Deal structure can make or break an M&A transaction. It determines how risks, rewards, and future incentives are shared between buyers and sellers. Here’s a quick breakdown of how different deal structures align interests and address common challenges:

- Asset Purchases: Buyers pick specific assets, reducing liability risks, but sellers face higher taxes and complex transfers.

- Share Purchases: Sellers benefit from favorable tax treatment and a clean exit, but buyers inherit all liabilities.

- Earnouts: Payments are tied to performance metrics, aligning future goals but introducing uncertainty and potential disputes.

- Equity Rollovers: Sellers reinvest part of their proceeds, sharing future success with buyers but risking dilution.

- Vendor Notes: Buyers defer payments, easing cash flow, while sellers face credit risks tied to buyer performance.

Each structure has unique pros and cons, often requiring careful tax planning and clear agreements to balance priorities effectively. Read on to explore how these structures work and how they can align buyer-seller interests.

How Private Equity Firms Structure M&A Deals with Jon Dhanawade

1. Asset Purchase Structures

In an asset purchase, the buyer selects specific assets and liabilities to acquire, leaving the remaining assets and obligations with the seller’s legal entity. This "cherry-picking" approach shapes how risks and rewards are divided between the parties.

Buyer Risk

Asset purchases protect buyers from many legacy liabilities and provide a "step-up" in tax basis to fair market value, which enhances future depreciation and amortization deductions. However, buyers aren’t completely immune to risks. Courts can still hold them accountable for issues like product defects, environmental violations, or fraudulent transfers.

"The buyer in an asset acquisition can generally: avoid successor liability for the business (other than liabilities expressly assumed under the definitive agreements); and obtain a favourable tax basis (known as a ‘step-up’ basis) in the acquired assets." – Holland & Knight

While buyers gain tax advantages and reduced liability, sellers face a different set of hurdles.

Seller Certainty

For sellers, asset deals often come with a heavier tax burden. This is particularly true for C-corporations, which are subject to double taxation – first at the corporate level and then at the shareholder level. Additionally, depreciation recapture taxes gains at ordinary income rates instead of the lower capital gains rates. To offset these tax disadvantages, buyers may offer a higher purchase price to make the deal more appealing to sellers. Early collaboration with a CPA is critical, as the choice between an asset and stock sale can greatly influence the seller’s after-tax proceeds.

Tax Implications

The tax dynamics in asset purchases often create a misalignment between buyers and sellers. Buyers benefit significantly from the step-up basis and the ability to amortize goodwill over 15 years, while sellers lose out on the more favorable capital gains treatment. Under IRS rules, the allocation of the purchase price across seven asset classes determines the seller’s tax obligations and the buyer’s depreciation schedule. Additionally, holdbacks and escrows, which typically account for 10% to 15% of the deal value, further complicate the financial picture.

This inherent misalignment highlights the need for careful planning to balance buyer caution with seller expectations.

Alignment Strength

"Generally interests are not totally aligned. Sellers want to sell stock, and buyers want to buy assets." – Brett Cenkus, Business Attorney, Cenkus Law

The alignment between buyers and sellers in asset purchases is often weak, stemming from conflicting tax preferences and liability concerns. These deals also introduce operational challenges – each individual asset transfer requires retitling, permits, and third-party consents. These can trigger anti-assignment clauses, delaying the closing process. To mitigate these risks, both parties should review commercial contracts early to identify consent requirements, as these are common deal breakers. Despite these hurdles, asset purchases may be the only viable option for buyers unwilling to assume the risks associated with acquiring an entire legal entity.

2. Share Purchase Structures

In the world of deal structures, share purchases strike a balance between operational continuity and increased risk for buyers. In these transactions, the buyer acquires all the equity of the company, which includes its assets, contracts, employees, and liabilities – such as debts, lawsuits, and any lingering issues. Unlike asset purchases, where buyers can cherry-pick what to assume, share purchases are done on an "as-is" basis. While this setup exposes buyers to greater risks, it often provides sellers with better tax outcomes.

"In a stock sale… the buyer steps into the seller’s shoes, taking over all assets, liabilities, contracts, and obligations of the company." – Keene Advisors

Buyer Risk

Compared to asset purchases, share deals carry a broader set of risks for buyers. With these transactions, buyers inherit the company’s full tax history and liabilities, without the benefit of a tax basis step-up for depreciation. To mitigate these risks, buyers typically negotiate strong representations and warranties, set up escrow accounts, and rely on detailed indemnification provisions. Representations and Warranties Insurance (RWI) has also become a standard tool to shield buyers from unexpected liabilities. However, one major upside is that the legal entity remains intact, allowing contracts, licenses, and permits to stay in place without triggering anti-assignment clauses or requiring extensive third-party consents.

