When selling your business, EBITDA multiples are a key factor in determining its value. The multiple reflects how many years of earnings a buyer expects to recover their investment, and it varies widely by industry. Here’s what you need to know:

- What is an EBITDA multiple? It’s the number used to multiply your EBITDA (earnings before interest, taxes, depreciation, and amortization) to calculate your business’s value.

- Why does it matter? Even small changes in the multiple can impact your sale price by millions.

- Industry differences: Sectors like technology and healthcare often have higher multiples due to growth and recurring revenue, while manufacturing and energy tend to have lower multiples because of capital intensity and market risks.

- Examples: Public software companies average 24.48x, while small private tech businesses average only 3.33x. Manufacturing businesses range from 3x to 7x, depending on factors like automation or contracts.

- Improving your multiple: Reduce dependency on the owner, build recurring revenue streams, and diversify your customer base.

Pro Tip: Professional services like Deal Memo can help adjust your financials to reflect true value, making your business more appealing to buyers.

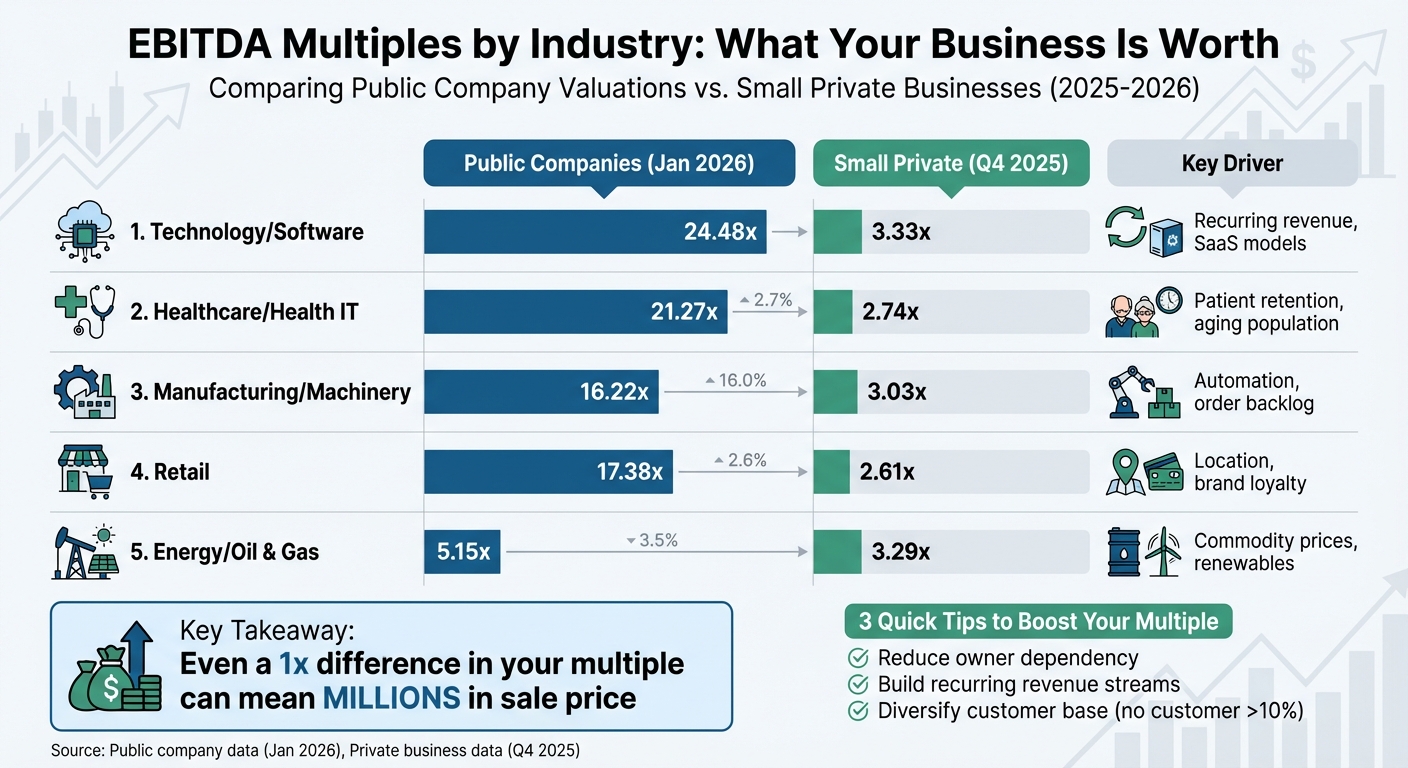

EBITDA Multiples by Industry: Public vs Private Companies 2025-2026

Understanding Valuation Multiples by Industry

EBITDA Multiples Across Different Industries

EBITDA multiples can vary significantly across industries. Sectors like technology and healthcare often command higher multiples due to their strong growth prospects and recurring revenue streams. On the other hand, industries such as energy, manufacturing, and certain retail segments tend to see lower multiples, reflecting their capital-intensive nature and exposure to market fluctuations. For instance, in January 2026, public software companies had an average EBITDA multiple of 24.48x, while small private tech businesses averaged just 3.33x. This stark contrast underscores the impact of factors like scale, liquidity, and risk on valuations.

The table below provides a snapshot of EBITDA multiples across various industries, comparing public companies with smaller private businesses. It also highlights key drivers that influence these valuations. Technology companies, especially those with recurring subscription revenue, often achieve higher valuations due to their scalability and efficient use of capital. Meanwhile, industries like energy and manufacturing face lower multiples, largely because of their reliance on significant capital investments and vulnerability to commodity price swings.

| Industry | Public Company Average (Jan 2026) | Small Business Average (Q4 2025) | Key Value Drivers |

|---|---|---|---|

| Technology | 24.48x (Software) | 3.33x (Online/Tech) | Recurring revenue (SaaS), AI integration, scalability |

| Healthcare | 21.27x (Health IT) | 2.74x (Health/Fitness) | Regulatory compliance, patient retention, aging population |

