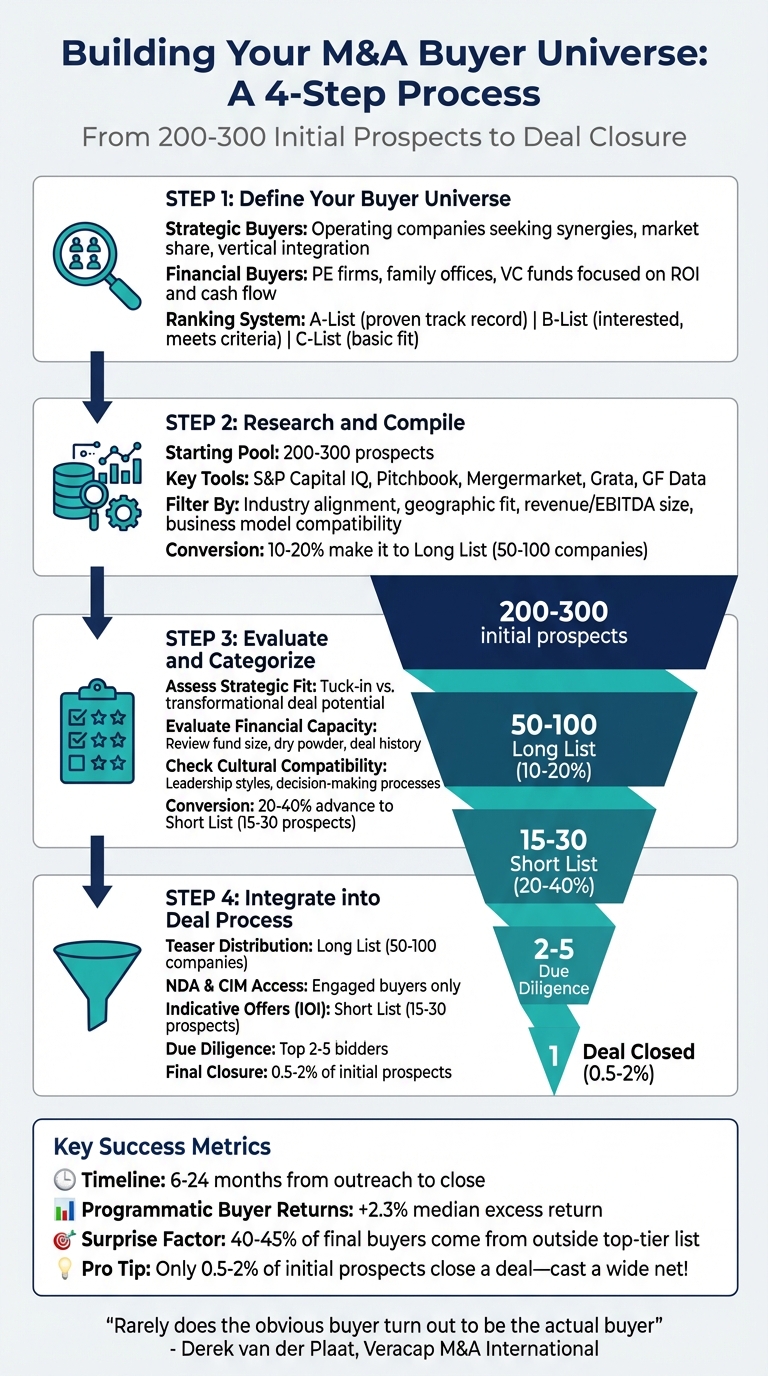

Want to maximize the value of your M&A deal? Start by building a strong buyer universe. This is the pool of potential acquirers – companies, private equity firms, and others – who could buy your business. A well-researched buyer universe not only boosts competition (and valuation) but also ensures you find the right buyer for your goals.

