Breaking into M&A without state licensing requirements can be challenging, but certifications are a great way to build credibility and skills. Whether you’re new to the field or looking to enhance your expertise, here are key certifications to consider:

- CM&AA (Certified Merger and Acquisition Advisor): Focuses on middle-market M&A transactions and requires an academic degree or professional designation. Costs range from $2,150 to $5,495.

- M&AP (Mergers & Acquisitions Professional): Offers global insights into M&A best practices. Costs range from $3,290 (online) to $4,890 (onsite).

- CM&AP (Certified M&A Professional): Tailored for intermediaries in lower middle-market transactions. Costs $2,950.

- FMVA (Financial Modeling & Valuation Analyst): Ideal for strengthening financial modeling skills. Costs around $200.

Each certification varies in prerequisites, costs, and focus areas, making it essential to match your choice with your career goals and experience level.

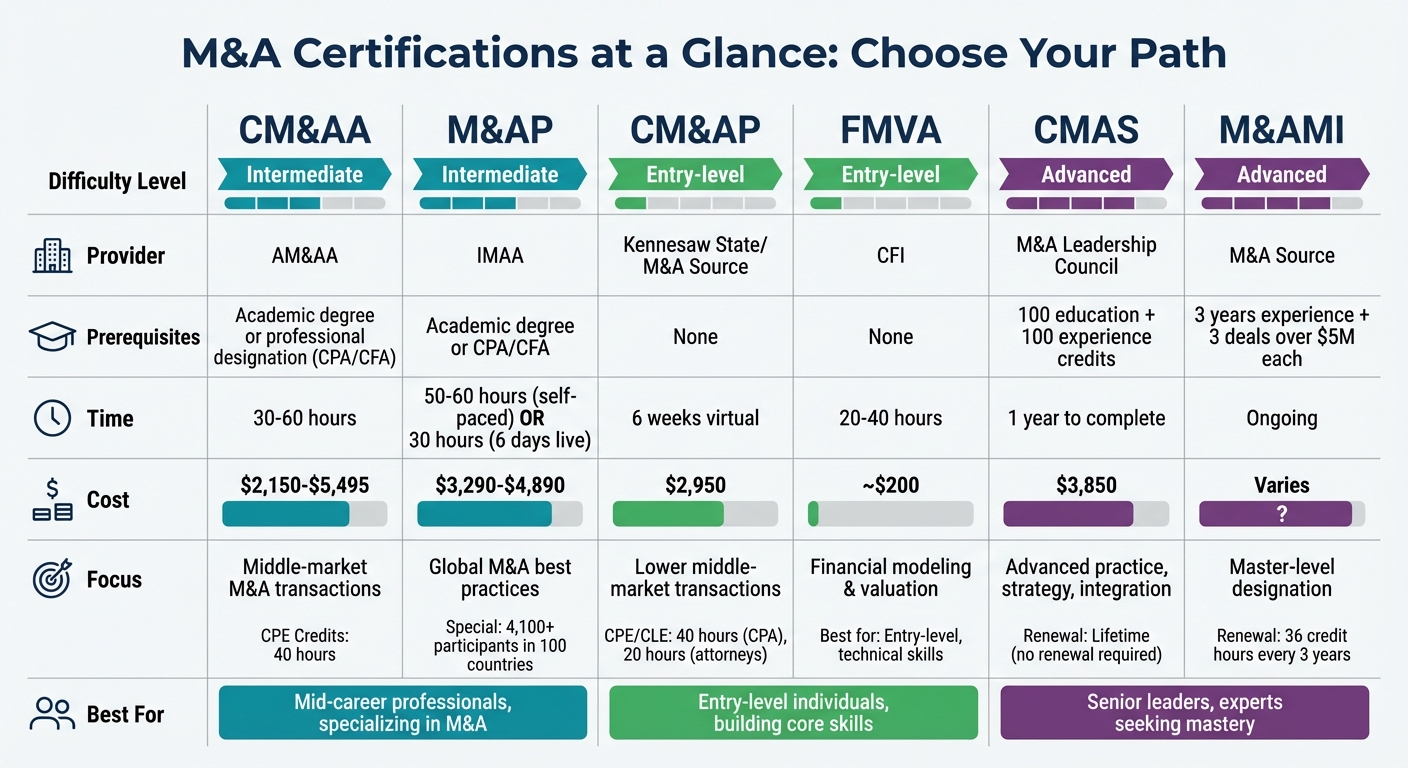

Quick Comparison

| Certification | Prerequisites | Time Commitment | Cost Range | Focus Area |

|---|---|---|---|---|

| CM&AA | Academic degree or professional designation | 30–60 hours | $2,150–$5,495 | Middle-market M&A |

| M&AP | Academic degree or CPA/CFA | 50–60 hours (self-paced) or 30 hours (live) | $3,290–$4,890 | Global M&A practices |

| CM&AP | None | 6 weeks virtual | $2,950 | Lower middle-market M&A |

| FMVA | None | 20–40 hours | ~$200 | Financial modeling and valuation |

Certifications not only demonstrate expertise but also connect you with professional networks and career opportunities. Choose based on your goals, budget, and time availability.

M&A Certification Comparison: Prerequisites, Costs, and Time Commitments

CM&AA Certification through the Alliance of Merger and Acquisition Advisors (AM&AA)

Top Certifications for M&A Advisors

Four certifications can help professionals develop essential M&A skills, covering areas like middle-market transactions and advanced financial modeling.

Certified Merger and Acquisition Advisor (CM&AA)

The CM&AA certification, offered by the Alliance of Merger & Acquisition Advisors (AM&AA), is designed for those focusing on middle-market corporate finance and transaction services. It provides a comprehensive overview of the M&A process, from deal origination to closing, through 10 core modules: Private Capital Markets, M&A Sales Process, Strategic Buyer Process, Financing, Business Valuation, Financial Analysis, Due Diligence, Tax Considerations, Legal Issues, and Investment Banking Structuring.

