Selling a business and selling real estate are entirely different processes. While both involve asset transfers, the complexity, valuation methods, confidentiality needs, and timelines vary significantly. Real estate revolves around tangible assets like land or buildings, with a straightforward valuation based on comparable sales and public marketing. In contrast, business sales involve both tangible (equipment, inventory) and intangible assets (customer relationships, goodwill), requiring financial recasting, confidentiality, and a longer timeline due to due diligence.

Key differences:

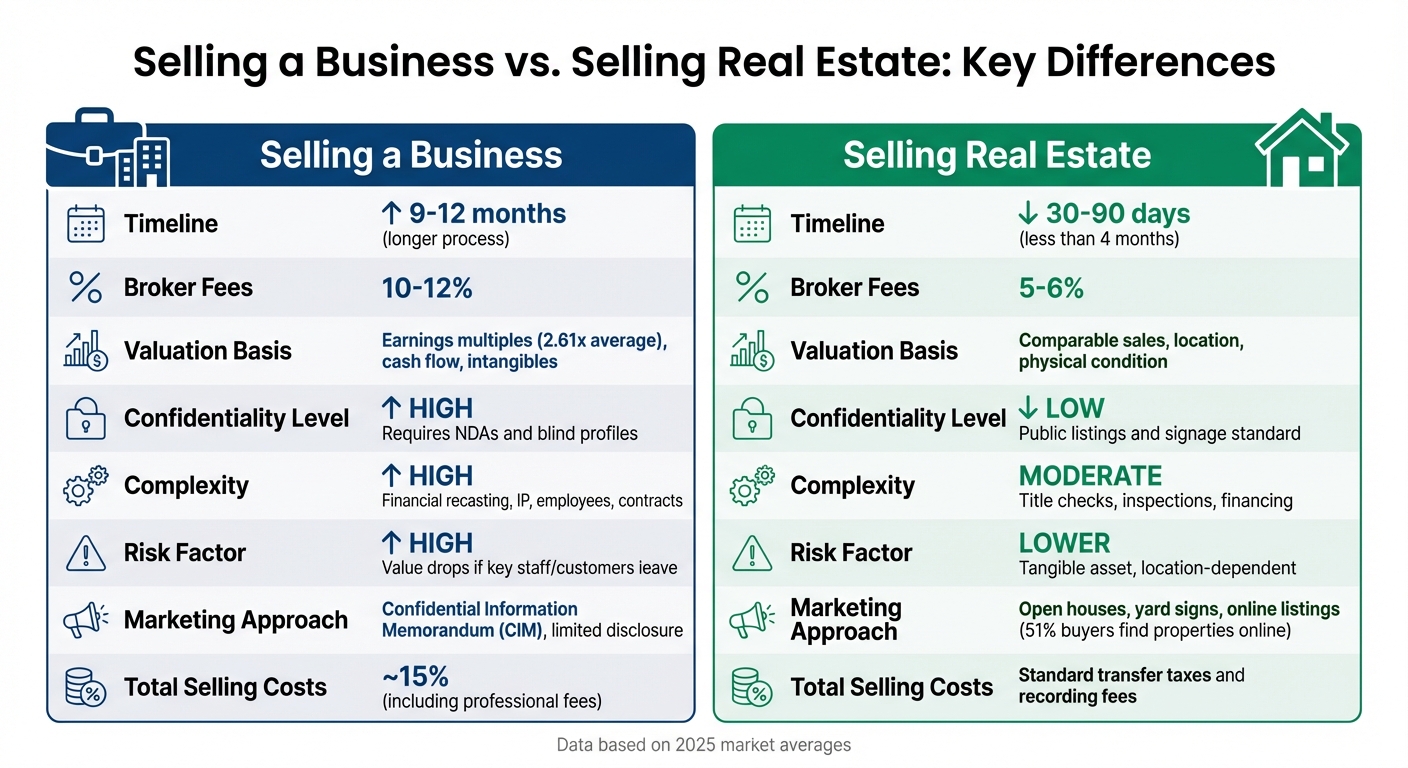

- Valuation: Businesses are valued based on cash flow and earnings multiples, while real estate relies on physical attributes and location.

- Confidentiality: Business sales require NDAs and secrecy to protect operations, unlike the open marketing of real estate.

- Timeline: Selling a business takes 9-12 months on average, compared to 30-90 days for real estate.

- Complexity: Business sales involve due diligence on financials, contracts, and risks, while real estate focuses on inspections and title checks.

