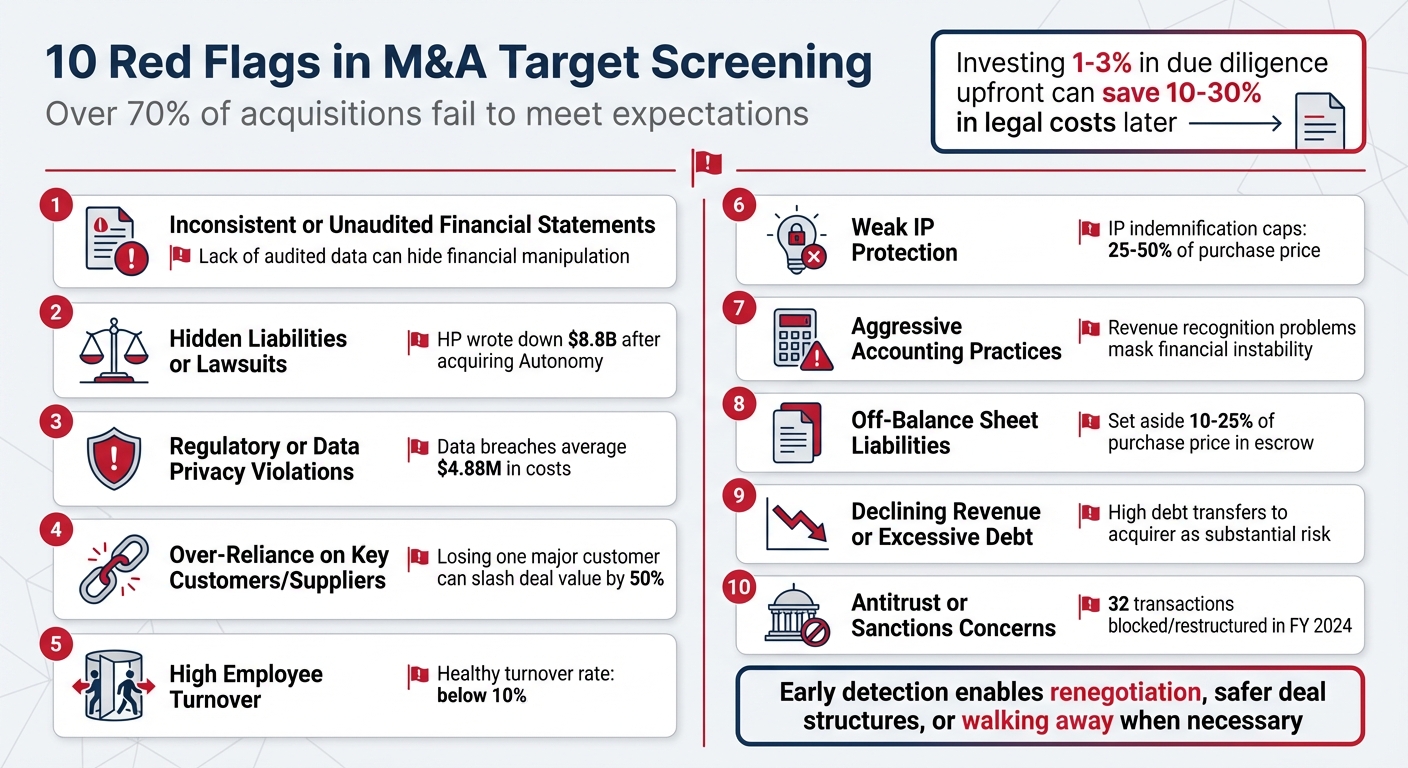

- Why it matters: Over 70% of acquisitions fail to meet expectations, often due to missed warning signs. Examples like Hewlett-Packard’s $8.8 billion write-down after acquiring Autonomy highlight the risks.

- Key takeaway: Early detection of financial, legal, and operational issues can prevent overpayment, legal disputes, and post-deal complications.

Top Red Flags to Watch For:

- Inconsistent or unaudited financial statements: Lack of audited data can hide financial manipulation or weaknesses.

- Hidden liabilities or lawsuits: Undisclosed issues like tax obligations or pending legal cases can derail a deal.

- Regulatory or data privacy violations: Successor liability for past violations can lead to fines or reputational damage.

- Over-reliance on key customers or suppliers: Heavy dependence on a few relationships increases risk.

- High employee turnover: Signals deeper management or operational problems.

- Weak intellectual property protection: Ownership disputes or open-source issues can harm deal value.

- Aggressive accounting practices: Revenue recognition problems often mask financial instability.