This program is available in two formats: an intensive one-week in-person course or a five-week virtual program, both offering 40 CPE hours upon completion. Ken Saddler, a Partner and Certified Business Transition Expert™, shared his perspective:

"Even though I have been involved in over 30 M&A transactions as CFO in my career, I learned at least twice as much new information in the course as I had in doing all those past transactions!"

To enroll, candidates must hold an academic degree or a recognized professional designation like CPA or CFA. The program concludes with a proctored online exam. Costs start at $2,150 for AM&AA members and $2,750 for professional bundles online, while in-person training ranges from $4,950 to $5,495.

Mergers & Acquisitions Professional (M&AP)

The M&AP designation, offered by the Institute for Mergers, Acquisitions and Alliances (IMAA), emphasizes global best practices in M&A. With over 4,100 participants trained across 100 countries, it is one of the most internationally respected certifications. The curriculum is divided into four key areas: Essentials of M&A, Due Diligence, Valuation, and Running a Successful M&A Practice.

IMAA highlights the value of this credential:

"This charter signals to peers, clients, employers, and other professionals that you have completed the most comprehensive M&A education program available."

The program offers flexibility with a self-paced online option requiring 50–60 hours of study or live interactive sessions spanning 30 hours over six days. Enrollment includes a one-year IMAA membership, providing access to exclusive research databases and networking opportunities. Continuing education requires 10 hours every two years. Pricing varies by format: $3,290 for self-paced online (discounted from $4,360), $3,790 for live online sessions, and $4,890 for onsite programs held in cities like London, New York, and Singapore.

Certified M&A Professional (CM&AP)

Developed by Kennesaw State University’s Coles College M&A Academy in partnership with M&A Source, the CM&AP program is tailored for intermediaries working with private middle-market companies. This six-week virtual course provides 40 credit hours for CPAs and 20 hours of CLE for attorneys.

The CM&AP certification also opens the door to the M&AMI designation, which is unique in requiring both educational credits and proof of three completed transactions (each exceeding $5 million) within the past decade. M&A Source explains the significance of this designation:

"The Master designation is the only one to require both educational credits and the successful completion of multiple transactions. As such, it provides a distinct competitive advantage."

