, and the cash conversion cycle.

Accounts Receivable, Payable, and Inventory

It’s essential to provide aging schedules for accounts receivable (AR) and accounts payable (AP) broken down into 30-, 60-, and 90+ day categories. These schedules help demonstrate the quality of your receivables and the efficiency of your collection process. For instance, if most of your AR falls under the 30-day bracket, it reflects strong credit management and solid customer relationships. On the other hand, a significant portion of receivables over 90 days could point to collection issues or financial struggles among your customers.

Disclose your inventory valuation method – whether it’s FIFO, LIFO, or standard costing – along with current inventory levels and turnover rates. This transparency allows buyers to assess asset values accurately and identify any risks related to obsolete inventory.

Another key step is establishing a working capital "peg", which acts as a baseline for the normal working capital needed to run the business. This figure becomes crucial during deal negotiations, as it serves as the reference point for any working capital adjustments at closing. If your business experiences seasonal changes, explain how these shifts impact working capital needs. For example, a retail business might require significantly more working capital during the holiday season than during slower periods.

From here, take a closer look at how quickly these components convert into cash.

Cash Conversion Cycle

Expanding on the working capital analysis, the cash conversion cycle measures how quickly your business transforms investments in inventory and receivables into cash. Buyers also assess how effectively EBITDA translates into Free Cash Flow (FCF), which reflects operational efficiency. A shorter cash conversion cycle indicates stronger cash generation, meaning the business requires less reinvestment in working capital and capital expenditures.

Maintaining consistency in your monthly financial close process is another critical factor. Ensure your financial statements align directly with bank statements on a predictable schedule. This level of accuracy and organization builds buyer confidence and minimizes perceived risks, making it easier for potential buyers to trust the financial data and move forward with due diligence. A clear understanding of cash conversion supports the overall valuation narrative presented in the CIM.

Debt and Liability Disclosure

When crafting a CIM (Confidential Information Memorandum), providing a thorough debt and liability schedule is non-negotiable. Buyers rely on this information to calculate Enterprise Value accurately. Without a clear breakdown of current balances, interest rates, maturity dates, and repayment schedules, buyers can’t effectively model their Internal Rate of Return (IRR) or determine if the business can sustain its existing leverage.

Being upfront about liabilities builds trust. Every business faces challenges, but addressing them openly helps buyers avoid making unfavorable assumptions. Concealing liabilities – whether related to ongoing litigation, warranty reserves, or lease obligations – can derail deals when they inevitably come to light during due diligence. By tackling these issues with a clear mitigation plan, you reduce the risk of last-minute surprises that could jeopardize the deal. This level of transparency not only clarifies current financial commitments but also sheds light on future obligations.

Debt Obligations and Contingent Liabilities

Start by outlining your debt obligations and any potential liabilities. Your debt schedule should include details such as current balances, interest rates, rate floors, maturity dates, and repayment schedules for all commercial loans. Be sure to include information on debt covenants, collateral, and any restrictions tied to the loans. If seller financing is part of the deal, spell out the terms and buyer qualifications upfront.

Equally important is the disclosure of contingent liabilities. This includes any ongoing or potential legal disputes, along with expected settlement amounts and the extent of insurance coverage. For instance, if a legal matter has been resolved, you can adjust Adjusted EBITDA to reflect one-time legal expenses. For example: "Legal Fees: $50,000 one-time add-back for litigation related to a real estate dispute resolved in Q2 2024".

Off-Balance-Sheet Commitments

Transparency shouldn’t stop at the balance sheet. Make sure to disclose all off-balance-sheet liabilities as well. This includes lease agreements for properties and equipment, with details on monthly payments, expiration dates, and renewal options.

Other critical disclosures include warranty reserves, third-party contracts, and any other operational liabilities that might impact the business. Providing this level of detail ensures buyers have a complete picture of the company’s financial health and obligations.

Tax Positions and Compliance Records

Navigating tax documentation can be tricky. Buyers want assurance that your company has consistently filed returns on time, paid the correct amounts, and avoided aggressive tax strategies that could attract future scrutiny from the IRS. While it’s not necessary to include every tax return in your initial Confidential Information Memorandum (CIM), you should share enough details to show compliance and address any potential concerns upfront.

The best way to handle this is through incremental disclosure. Your CIM should outline high-level tax provisions, explaining your accounting method – whether it’s accrual or cash basis – and how tax obligations were calculated. Save the more detailed records for the due diligence phase after a Letter of Intent (LOI) is signed. This approach protects sensitive information while giving buyers confidence in your transparency. After covering revenue, working capital, and liabilities in previous sections, a clean tax compliance profile is a key piece of the financial puzzle.

Tax Returns and Provisions

Provide at least three years of federal, state, and local tax records. During the due diligence phase, be ready to share payroll tax documents like Forms 940, 941, W-2s, W-3s, and SUI filings.