Seller Certainty

For sellers, share purchases provide a clean break and favorable tax treatment. The proceeds are usually taxed as long-term capital gains – at rates of about 15% to 20% – avoiding the double taxation that can occur in C-corporation asset sales. Sellers also sidestep ongoing operational and legal risks tied to the business. Many share deals include rollover equity, where sellers reinvest a portion of their proceeds (often 10% to 20% or more) into the buyer’s new entity, aligning their financial interests with the company’s future success.

"Retaining equity aligns interests: you help the business succeed and share in the upside if it does." – 37th & Moss

Tax Implications

Tax considerations in share purchases often create tension between buyers and sellers. Sellers benefit from single-level capital gains taxation, but buyers inherit the company’s existing tax basis, which lacks depreciation advantages. Buyers may also acquire tax attributes like Net Operating Losses (NOLs), though these are subject to limitations under IRC Section 382. To address these issues, parties sometimes choose a Section 338(h)(10) election. This approach allows the transaction to be treated as an asset sale for tax purposes while retaining the legal simplicity of a stock transfer. Although this election can provide buyers with a step-up in tax basis, sellers often demand a higher purchase price to offset the additional tax they would owe.

Alignment Strength

Share purchases can promote better alignment between buyers and sellers. Since the legal entity remains intact, business operations continue smoothly – employees stay with the same employer, and existing contracts and processes remain unchanged. Rollover equity further ties sellers to the company’s future performance. However, alignment can become tricky when deferred payments or earnouts are part of the deal. A notable example is Johnson & Johnson’s 2019 acquisition of Auris Health for $3.4 billion upfront, with an additional $2.35 billion tied to product development milestones. When J&J later integrated Auris’s technology into its own platform, the Delaware Court of Chancery ruled that J&J had breached its obligations and committed fraud regarding its intentions. This case highlights the importance of clearly defining post-closing responsibilities when contingent payments are involved.

3. Earnout Structures

Earnouts help bridge valuation gaps by tying additional payments to specific performance targets like revenue, EBITDA, or other milestones. In 2024, earnouts made up a median of 31% of closing payments across most industries. However, in life sciences, they accounted for a much larger share – 61% of total deal consideration. Outside of life sciences, the median performance period for earnouts is roughly 24 months, while pharmaceutical deals often extend to three to five years or more. This performance-based approach naturally leads to exploring other alignment tools, such as equity rollovers.

Buyer Risk

Earnouts can protect buyers from overpaying based on overly optimistic projections, but they also add layers of complexity. Buyers must track performance metrics carefully and may face restrictions on how they integrate the acquired business. A notable example is Alexion Pharmaceuticals’ acquisition of Syntimmune. Alexion paid $400 million upfront and included up to $800 million in earnouts tied to drug development milestones. When Alexion terminated the program due to merger synergies, the Delaware Court of Chancery ruled that the company had breached its obligation to use "commercially reasonable efforts". Buyers also risk legal claims if changes in resource allocation or accounting practices unintentionally hinder the achievement of earnout targets.

Seller Certainty

For sellers, earnouts come with a degree of uncertainty because their payments depend on the buyer’s actions after the deal closes. Revenue-based metrics are generally more difficult for buyers to manipulate compared to EBITDA-based targets, which can be influenced by accounting adjustments. Sellers also face credit risk, as future payments rely on the buyer’s financial strength. To mitigate this, sellers should negotiate for acceleration clauses that trigger immediate payment if there’s a change of control or a material breach of operating covenants. Additional safeguards like escrow accounts or parent guarantees can also provide reassurance by reducing exposure to credit risk.

Tax Implications

The tax treatment of earnouts often becomes a sticking point between buyers and sellers. Sellers typically prefer earnout payments to be treated as part of the purchase price, which qualifies for capital gains tax rates of 15% to 20%. On the other hand, buyers usually aim to deduct earnout payments as compensation expenses, which is more favorable to them. The IRS closely examines whether earnouts are tied to the seller’s continued employment. If they are, the payments may be reclassified as ordinary income and taxed at rates as high as 37%. To avoid this, earnouts should be structured in line with the seller’s equity stake and not depend on employment. Sellers can also use the installment method to defer tax liability, recognizing gains only as payments are received. Both parties need to carefully weigh these tax considerations alongside their broader financial goals.