The program costs $2,950, which includes all electronic materials. For those committed to a long-term career in M&A, this certification offers a pathway to advanced credentials.

Financial Modeling & Valuation Analyst (FMVA)

Unlike the other certifications, which focus on the broader M&A process, the FMVA hones in on analytical skills essential for deal evaluation. It covers financial modeling and valuation techniques, equipping participants to assess acquisition targets, build discounted cash flow (DCF) models, and structure leveraged buyout (LBO) scenarios.

This certification is particularly suited for newer advisors looking to strengthen their quantitative expertise. The technical skills gained through the FMVA serve as a solid complement to the transaction-focused knowledge provided by the other certifications. A detailed side-by-side comparison of these certifications follows next.

Comparing M&A Certifications

When it comes to M&A certifications, the right choice often depends on your career stage and goals. Certifications like CM&AA and M&AP require candidates to hold an academic degree or a professional designation such as a CPA or CFA. In contrast, the FMVA is open to anyone without prerequisites, and the CM&AP offers flexible entry criteria, making it especially appealing for middle-market practitioners. Let’s break down some key aspects of these certifications.

Study Time and Flexibility

The time commitment for these certifications varies widely. Online study options range from 20 to 60 hours. For example, the M&AP program typically requires about 50 hours for its self-paced format, while the onsite version condenses the material into an intensive six-day program. Similarly, the CM&AP certification is delivered over six weeks in a virtual format. These options allow candidates to tailor their learning experience to fit their schedules and learning preferences.

Cost and Program Depth

The cost of these certifications reflects their depth and delivery format. The CM&AP program is priced at approximately $2,950. For the M&AP, the self-paced online program costs around $3,290, while the onsite training in major cities is closer to $4,890. Advanced credentials, such as the CMAS, are priced at about $3,850 and include extensive materials and assessments.

Certification Comparison Table

| Certification | Provider | Prerequisites | Time Commitment | Cost Range | Primary Focus |

|---|---|---|---|---|---|

| CM&AA | AM&AA | Academic degree or professional designation | 30–60 hours | $2,150–$5,495 | Middle-market transactions, deal process fundamentals |

| M&AP | IMAA | Academic degree or CPA/CFA | 50–60 hours (self-paced) or 30 hours (6 days live) | $3,290–$5,490 | Global M&A best practices, full deal lifecycle |

| CM&AP | Kennesaw State / M&A Source | None specified | 6 weeks virtual | $2,950 | Lower middle-market transactions, practitioner skills |

| FMVA | CFI | None | 20–40 hours | ~$200 | Financial modeling, valuation, technical analysis |

| CMAS | M&A Leadership Council | 100 education + 100 experience credits | 1 year to complete | $3,850 | Strategy, due diligence, integration, advanced practice |

| M&AMI | M&A Source | 3 years experience + 3 deals over $5M each | Ongoing | Varies | Master-level designation requiring proven transaction history |

Advanced Credentials and Continuing Requirements

Advanced certifications like CMAS and M&AMI cater to experienced professionals. These programs often require documented deal experience, making them ideal for those with a proven track record. For instance, the M&AMI certification demands three years of experience and involvement in at least three deals exceeding $5 million each. Additionally, maintaining certain certifications involves ongoing requirements. For example, M&AMI holders must complete 36 credit hours every three years, while CMAS is a lifetime credential with no renewal requirements.

Whether you’re just starting or looking to solidify your expertise, these certifications offer a range of options to match your professional background and aspirations.

sbb-itb-798d089

How to Choose and Pursue Your First Certification

Assess Your Career Goals and Current Skills

When selecting a certification, make sure it aligns with your career ambitions. For instance, if you’re aiming for a role in investment banking, the FMVA program can help you build expertise in financial modeling and valuation. On the other hand, if you’re interested in middle-market advisory work, the CM&AA emphasizes the fundamentals of the deal-making process. Consider whether your focus should be on enhancing technical skills, like financial modeling, or strategic abilities, such as deal sourcing and negotiation.

