Selling your business is just the beginning. The real challenge? Ensuring a smooth transition for the new owner while safeguarding your legacy. Without a proper post-sale plan, you risk losing employees, straining customer relationships, and dealing with costly disruptions. Here’s what you need to know:

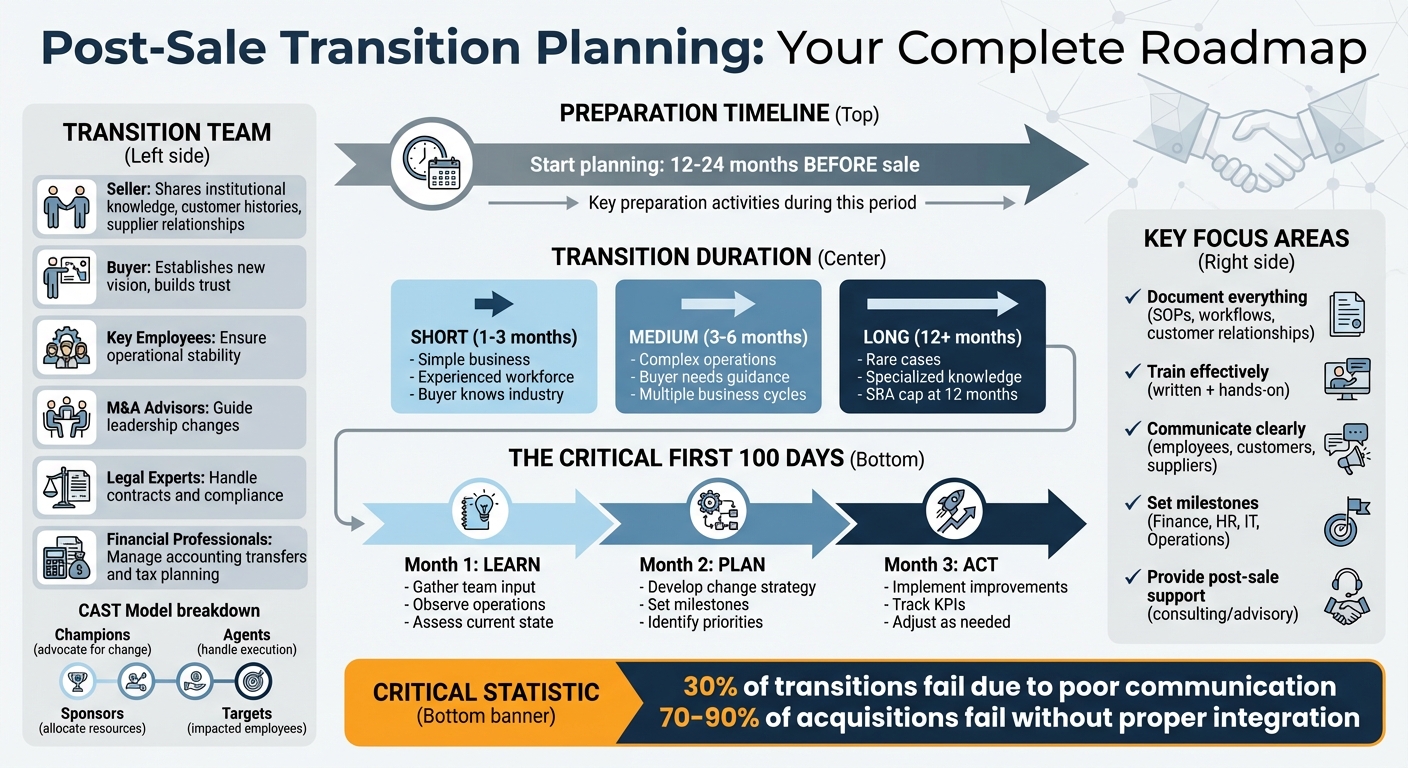

- Start Early: Plan your transition 12-24 months before the sale for better outcomes.

- Build a Transition Team: Include the seller, buyer, key employees, and external advisors like legal and financial experts.

- Document Everything: Create detailed guides covering operations, customer relationships, and workflows.

- Set a Timeline: Transitions can range from 1-12+ months depending on the business complexity.

- Train Effectively: Combine written instructions with hands-on sessions for a comprehensive handover.

- Communicate Clearly: Keep employees, customers, and suppliers informed to maintain trust.

- Focus on the First 100 Days: This period is critical for stabilizing the business and setting the new owner up for success.

- Provide Post-Sale Support: Offer consulting or advisory services as needed to ensure a smooth handover.

