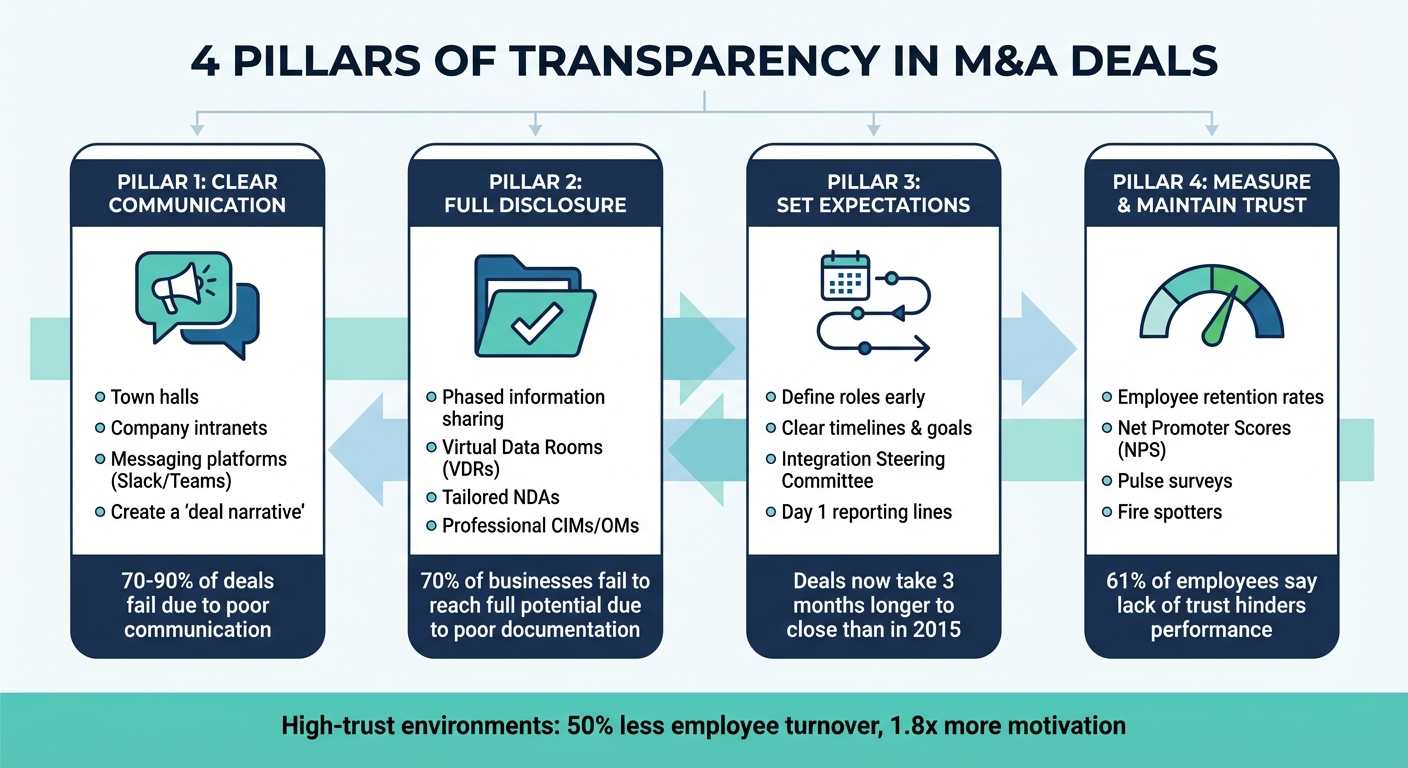

In mergers and acquisitions (M&A), trust is the backbone of success. Without it, even promising deals can crumble. Transparency helps build this trust by ensuring clear communication, full disclosure, and aligned expectations between all parties involved. Here’s the essence of how transparency strengthens trust in M&A:

- Clear Communication: Use structured, consistent updates via tools like town halls, intranets, and messaging platforms to prevent misinformation and rumors. Establish a "deal narrative" to keep everyone aligned.

