A Confidential Information Memorandum (CIM) is a critical document for selling a business. It introduces your company to potential buyers, highlights its strengths, and sets the foundation for valuation discussions. A well-prepared CIM can attract more qualified buyers, reduce due diligence time, and increase deal closure rates by up to 50%. Here’s how to craft one effectively:

- Start with an Executive Summary: Provide a snapshot of your financials, growth plans, and competitive advantages. Keep it concise to grab attention.

- Detail Your Business Overview: Explain operations, products, and key team members. Emphasize scalability and systems that reduce reliance on the owner.

- Outline Market Position: Use data to define your market, showcase your competitive edge, and address risks with mitigation plans.

- Present Financials Clearly: Include 3–5 years of financial statements, explain adjustments, and provide realistic projections tied to growth drivers.

- Highlight Growth Opportunities: Offer actionable plans, like targeting new markets or expanding product lines, with clear resource and ROI details.

- Clarify Transaction Details: List included assets, leadership expectations, and deal terms without being overly rigid.

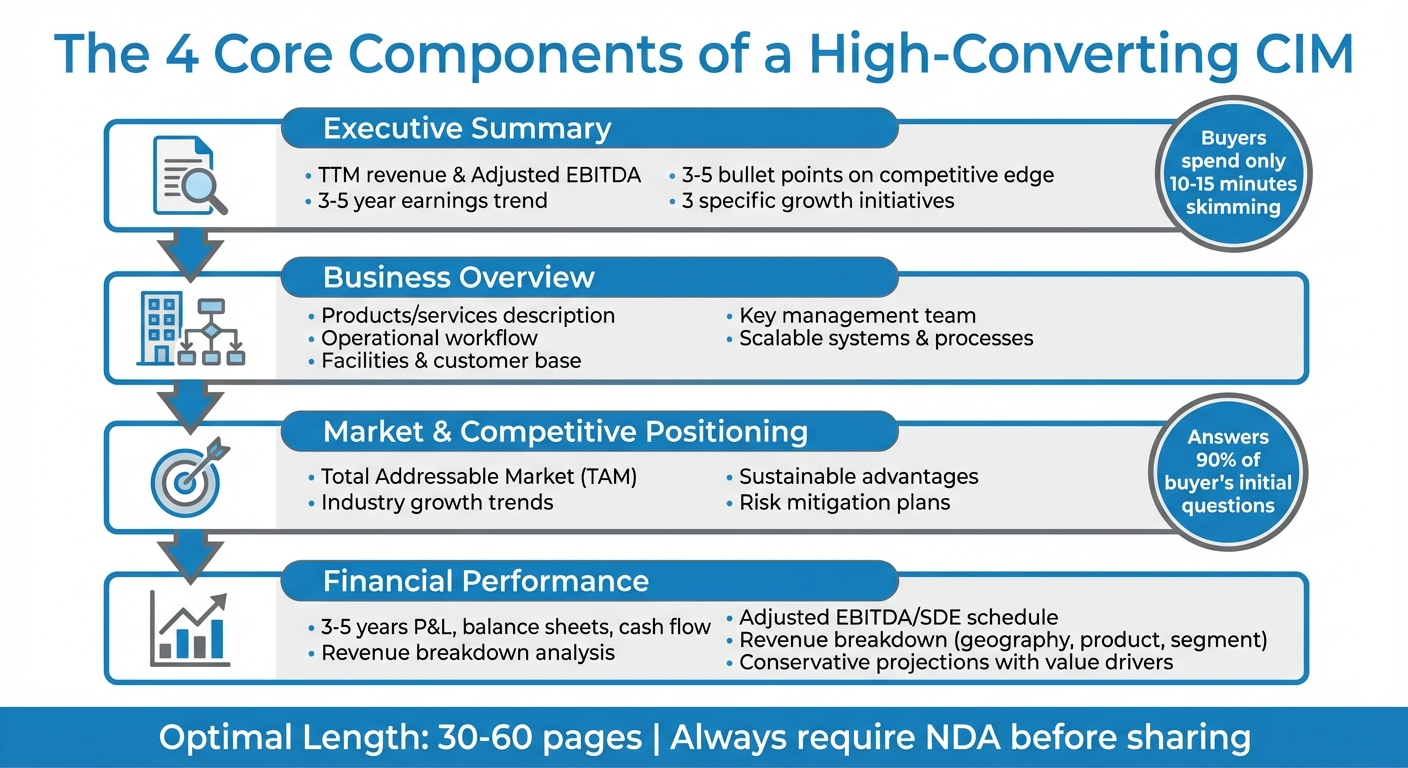

Key Tips: Use charts for clarity, maintain confidentiality with NDAs, and consider outsourcing for professional presentation. Keep the document concise (30–60 pages) and ensure it tells a clear, engaging story. Buyers spend only 10–15 minutes skimming a CIM – make every detail count.

Crafting an Effective Confidential Information Memorandum: A Guide

How to Structure Your CIM

Essential Components of a High-Converting CIM Structure

A well-organized CIM answers the majority of a buyer’s initial questions – up to 90% of them, in fact. The trick is to strike the right balance between depth and readability. A bulky 200-page CIM often gets skimmed, while a concise and focused 50-page document is far more likely to hold a buyer’s attention. To make your CIM both engaging and effective, structure it around these key sections. Each part works together to tell a clear story and address the critical questions buyers are asking.

Executive Summary

Think of the executive summary as your one-page pitch – the hook that convinces buyers to dive deeper. Start by showcasing your trailing twelve months (TTM) revenue, Adjusted EBITDA, and a 3–5 year earnings trend to give a snapshot of your financial trajectory. Include 3–5 bullet points that outline your competitive edge – what makes your business not just survive but thrive.

Then, highlight three growth initiatives with specific, actionable details. Instead of vague goals like "expand sales", say something concrete like "hire a two-person sales team to target the healthcare sector." This section should immediately answer the buyer’s first question: Is this worth my time?