Here’s how to do it:

- Define Buyer Categories: Split buyers into two groups – operating companies (focused on synergies) and financial buyers (focused on ROI). Rank them into A, B, and C lists based on relevance.

- Research Buyers: Use tools like Pitchbook or S&P Capital IQ to identify prospects. Start with 200–300 names and narrow it down.

- Evaluate Fit: Check for alignment with your goals, financial capacity, and deal history. Prioritize buyers most likely to close.

- Refine the List: Progressively filter buyers at each stage – teasers, NDAs, bids – until you’re left with top contenders.

Pro Tip: Only 0.5–2% of initial prospects close a deal, so cast a wide net and stay flexible.

This process ensures better pricing, deal certainty, and alignment with your priorities.

4-Step Process to Build an M&A Buyer Universe with Conversion Rates

The M&A Mastermind Podcast – Episode 83 – Tips on Screening Buyers

Step 1: Define Your Buyer Universe

Before diving into a list of potential buyers, it’s crucial to first understand who might be interested in your target and why. Start by sorting buyers into two main groups – strategic and financial – based on their distinct goals. This approach ensures your search aligns with the seller’s priorities.

Identify Buyer Categories

Strategic buyers are operating companies looking to acquire businesses that align with their operational goals. They’re often motivated by synergies, such as cutting redundant costs, growing market share, or acquiring proprietary technology. This group can include competitors, complementary businesses, vertical integrators (suppliers or distributors aiming to control more of the value chain), and companies seeking intellectual property or technical expertise.

On the other hand, financial buyers – like private equity firms, family offices, and venture capital funds – focus on investments that promise strong returns. Their decisions are driven by factors such as cash flow, leverage opportunities, and potential exit strategies. As Andy Jones, Founder of Private Equity Info, explains:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment."

When building your buyer list, it helps to rank prospects into three categories:

- A-List: Firms with a proven track record in the target’s industry.

- B-List: Firms that show interest in the space and meet general criteria like size or location.

- C-List: Firms where the target fits basic transaction parameters but lacks a direct connection to their prior investments.

For instance, a banker might focus on 15–30 private equity firms on a B-List, while narrowing down to a dozen high-probability A-List targets.

| Feature | Strategic Buyers | Financial Buyers |

|---|---|---|

| Primary Motivation | Synergies, market share, vertical integration | ROI, cash flow, exit opportunities |

| Valuation Basis | Premium for cost savings or revenue growth | Standalone financial performance, leverage potential |

| Post-Deal Involvement | Often integrate the target into their operations | Typically retain management for platform or tuck-in growth |

| Key Criteria | Strategic fit, compatibility, technology access | Fund size, available capital, typical deal size |

Once you’ve categorized buyers, align these profiles with the seller’s specific objectives.

Understand Seller Objectives

For sellers, price isn’t the only factor that matters. As Derek van der Plaat, Managing Director at Veracap M&A International Inc., advises:

"The first step in constructing a buyer list is having a conversation with the divestiture principal. He/she will know the immediate competitors they face every day and why or why not they will be ‘good’ buyers."

Some sellers may prioritize preserving their brand and retaining staff, while others might focus on a quick exit with immediate cash. Others may even prefer ongoing involvement, such as through an earnout or equity in the acquiring company. These goals will heavily influence which buyers are the best fit. For example:

- A strategic buyer planning aggressive cost-cutting might offer a high price but conflict with a seller’s desire to protect jobs.

- A financial buyer expecting the seller to stay on and drive growth may not align with someone seeking an immediate exit.

It’s also essential to exclude certain prospects from the start. For instance, direct competitors may only be interested in gathering competitive intelligence, while some buyers may clash with the seller’s vision for the business. Filtering these prospects early ensures your final buyer list reflects the seller’s true priorities.

Defining buyer types and seller goals clearly sets the stage for deeper buyer research and a more targeted approach.