| Manufacturing | 16.22x (Machinery) | 3.03x (General Mfg) | Asset value, order backlog, advanced tech (3D printing) |

| Retail | 17.38x (General) | 2.61x (General Retail) | Location, inventory turnover, omnichannel presence |

| Energy | 5.15x (Oil/Gas Prod) | 3.29x (Petroleum Prod) | Commodity prices, regulatory environment, cyclicality |

High multiples in industries like technology and healthcare are often driven by factors such as strong recurring revenue (e.g., SaaS models), low customer churn, and proprietary assets. Healthcare benefits from insurance partnerships, specialized equipment, and a growing aging population. Manufacturing sees value from long-term contracts and automation technologies like 3D printing. Retail gains advantages from prime locations and brand loyalty, while energy companies with diversified portfolios and investments in renewables can enhance their appeal.

However, challenges can dampen these valuations. For technology, high customer acquisition costs and technical debt can weigh on multiples. Healthcare faces hurdles like regulatory compliance and workforce turnover. Manufacturing struggles with aging equipment and fluctuating raw material costs. Retail is often impacted by reliance on foot traffic and stiff competition, while energy companies face environmental liabilities and volatile commodity prices.

1. Industry-Specific EBITDA Multiples

Relevance to Sellers

Industry benchmarks play a crucial role in setting realistic expectations for business valuation. Without these benchmarks, sellers risk overestimating their company’s worth, leading to frustration when the market doesn’t align with their expectations. An EBITDA multiple reflects both a company’s risk and its growth potential. For instance, high-growth industries like technology and biotechnology often command higher multiples due to their ability to scale earnings quickly. On the other hand, cyclical sectors such as construction or energy tend to have lower multiples because of their sensitivity to commodity prices and reliance on tangible assets.

Understanding where your industry stands can prevent emotional pricing. Take, for example, a manufacturing business owner anticipating a 10x multiple. If the market realistically values similar businesses between 5x and 7x, that owner might face disappointment. However, knowing this range early allows for strategic adjustments – like shifting toward recurring revenue models or diversifying the customer base – to aim for the higher end of the spectrum. This insight also lays the groundwork for more effective negotiations.

Application in Valuation

Once industry benchmarks are clear, EBITDA multiples become powerful tools during valuation discussions. Buyers use these multiples to calculate a company’s purchase price by multiplying EBITDA by the selected multiple. Even a slight adjustment in the multiplier can lead to substantial differences in the final sale price. For example, a software company founder raised their multiple from 7x to 11x by leveraging market benchmarks, ultimately securing an additional $10 million at closing.