Alignment Strength

While earnouts are meant to align the interests of buyers and sellers by linking payments to performance, they can sometimes create conflicting incentives. Sellers might focus on hitting short-term metrics to secure their payments, while buyers could make strategic decisions that unintentionally undermine those targets. Courts, particularly in Delaware, have treated different "reasonable efforts" clauses – like "commercially reasonable efforts" versus "reasonable best efforts" – as largely interchangeable. To reduce the risk of disputes, parties should clearly define accounting standards beyond GAAP, specifying how non-recurring expenses and other items will be treated. Including detailed calculation schedules in the agreement and negotiating strong information rights, such as regular performance reports and audit access, can also help. Disputes over earnouts are relatively common, arising in 28% of cases, and often result in sellers recovering just 21 cents on the dollar.

sbb-itb-798d089

4. Equity Rollover Structures

Equity rollovers require sellers to reinvest a portion of their sale proceeds – usually between 10% and 40% – into the buyer’s entity instead of cashing out entirely. This approach has grown more common over the years. For example, a 2024 review revealed that rollovers were included in 63.6% of middle-market deals, a jump from 46% in 2020. On average, sellers rolled about 14.5% of the total purchase price in 2024. Unlike earnouts, rollovers allow sellers to maintain a stake in the business until the next exit event, typically occurring within 3 to 5 years. This structure ties seller rewards to the company’s future success, balancing risks between both parties.

Buyer Risk

For buyers, rollovers reduce the upfront cash required, easing their debt load and freeing up capital for future opportunities. More importantly, when sellers choose to reinvest, it signals their confidence in the business, suggesting there are no hidden issues or liabilities.

"A meaningful rollover signals that management has ‘skin in the game,’ aligning incentives for post-close cooperation" – Stonehelm Group

However, buyers need to carefully structure these agreements. If sellers retain more than 20% equity, it can impact bonus depreciation and intangible amortization benefits. Thoughtful structuring ensures that rollovers support the broader goal of aligning long-term interests.

Seller Certainty

For sellers, rollovers come with uncertainty. The retained equity is generally illiquid until a future exit event, and sellers often hold a minority stake that’s subordinate to debt holders and preferred stockholders. This means they’re last in line when proceeds are distributed. Despite these risks, rollovers offer the potential for a lucrative "second bite at the apple." Take, for instance, a Denver-based industrial products manufacturer that reinvested 10% of a $45 million deal and later liquidated its equity for a 3.2× return.

To mitigate risks, sellers should negotiate protections like tag-along rights, board observer positions, and fair market value buyout terms in cases of death or disability. These safeguards ensure sellers’ interests are protected while supporting the overall goal of shared success.

Tax Implications

When structured correctly, rollovers can defer capital gains taxes on the reinvested portion until a future liquidity event. In fact, 88% of rollovers in 2019 were tax-deferred using Section 351 (for corporations) or Section 721 (for partnerships and LLCs). However, any cash received during the deal – referred to as "boot" – is immediately taxable. Sellers should also ensure that their rollover equity is fully vested at closing. If it’s subject to employment-based vesting, the IRS may treat it as taxable compensation instead of part of a tax-deferred exchange.

For buyers, a Section 754 election or treating the cash portion as an asset purchase can provide a step-up in tax basis on the cash portion of the deal.

Alignment Strength

Rollovers are powerful tools for aligning incentives between buyers and sellers, as both parties share in the future performance of the company. Financial buyers especially value this structure – around 70% of private equity investors prefer working with existing management teams rather than bringing in new leadership.

"Financial buyers believe that having the target’s management team take equity as a meaningful share of their deal consideration is a powerful tool for aligning their interests" – Frost Brown Todd

This approach also helps maintain key customer and supplier relationships during the transition. Sellers, however, should request a pro-forma capitalization table to understand their position in the capital structure. Preferred equity layers and fees can significantly dilute the eventual value of their "second bite."

5. Vendor Notes and Deferred Payments

Vendor notes provide a way for buyers to pay part of the purchase price upfront while financing the rest through a promissory note. These notes typically come with interest rates between 5% and 8%, paid over a term of three to five years with fixed, predetermined installments. Interestingly, seller financing like this is a common feature in about 70% to 80% of smaller M&A deals. Let’s explore how vendor notes and deferred payments help align the interests of buyers and sellers in these transactions.

