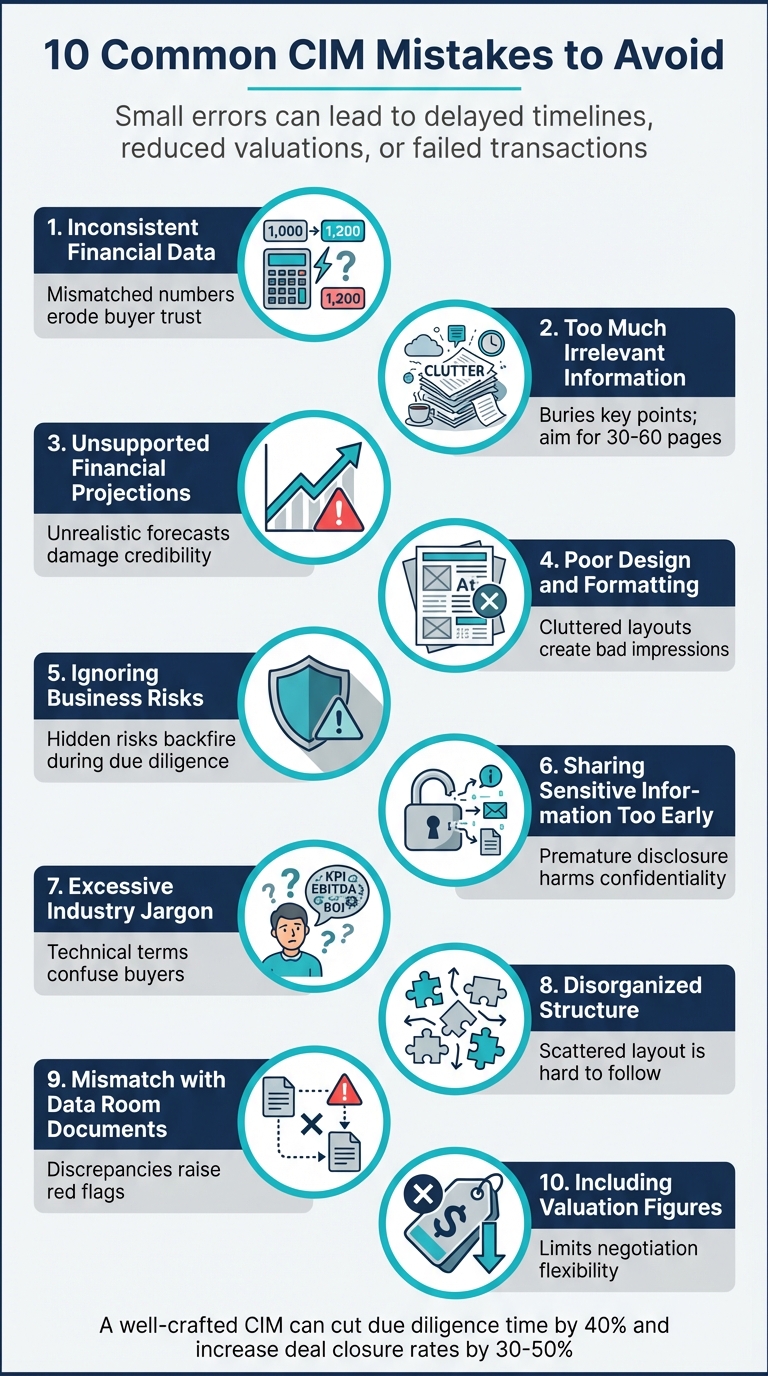

When creating a Confidential Information Memorandum (CIM) for M&A deals, small errors can lead to major consequences, like delayed timelines, reduced valuations, or failed transactions. This guide outlines the 10 most frequent mistakes professionals make in CIMs and how you can avoid them:

- Inconsistent Financial Data: Mismatched numbers erode buyer trust. Always reconcile figures with financial statements and provide clear explanations for adjustments.