Your level of experience plays a significant role in determining the right program. Entry-level professionals often start with certifications from institutions like the University of Illinois or the Corporate Finance Institute. For seasoned executives with over a decade of experience, programs from Harvard or Stanford may be a better fit.

Once you’ve identified your goals and any skill gaps, create a detailed plan that includes the financial and time commitments necessary to pursue your chosen certification.

Plan for Costs and Time Commitment

Budgeting and time management are essential when preparing for a certification. Beyond tuition, account for additional expenses like travel, lodging, and meals, especially for in-person programs. For example, attending Harvard may cost around $18,000, while Stanford programs range from $13,500 to $15,000, excluding these extra costs.

Some certifications operate on a credit-based system, where you earn points through coursework and documented experience. Take the CMAS, for example – it requires 200 credits, divided equally between education and professional experience, all of which must be completed within a year of enrollment. It’s also important to consider whether the certification requires ongoing upkeep. While some programs mandate continuing education to maintain credentials, others, like the CMAS, offer lifetime certification with no renewal requirements.

Prepare for Certification Exams

To prepare effectively, rely on the official study materials provided by your program. For instance, the CMAS exam is based on The Art of M&A, 6th Edition and allows a 72-hour open-book window to answer 60 questions. The CM&AA program offers a Study Guide that covers topics like private capital markets, tax considerations, and legal issues. If you’re pursuing the NYIF M&A Professional Certificate, you’ll need to pass a 20-question exam within 60 minutes, requiring a 70% score to succeed.

For certifications that require experience credits, prepare your deal descriptions in advance. Write them in a professional, memo-style format, as though addressing C-level executives. Avoid bullet points and aim for well-structured paragraphs. Additionally, ensure that a senior executive or deal sponsor is available to verify your role in the transactions. Many programs also provide resources to support your preparation. For example, NYIF offers discussion forums where Teacher’s Assistants respond to questions within 2-3 business days.

How Certifications Advance Your M&A Career

Show Expertise to Clients and Employers

Earning certifications in the M&A field is a powerful way to demonstrate your expertise. They confirm your grasp of essential M&A principles and signal to employers that you’re ready to handle intricate transactions. In an industry where there are no universal licensing requirements, certifications stand out as a key indicator of your commitment and skillset.

Take advanced credentials like the M&AMI, for example. To earn this designation, you need to prove both your educational achievements and your hands-on experience – specifically, by completing three transactions, each worth at least $5 million. This blend of academic training and practical success shows that you’re not just knowledgeable in theory but also capable of delivering real results.

Certified professionals also commit to ethical standards, such as those outlined in the 18-article M&A Source code, which ensures clients receive fair and professional service. Many certifications require renewal every three years, keeping you up to date with evolving regulations, market trends, and best practices. This continuous learning not only sharpens your skills but also strengthens your reputation, helping you build trust with clients and colleagues while expanding your professional reach.

Expand Your Professional Network

Certifications don’t just enhance your credentials – they also open doors to exclusive professional networks that can boost your career. For instance, programs often connect you with groups like the Alliance of Merger & Acquisition Advisors (AM&AA) or M&A Source, where advisors, private equity professionals, and investment bankers collaborate. These organizations provide access to tools like "DEALMATCH" and "Deal Corner", which streamline deal alerts and help you close transactions more efficiently.

Beyond online platforms, many certification programs host in-person events and "Deal Markets", tailored for the lower middle market, creating opportunities to forge meaningful relationships that can lead to actual transactions. Programs from prestigious institutions like Stanford and Harvard also include team-based simulations, offering an intense networking environment with senior-level professionals. Additionally, alumni directories and global networks of M&A experts provide ongoing opportunities for mentorship and career advancement through peer connections.

Stand Out in a Competitive Job Market

In competitive industries like investment banking, private equity, and consulting, certifications can make your resume shine. They highlight your specialized deal-making expertise, making you a standout candidate. Many programs even provide digital badges for email signatures and LinkedIn profiles, allowing you to showcase your achievements instantly to recruiters and potential clients.