This approach moves valuation discussions from subjective opinions to a solid financial argument. Buyers often compare a business’s performance to its peers, setting aside differences in capital structure, debt levels, or tax situations. Adjusting EBITDA – by adding back one-time expenses like legal fees, personal perks, or above-market salaries – can uncover hidden value and justify a higher multiple.

Key Benefits for Enhancing Business Value

Knowing your industry’s average multiple gives you the opportunity to plan ahead and make strategic improvements before listing your business for sale. For instance, if you run a service-based company typically valued at 3x to 5x EBITDA, building a management team capable of operating independently could push your valuation toward the higher end. In the healthcare sector, where multiples generally range from 6x to 8x, investments like forming insurance partnerships or acquiring specialized equipment can significantly increase your business’s appeal.

To further boost your business’s value, consider these steps:

- Limit any single customer’s contribution to no more than 10% of your total revenue.

- Transition one-time sales into recurring revenue contracts.

- Standardize processes and digitize records to make due diligence smoother.

These actions not only enhance your business’s marketability but also position it for a more favorable valuation.

sbb-itb-798d089

2. Deal Memo Services

Relevance to Sellers

When preparing to sell your business, how you present your financials can significantly impact the outcome. Beyond understanding industry-specific EBITDA multiples, sellers need to ensure their financial presentation aligns with what buyers expect. This is where Deal Memo comes in. They specialize in crafting Confidential Information Memorandums (CIMs) and Offering Memorandums (OMs) that translate your business’s performance into terms that resonate with buyers – especially when it comes to justifying your EBITDA multiple. Instead of using generic templates, their team conducts interviews with sellers and customizes each document to reflect the unique aspects of the business. For instance, if you’re in the healthcare sector, where recurring revenue is supported by strong patient retention, your CIM should highlight these strengths to enhance your valuation.

Application in Valuation

Professional financial presentations play a crucial role in negotiations. Deal Memo ensures that sellers present adjusted EBITDA figures backed by proper documentation, making them more credible to buyers. This isn’t about inflating numbers; it’s about offering a clear and accurate representation of your company’s financial health.

Key Benefits for Enhancing Business Value

Deal Memo delivers drafts within 72 hours and offers unlimited revisions, giving sellers the flexibility to adapt their presentations as market conditions shift or as strategic changes are implemented. Their services include white-labeled packages, curated buyer lists (also known as buyer universes), and Data Room setup to streamline due diligence and create competitive tension. This comprehensive approach not only reduces perceived risk but can also lead to quicker closings and more favorable terms. By providing tailored materials, Deal Memo sets the stage for competitive bidding and smoother negotiations.

Advantages and Disadvantages

When selling a business, deciding between a quick industry multiple estimate and professional sell-side preparation can have a significant impact on your final sale price. Each method offers distinct benefits and challenges, and the choice often depends on your priorities.

Using industry multiples alone is fast and free. You can estimate your business’s value with publicly available data. For example, the median EBITDA multiple across private sectors is 3.0x. While this approach is convenient, it comes with considerable risks. Dan Gray from Equidam highlights this issue:

Originally just a valuation solidity check, multiples have become a popular approach to value young, fast growing companies. The simplicity of this approach leads many practitioners to apply it uncritically… This might generate biased results.

Take the transportation sector as an example: multiples in this industry can vary widely, from 2.2x to 16.2x. Relying on an "average" figure in such cases can lead to serious miscalculations.

On the other hand, professional services like Deal Memo offer a more thorough approach by recasting financials to uncover hidden value. This process adjusts your financials to better reflect your company’s true worth. However, it does require more time and involves professional fees, unlike the quick and free multiple-based estimation. Below is a side-by-side comparison of the two methods:

| Feature | Industry Multiples Alone | Professional Services (Deal Memo) |

|---|---|---|

| Cost | Free; uses public data | Requires professional fees |

| Speed | Immediate estimation | 72-hour delivery for full CIM |

| Accuracy | High risk of under/overvaluation | Accounts for unique value drivers |

| Buyer Credibility | May appear unverified | Professionally documented and normalized |

| Risk Mitigation | Ignores customer concentration and owner dependency | Addresses key risk factors |

The table highlights the trade-offs between speed and thoroughness. While industry multiples offer a quick snapshot, they often ignore critical factors like customer concentration or owner dependency. Professional services, in contrast, address these risks while emphasizing your business’s unique strengths, such as recurring revenue, strong management, or growth potential.