Your CIM should also include tax provision calculations with clear footnotes explaining how they were determined. If your financials comply with GAAP standards, make that explicitly clear. For companies that claim specific incentives, such as the Research and Development (R&D) tax credit or the Employee Retention Credit (ERC), ensure you have supporting documentation to confirm eligibility. In stock deals, this becomes especially critical due to the concept of successor liability – buyers may become legally responsible for any unpaid taxes from before the acquisition.

"If you are buying the stock of a company or ownership interest, that is a little bit riskier for the buyer because of something called successor liability. The one buying the company could be on the hook, legally, for taxes that are due." – Shaun Hunley, Tax and Accounting Executive Editor, Thomson Reuters

Additionally, it’s important to address any historical tax issues to complete your financial story.

Tax Disputes and Audits

If your company has been involved in tax audits or disputes, disclose them along with a clear mitigation strategy. Concealing these matters can lead to distrust when they inevitably come to light during due diligence. Buyers are likely to assume the worst-case scenario if you don’t take control of the narrative. Include settlement documents with the IRS or other tax authorities, as well as correspondence about ongoing disputes.

For resolved issues, consider presenting one-time settlements or legal fees as add-backs in your Adjusted EBITDA reconciliation. For example, you might note: "One-time $50,000 add-back for a concluded real estate tax dispute in Q2 2024". This demonstrates that the matter is resolved and won’t affect future earnings. If your company has deferred tax liabilities or transfer pricing agreements, include a schedule showing their potential impact on future cash flows.

"Every business has warts. Name them and frame them so buyers don’t assume worse." – Doreen Morgan, Sunbelt Atlanta

Buyers will also want tax clearance letters from relevant authorities for income, sales, and employment taxes to confirm there are no outstanding liabilities. Be prepared to share any recent IRS, state, or local tax notices. Transparency in these areas helps avoid last-minute surprises that could jeopardize the deal or lead to significant price reductions.

Conclusion

A strong Confidential Information Memorandum (CIM) does more than just present numbers – it tells a story that informs and persuades potential buyers. It’s not just about financial statements; the CIM sets the foundation for how buyers assess your business’s value and make decisions. Key elements like historical profit-and-loss statements, normalized EBITDA, customer concentration risks, and tax compliance records all play a role in building trust and justifying your asking price.

The quality of your CIM can make or break deal momentum. A well-prepared document addresses around 90% of a buyer’s initial questions, cutting down on time-consuming back-and-forth and letting you stay focused on running your business.

"A well-prepared CIM – one that is professional, transparent, and compelling – is the pivot point for attracting multiple, high-quality bids." – Doreen Morgan, Sunbelt Atlanta

A polished and professional CIM doesn’t just showcase strong financials; it signals that your business is well-managed and that you’re serious about the sale. On the flip side, a poorly crafted or incomplete document can stop the process in its tracks, as buyers gravitate toward opportunities presented with more clarity and confidence. Every detail in your CIM will be scrutinized during due diligence, and inaccuracies or omissions can lead to legal issues and irreparably harm your credibility.

To ensure your CIM is as effective as possible, seeking professional assistance can be a game-changer. Services like Deal Memo offer white-labeled CIM writing, delivering high-quality drafts within 72 hours for M&A transactions.

FAQs

Why is it important to include normalized earnings in a Confidential Information Memorandum (CIM)?

Including normalized earnings in a CIM gives potential buyers a better understanding of the company’s actual, ongoing profitability. By factoring out non-recurring, unusual, or one-time expenses and revenues, normalized earnings offer a clearer view of the business’s steady financial performance.

This added clarity helps buyers make more accurate valuations and feel more confident in their assessments. It reduces uncertainties, which can lower the perceived risks involved in the transaction.

How can a business address customer concentration risks in a Confidential Information Memorandum (CIM)?

To tackle customer concentration risks in a CIM, it’s essential to provide a clear breakdown of revenue by both customer and geography. For instance, specify how much of the total revenue comes from major clients, such as: "Customer A contributes 25% of FY 2024 revenue." If one customer accounts for a large share of revenue, flag it as a potential risk. Be sure to explain any related contractual details, like renewal terms, pricing structures, or termination penalties, to give a full picture of the situation.

Additionally, include the company’s approach to managing this risk. This could involve efforts to diversify the customer base, plans to enter new markets, or strategies to secure longer-term contracts. Sharing these details shows potential buyers that the business is aware of the risk and actively working to mitigate it. This helps build confidence in the company’s revenue stability and future growth.

Why is it important to disclose debts and liabilities clearly in a CIM?

Clear and open disclosure of debts and liabilities in a Confidential Information Memorandum (CIM) plays a key role in earning the trust of potential buyers. It gives them a complete picture of the company’s financial health, helping them evaluate risks and arrive at a fair valuation.

Being upfront about financial obligations also helps avoid surprises during due diligence – surprises that could derail the deal. Buyers appreciate honesty and straightforwardness, especially when it comes to details that influence financing decisions and long-term stability. Taking this transparent approach can make negotiations smoother and build confidence in the entire transaction process.