Once you’ve captured their interest, the next step is to provide operational details that build credibility.

Business Overview

In this section, explain how your business runs day-to-day. Describe your products or services, outline your operational workflow, and include details about your facilities and customer base. Introduce your key management team, focusing on their roles and expertise. The aim here is to show buyers that the business can operate smoothly without being overly reliant on the current owner.

Also, emphasize systems and processes that make the business scalable. Buyers want to see that growth is possible without a proportional increase in costs or complexity.

Market and Competitive Positioning

Here’s where you define your place in the market. Use credible data to outline your Total Addressable Market (TAM) and highlight the industry trends that are fueling growth. Offer a competitive analysis, showing where you stand among your peers, and list your sustainable advantages. These could be anything from proprietary technology to exclusive supplier agreements or a dominant market share.

This section should answer two critical questions: Why choose you over competitors? and What challenges or opportunities does the market present? Don’t shy away from addressing weaknesses. For example, if customer concentration is a potential risk, include a brief mitigation plan to reassure buyers.

How to Present Financial Performance and Projections

When presenting your business’s financial health, include 3–5 years of profit and loss statements, balance sheets, and cash flow data. This provides a solid foundation to demonstrate your business’s earnings and stability. Next, highlight past performance to instill confidence in potential buyers.

Historical Financials

To reinforce your business’s credibility, build on the narrative established earlier by offering a detailed Adjusted EBITDA or SDE schedule. Include each add-back (such as one-time legal fees, owner expenses, or excess salary) with clear, concise explanations. This transparency fosters trust and helps avoid disputes during due diligence.

Break down revenue by geography, product, and segment to illustrate alignment with your strategic goals. Share details about your monthly close processes, revenue recognition policies, accounts receivable/payable aging, and inventory valuation method (e.g., FIFO or LIFO). If your financial statements are prepared on an accrual basis while your tax returns use cash accounting, include a clear reconciliation to prevent raising concerns during reviews.

"The ‘Financial Performance’ section also takes up a lot of time because you have to ‘dress up’ a company’s financial statements… without outright lying",

notes Brian DeChesare, Founder of Mergers & Inquisitions.

Once you’ve established a comprehensive historical record, shift focus to realistic future projections that are tied to specific value drivers.