Post-Sale Business Transition Timeline and Key Milestones

Post M&A Acquisition Buyer/Seller Transition Planning Best Practices

Building Your Transition Team and Setting the Timeline

A successful transition hinges on two key elements: having the right people involved and following a well-structured schedule. Your transition team should include more than just the buyer and seller – it needs to bring together all essential stakeholders.

The seller plays a vital role by sharing institutional knowledge, such as customer histories, supplier relationships, and the unwritten norms that keep the business running smoothly. Meanwhile, the buyer focuses on establishing a new vision and building trust with employees and customers. Key employees and management serve as the glue, ensuring operations remain steady and minimizing turnover during the transition. Beyond your internal team, you’ll need M&A advisors to guide leadership changes, legal experts to handle contracts and compliance, and financial professionals to manage accounting system transfers and tax planning.

One effective way to structure your internal team is by using the CAST model:

- Champions advocate for change.

- Agents handle execution.

- Sponsors allocate necessary resources.

- Targets are the employees directly impacted by the transition.

As Lake Country Advisors puts it:

"If leadership plans are left until after the acquisition, employees and customers are left guessing".

This model helps assign clear responsibilities, ensuring every team member knows their role in the transition process.

Identifying Key Roles in the Transition Team

Defining each team member’s role early is critical to avoid confusion later. Key employees need clear instructions about how their duties will change and what new systems they’ll need to adopt. External advisors, like accountants, oversee financial reporting and payroll, while legal professionals handle employment agreements and regulatory compliance.

Start by determining which positions will stay the same, which will change, and where new hires are necessary. To ensure smooth knowledge transfer, create a formal reference guide that documents essential information – seller insights, employee responsibilities, and advisor input. This guide should include client details, operational workflows, and proprietary strategies. Schedule 30-, 60-, and 90-day reviews to track progress and make adjustments as needed.

Building a Practical Transition Timeline

Once roles are defined, the next step is to develop a realistic timeline. Transition lengths vary depending on the complexity of the business and the buyer’s experience.

- Short transitions (1–3 months): Ideal for straightforward businesses with experienced employees and a buyer familiar with the industry.

- Medium transitions (3–6 months): Suitable for more complex operations or when the buyer needs hands-on coaching through multiple business cycles.

- Long transitions (12+ months): Rare but necessary for highly specialized knowledge transfers, often capped at 12 months for SBA-funded deals.

| Transition Type | Duration | Typical Scenario |

|---|---|---|

| Short | 1–3 Months | Simple business; experienced workforce; buyer knows the industry. |

| Medium | 3–6 Months | Complex operations; buyer requires guidance over several cycles. |

| Long | 12+ Months | Rare; needed for specialized knowledge transfer; SBA cap at 12 months. |

Brian J. Sharkey of Kreischer Miller stresses the importance of early preparation:

"Starting early and evaluating your long-term goals and objectives will give you time to optimize value and address any issues that could derail a deal".

Ideally, you should begin planning 12 to 24 months before the sale. Build your timeline around key milestones for knowledge transfer. For instance, include shadowing sessions where the buyer observes daily operations and schedules regular meetings between the buyer and seller to address questions and share insights. As the Benjamin Ross Group notes:

"A good transition is vital for the business to succeed after the sale. The length and details of this transition should be worked out during the purchase agreement negotiation".

Recording Processes and Transferring Knowledge

Once you’ve set up a transition team and timeline, the next critical step is documenting your business’s operational knowledge. Think of this documentation as the glue that holds everything together during the handover. Without it, important details – like customer preferences, vendor quirks, or software shortcuts – can easily slip through the cracks. Proper documentation helps prevent disruptions and ensures the new owner has everything they need to hit the ground running.

The BizBuySell Team puts it simply: Standard Operating Procedures (SOPs) are "written instructions that document how to perform routine tasks – think of them as your business’s instruction manual". Your operations manual should cover all the essentials: daily workflows, training guidelines, customer service standards, vendor details, financial processes, and even things like alarm codes and passwords. To keep everything organized and easily accessible, use platforms like Google Drive or Notion, and structure the content by department with a clear table of contents.

As Brian J. Sharkey from Kreischer Miller points out:

A business that runs like a well-oiled machine is more attractive and commands a higher valuation.

To make your documentation even more user-friendly, include visual aids like flowcharts, diagrams, or screen recordings. Use plain, straightforward language so that even someone unfamiliar with your industry can follow along. For larger businesses, creating a Confidential Information Memorandum (CIM) is often necessary. These documents typically range from 20 to 50 pages, though some can exceed 75 pages. If you need help crafting a professional CIM, services like Deal Memo can assist.