- Costs: Broker fees for businesses are higher (10-12%) compared to real estate (5-6%).

Quick Comparison:

| Feature | Selling a Business | Selling Real Estate |

|---|---|---|

| Timeline | 9-12 months | 30-90 days |

| Broker Fees | 10-12% | 5-6% |

| Valuation Basis | Earnings, cash flow, intangibles | Location, physical condition |

| Confidentiality | High; requires NDAs | Low; public marketing |

| Complexity | High; financial and legal risks | Moderate; inspections, title |

Selling a business demands specialized expertise, preparation, and confidentiality. By contrast, real estate sales are faster and more public, making them simpler but less intricate. Both require different strategies to ensure a successful transaction.

Selling a Business vs Real Estate: Key Differences Comparison

1. Selling a Business

Valuation Methods

When valuing a business, the focus shifts away from real estate-style comparisons and instead zeroes in on income streams and future earnings potential. A widely used approach for small, profitable businesses is the market-based method, which applies a pricing multiple to the company’s Seller’s Discretionary Earnings (SDE). For instance, in 2025, businesses sold on average for 2.61 times their annual earnings and 0.69 times their annual revenue. Certain industries, like Online and Technology businesses, fetched higher multiples at 3.25x, while Transportation businesses saw lower multiples at 1.82x.

A key difference between business and real estate sales is the impact of owner dependency. As BizBuySell explains, "Most business buyers want to buy an income stream, not a job. A business managed largely by employees is much more valuable than one whose owner needs to work 60 hours a week". To make the business more appealing to buyers, sellers need to adjust the financials to reflect true cash flow, adding back discretionary expenses such as personal travel, family salaries, and owner health insurance. Interestingly, Thomas Pavlick of Bank of America notes, "I used to think that owners might overvalue their businesses… But many business owners tend to undervalue their enterprises before they get an actual evaluation".

Once the valuation is established, sellers must also prioritize confidentiality during the sale process.

Confidentiality and Marketing

Unlike real estate sales, where public listings and open houses are common, selling a business demands strict secrecy. Revealing a pending sale can lead to competitors poaching clients, suppliers renegotiating terms, or employees jumping ship. To avoid such risks, sellers rely on Nondisclosure Agreements (NDAs) before sharing sensitive details like customer lists, proprietary algorithms, or manufacturing processes. As Josh Felser, a seasoned entrepreneur, aptly states, "Companies are sold not bought". This means sellers must actively market their business while safeguarding critical information, releasing it in stages and holding back the most sensitive details – such as intellectual property or customer specifics – until late in the process.

A key marketing tool is the Confidential Information Memorandum (CIM), which is shared exclusively with serious, pre-vetted buyers who have signed an NDA. Keeping the sale under wraps also helps maintain negotiating power. If buyers sense financial distress, they may use it as leverage to push for a lower price.

Once confidentiality is secured, the next challenge is navigating due diligence and negotiations.

Negotiation and Due Diligence

Compared to a home inspection, due diligence for a business sale is far more complex. Buyers typically request 3 to 5 years of financial records, including profit and loss statements, tax returns, supplier contracts, and intellectual property documentation. They also scrutinize customer concentration – if a single client represents more than 20% of revenue, it’s seen as a risk that can lower the valuation. Attorneys J. Gerard Legagneur and Amanda Hayes describe this phase as "the most time-consuming and burdensome part of the purchase process".

Negotiations often involve choosing between two types of sales: an asset sale or a stock sale. In an asset sale, buyers purchase specific assets and generally avoid taking on past liabilities unless explicitly agreed upon. However, transferring contracts and licenses may require third-party approval. In contrast, a stock sale involves buying the entire entity, including all liabilities – both known and unknown – but contracts and permits typically transfer automatically. Sellers are wise to address issues like tax delinquencies, outdated permits, or bookkeeping errors before due diligence begins, as buyers will use these as leverage to negotiate a lower price.

Tax Implications

Selling a business comes with tax complexities that go beyond the straightforward capital gains taxes seen in real estate. In an asset sale, sellers may face higher ordinary income tax rates on specific assets, while buyers benefit from a "step-up" in basis, allowing for greater depreciation and amortization. On the other hand, stock sales often provide sellers with more favorable capital gains tax rates, but buyers inherit the historical tax basis, limiting their depreciation opportunities.