- Too Much Irrelevant Information: Overloading the CIM with unnecessary details buries key points. Focus on the essentials that drive valuation.

- Unsupported Financial Projections: Unrealistic growth forecasts without clear assumptions damage credibility. Back every projection with data and logic.

- Poor Design and Formatting: Cluttered layouts or misaligned visuals create a bad impression. Use clean, professional formatting and ensure visuals support the narrative.

- Ignoring Business Risks: Hiding risks can backfire during due diligence. Address challenges upfront and explain mitigation strategies.

- Sharing Sensitive Information Too Early: Prematurely disclosing details can harm confidentiality. Use phased disclosures and vet buyers before sharing full CIMs.

- Excessive Industry Jargon: Overuse of technical terms can confuse buyers. Use clear, simple language to communicate effectively.

- Disorganized Structure: A scattered layout makes the document hard to follow. Stick to a logical sequence and maintain a smooth flow.

- Mismatch with Data Room Documents: Discrepancies between the CIM and supporting documents raise red flags. Ensure all data aligns perfectly.

- Including Valuation Figures: Listing a specific price can limit negotiation flexibility. Highlight strengths and let buyers determine value.

These insights can help you create a CIM that builds trust, avoids delays, and drives better outcomes for your deal.

10 Common CIM Mistakes to Avoid in M&A Deals

How To Analyze M&A Broker CIMs for Business Buyers

1. Presenting Inconsistent Financial Data

Inconsistent financial data can quickly erode buyer confidence. If your Confidential Information Memorandum (CIM) lists one revenue figure while your financial statements show another, buyers are likely to question the reliability of everything else in the document. This breakdown in trust can drag out the deal process – or worse, cause buyers to back out entirely.

The root cause often lies in poor data practices. Issues like unstructured monthly closes, inconsistent revenue recognition, or failing to reconcile GAAP or SDE figures with Adjusted EBITDA are common culprits. When add-backs lack thorough explanation or when charts fail to match the narrative, buyers are forced to spend extra time sorting out discrepancies.

This kind of conflicting data doesn’t just slow things down – it can lead to endless Q&A sessions, lower valuations, or even derail the deal altogether during due diligence. Worse, it signals to buyers that the business may be poorly organized.

To prevent these pitfalls, prepare a detailed Adjusted EBITDA or SDE schedule that clearly outlines each add-back and provides solid justification. Make sure reported figures are reconciled to normalized earnings to establish credibility. Standardizing your data by tying every number to official bank statements and finalized monthly closes can also help.

Before going to market, double-check that every figure – whether in the executive summary, financial tables, or supporting documents – matches perfectly. Buyers will scrutinize these numbers, and any inconsistencies will undermine your credibility.

2. Including Too Much Irrelevant Information

Packing a CIM with unnecessary details can hurt your chances of closing a deal. Why? Because it buries the key value drivers under a mountain of irrelevant information, making it harder for buyers to see what truly matters. Overloaded CIMs often get skimmed – or worse, ignored altogether – while concise, focused ones grab attention.

"A 200-page CIM often gets skimmed, while a focused, 50-page CIM gets read thoroughly." – Doreen Morgan, Sunbelt Atlanta

Stick to the essentials – details that directly impact current earnings and future growth. Skip the irrelevant backstory and avoid raw data dumps like unannotated charts, which only distract from your core message.

For lower-middle market businesses, aim for a CIM that’s between 30–60 pages. Every section should serve a purpose: to highlight the key drivers that justify your valuation. If a section doesn’t directly support this, cut it. Save specifics like customer names, vendor lists, and trade secrets for the due diligence phase, once you’ve identified serious buyers.

Think of your CIM as a marketing tool, not just a financial document. Avoid filler and add brief, clear commentary to charts and metrics. This approach keeps the narrative sharp and builds momentum toward a successful sale.