- Full Disclosure: Share essential information in phases, using secure tools like Virtual Data Rooms (VDRs) and tailored NDAs to balance confidentiality with openness.

- Set Expectations: Define roles, timelines, and goals early on to avoid confusion. Use professional materials like Confidential Information Memorandums (CIMs) to establish clarity and professionalism.

- Measure and Maintain Trust: Track metrics like employee retention, Net Promoter Scores (NPS), and feedback tools to identify and address trust gaps.

Transparency isn’t just about sharing information – it’s about creating systems that enable trust and collaboration throughout the M&A process. When done right, it reduces risks, strengthens relationships, and increases the likelihood of success.

4 Pillars of Transparency in M&A Deals

The smoothest deals happen when you’re transparent.

sbb-itb-798d089

How to Communicate Transparently with Clients

Clear and consistent communication forms the backbone of trust during M&A transactions. By keeping dialogue open and structured from the start, advisors can avoid the pitfalls of rumors and misinformation. Establishing a clear communication plan early and sticking to it throughout the process is essential.

Setting Up Open Communication Channels

Top M&A advisors rely on multiple communication channels to connect with clients at every stage of a transaction. Town hall meetings provide an opportunity for face-to-face discussions, addressing concerns directly. Meanwhile, company intranets serve as centralized platforms for critical documents, FAQs, and announcements. Tools like Slack or Microsoft Teams allow integration teams to share real-time updates and stay coordinated.

To ensure consistency across all communications, create a core "deal narrative" that outlines the strategic goals, value, and vision of the transaction. This narrative should guide everything from email updates to client meetings. McKinsey highlights the dangers of silence during such deals: "Communication vacuums are dangerous. Employees and customers are unlikely to wait until day one to decide what they think of the deal". To prevent this, provide regular updates to keep everyone informed and aligned.

It’s also crucial to have a dedicated communications team. This team, with representation from both parties, can handle the high volume of content, navigate legal approvals, and prepare a "leak strategy" to address any premature disclosures. Pre-drafted messaging and a clear escalation plan help maintain control of the narrative.

By setting up these communication channels, you create a foundation for meaningful two-way interaction.

Getting Client Input and Feedback

Transparent communication isn’t just about sharing updates – it’s also about listening. Advisors need to establish two-way feedback loops where clients can express concerns and influence the process. For example, in November 2024, 3Capital Partners guided a tech company through international expansion. During due diligence, they held direct discussions about intangible asset valuation, building trust and alignment on asset worth.

To gather feedback effectively, implement tools like pulse surveys and Q&A sessions. Additionally, consider using "fire spotters" – key employees who can detect potential issues early and help address them before they escalate. As Rami Cassis, CEO of Parabellum Investments, advises: "GPs and senior leadership teams must have honest conversations with the wider team – both about the good and bad – to build trust and establish long-term relationships". This means engaging not just senior leaders but the broader team to gain a comprehensive view of the business.

Collecting feedback is vital, but leveraging technology can further enhance communication.

Using Tools to Improve Communication

Technology plays a crucial role in simplifying communication and ensuring clients receive professional, consistent updates. Virtual data rooms (VDRs) are a great example – they offer secure access to sensitive information with features like granular permissions, watermarking, and activity tracking, all while maintaining transparency. Additionally, 22% of M&A professionals now use generative AI to draft communications aligned with the deal’s vision and to analyze potential cultural challenges.

Professional-grade documentation also sets the tone for a smooth transaction. Platforms like Deal Memo (https://dealmemo.com) provide on-demand services for creating Confidential Information Memorandums (CIMs) and Offering Memorandums (OMs). Tailored for M&A firms, business brokers, and investment banks, these white-labeled packages are delivered within 72 hours, ensuring clients receive clear, detailed materials that inspire confidence. Tools like Nitro Sign further enhance the process by securely distributing these documents and collecting signatures to confirm receipt and understanding.

Combining personal interactions with the right digital tools ensures clients stay informed, engaged, and confident throughout the deal.

How to Ensure Full Disclosure in M&A Deals

Building trust in mergers and acquisitions (M&A) requires more than just open communication. Full disclosure plays a critical role in maintaining that trust by carefully managing how and when essential information is shared.