Sellers should also account for the costs of selling, which can be significant. Broker commissions typically range from 10% to 12% for businesses valued under $1 million, and combined with professional fees, total selling expenses can reach about 15% of the sale price. Additionally, the IRS mandates the use of the "residual method" to allocate the purchase price across various asset classes in an asset sale. This allocation has tax implications for both the buyer and seller, making it a critical step in the process.

How do you Value Businesses Differently From Real Estate?

2. Selling Real Estate

Selling real estate is a very different process compared to selling a business. While business sales often involve managing confidential information and intangible assets, real estate sales are all about tangible property and public visibility.

Valuation Methods

Valuing real estate is typically more straightforward than valuing a business. The most widely used method is the sales comparison approach, which evaluates recent sale prices of similar properties in the same area. Appraisers consider factors like square footage, age, condition, and features to determine a property’s market value based on comparable sales.

Other valuation methods include the cost approach, which estimates the cost to rebuild the property plus the value of the land, and the income approach, commonly used for investment properties. Unlike business valuations – where intangible assets like customer loyalty or proprietary technology play a big role – real estate appraisals focus on physical characteristics and location. With approximately 1.6 million Realtors actively working in the U.S., it’s worth noting that 51% of home buyers find properties online through public listings. This transparency in valuation aligns with the open marketing strategies typical in real estate sales.

Confidentiality and Marketing

When it comes to marketing, real estate sales are all about visibility. Sellers use tools like yard signs, public online listings, and open houses to attract buyers. The property’s address is public, and anyone can drive by to see the exterior. This transparent approach is a stark contrast to business sales, where confidentiality is key to avoid alarming employees or customers.

In real estate, the goal is to maximize exposure – getting as many interested buyers to view the property as possible. There’s no need for NDAs or confidential documents because the asset is visible, and the sale doesn’t disrupt ongoing operations.

Negotiation and Due Diligence

Real estate transactions generally follow a standardized process. A Purchase and Sale Agreement (PSA) lays out the terms, including earnest money, contingencies, and a closing timeline of 30 to 60 days. Miranda Crace, Senior Section Editor at Rocket Mortgage, explains:

"A purchase and sale agreement (PSA) details the terms and conditions of your home purchase".

Due diligence in real estate focuses almost entirely on the physical property. Buyers hire inspectors to assess critical components like the foundation, roof, plumbing, and electrical systems. Federal law requires a Lead-Based Paint Disclosure for homes built before 1978. Additionally, title searches ensure the seller has clear ownership and reveal any liens or encumbrances. Lenders also require professional appraisals to confirm the property’s value matches the loan amount.

This process is far simpler than the due diligence required for business sales, which often involves analyzing years of financial records, customer contracts, and intellectual property. In real estate, buyers are purchasing a tangible asset with a clear market value, so the focus remains on physical inspections rather than operational complexities.

Tax Implications

Taxes on real estate sales are relatively straightforward. Sellers typically deal with capital gains taxes, transfer taxes, and standard recording fees.

Most buyers secure financing through standard mortgage loans, and the transaction is recorded in public records. Unlike business sales, which require filing IRS Form 8594 to report asset allocation, real estate transactions involve minimal tax-related paperwork, making the process simpler for both parties.

sbb-itb-798d089

Pros and Cons

Looking at the processes outlined earlier, it’s clear that selling a business and selling real estate come with distinct advantages and challenges. These differences aren’t just about how the transactions are handled – they impact everything from how long the sale takes to the risks involved.

Selling a business can deliver higher returns, but it’s a much more intricate process. For instance, in 2025, businesses sold for an average of 2.61 times their annual earnings, often with higher cap rates than commercial real estate. That said, this potential for greater profit comes with added challenges. One major issue is the need for strict confidentiality. Keeping the sale under wraps is essential to avoid unsettling employees or exposing sensitive customer information. As Chris Capelle, a Technology Expert, explains:

"Sharing CIMs and other financial documents related to an M&A is a risky proposition; since these documents are a detailed, intimate look behind the curtain of a company, ending up in the wrong hands (a competitor, perhaps) could be trouble."

On the other hand, real estate sales are typically more straightforward. Unlike business transactions, real estate deals often use public marketing channels, which eliminates the need for secrecy.