3. Using Unsupported Financial Projections

Making financial projections without solid backing can seriously damage buyer confidence. When growth forecasts lack clear, realistic assumptions, buyers quickly become skeptical. And here’s the kicker: deals often collapse during due diligence when buyers discover that the numbers don’t hold up under scrutiny. This is why experts frequently caution against overly optimistic "hockey stick" projections.

"Aggressive, ‘hockey stick’ financial projections are the single biggest red flag for a sophisticated buyer." – Sunbelt Atlanta

For instance, projecting sudden, dramatic growth after years of steady but modest performance is a major red flag. If your business has grown 5% annually for the past three years, claiming a 50% jump next year without a concrete reason – like a newly signed, game-changing contract – will immediately raise doubts.

"First thing you do when you get a CIM from a bank is discount management projects by at least 10%." – JustADude, Private Equity Associate

To avoid this, make sure every projection is backed by clear assumptions and external validation. Instead of vague statements, get specific. For example: "We plan to hire a two-person sales team to target a $50M market segment." Detail the time, capital, and staffing investments required. Additionally, support your growth claims with third-party validation, such as media coverage, analyst reports, or market data that aligns with your story. By presenting accurate and well-supported projections, you build the trust necessary for a successful CIM.

4. Poor Design and Formatting

The design and layout of a Confidential Information Memorandum (CIM) play a bigger role than you might think. A poorly designed CIM can leave a negative first impression, making potential buyers question the professionalism and organization of your business. Issues like inconsistent formatting, cluttered layouts, misaligned charts, or visuals without context can overwhelm readers. Worse, these missteps may come across as careless – or even as an attempt to hide unfavorable details – leading to delays in the deal process as buyers may request additional clarifications or Q&A sessions.

To avoid these pitfalls, pay close attention to formatting. Stick to a clear heading structure (H1, H2, H3), use easy-to-read fonts like Arial or Calibri at 11–12 points, and limit your color scheme to 2–3 complementary colors. For documents longer than four pages, include a Table of Contents to guide readers. If your CIM exceeds 10 pages, consider adding a Summary Page with a unique ID and a confidentiality footer to reinforce professionalism.

Visuals are another key element. Charts and graphs should enhance your narrative, not distract from it. For example, use line graphs to show financial trends over time or pie charts to break down market share or customer concentration. Every visual should directly support the text and provide clear context – random or poorly explained visuals can confuse rather than clarify.

A polished, well-organized CIM signals that you’re prepared to engage with serious buyers. It’s not just about aesthetics; it’s about building trust. Tailor each section with relevant text and visuals to maintain reader interest, even in longer documents. A thoughtful design shows buyers you’re serious – and that can make all the difference.

5. Hiding or Ignoring Business Risks

Overlooking business risks in a Confidential Information Memorandum (CIM) can lead to serious consequences. Due diligence often uncovers hidden issues, which can derail deals, lead to tougher negotiations, lower valuations, or even tarnish your reputation.

The better strategy? Be upfront about potential risks. Brian Dukes, Founder of Exitwise, emphasizes:

"A CIM can help you de-risk the sale by making disclosures early to avoid putting off interested buyers later when problems arise. You can explain any problem areas early and show you are in control."

By addressing risks early – whether it’s customer concentration, key-man dependency, or outdated technology – you take control of the narrative. This approach allows you to present challenges in a positive light while showing that your team is actively working to address them.

However, don’t stop at simply naming the risks. Pair them with clear mitigation strategies. For instance, if customer concentration is a concern, highlight your plan to diversify your client base. If you depend on a single supplier, share evidence of steps you’ve taken to secure alternative sources. This approach not only demonstrates transparency but also reassures buyers that you’re proactive and organized in managing risks.

Antoine Bradette, Associate at BDC‘s Growth and Transition Capital, explains:

"The biggest error is to present information that is not reliable and gets broken apart in due diligence. You don’t want surprises during due diligence where the buyer finds incorrect information or missing details."