Step 2: Research and Compile the Buyer List

After defining your buyer categories and understanding the seller’s priorities, it’s time to roll up your sleeves and build a list of potential buyers. This step connects your strategic groundwork to actionable insights. Start with a broad pool of 200–300 prospects, then refine it based on strategic fit and acquisition intent.

Use Industry Databases and Tools

The right tools can cut down weeks of research. Here are some of the best options:

- S&P Capital IQ: Ideal for strategic buyers needing in-depth financial modeling and valuation benchmarks.

- Pitchbook: A favorite for private equity and venture capital insights, offering detailed deal flow and fund performance data.

- Mergermarket: Known for uncovering transactions before they go public, thanks to its network of journalists.

- Grata: Perfect for private company data, using advanced analytics to track real-time changes on company websites.

- GF Data: Focused on middle-market deals ($10 million to $500 million), providing benchmarks tailored to private transactions.

Jeremy Ellis, Managing Director at Genesis Capital, highlights the value of GF Data:

"GF Data’s proprietary M&A deal data is important for both our sell-side and buy-side clients in the $10-250 million deal space. It helps us prepare our clients with current, credible and relevant market expectations."

When using these tools, apply precise filters like NAICS/SIC codes, location, revenue, EBITDA, and ownership. Cross-referencing data across multiple sources is key, especially since private company information often relies on voluntary disclosures, which can be incomplete.

Assess Market Synergies and Buyer Rationale

Not every buyer will see value in the same opportunities. Identifying specific synergies is crucial to understanding why a deal might appeal to them. Here are some common acquisition strategies:

- Horizontal acquisitions: Focus on cost reductions through shared infrastructure and consolidated operations.

- Vertical acquisitions: Eliminate intermediary costs and secure the supply chain.

- Concentric acquisitions: Use existing customer relationships to introduce new product lines.

- Conglomerate acquisitions: Diversify cash flows across unrelated industries.

For financial buyers, the decision often hinges on fund size and available "dry powder" (undeployed capital). Andy Jones from Private Equity Info explains:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment."

Also, look for buyers who can unlock untapped potential, like proprietary technology or R&D assets. Programmatic buyers – those who systematically acquire companies to strengthen existing operations – tend to deliver better results. They achieve a 2.3% median excess total return to shareholders, compared to -0.1% for infrequent large-deal buyers.

Narrow Down the Initial List

Once you’ve gathered your data, it’s time to refine the list. Apply strict criteria like industry alignment, geographic fit, revenue and EBITDA size, and business model compatibility. Rank the remaining candidates using a weighted scoring system that considers strategic fit, financial capacity, and acquisition history.

Keep in mind that typical conversion rates are low – only 10-20% of your initial list will make it to a long list, and just 0.5% to 2% will result in a closed deal. To save time, review websites and financials with your team to filter out borderline cases quickly. It’s also smart to maintain a "blacklist" of companies to avoid, such as direct competitors who might misuse the process for competitive intelligence.

As MarktoMarket advises:

"Identifying one extra motivated acquirer can change the trajectory of a deal. Don’t leave deals closing to chance."

This refined list becomes the foundation for a deeper evaluation of buyer compatibility in Step 3.

sbb-itb-798d089

Step 3: Evaluate and Categorize Buyers

Sorting potential buyers into three groups – A-List, B-List, and C-List – can help you focus your efforts and resources where they’ll have the most impact. This approach ensures you prioritize outreach to the most promising prospects.

A-List buyers are those who’ve already invested in your target’s industry or a closely related sector. These buyers have demonstrated interest and understand the strategic value of such investments. As Andy Jones from Private Equity Info explains:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment".

B-List buyers are interested in the sector and meet your criteria for size and location, but they don’t currently have direct investments in the space. C-List buyers, on the other hand, meet basic transaction parameters but are less likely to engage. These are your fallback options if A- and B-List buyers don’t pan out.