Projections and Value Drivers

Offer conservative, well-supported projections that avoid overly optimistic "hockey stick" growth curves. Back up your forecasts with historical data or actionable plans. For example, instead of vaguely claiming "we’ll grow revenue by 30%", explain that a signed contract with a new distributor is expected to generate $2M in annual sales, based on their current customer base.

Highlight key value drivers such as strong customer retention, solid unit economics, recurring revenue streams, low capital expenditures, and high free cash flow conversion. Connect these drivers to your growth strategies, providing a clear roadmap for achieving the projections.

Don’t shy away from addressing potential risks. For instance, if customer concentration poses a challenge, include a simple mitigation plan like: "We are actively pursuing three new enterprise contracts to diversify revenue by Q3 2026". This level of transparency in your financials not only strengthens buyer confidence but also increases the attractiveness of your business to potential investors.

sbb-itb-798d089

How to Highlight Growth Opportunities and Transaction Details

When presenting your business to potential buyers, it’s essential to showcase its potential for growth and provide a clear picture of the transaction details. This approach not only piques interest but also frames your business as a forward-thinking investment.

Growth Initiatives

Buyers want tangible plans they can evaluate. As Roadmap Advisors puts it, "The growth section is a critical aspect… buyers do appreciate a concrete plan that helps them underwrite your growth story". To meet this expectation, include specific, actionable initiatives. For example: “Hire a two-person outside sales team to target a $50M healthcare vertical”.

Frame these opportunities as part of an Investment Thesis with well-defined paths. This could involve geographic expansion backed by demographic trends, launching new product lines with clear development timelines, optimizing pricing strategies to improve margins, or automating processes to cut labor costs. For each plan, detail the necessary resources – time, money, and personnel – and the expected return on investment.

Transaction Overview

When outlining the transaction, provide a technical summary without committing to rigid terms. Middle-market M&A deals are typically negotiated, so avoid stating a specific asking price. Instead, focus on the rationale behind the deal, expectations for management continuity, and any conditions tied to the sale.

Be clear about what’s included in the transaction. List assets such as intellectual property, contracts, and equipment. Highlight key terms like post-acquisition leadership continuity, seller financing, transition periods, or non-compete agreements. By doing so, you set clear expectations for negotiations and provide buyers with a solid understanding of the deal framework.

Presentation Best Practices for Maximum Outreach

After structuring your CIM to address key buyer questions, the next crucial step is presenting it in a way that grabs attention and builds trust. A well-prepared CIM needs more than just solid content – it should look professional and guide buyers seamlessly through the information.

Design and Data Visualization

Your CIM should tell a clear and compelling story, not bombard readers with raw data. As Alex Karlsen from Captarget puts it:

"The most important thing that a CIM does is tell a story. Period."

To achieve this, focus on clean, organized layouts that highlight your company’s history, strengths, and future opportunities. Stick to standard fonts like Arial, Calibri, or Times New Roman (11–12 pt), a cohesive color palette with 2–3 brand colors, and a clear heading structure (H1-H3). For lower-middle market deals, aim for a length of 30–60 pages – enough to cover everything without overwhelming the reader.

Replace dense paragraphs with charts and graphs whenever possible. Visualizing financial trends, market share comparisons, or growth projections makes complex data easier to digest. But remember, every visual element should have a purpose. If a chart doesn’t make information clearer or faster to understand than text would, leave it out.

Once your CIM is visually polished, ensure confidentiality measures are in place to protect sensitive information.

Confidentiality and Professionalism

Never share a CIM without first securing a signed Non-Disclosure Agreement (NDA) from a vetted, qualified buyer. This step not only protects your business but also reassures buyers that you’re serious about confidentiality.

To further safeguard your document, assign each CIM a unique identification number and use tools like dynamic watermarking, multi-factor authentication, and timed access to control distribution.

Proactively addressing potential weaknesses in the CIM can also build trust. By openly acknowledging and framing challenges, you control the narrative and prevent surprises during due diligence. Additionally, an error-free, professionally formatted document signals that your company operates at a high standard, while sloppy presentation can raise doubts about your operations.

Outsourcing CIM Development

If creating a polished CIM feels overwhelming, consider outsourcing to professionals. Specialized services can bring a buyer’s perspective to the table, helping you highlight undervalued strengths and address any weaknesses.