Being transparent builds trust, while hiding risks can damage your credibility. A CIM that openly addresses challenges from the start keeps the process on track and avoids endless rounds of questioning during due diligence. But remember, timing matters – share sensitive details strategically to maintain buyer confidence.

sbb-itb-798d089

6. Sharing Sensitive Information Too Early

Revealing confidential details too soon can lead to serious consequences. If your Confidential Information Memorandum (CIM) ends up in the hands of a competitor posing as a buyer, you risk exposing your proprietary data, intellectual property, and strategic weaknesses. Additionally, premature leaks about a potential sale can disrupt operations and jeopardize your company’s stability. Doreen Morgan from Sunbelt Atlanta emphasizes:

"The moment word gets out that your company might be for sale, you risk destabilizing the very asset you’ve worked so hard to build."

To avoid these pitfalls, consider using a phased disclosure approach.

Start with an anonymous teaser – a brief 5 to 10-page executive summary that omits your company’s identity but gives potential buyers enough information to gauge interest. Only after a buyer signs a Non-Disclosure Agreement (NDA) should you provide the full CIM. Save your most sensitive documents – like tax returns, bank statements, detailed contracts, and payroll records – for the due diligence stage, which comes after accepting a Letter of Intent (LOI).

Before sharing a CIM, vet potential buyers carefully. Conduct phone interviews, verify their identity, and request financial questionnaires to confirm they’re serious and qualified. Be particularly cautious with strategic buyers in your industry, as they may need additional information redacted compared to financial buyers like private equity firms.

Protecting confidentiality isn’t overcautious – it’s a practical strategy to keep your sale process secure. Services like Deal Memo can help ensure that disclosures are phased appropriately, safeguarding sensitive details until buyers are thoroughly vetted.

7. Using Too Much Industry Jargon

The language you use in your CIM is just as important as its design and layout. Packing your document with technical jargon can create unnecessary hurdles for potential buyers. While strategic buyers may have the industry expertise to navigate complex terms, financial buyers and private equity groups often don’t. Overloading them with jargon can confuse them and derail your deal before it even gets off the ground. If buyers struggle to make sense of your document, they may interpret it as an attempt to obscure weaknesses – a red flag that can erode their confidence. Clear, straightforward language ensures your message is accessible and persuasive.

Overusing technical language can also disrupt the flow of your narrative, making it harder to communicate your investment thesis effectively. Instead of telling a compelling story, jargon-filled CIMs often come across as generic and uninspiring. Alex Karlsen from Captarget puts it simply:

"The most important thing that a CIM does is tell a story. Period."

To make your CIM more approachable, swap out complex terms for simpler alternatives. For example, replace "synergistic acquisition opportunities" with "growth potential through acquisitions." Instead of "normalized EBITDA", use "adjusted earnings" and clearly explain any adjustments. Similarly, trade "proprietary production technology" for "unique manufacturing process."

Each section of your CIM should reinforce your business narrative with smooth transitions. When presenting market data, don’t just show numbers – explain what they mean. For instance, clarify what’s driving peaks or dips in a graph rather than leaving the data open to interpretation.

As Karlsen advises:

"Taking this approach can help ensure that your CIMs are not too technical and not too long."

A well-written CIM demonstrates that you’re a prepared and credible seller, helping to build the trust needed to move deals forward. By using clear, accessible language, platforms like Deal Memo help create CIMs that connect with a broad range of buyers while maintaining a professional tone.

8. Creating a Confusing or Disorganized Structure

A poorly organized CIM can confuse buyers and damage your credibility. If sections seem scattered or subsections fail to connect to a clear narrative, the document becomes difficult to follow. Just like focused content and accurate data, a logical structure is essential to guide buyers through your investment story. As Doreen Morgan from Sunbelt Atlanta puts it:

"A weak, confusing, or incomplete CIM stops the sale process cold, as buyers will move on to other, more professionally presented opportunities."