Buyer Risk

For buyers, vendor notes reduce the need for large upfront cash payments and demonstrate the seller’s confidence in the business’s future performance. However, they also introduce credit risk. If the business underperforms, buyers might struggle to meet their payment obligations. To address this risk, buyers should negotiate a "right of offset" in the purchase agreement. This provision allows them to deduct any indemnification claims – such as those arising from misrepresentations – directly from the outstanding note balance.

Seller Certainty

From the seller’s perspective, vendor notes offer a more predictable payment structure compared to contingent earnouts, as the payment amounts and schedule are locked in at closing. However, the main concern for sellers is the risk of buyer default. If the buyer fails to make payments, the seller could end up repossessing a poorly performing business. To reduce this risk, sellers can secure the note with the business’s assets or include acceleration clauses in the agreement. These clauses might require full repayment if the buyer sells the company or terminates key founders without cause. It’s also worth noting that vendor notes are often subordinated to senior bank debt, meaning sellers may need to wait until the primary lender is paid in full before receiving any payments.

Tax Implications

The tax treatment of vendor notes has a big impact on cash flow and financial outcomes for both parties.

By default, sellers report capital gains using the installment method, recognizing income as payments are received. This approach can help sellers stay in lower tax brackets over time. However, if the note lacks a market-rate interest component, the IRS might reclassify some of the principal as ordinary interest income, which could be taxed at rates as high as 37% instead of the lower 15–20% capital gains rates. On the other hand, buyers often prefer to classify deferred payments as compensation, as these are immediately deductible. Payments attributed to the purchase price, however, must be capitalized and amortized over time.

Alignment Strength

Vendor notes create a shared interest in the business’s future success by keeping sellers financially invested. When sellers agree to deferred payments, it signals their belief that the business will generate enough cash flow to meet its obligations. However, this structure isn’t without challenges. Buyers might make operational changes aimed at reducing payouts, while sellers who remain involved in management could focus on short-term results to protect their financial interests. To avoid conflicts, clear documentation and consistent accounting practices are essential.