This increased visibility, combined with the practical skills you’ve gained, positions you for promotions, high-value projects, and greater recognition within the industry. Certifications not only validate your abilities but also enhance your professional image, helping you stay ahead in a crowded job market.

Conclusion

Starting your M&A career means choosing certifications that align with your experience and aspirations. If you’re new to the field, education-focused programs like the CM&AP or FMVA can help you establish a solid technical base. On the other hand, if you’ve already closed multiple deals and gained hands-on experience, transaction-focused credentials like the M&AMI – requiring three deals valued at $5 million or more – can help distinguish you in the industry.

Certifications are a tangible way to showcase your dedication in a field that lacks state licensing requirements. They signal your expertise, and some, like the CM&AA, even offer 40 CPE hours to support ongoing professional development.

Take a close look at each program’s prerequisites. Some certifications require specific degrees or existing credentials (like a CPA or CFA), while others prioritize practical deal-making experience. Costs can range widely, from $150 per month to $13,500, with time commitments typically falling between 20 and 60 hours.

Beyond the technical knowledge, certifications can also open doors to valuable connections. They provide access to professional organizations like the M&A Source or AM&AA, where you can find mentors, expand your network, and tap into deal opportunities. These designations not only sharpen your skills but also help you build the relationships crucial for success in deal-making.

Think about your career objectives, research which certification fits your market focus, and select the program that propels you toward your next big opportunity.

FAQs

What should I look for when choosing an M&A certification as a new advisor?

When choosing an M&A certification, it’s important to pick one that supports your career goals and boosts your professional standing. Start by looking into the certification’s industry reputation. Recognized credentials like the Mergers & Acquisitions Master Intermediary (M&AMI®) or Certified Mergers & Acquisitions Professional (CM&AP) can help you stand out, especially if you’re just starting in the field.

Next, take a close look at the program requirements. Some certifications may ask for prior deal experience, specific coursework, or ongoing education. Be sure the program aligns with your current experience and fits into your schedule.

Lastly, evaluate the certification’s focus and long-term benefits. Certain credentials are tailored to deal-making expertise, while others may highlight areas like leadership or strategic growth. Also, check whether the certification needs periodic renewal or offers lifetime validity. Picking the right certification can have a lasting impact on your career as an emerging M&A advisor.

What are the main differences in prerequisites for M&A certifications?

The requirements for M&A certifications can differ greatly depending on the program. For instance, the Mergers & Acquisitions Master Intermediary® (M&AMI®) demands significant professional experience. Candidates must demonstrate full-time deal-making expertise, hold prior certifications, and have completed middle-market transactions. In contrast, the Certified M&A Professional (CM&AP) leans more toward educational coursework and has fewer experience-based prerequisites.

To qualify for the M&AMI®, applicants need to earn the Certified Business Intermediary® (CBI®) designation, complete 20 hours of M&A-specific coursework, and provide proof of transaction experience. Meanwhile, the CM&AP focuses on education, requiring participants to complete a six-week program, but it doesn’t mandate prior deal-making experience. Another certification, the Certified M&A Specialist (CMAS®), combines education, exams, and work experience. Participants earn credits through coursework and must submit evidence of relevant professional achievements.

In summary, certifications like the M&AMI® cater to seasoned professionals, while programs such as the CM&AP are more approachable for those just starting in the M&A field.

What networking opportunities come with M&A certifications?

Earning certifications as a new M&A advisor can open up networking opportunities that may give your career a boost. Programs like the Mergers & Acquisitions Master Intermediary® (M&AMI®) or the Certified Mergers & Acquisitions Professional (CM&AP) provide more than just credentials – they connect you with peers, industry veterans, and potential clients through events like conferences, virtual workshops, and ongoing educational sessions.

Joining professional organizations such as the Alliance of M&A Advisors or the M&A Leadership Council adds another layer of opportunity. These groups offer access to industry events, seminars, and forums where you can exchange ideas, form partnerships, and stay updated on market trends. Building these connections helps you grow professionally and strengthens your presence within the M&A community.