The solution? Stick to a standardized sequence: Executive Summary, Company Overview, Products and Services, Market Analysis, Operations, Management Team, Financial Information, and Growth Opportunities. Use a clear heading hierarchy (H1, H2, H3) and include a table of contents for longer documents. This approach ensures what Tammie Miller, CEO of TKO Miller, describes as a "transitive flow." She explains:

"A scattered structure will lead to a disjointed narrative. Conversely, an organized structure will produce a transitive flow that coherently presents the information."

Each section should build upon the last, reinforcing your investment thesis. This logical flow helps buyers understand the opportunity and strengthens your narrative.

In addition to clear content, well-structured formatting boosts buyer confidence. Avoid focusing too much on historical details while neglecting future growth potential. Strike a balance by highlighting what matters most – the future upside. These thoughtful touches make your CIM feel polished and reliable.

If creating a cohesive, well-structured CIM feels daunting, Deal Memo can help. They deliver professionally crafted documents within 72 hours, ensuring every section flows seamlessly and supports your investment story with precision.

9. Mismatching CIM Content with Data Room Documents

When your Confidential Information Memorandum (CIM) paints one picture but the data room documents tell another, you risk eroding trust with potential buyers. Buyers expect every number and projection in your CIM to align seamlessly with the supporting documents they examine during due diligence. Whether it’s discrepancies in revenue figures, customer counts, or EBITDA calculations, any inconsistency can raise red flags about your data management and internal operations. This alignment is just as critical as maintaining consistency in financial data, as discussed earlier.

Even small mismatches between your CIM and data room documents can have significant consequences. Buyers may lose confidence, walk away from the deal, or use the inconsistencies to push for a lower price. Minor errors can also lead to extended Q&A sessions and drawn-out negotiations, ultimately delaying the transaction process. Monte Carlo Data emphasizes this point clearly:

"Trust disappears quickly once stakeholders catch inconsistencies".

To avoid these pitfalls, ensure that every figure in your CIM is derived from a single, verified source. Rigorously review and organize all files in your Virtual Data Room (VDR). For example, if your CIM mentions normalized EBITDA with add-backs, those figures must be traceable directly to the financial statements in your data room. Consistency between the CIM and supporting documents is non-negotiable.

Take it a step further by implementing version control. This ensures that any updates made to the CIM are accurately reflected in the data room. Cross-referencing is also essential – compare your CIM appendix with the corresponding folders in the VDR. Asset lists, financial statements, and operational metrics should match perfectly. Keep in mind that sellers are often required to legally certify the accuracy of all information before closing, making thorough cross-checking a legal obligation as well as a best practice.

10. Including Specific Valuation Figures in the CIM

When preparing your Confidential Information Memorandum (CIM), maintaining negotiation flexibility is just as important as ensuring data consistency and a clear structure.

Adding a specific purchase price to your CIM can limit the potential of the deal. Why? Because setting a hard number can act as a price ceiling, discouraging strategic buyers from offering more based on their unique synergies or investment strategies. This can unintentionally anchor negotiations too early, reducing the chances of competitive bidding.

Here’s an important distinction to keep in mind: a CIM is a marketing document, not a contract. It’s designed to generate interest in your business, while the Letter of Intent (LOI) is where purchase terms – like the proposed price – are outlined. The LOI is typically submitted by the buyer after they’ve reviewed your materials. As Antoine Bradette, Associate at BDC’s Growth and Transition Capital, explains:

"A CIM showcases the business in the best possible way to maximize value and let buyers know exactly what they’re going into if they make an offer".

The goal of the CIM is to give buyers enough detailed information about the business’s past performance and growth potential so they can form their own informed offers. By avoiding a preset price, you enable buyers to evaluate the business on their terms, which often leads to stronger offers.

Valuation is highly subjective, varying from buyer to buyer based on factors like strategic fit, market position, and synergies. Leaving the price open-ended allows multiple buyers to assess the business through their own lens, increasing the likelihood of receiving higher bids. As ALIGNMT puts it:

"The goal is to maximize your business valuation when it matters: in a transaction".