Full disclosure doesn’t mean dumping every document on the table at once. Instead, it’s about following a structured process that ensures all relevant details are shared while safeguarding sensitive information. When management teams fail to be upfront, even the most promising deals can fall apart. The solution lies in creating workflows that encourage transparency without jeopardizing the deal.

Creating a Workflow That Prioritizes Transparency

Experienced advisors often take a phased approach to sharing information. Start by forming a "Circle of Trust", where only a select group of key executives are involved early on. This minimizes the risk of leaks while ensuring decision-makers are fully informed. As the process advances, use a tiered Virtual Data Room (VDR) to control the flow of information. Begin with high-level summaries, move to a detailed Confidential Information Memorandum (CIM) after signing an NDA, and save the most sensitive data for the final stages of due diligence.

For particularly sensitive information, like pricing or customer data, consider using "clean teams." These are individuals or third-party consultants who aren’t involved in daily operations and can perform independent analyses. Establish materiality thresholds – for example, disclose only items exceeding $500,000 in value – to keep the focus on significant details instead of overwhelming buyers with minor issues.

Addressing potential negatives early is also essential. Whether it’s pending litigation or expiring intellectual property, bring these issues up in initial conversations rather than burying them in later documents. As Anthony Galvan from PCE Companies explains:

Confidentiality isn’t paperwork – it’s a shield that protects your valuation, your people, and your future options.

This phased approach ensures that documentation is both thorough and strategically shared.

Producing Accurate and Detailed Documentation

A polished and professional CIM, typically 30–150 pages long, can make a strong impression. Unfortunately, 70% of businesses fail to reach their full potential in M&A deals because their documentation doesn’t reflect their true value. High-quality documentation is essential for building trust with potential buyers.

Beyond presenting financials and operations in a clear and compelling way, these materials serve a legal purpose. Disclosure schedules, for instance, extend the acquisition agreement and shield sellers from future liability claims. Simply uploading a document to a virtual data room isn’t enough – it must also be formally listed in disclosure schedules to meet legal requirements.

Tools like Deal Memo (https://dealmemo.com) simplify this process by creating white-labeled CIMs and Offering Memorandums (OMs) in as little as 72 hours. These services include seller interviews and unlimited revisions, helping ensure the documentation is both professional and comprehensive.

Striking the Right Balance Between Confidentiality and Transparency

The real challenge in M&A deals isn’t choosing between being open and keeping things confidential – it’s finding a balance that works at each stage of the process. Early on, share general business information, but reserve sensitive details like customer lists and proprietary methods for buyers who show genuine commitment. Use advanced VDR settings to restrict access, such as enabling "view-only" permissions, disabling downloads, and adding watermarks with user-specific identifiers to track document access.

Tailor NDAs to the specific vulnerabilities of the deal rather than relying on one-size-fits-all templates. A strong NDA should clearly define what counts as confidential and outline specific consequences for breaches. When it comes to customer introductions, timing is key. Introduce high-priority customers to the buyer shortly before closing, often in joint meetings, to reassure clients without creating unnecessary uncertainty.

Lastly, prepare for potential crises. Draft internal memos and customer-facing scripts ahead of time to stabilize the business in case of a deal leak. Taking these proactive steps shows professionalism and helps protect the transaction’s value, even in challenging situations.

How to Set Clear Expectations

When roles and objectives are unclear, M&A deals can quickly go off track. Confusion leads to muddled timelines, inconsistent materials, and a breakdown of trust – often before the deal even begins. Below, we’ll explore how to define roles, establish clear goals, and use professional documentation to keep everything on course.

Defining Roles and Responsibilities

To ensure smooth execution, every M&A deal needs a clear governance structure. This means identifying decision-makers, executors, and communicators from the outset. Start by forming an Integration Steering Committee to handle key decisions, appointing an Integration Leader to oversee daily operations, and designating a Communications Leader to manage messaging across channels. This structure helps avoid missed deadlines and redundant efforts.