Next, let’s explore how to systematically organize these processes and integrate effective training sessions.

Cataloging Systems, Processes, and Tools

Start by mapping out your workflows and identifying Key Performance Indicators (KPIs) that will allow the new owner to track progress against historical benchmarks. Create a detailed checklist that captures every tool, system, and process your business depends on. Group this information into logical categories, such as:

- Access and Security: Alarm codes, login credentials, and digital access points.

- Relationships: Client lists, supplier histories, and key contacts.

- Daily Operations: Equipment manuals, process maps, and task schedules.

- Human Resources: Organizational charts, team roles, and contact details.

- Financials: Payroll systems, bank account access, and internal controls.

It’s also a good idea to schedule regular reviews of your documentation to ensure it stays up to date as your business evolves. With a solid foundation in place, the next step is to complement this documentation with hands-on training.

Organizing Training and Shadowing Sessions

While documentation is essential, hands-on training captures the subtleties that manuals can’t – like company culture, team dynamics, and informal practices.

Don Woodard III from Western Commerce Group emphasizes:

The transfer of institutional knowledge is one of the most important aspects of transition planning.

Jacob Orosz, President of Morgan & Westfield, adds:

While the employees can often train the buyer on the technical elements of the business, the seller must usually train the buyer in the managerial tasks.

Before the deal closes, meet with key stakeholders to outline training expectations and decide who will handle day-to-day operations during the transition phase. During due diligence, draft a detailed training agenda based on the buyer’s questions. Use a spreadsheet to track each training topic – like accounting, HR, or vendor relations – marking them as completed and having the buyer sign off to avoid misunderstandings later.

It’s usually best to wait until the deal is finalized before starting formal training. Record technical procedures on video to create a permanent resource, reducing the buyer’s reliance on you post-sale. Most sellers remain involved for at least a month after the sale, with the first three months being crucial for the new owner to get up to speed. To ensure a smooth transition, include a clause in the purchase agreement for post-sale consulting support, billed hourly, to address any lingering questions after the formal training ends.

Communicating with Stakeholders and Maintaining Operations

When a business undergoes a post-sale transition, it impacts everyone involved – employees, customers, suppliers, investors, and even regulatory bodies. Miscommunication during this time can be disastrous. In fact, poor communication is a leading cause of failure in approximately 30% of transitions. To keep things on track, it’s essential to communicate clearly, early, and in a way that addresses the specific concerns of each stakeholder group.

A strong communication strategy should revolve around four key elements: Purpose (why the change is happening), Picture (what the business will look like afterward), Plan (steps and timeline for the transition), and Part (the role each stakeholder will play).

Start by identifying everyone who will be affected by the sale. This includes employees, customers, suppliers, investors, and any relevant regulatory bodies. From there, create a communication roadmap that outlines when and how you’ll reach out to each group, as well as the specific messages you’ll deliver.

For employees, consider holding an all-hands meeting immediately after the sale is announced to address their concerns. Follow up with regular updates through town halls or internal newsletters. For major customers, arrange joint meetings with the buyer to provide reassurance about the transition. For smaller accounts, send personalized emails or letters signed by both parties. Suppliers should receive newsletters or meeting invitations to discuss the acquisition’s impact on existing contracts.

Here’s an example of how you can structure your communication plan for different stakeholder groups:

| Stakeholder Group | Primary Communication Channels | Key Message Focus |

|---|---|---|

| Employees | Town halls, Intranet, 1-on-1 meetings | Job security, role changes, company vision |

| Customers | Personalized emails, Webinars, Joint meetings | Continuity of service, relationship stability |

| Suppliers | Newsletters, Contract review meetings | Contractual obligations, future collaboration |

| Investors | Summary reports, Conference calls | Financial health, integration milestones |

To ensure you’re addressing concerns effectively, establish a feedback loop. Use tools like anonymous surveys, dedicated email addresses, or hotlines where stakeholders can share their thoughts and ask questions.

Managing Concerns and Keeping Morale High

Uncertainty can breed anxiety, and silence only makes it worse. As Team Acquira aptly puts it:

"Uncertainty thrives in silence. If employees or customers don’t know what’s happening, they’ll start making assumptions – often the worst-case scenario".

To combat this, overcommunicate. Make sure everyone understands the purpose of the transition and the benefits it brings. Identify "Champions" within your organization – trusted individuals who support the change and can help rally others.

For critical employees who manage important customer or vendor relationships, work with the buyer on retention strategies. These could include stay bonuses, recognition awards, or updated employment agreements. Providing additional resources like counseling services, mentorship programs, or transition workshops can also help employees navigate the process.