Assess Buyer Fit

Determining whether a buyer is a good match goes beyond financials – it’s about strategic alignment and the likelihood of closing the deal. Start by deciding if the acquisition would be a "tuck-in" (a smaller, incremental investment with immediate benefits) or a "transformational" deal (one that significantly expands the buyer’s operations). Strategic buyers often look for synergies such as complementary product lines, new geographic markets, or proprietary technology.

Equally important is cultural compatibility. Becky Kaetzler from McKinsey highlights this:

"We believe companies should apply the same rigor to thinking about culture as they do to the financials when they are planning a deal and doing the integration".

This means examining leadership styles, decision-making processes, and workplace values to avoid integration issues down the line. As Joseph Carleone, Chairman of Avid Bioservices, notes:

"The leadership on both sides of the acquisition can impact a deal even with an exceptional strategic fit".

For private equity buyers, it’s crucial to identify the right partner within the firm – someone who holds board seats in relevant portfolio companies. Andy Jones warns:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response".

Once you’ve confirmed strategic compatibility, shift your focus to the buyer’s financial strength and their ability to complete the transaction.

Evaluate Financial Capacity and Deal Viability

For public buyers, review financial filings to assess their funding capabilities. For private buyers, look into their past purchasing behavior and current access to capital.

When dealing with private equity firms, pay attention to their current fund size, available dry powder, and recent check sizes. A lack of dry powder may mean they’ll need to rely on external partners, which can reduce deal certainty. Make sure their typical check size aligns with your transaction value.

Reputation also plays a key role. Look into each buyer’s history of closing deals efficiently and their specific financing plans for your transaction. Understand the mix of cash versus non-cash consideration and identify any contingencies that could complicate the process. Using a weighted scoring system that evaluates strategic fit, financial capacity, and acquisition history can help you objectively rank your top candidates.

Even at this stage, conversion rates are fairly low. Only 30–60% of buyers on your short list will move forward to active engagement. Start with your A-List, where there’s the greatest chance of success due to proven interest and alignment.

Step 4: Integrate the Buyer Universe into the Deal Process

Now that you’ve refined your buyer list in Step 3, it’s time to weave this information into every part of the deal process. The idea is to shift from a static list to a dynamic approach that evolves as the deal progresses. Your well-researched buyer universe becomes the backbone of your outreach, timing, and decision-making.

Align the Universe with Key Deal Milestones

To make the most of your buyer universe, align it with the major phases of your M&A process. Begin by distributing teasers to your broader "Long List", typically consisting of 50 to 100 companies, to gauge initial interest. This step helps identify which buyers are ready to engage further.

Once a buyer shows interest, have them sign an NDA and provide access to the Confidential Information Memorandum (CIM). From there, you can start narrowing the pool based on their level of engagement. The next step is the indicative offer (IOI) stage, where buyers submit non-binding preliminary bids by a set deadline. Only those with strong IOIs move forward to management presentations, forming a "Short List" of 15 to 30 prospects. Finally, the top 2 to 5 bidders gain access to the virtual data room for formal due diligence.

This structured approach ensures you consistently filter out less viable buyers, keeping the process focused and efficient.

Progressively Narrow the Buyer Pool

At each milestone, your buyer universe should shrink, creating a competitive yet manageable environment. Here’s how the numbers typically break down: only 10–20% of the initial universe makes it to the Long List, and from there, just 20–40% advance to the Short List. By the time you reach due diligence, you’re left with only a handful of serious contenders.

Refine your messaging along the way by analyzing feedback from buyers who decline to move forward. Data from the Axial platform in 2023 highlights the importance of a well-researched buyer universe. For example, a list of 100 buyers generated an average of 11 signed NDAs, while a list of 400 buyers produced 39 – a clear indication that a broader, targeted list boosts engagement.