For larger deals, consider setting up an Integration Management Office (IMO). The IMO coordinates workstreams and manages dependencies across the organization, ensuring all moving parts align.

A great example of this in action is Dell’s $67 billion acquisition of EMC in 2016. By clearly defining roles – such as separating sales teams to focus on cross-selling – Dell achieved multibillion-dollar revenue synergies within the first year.

One critical but often overlooked step is clarifying Day 1 reporting lines. Employees should know exactly who they report to and what processes to follow the moment the deal closes. This simple step can prevent confusion and maintain momentum.

Clarifying Deal Goals and Timelines

Unclear objectives and shifting timelines can erode trust and derail progress. To avoid this, advisors should move beyond financial forecasts and craft an integration thesis. This thesis outlines how the deal will create value and meet strategic goals, identifying key decisions – like operating model choices or R&D alignment – that will drive results quickly.

Develop milestone-specific plans for critical events, such as the announcement, transaction close, and Day 1 operations. These plans provide clarity and ensure that employees, customers, and stakeholders stay informed. As McKinsey & Company warns:

Communication vacuums are dangerous. Employees and customers are unlikely to wait until day one to decide what they think of the deal.

A strong example comes from Emerson’s 2023 acquisition of National Instruments. Before the announcement, Emerson had already set clear synergy targets and gained a deep understanding of the target’s technology. This preparation enabled the company to hit the ground running and deliver value immediately after the deal closed.

It’s also essential to set strict deadlines for resolving critical "power and people" issues, such as filling top leadership roles. Clear timelines reduce employee anxiety and help retain key talent. Keep in mind that deals facing challenges now take, on average, three months longer to close than in 2015. Building extra time into your timeline is a smart move.

Using Professional Materials to Set Expectations

High-quality documentation is key to establishing trust and setting the right tone for the transaction. A well-prepared Confidential Information Memorandum (CIM) or Offering Memorandum (OM) not only demonstrates professionalism but also anchors all communications in a cohesive "deal narrative." This narrative should clearly explain the strategic vision and benefits of the combined company.

Tools like Deal Memo (https://dealmemo.com) can help advisors create polished, white-labeled CIMs and OMs quickly – within 72 hours. These materials often include seller interviews and unlimited revisions, ensuring consistency and alignment across all communications.

In addition to the CIM, create a communications-activity plan that outlines the who, what, when, why, where, and how of the merger. Use watermarked documents and pre-drafted crisis playbooks to maintain confidentiality and control the narrative.

Professional materials also play a legal role. For example, disclosure schedules – which extend the acquisition agreement – are crucial for preventing future liability claims. These documents must be both accurate and comprehensive, creating a transparent framework that builds trust throughout the transaction. The goal isn’t just to share information – it’s to establish a solid foundation that keeps everyone aligned.

How to Measure and Maintain Trust

In mergers and acquisitions (M&A), transparency thrives on measurable trust and responsive feedback. Trust can be quantified, yet there’s a stark disconnect: while 90% of executives believe their customers trust them, only 30% of consumers feel the same way. This gap highlights a critical blind spot that can quietly undermine the success of a deal. Without clear metrics, M&A teams risk operating on assumptions instead of facts.

Key Transparency Metrics for M&A

To gauge trust effectively, focus on three key groups: customers, employees, and investors. For customers, Net Promoter Scores (NPS) and Customer Satisfaction Scores (CSAT) are invaluable. These metrics shed light on how the transition impacts customer loyalty. A sudden rise in support tickets or refund requests can act as an early warning sign, signaling confusion or dissatisfaction during the M&A process.

When it comes to employees, tools like Employee Net Promoter Scores (eNPS) and retention rates help identify potential cultural clashes before they escalate. The data speaks volumes: 61% of employees report that a lack of trust from leadership hinders their ability to perform well. Meanwhile, financial metrics like net profit margin and operating cash flow validate operational claims, and stability indicators such as Net Dollar Retention Rate and customer tenure underscore long-term value for potential acquirers.