Here’s a quick comparison of the key differences between selling a business and selling real estate:

| Feature | Selling a Business | Selling Real Estate |

|---|---|---|

| Timeline | 9 to 12 months on average | Typically less than 4 months |

| Broker Fees | 10% to 12% commission | Typically 5% to 6% commission |

| Risk Factor | High; value can drop if key staff or customers leave | Lower; asset is tangible and location-dependent |

| Valuation Basis | Multiples of SDE/Earnings, Intangibles, and Assets | Comparable sales, location, and physical condition |

| Confidentiality | High; requires NDAs and blind profiles to protect operations | Low; public listings and signage are standard |

| Complexity | High; involves employees, IP, and complex tax recasting | Moderate; focused on title, inspection, and financing |

While business sales demand more effort, preparation, and professional expertise, they often come with the promise of a bigger payout. Real estate transactions, on the other hand, are faster and more predictable, making them a simpler option for many sellers.

Conclusion

Selling a business is a complex process that requires a different approach than selling real estate. While real estate transactions often hinge on location and physical condition, the value of a business is tied to factors like earnings multiples, operational dependencies, and projections of future cash flow. This added complexity makes professional expertise not just helpful but essential for a successful sale.

Earlier, we explored how valuation methods and marketing strategies for businesses differ significantly from those used in real estate. As Merger Resources wisely highlights:

"The slightest whisper of desperation on the part of the target for merger or acquisition immediately lowers its potential valuation".

This is where professional support becomes invaluable. A skilled business broker can create a compelling Confidential Information Memorandum to attract buyers. A CPA can recast financials to uncover true Seller’s Discretionary Earnings, and an experienced M&A attorney can navigate the nuances of asset and stock purchases.

BDO Capital Advisors offers a timeless piece of advice:

"The Boy Scout motto – ‘Be Prepared’ – is apt, as being prepared for a potential sale can help bring about a successful transaction."

Preparation is key. Start assembling your team and organizing documentation at least one to two years before your intended sale. Although selling expenses typically run about 15%, cutting corners on professional guidance could cost you far more in terms of a lower sale price – or even a failed deal.

FAQs

What makes valuing a business different from valuing real estate?

Valuing a business means diving into its financial health, assets, and potential for growth. This typically involves evaluating cash flow, earnings multiples like EBITDA, and the worth of both tangible assets (like equipment) and intangible ones (such as intellectual property). Industry trends also play a big role in predicting future performance. Plus, having clean financial records and a history of steady profits can make a business more attractive to potential buyers.

On the other hand, valuing real estate revolves around factors like location, property condition, comparable sales, and income potential (such as rental income or cap rates). While both processes demand thorough analysis, business valuation is often trickier. It goes beyond just physical assets, requiring a deeper look at operational and market dynamics.

Why is confidentiality so important when selling a business?

Confidentiality plays a crucial role in business sales because the information exchanged – like customer lists, financial records, or proprietary processes – can cause serious harm if it falls into the wrong hands. To safeguard this sensitive data, sellers often create a Confidential Information Memorandum (CIM). This document is only shared with potential buyers who have signed a non-disclosure agreement (NDA). The NDA acts as a protective shield, ensuring the business’s competitive edge is preserved and preventing any unwarranted speculation in the market.

The timing and method of disclosure are also influenced by confidentiality. Initial conversations typically stick to general information, while more sensitive details are disclosed later – after an NDA is in place and during the due diligence phase. By adhering to strict confidentiality measures, sellers can protect their business’s value, foster trust with buyers, and minimize risks throughout the sale process. Breaches of confidentiality can lead to legal issues and tarnish a business’s reputation, making it a top priority for everyone involved.

What makes selling a business more complex than selling real estate?

Selling a business is a far more intricate process than selling real estate, mainly because the factors involved go well beyond just property value. While real estate sales typically focus on the worth of the property, selling a business hinges on operational and financial performance. Key considerations include earnings, cash flow, customer contracts, and intellectual property. On top of that, the purchase price often needs to be divided among different asset classes for tax purposes – something that doesn’t come into play with real estate transactions.

Another major hurdle is maintaining confidentiality. Selling a business demands a careful vetting process for potential buyers. Tools like Confidential Information Memorandums (CIMs) and Letters of Intent (LOIs) are essential before sharing sensitive financial data. This adds extra layers of negotiation and requires careful timing to ensure discretion.

The structure of business transactions also adds complexity. Buyers must decide between asset purchases, stock purchases, or hybrid approaches, each with unique tax consequences, liability considerations, and integration challenges. Negotiations often extend to terms like earn-outs, non-compete agreements, and employee transitions, making the process not only more strategic but also significantly more time-intensive than a straightforward real estate sale.