It’s worth noting that around 80%–90% of businesses are overpriced when owners base valuations on exceptional cases rather than competitive market data. Professional services help avoid this pitfall by aligning your business with its proper industry range. By understanding these trade-offs, you can make more informed decisions and position your business to achieve the best possible valuation.

Conclusion

Grasping the concept of industry-specific EBITDA multiples goes far beyond just memorizing a figure – it’s about securing your financial future. Even small changes in your multiplier can translate into millions of dollars when it’s time to close the deal. By walking into negotiations with solid benchmarks, you shift the discussion from vague assumptions to a well-supported financial stance that buyers respect. This foundation is crucial for reaping the rewards of detailed financial adjustments.

Relying on quick estimates can lead to outcomes that are worlds apart from those based on professional valuations. This highlights how properly normalizing your financials can make a significant difference in your final sale price.

Deal Memo bridges this gap with its 72-hour CIM delivery service, helping sellers recast their financials to uncover hidden value. This process documents operational independence and shines a light on key metrics – like recurring revenue or low customer concentration – that justify higher multiples in your industry. With such detailed documentation, your business becomes more than just another listing; it transforms into a credible investment opportunity that strategic buyers are eager to consider.

What should you do next? Start normalizing your financials early, reduce owner dependency by building a strong management team, and ensure no single customer accounts for more than 10% of your revenue. These steps can determine whether you land at the lower or upper end of your industry’s multiple range. Whether your sector averages 3x or 15x, how you position your business matters far more than the average itself.

The difference between taking the first offer and securing a premium exit often boils down to preparation. As the Business Brokers Guide aptly puts it:

Clarity in your numbers creates confidence in your negotiations. When you understand your multiple, you control the narrative of your exit.

There’s no better time to start preparing than now.

FAQs

What steps can I take to increase my business’s EBITDA multiple before selling?

To increase your business’s EBITDA multiple before selling, focus on boosting profitability, maintaining steady growth, and reducing potential risks. Buyers are drawn to businesses with predictable revenue, recurring income, and streamlined operations – factors that often lead to higher valuation multiples.

Start by refining your internal processes to cut unnecessary costs and improve profit margins. Make sure your financial records are accurate, well-organized, and adjusted to reflect the actual profitability of your business. Positioning your business as a leader in your industry and meeting key performance benchmarks can also add to its appeal.

Additionally, demonstrating a solid growth trajectory and long-term stability can make your business more attractive to potential buyers. By concentrating on these areas, you can enhance your EBITDA multiple and maximize the value of your business when it’s time to sell.

Why do businesses in technology and healthcare often have higher EBITDA multiples?

Technology and healthcare companies often command higher EBITDA multiples, largely because of their potential for growth, innovation, and the perception of lower risk compared to other industries. These sectors frequently include businesses with recurring revenue streams, unique technologies, or significant barriers to entry – qualities that make them attractive to investors ready to pay more for future earnings.

In the healthcare sector, steady demand fueled by aging populations and breakthroughs in medical technology bolsters investor confidence, driving up valuations. On the other hand, the tech industry thrives on rapid advancements, scalability, and high-profit margins, making these companies highly desirable for acquisitions. Together, these factors highlight why investors are willing to pay a premium for the stability and growth prospects these industries offer.

Why is professional financial presentation important when valuing a business?

A well-prepared financial presentation plays a key role in accurately determining a business’s value, especially when EBITDA multiples come into play. Organized, clear, and consistent financial data allows sellers to highlight normalized earnings and present their business in the best possible way. This not only enhances credibility with potential buyers but can also support higher valuation multiples, giving sellers a stronger position during negotiations.

For buyers, detailed financial information is crucial for evaluating profitability, growth potential, and how the business measures up to industry benchmarks. For example, EBITDA multiples can vary widely – ranging from 3x–5x in manufacturing to 8x–15x in technology. A polished financial presentation ensures that key strengths, such as recurring revenue or scalability, are effectively highlighted, increasing the chances of securing a favorable valuation.