To start, focus on 8–10 executive-level metrics, rolling out 1–3 new ones per quarter to avoid overwhelming your team. At the operational level, it’s wise to pause the introduction of new metrics for the first three months post-acquisition. This allows trust to develop naturally between teams. Tracking these indicators paves the way for timely, data-driven responses.

Improving Through Feedback

Metrics alone won’t build trust – they need to be paired with actionable feedback mechanisms. 46% of employees who experienced a trust-breaking event said they saw it coming. This underscores the importance of listening channels that can detect issues early. Tools like pulse surveys, integration barometers, and town halls create opportunities for two-way communication. Additionally, appointing "fire spotters" – trusted employees who can identify and flag rumors or cultural tensions – can help pinpoint areas where trust is faltering.

Technology can also play a big role. AI-powered sentiment analysis tools can scan for cultural gaps and alert leadership to potential risks. For example, Deloitte’s TrustID® platform organizes trust data by demographic, enabling targeted interventions. The results are hard to ignore: employees in high-trust environments are 1.8 times more motivated and 50% less likely to consider leaving their jobs. After the deal closes, conducting post-mortems can reveal what worked well and where improvements are needed.

Conclusion

In mergers and acquisitions (M&A), transparency often determines whether a deal thrives or collapses. A staggering 70% to 90% of deals fail due to poor communication. By prioritizing transparency from the first discussion all the way through to closing, advisors can significantly reduce buyer concerns – directly boosting the deal’s valuation. As Jacob Orosz, President of Morgan & Westfield, succinctly states:

Honesty is the #1 weapon in M&A transactions.

The benefits of transparency extend beyond the negotiation table. In environments where trust is high, employees are 50% less likely to leave their roles and are nearly twice as motivated. Open communication also streamlines the entire process, cutting down on due diligence delays and avoiding last-minute price renegotiations that could derail agreements.

Building trust in M&A requires more than good intentions – it calls for structured systems and effective tools. For example, a well-prepared Confidential Information Memorandum (CIM) can set the tone for transparency from the outset. Platforms like Deal Memo (https://dealmemo.com) support M&A advisors by creating professional, white-labeled CIMs and Offering Memorandums within 72 hours. Their services include seller interviews and unlimited revisions, ensuring the documentation is comprehensive and credible. These materials give buyers the clarity they need to proceed with confidence.

FAQs

How does transparency help minimize risks in M&A deals?

Transparency is a cornerstone of minimizing risks in mergers and acquisitions (M&A). By openly sharing critical information – like financial data, strategic objectives, and integration plans – companies can avoid surprises such as hidden liabilities, overinflated valuations, or unexpected regulatory hurdles. This level of openness also calms nerves among employees and stakeholders, reducing resistance that could otherwise throw the deal off course.

When M&A teams create a clear, transparent roadmap, they establish accountability and ensure everyone is on the same page. This shared clarity helps sidestep common pitfalls like cultural clashes and operational hiccups – two major reasons many deals fall apart. In the end, embedding transparency throughout the process not only safeguards value but also paves the way for smoother integration and a higher likelihood of success.

What are the best tools for ensuring clear communication during an M&A deal?

Effective communication is essential during an M&A deal. To keep things running smoothly, you need tools that simplify collaboration, protect sensitive information, and ensure everyone stays on the same page. A centralized platform offering features like secure document sharing, real-time updates, and task management can go a long way in building trust and clarity throughout the process.

Some must-have tools include virtual data rooms for securely storing and sharing confidential documents, project management dashboards to track progress effectively, and secure messaging channels for quick and reliable communication. These tools not only streamline workflows but also minimize the chances of miscommunication, ensuring all stakeholders remain informed at every step of the transaction.

Why is transparency critical for building trust in M&A transactions?

Transparency plays a key role in M&A transactions, serving as the foundation for trust, reducing uncertainty, and ensuring everyone involved is on the same page. When information is shared openly, expectations are clearly set, and communication remains honest, both buyers and sellers can tackle the complexities of the deal with greater confidence.

Being upfront and thorough in disclosure helps uncover potential risks early on, safeguarding the value of the deal by avoiding unexpected issues. This approach not only boosts the likelihood of a successful outcome but also strengthens the relationships between advisors and their clients.