Instead of focusing on a fixed number, emphasize what makes your business valuable. Showcase its strengths, market position, and investment potential. For example, highlight growth strategies such as entering new markets or launching innovative products. Use metrics like adjusted EBITDA or normalized earnings to demonstrate the company’s true earning potential. This shifts the conversation from "how much it costs" to "how much it’s worth."

Conclusion

A Confidential Information Memorandum (CIM) plays a critical role in mergers and acquisitions. According to LexisNexis, it sets the stage for buyer discussions and valuation, while Tammie Miller emphasizes that millions of dollars are on the line when selling your business.

Avoiding common mistakes in your CIM can establish trust with buyers right from the start. Presenting consistent financial information, structuring the document clearly, and addressing risks proactively all contribute to building credibility. A well-crafted CIM not only signals that you’re a serious seller but also helps speed up the entire deal process.

For instance, a clearly structured CIM can cut due diligence time by up to 40%, increase deal closure rates by 30–50%, and attract as much as five times more qualified buyers. These outcomes directly enhance your bottom line, all by steering clear of the typical pitfalls discussed earlier.

To maximize effectiveness, focus on key sections like the Executive Summary and Financials. Align your messaging with the priorities of your target buyers, whether they are strategic or financial investors. This tailored approach creates competitive tension and leads to better offers. By ensuring data consistency and maintaining a logical structure, your CIM becomes a powerful, market-ready tool.

If you need professional assistance, Deal Memo offers white-labeled CIM packages within 72 hours. Their services include seller interviews, unlimited revisions, and personalized sell-side materials to help you stand out in the market.

FAQs

How do I ensure financial data is accurate and consistent in a CIM?

To ensure your Confidential Information Memorandum (CIM) is accurate and consistent, start with a well-organized plan. Use a standardized template that specifies the financial statements to include – such as the income statement, balance sheet, and cash flow statement – and the time periods they should cover (e.g., historical data, trailing twelve months, or projections). Pull all data directly from reliable, audit-ready sources like tax returns or ERP reports. Then, reconcile every number against a master spreadsheet to identify and resolve discrepancies early in the process.

Collaboration plays a crucial role. Engage key stakeholders – like the business owner, financial team, and your investment-banking advisor – from the outset to ensure that critical assumptions, such as depreciation methods or revenue recognition policies, are applied consistently throughout the document. Before finalizing the CIM, conduct a detailed review to ensure all sections align. Check that monetary figures use the $USD format (e.g., $1,250,000) and that dates follow the U.S. format (MM/DD/YYYY). A second review by a finance expert can provide an additional layer of scrutiny, helping to catch any overlooked errors and reinforcing buyer confidence.

How can I safely share sensitive information in a CIM?

Sharing sensitive information in a Confidential Information Memorandum (CIM) demands careful steps to maintain confidentiality. Start by requiring all potential recipients to sign a robust nondisclosure agreement (NDA) before sharing any details. Before the NDA is in place, stick to a brief teaser that avoids revealing highly sensitive data. Once the NDA is signed, use a secure virtual data room (VDR) with encryption, user permissions, and activity tracking to distribute the full CIM.

To add an extra layer of protection, consider redacting or masking critical information – like profit margins or customer lists – during the initial stages. Only share these details when buyers demonstrate genuine interest and credibility. Use watermarked documents with timestamps and, when sharing files outside the VDR, apply password protection.

It’s also smart to maintain a master log of all disclosures, restrict access to thoroughly vetted buyers, and rely on encrypted file transfers for any additional materials. These precautions help ensure your sensitive information remains secure and reaches only qualified parties.

Why shouldn’t specific valuation figures be included in a CIM?

Including exact valuation numbers in a Confidential Information Memorandum (CIM) can sometimes backfire. It risks setting rigid expectations among potential buyers, who might treat those figures as hard targets. If the actual performance or deal terms don’t align perfectly, it could lead to skepticism or even mistrust.

Leaving valuations out of the CIM keeps things more flexible. It allows buyers to independently evaluate the business’s worth, creating room for open, constructive conversations about its value without preconceived constraints.