Pros and Cons

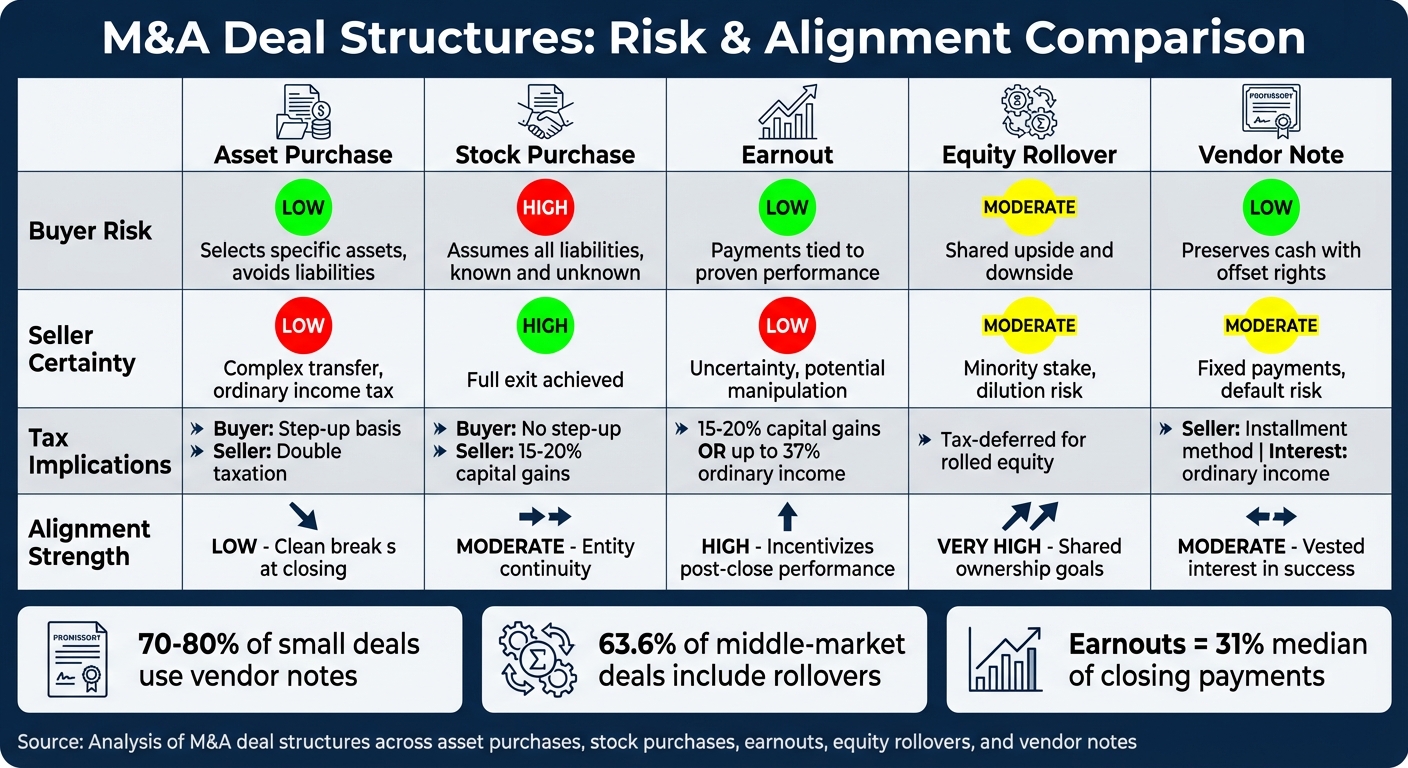

M&A Deal Structures Comparison: Risk, Tax, and Alignment Analysis

When structuring a deal, the balance of risk and reward varies depending on the approach. Below is a breakdown of how asset purchases, stock purchases, earnouts, equity rollovers, and vendor notes compare across four important factors:

| Structure Type | Buyer Risk | Seller Certainty | Tax Implications | Alignment Strength |

|---|---|---|---|---|

| Asset Purchase | Low (buyer selects specific assets and avoids liabilities) | Low (complex transfer process with potential ordinary income tax) | Buyer: Step-up in basis; Seller: Possible double taxation | Low (clean break at closing) |

| Stock Purchase | High (buyer assumes all liabilities, known and unknown) | High (seller achieves full exit) | Buyer: No step-up; Seller: Capital gains (15–20%) | Moderate (entity continuity) |

| Earnout | Low (payments tied to proven performance) | Low (uncertainty due to future metrics and potential manipulation) | Variable (15–20% capital gains or up to 37% ordinary income) | High (incentivizes post-close performance) |

| Equity Rollover | Moderate (shared upside and downside) | Moderate (seller retains a minority stake with dilution risk) | Tax-deferred for rolled equity | Very High (shared ownership goals) |

| Vendor Note | Low (buyer preserves cash with offset rights) | Moderate (fixed payments but buyer default risk) | Seller: Deferred tax via installment method; interest taxed as ordinary income | Moderate (seller has vested interest in buyer’s success) |

This table highlights the trade-offs inherent in each structure. Below, we explore how these differences play out in practice.

Asset purchases give buyers more control by letting them cherry-pick assets and avoid liabilities. However, sellers often face a heavier tax burden since gains may be taxed as ordinary income instead of capital gains. This setup prioritizes buyer protection but can complicate matters for sellers.

Stock purchases, on the other hand, provide sellers with a clean exit and favorable tax treatment, thanks to capital gains rates. The trade-off? Buyers inherit all liabilities, including those that may not be immediately apparent. This structure ensures continuity for the business but places significant risk on the buyer.

Earnouts are performance-based, aligning interests by tying payments to future results. While this motivates sellers to ensure the business thrives post-sale, it also introduces uncertainty. Sellers may find themselves at the mercy of metrics that are difficult to control – or even subject to manipulation. As Vice Chancellor J. Travis Laster of the Delaware Court of Chancery aptly put it:

"An earnout often converts today’s disagreement over price into tomorrow’s litigation over the outcome".

Equity rollovers keep sellers invested in the company’s future, offering them a chance at a "second bite at the apple." This structure creates the strongest alignment between buyer and seller, as both parties share ownership goals. However, sellers must contend with the risks of being minority shareholders, including potential dilution.

Vendor notes reduce the buyer’s upfront cash needs, making them an attractive option for buyers. For sellers, this structure provides steady payments but comes with credit risk if the buyer defaults. It also keeps the seller financially tied to the buyer’s success, ensuring some level of ongoing alignment.

Ultimately, the best deal structure strikes a balance between immediate financial priorities and long-term alignment. Each approach has its own advantages and challenges, and the right choice depends on the unique goals and circumstances of both buyer and seller.