To keep the process on track, set clear deadlines for inquiries, data requests, and indicative offers. Including private equity firms in your buyer universe – even if you favor strategic buyers – can help maintain momentum. Financial buyers are accustomed to structured sell-side processes and can keep timelines disciplined. And here’s an interesting takeaway: roughly 40–45% of the time, the final buyer comes from outside your top-tier list. So, avoid narrowing your options too soon.

Conclusion

Building a strong buyer universe isn’t just about compiling a list of potential names – it’s about creating a well-thought-out roadmap that shapes every decision in your M&A journey. By defining buyer categories, researching potential acquirers, assessing fit, and applying insights, you set the stage for better deal outcomes. This roadmap reflects every step outlined earlier, from crafting detailed buyer profiles to narrowing down the candidate list. A carefully designed buyer universe not only helps you secure the best valuation but also supports non-financial goals, such as preserving your company’s legacy or safeguarding your team, while fostering the competitive tension needed to achieve favorable terms.

Here’s a reality check: out of an initial pool of 500–2,000 companies, only 0.5%–2% typically close a deal. As Derek van der Plaat, Managing Director at Veracap M&A International Inc., notes:

"Rarely does the obvious buyer turn out to be the actual buyer".

This highlights why casting a wide net and staying open to unexpected buyers is so critical. The process is iterative, with new prospects surfacing as market feedback comes in, conditions change, or previously overlooked buyers express interest. These dynamics emphasize the importance of a flexible and evolving approach. Data backs this up: programmatic buyers who maintain discipline see a 2.3% median excess return, compared to -0.1% for those pursuing infrequent large deals.

Patience is key. The journey from initial outreach to closing the deal often takes 6 to 24 months. By sticking to the structured process detailed in this guide – from defining your universe to progressively refining it – you’ll position yourself for a successful transaction that aligns with both your financial goals and broader strategic priorities.

FAQs

How can I identify the best type of buyer for my M&A target?

To determine the ideal buyer for your M&A target, start by examining two key factors: strategic fit and financial capacity. Strategic fit includes elements like market synergies and complementary technologies, while financial capacity involves metrics such as cash flow, EBITDA, and acquisition funding. The goal is to identify buyers that not only align with the target’s growth objectives but can also integrate operations effectively and bring added value to the business.

Buyers typically fall into two primary categories:

- Strategic buyers: These are companies looking to broaden their product offerings, enter new markets, or achieve operational efficiencies.

- Financial buyers: These include private equity firms or investment groups focused on improving operations and generating returns, often with the intent of reselling the business later.

Once you’ve identified potential buyers, rank them as A-List, B-List, or C-List based on how well they meet your criteria and their level of activity in the sector. A scoring system can be a useful tool here, allowing you to prioritize buyers with the strongest alignment, sufficient financial resources, and clear acquisition intent. This focused approach can streamline the deal process and improve your chances of securing the best outcome.

What are the best tools for identifying potential buyers in an M&A process?

To create a robust pool of potential buyers for an M&A target, using specialized tools and databases can make all the difference. Among the top resources is Private Equity Info, which provides an extensive database of both strategic and financial buyers. Then there’s PitchBook, a go-to platform for digging into detailed company financials, deal histories, and ownership structures. These tools help you pinpoint and prioritize buyers based on how well they align strategically and their financial capabilities.

Other useful platforms include CorpDev AI, which compiles market data and company intelligence, as well as Crunchbase and CB Insights. These two are excellent for tracking private equity activity, venture-backed companies, and recent transaction trends. Leveraging these resources allows you to quickly identify, analyze, and categorize potential buyers, ensuring your outreach efforts are directed toward the most promising leads.

Why should I consider financial buyers even if I prefer strategic ones?

Including financial buyers in your pool of potential buyers is a smart move, as they bring distinct benefits to the process. They can inject growth capital, contribute operational expertise, and introduce competitive dynamics that might drive up the valuation of your M&A target.

Even if you’re inclined to favor strategic buyers, financial buyers broaden your horizons and enhance your leverage during negotiations, helping you secure the best possible deal.