Keep an eye on productivity and engagement metrics during this time. If you notice any dips, address them quickly. During the initial handover phase, aim to keep operational changes to a minimum. Maintaining consistent service levels reassures both customers and employees that the business remains steady and reliable.

Once communication is solidly in place, the next focus should be on implementing and tracking key milestones during the critical first 100 days.

sbb-itb-798d089

Implementing and Tracking the First 100 Days

The first 100 days after a sale are a make-or-break period. A well-structured integration plan during this time can significantly increase the likelihood of success, even though 70%-90% of acquisitions fail.

To navigate this critical window, break it into three phases:

- Month 1: Focus on learning. Gather input from the team and observe how operations are running.

- Month 2: Develop a plan for necessary changes based on your observations.

- Month 3: Put those improvements into action.

This step-by-step approach helps avoid the chaos that can come from rushing into too many changes all at once.

Financial controls are a top priority. Start by canceling old credit cards, reissuing them through the buyer’s program, and setting up a 13-week cash flow statement that’s updated weekly. As Deloitte cautions:

One misstep may mean thousands of invoices go unpaid for months, severely impacting cash flow.

From there, establish clear milestones for each functional area to ensure a smooth transition.

Establishing Milestones for Transition Activities

A detailed 100-day plan should outline milestones for every key function. Here’s a breakdown of what to focus on:

- Finance: Finalize the opening balance sheet and working capital settlements (usually within 90–180 days), set up new banking structures, and handle tax filings like IRS Form 8594.

- HR: Complete payroll setup, remove unnecessary personnel from payroll, and introduce retention programs to keep key employees.

- IT: Integrate ERP and CRM systems, migrate data, and perform User Acceptance Testing (UAT).

- Operations: Review supplier contracts, align service levels, and refine processes.

Additionally, ensure that legacy vendor invoices and transaction-related legal bills remain the seller’s responsibility, so these costs don’t unintentionally fall on the new entity.

| Function | Critical 100‑Day Integration Activities |

|---|---|

| Finance | Complete financial close, finalize the opening balance sheet and working capital settlements, set up new banking structures, and manage tax filings (e.g., IRS Form 8594). |

| IT | Integrate ERP/CRM systems, prepare for infrastructure cutovers, and conduct User Acceptance Testing (UAT). |

| Operations | Streamline supplier contracts, align service levels, and improve processes. |

| HR | Finalize payroll setup, adjust benefit plans, and implement retention strategies for key employees. |

Measuring Progress with Performance Metrics

Once your milestones are in place, track progress using objective, data-driven metrics. These metrics remove the guesswork and help you stay on course. Define Key Performance Indicators (KPIs) that align with your deal’s goals, and monitor them through digital dashboards and weekly scorecards.

The Kaizen Institute reinforces this idea:

The first three months of post‑transaction are crucial for integration success, as they establish… KPIs and performance metrics: Defining specific indicators to track progress, identify deviations, and adjust strategies as needed.

Key areas to monitor include:

- Synergy capture: Measure cost savings and revenue gains.

- Employee retention: Track whether key talent identified during due diligence is staying onboard.

- Operational efficiency: Keep an eye on metrics like process integration rates, IT system uptime, and supply chain optimization.

To maintain governance, use tools like "Weekly Scorecards" and "L10 Leadership Meetings" based on frameworks such as the Entrepreneurial Operating System (EOS). These tools help keep quarterly objectives on track.

Another useful strategy is incorporating Ready Checkpoints to assess handoffs between functions. These checkpoints evaluate individual workstream readiness and then review the overall process flow. Identifying "quick wins" within the first 30–90 days can also help build momentum and reassure stakeholders that progress is being made.

With these metrics and strategies in place, you’ll have a clear picture of where things stand and can make timely adjustments to prevent minor issues from becoming major setbacks.

Offering Post-Handover Support and Evaluating Results

After the initial 100-day integration period, providing ongoing support is essential to ensure a smooth transition and protect the legacy of your business. Finalizing the sale isn’t just about signing papers – post-handover support plays a key role in solidifying the new owner’s success. For most small businesses, this transition phase can take anywhere from 30 to 180 days, though more complex operations might need additional time.

Providing Support After the Transition

In many cases, sellers act as advisors for a set period after the handover. This often includes weekly check-ins, joint meetings with important vendors and customers during the first month, and access to a shared digital workspace containing standard operating procedures (SOPs), tutorial videos, and strategic notes.

Jacob Orosz, President of Morgan & Westfield, emphasizes:

The training period you offer the buyer can be an integral part of the new owner’s success.