Conclusion

Choosing the right deal structure hinges on the specific circumstances of the transaction. For high-growth companies, tying earnouts to revenue or ARR metrics can help bridge valuation gaps, especially when the company’s future potential isn’t fully proven yet. For family-owned businesses, seller financing not only expands the pool of potential buyers but also ensures a steady income stream while keeping the seller involved in the business.

Rollover equity is another powerful tool for aligning interests. As Jennifer Tetreault from Intrinsic points out:

"Rollover equity can serve as an additional lever within deal negotiations to either a) get the deal across the finish line with hesitant sellers, or b) mitigate risk for cautious buyers".

This approach is particularly valuable in private equity platform investments, where the founder’s ongoing involvement is critical for driving growth and creating value.

For early-stage tech and life sciences deals, milestone-based earnouts are often the way to go. These are tied to objective and measurable achievements like regulatory approvals or product launches, allowing both parties to work toward clear, shared goals. Unlike financial metrics such as EBITDA, these targets are less prone to manipulation and complement other alignment strategies.

Regardless of the structure, it’s crucial to define performance metrics clearly, relying on specific accounting standards. Including acceleration clauses for change-of-control events and thoroughly documenting business decisions that impact earnout achievement are also essential. Interestingly, even with these safeguards, only about 50% of maximum earnout payouts are realized in deals where any earnout is achieved.

Ultimately, the most effective deals often combine cash payments, performance-based earnouts, and rollover equity to balance risks and priorities for all parties involved.

FAQs

What are the key tax considerations for buyers and sellers in various deal structures?

Different deal structures – like earnouts, equity rollovers, and asset or stock sales – carry unique tax consequences for both buyers and sellers. Let’s break it down:

With earnouts, sellers are usually taxed on payments as they are received. These payments might be treated as either ordinary income or capital gains, depending on the terms of the agreement. For buyers, these payments can affect their cost basis and may influence future deductions.

In the case of equity rollovers, taxes can sometimes be deferred if the deal qualifies under certain tax provisions, such as sections 351 or 368 of the tax code. However, if the structure isn’t handled correctly, sellers could face immediate tax liabilities, such as capital gains or ordinary income, depending on the specifics of the transaction.

For asset sales, sellers often face capital gains taxes, but buyers might gain a step-up in the asset basis. This step-up can provide buyers with higher depreciation deductions over time. On the other hand, in stock sales, sellers typically pay capital gains taxes, and buyers may sidestep the double taxation that’s more common in asset sales.

No matter the structure, strategic tax planning is critical to ensuring the best possible financial outcomes for both parties in any M&A transaction.

How do earnouts impact buyer and seller alignment in M&A deals?

Earnouts are a useful tool for balancing the interests of buyers and sellers in a business transaction. By tying part of the purchase price to the company’s future performance, earnouts encourage sellers to keep the business thriving after the deal is finalized. At the same time, buyers gain some protection, as they only pay the full price if the business meets agreed-upon benchmarks. When done right, this approach can benefit both sides.

That said, earnouts can also become a source of tension if there’s confusion about performance goals, timelines, or who’s in charge during the earnout period. Disagreements over targets or decision-making can damage relationships and lead to expensive legal battles. To prevent such issues, it’s crucial to create detailed agreements that clearly define expectations, responsibilities, and protections for everyone involved.

What should buyers and sellers consider when deciding between an asset purchase and a stock purchase?

When choosing between an asset purchase and a stock purchase, it’s crucial for buyers and sellers to weigh factors like liability transfer, tax outcomes, and how the transaction affects the business’s operations.

In an asset purchase, the buyer picks specific assets and liabilities to acquire. This approach allows buyers to avoid taking on unwanted liabilities and offers tax advantages, such as a step-up in basis for depreciation. A stock purchase, however, involves buying the entire company – assets, liabilities, and contracts included. While this can streamline the transfer process, it may also come with added risks due to the assumption of all existing obligations.

Other factors to consider include how licenses, permits, and contracts are handled. These often need renegotiation in an asset purchase, while they usually transfer automatically in a stock purchase. Employee transitions can also vary depending on the deal structure. Tax implications are another key point: buyers typically lean toward asset purchases for depreciation benefits, while sellers may prefer stock sales to take advantage of capital gains treatment.

Ultimately, the right choice depends on the specific details of the deal, including financial objectives, risk tolerance, and operational needs. Each transaction is unique, so careful analysis is essential.