For example, Deal Memo provides tailored CIM writing services for business brokers, M&A firms, and investment banking teams. Their white-labeled packages include everything from buyer research and seller interviews to customized sell-side materials. With a 72-hour turnaround on drafts, they allow deal professionals to focus on negotiations while experts handle the time-intensive tasks of data collection and document creation. Their offerings also include unlimited revisions, dedicated account teams, and even data room setup – all designed to align with your brand and streamline the process.

Conclusion

A well-crafted CIM (Confidential Information Memorandum) is more than just a document – it’s your business’s chance to shine. Think of it as a marketing tool designed to highlight your company’s potential, build credibility, and inspire confidence that leads to Letters of Intent.

The numbers back this up: a professionally developed CIM can reduce due diligence time by up to 40%, attract 3–5 times more qualified buyers, and boost deal closure rates by 30–50%. The impact of a thoughtfully written, narrative-driven CIM versus a cookie-cutter template is huge. For instance, one SaaS company managed to secure an exit at three times the value of earlier offers after collaborating with experts to create a detailed, story-focused CIM.

To achieve these results, focus on the essentials: structure your document around a strong Executive Summary and standardized financial data, use visuals to simplify complex information, and address potential challenges head-on to maintain control of the narrative. Keep the document concise – 30 to 60 pages is ideal for lower-middle market deals. Pay attention to clean design, logical formatting, and always protect confidentiality through NDAs and controlled distribution. These steps create a polished, professional presentation that captures buyer interest.

Remember, buyers typically spend just 10–15 minutes skimming a CIM before deciding whether to move forward. Protect sensitive information with NDAs and ensure the document is clear and compelling. As M&A Advisor Doreen Morgan puts it:

"A weak, confusing, or incomplete CIM stops the sale process cold, as buyers will move on to other, more professionally presented opportunities".

FAQs

What should a Confidential Information Memorandum (CIM) include to attract potential buyers?

A Confidential Information Memorandum (CIM) serves as a critical document for showcasing the strengths and potential of a business. To make it effective, it should provide clear, accurate, and well-organized information that highlights what sets the business apart. Key components typically include:

- Executive summary: A concise overview of the business opportunity and its value proposition.

- Financial details: Historical performance, future projections, and insights into the market landscape.

- Core offerings: Descriptions of the main products or services, target customer base, and operational strengths.

- Company assets and leadership: Information about key assets and an introduction to the management team.

The structure of the CIM should guide readers through a compelling narrative about the business and its growth potential. A polished, professional presentation and strict confidentiality are vital to make a strong impression on potential buyers and facilitate successful negotiations.

How should a CIM be structured to attract and keep buyers engaged?

A well-crafted Confidential Information Memorandum (CIM) serves two purposes: it captures the interest of potential buyers while delivering essential business information. Start with an executive summary that immediately highlights the opportunity and sets the tone for the document. This section should grab attention and provide a snapshot of the company’s appeal.

Next, structure the CIM with sections that cover core areas like financial performance, market analysis, business operations, and assets. Each section should tell a clear, compelling story about the company’s strengths and potential for growth. Keep the layout clean and easy to follow, avoiding overwhelming details at the outset.

The key is to strike a balance – showcase the company’s value and growth opportunities while protecting sensitive information. Share enough to spark interest but hold back deeper details until buyers demonstrate serious intent. Maintain professionalism and clarity throughout to ensure the document leaves a strong impression.

How can I keep a CIM confidential and professional?

To protect confidentiality and maintain professionalism in a Confidential Information Memorandum (CIM), it’s crucial to take a few key steps.

Start by requiring all potential buyers to sign a Non-Disclosure Agreement (NDA) before any sensitive details are shared. This provides legal protection for your proprietary information and sets clear boundaries about its use.

Next, use a phased approach when sharing information. Kick things off with a concise executive summary to spark interest. Only share more detailed data after confirming the buyer’s seriousness and ensuring the NDA is in place. This approach reduces the chances of sensitive information ending up in the wrong hands.

Lastly, carefully craft the CIM to focus on strengths without revealing overly detailed operational specifics. To enhance security, use secure sharing tools such as virtual data rooms with controlled access. These steps not only safeguard your business but also build trust with potential buyers.