Once the formal training phase ends, any further assistance should be structured as hourly consulting. This arrangement ensures clear boundaries while still providing the buyer with a reliable safety net, without leaving you perpetually on-call. If the deal includes earnout provisions tied to future performance, delivering top-notch support can increase the likelihood of receiving those final payments.

It’s also crucial to get written confirmation from the buyer once the agreed-upon training is complete. This documentation protects you from potential claims of inadequate training, especially if disputes over payments arise later. Interestingly, nearly 90% of cases show that providing training too early – before the deal closes – can lead to "buyer’s remorse", potentially causing cancellations.

This structured approach to post-handover support helps lay the groundwork for a thorough review of the transition process.

Reviewing the Transition Process

When the advisory period concludes, take time to formally evaluate the transition’s success. Set up a review meeting and use a detailed checklist with key performance indicators, such as employee retention rates and customer churn, to ensure training objectives were met and business operations remain steady.

Even after your active involvement ends, occasional strategic check-ins via email can help identify emerging challenges early and protect the reputation you’ve worked hard to build.

Conclusion

Post-sale transition planning serves as the essential link between closing a deal and ensuring the business thrives under its new leadership. As Don Woodard III from Western Commerce Group explains:

Transition planning bridges the gap between closing the sale and the buyer fully taking over the reins.

Every stage of the transition carries its own weight in determining the outcome. A well-prepared team and carefully crafted timeline are the backbone of a successful handoff. Capturing institutional knowledge – whether it’s detailed workflows or those unwritten "rules of the game" – ensures critical insights remain intact. Open communication with stakeholders helps maintain employee morale and reassures customers during the period of change.

The first 100 days are all about stabilizing the business and making thoughtful progress. New owners who take the time to observe and understand existing operations often experience smoother transitions and higher employee retention. Setting clear milestones and measurable goals during this phase helps track progress and identify potential challenges early.

Beyond the initial stabilization, ongoing support is crucial for sustained success. Whether through consulting arrangements or periodic check-ins, the seller’s involvement after the handover helps protect the buyer’s investment and preserve the business’s legacy. This structured support ensures the transition is not just a momentary event but a lasting success. Experts recommend starting the preparation process 12 to 24 months – or even longer – before the sale. Early planning makes a world of difference.

FAQs

Who are the key members of a post-sale transition team, and why are they important?

A post-sale transition team brings together several key players, each with a specific responsibility to ensure a smooth and efficient handover. Here’s a look at the typical roles involved:

- Transition Manager: This person takes charge of the entire process, ensuring all team efforts are aligned and moving forward cohesively.

- Operational Experts: They focus on keeping daily operations running without hiccups and facilitate the transfer of essential knowledge.

- Human Resources Representatives: Their role is to handle employee communication, address retention concerns, and maintain morale during the transition.

- Financial and Legal Advisors: These professionals manage compliance, valuations, and contractual obligations, ensuring all legal and financial aspects are in order.

Each role is designed to tackle critical areas like operational continuity, employee management, and adherence to legal and financial standards. By working together, this team helps maintain stability, reduce disruptions, and instill confidence among stakeholders. A well-structured team with clear responsibilities can effectively address challenges such as employee turnover or customer concerns, ultimately preserving the business’s value and reputation.

How can I communicate effectively with stakeholders during a business transition?

Effective communication with stakeholders during a business transition hinges on openness and early involvement. By keeping everyone in the loop about the transition plan, key milestones, and anticipated changes, you can ease uncertainties and build trust. Sharing clear timelines and setting practical expectations ensures everyone stays on the same page.

It’s also crucial to address concerns proactively. Regular updates and opportunities for feedback – whether through meetings, email updates, or Q&A sessions – can go a long way in providing clarity and reassurance. Beyond that, offering resources like training sessions or mentoring can help stakeholders better understand their roles and adjust to the changes more easily. Consistent and open communication isn’t just helpful – it’s the backbone of preserving strong relationships and ensuring the transition goes as smoothly as possible.

How can I help the new owner transition smoothly after selling my business?

To make the transition after selling your business as seamless as possible, start by putting together a comprehensive transition plan. This should cover everything from transferring knowledge and handling operational responsibilities to introducing the new owner to key business relationships. Consider offering hands-on support, such as training sessions or shadowing opportunities, and make yourself available to answer any questions as the new owner gets up to speed.

Equally important is maintaining clear and open communication with employees, customers, and stakeholders. Keeping everyone in the loop fosters trust, minimizes uncertainty, and helps maintain stability throughout the process. Be sure to document all essential procedures and double-check that systems are running smoothly to prevent any hiccups. Working closely with the new owner not only helps them hit the ground running but also ensures the business continues to flourish.