- Off-balance sheet liabilities: Hidden financial commitments or risks can create unexpected costs.

- Declining revenue or excessive debt: Financial struggles may indicate broader operational challenges.

- Antitrust or sanctions concerns: Regulatory scrutiny and compliance issues can block or complicate deals.

Quick Tip:

Investing 1%–3% of the transaction’s value in due diligence upfront can save 10%–30% in legal or remedial costs later. Use tools like Quality of Earnings (QofE) reports and escrow arrangements to mitigate risks.

Bottom line: Identifying these red flags early can help renegotiate terms, structure safer deals, or walk away when necessary.

10 Critical Red Flags in M&A Target Screening

1. Inconsistent or Unaudited Financial Statements

Financial Transparency and Reliability

Financial statements generally fall into three categories: Audited (the most reliable, verified by a CPA firm), Reviewed (moderately verified), and Compiled (offering the least reliability). If a company presents compiled statements, it’s a red flag – they provide minimal assurance regarding accuracy. When a target company either cannot or chooses not to provide audited financials, it leaves you in the dark about critical financial details. This classification system highlights the importance of verified financial data before moving forward with any acquisition.

History has shown that relying on unaudited data can lead to trouble. For instance, there have been cases where multi-year accounting misconduct was hidden, resulting in massive financial losses.

"A company that fails to provide organized, detailed information throughout the process is sending you an important message: Be cautious of proceeding with this acquisition." – PCE Companies

Financial inconsistencies often point to deeper issues. For example, discrepancies might indicate aggressive revenue recognition practices, such as booking revenue before delivering goods or services. They could also reveal a lack of internal financial controls. Without audited data, sellers might manipulate EBITDA figures to mask weaknesses, which could lead to significant overvaluation of the company.

To safeguard your investment, consider requesting a Quality of Earnings (QofE) report. This report can verify how revenues are earned and help uncover risks that standard profit-and-loss statements might overlook. Additionally, reviewing at least 3 to 5 years of historical financial data can help you identify patterns, anomalies, and the company’s long-term financial health.

Protect yourself further by building safeguards into the deal structure. For example, include pro-buyer price adjustments, which are found in 55% of private M&A deals. Escrow arrangements (typically 10% to 25% of the purchase price) and earnout provisions (up to 25% of the deal) can also help mitigate risks tied to uncertain financial performance.

2. Hidden Liabilities or Pending Lawsuits

Legal Compliance and Risk Exposure

Undisclosed legal issues can quickly derail the value of an acquisition. History offers some stark examples. When Hewlett-Packard purchased Autonomy for $11.1 billion in October 2011, the deal turned sour in just over a year. By November 2012, HP had to write down $8.8 billion, with roughly $5 billion attributed to undisclosed issues and failures in disclosure that due diligence didn’t catch. A similar situation unfolded for Caterpillar in 2013. Just a year after acquiring ERA Mining Machinery and its subsidiary Siwei, the company announced a $580 million impairment charge due to accounting misconduct uncovered during an internal investigation. These cases highlight why thorough legal due diligence is critical in protecting acquisition value.

Financial Transparency and Reliability

Hidden liabilities can take many forms, from unfunded employee benefits and tax obligations across multiple states to property-related risks under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). Other potential pitfalls include product liability claims, unresolved labor disputes, and intellectual property conflicts.

"A company that is not compliant with the obligations that correspond with its nexus in all states is sending up an acquisition red flag." – PCE Companies

Operational Stability and Scalability

Mitigating these risks requires proactive measures. For instance, data breaches now average a staggering $4.88 million in costs – a 10% increase from the previous year. Legal disputes over intellectual property can also block access to the technology or branding that was central to the acquisition’s goals. To address these challenges, consider implementing legal warranties and financial safeguards. Conduct a Phase 1 Environmental Assessment to identify property-related liabilities, and set aside 10% to 25% of the purchase price in escrow to manage potential post-closing claims. These steps can help ensure that unforeseen liabilities don’t undermine the deal’s success.

3. Failure to Comply with Regulatory or Data Privacy Laws

Legal Compliance and Risk Exposure

Regulatory violations can derail deals and create lasting problems. When you acquire a company, you’re not just buying its assets – you’re also taking on its legal history, including any past violations. This concept, known as successor liability, applies to issues like anti-bribery, anti-money laundering, and sanctions violations.

Take the White Deer Management case as an example. In December 2024, White Deer acquired Unicat Catalyst Technologies, only to discover post-acquisition that Unicat had made 23 illegal sales to customers in Iran, Syria, Cuba, and Venezuela between 2014 and 2021. These violations came to light during post-close integration in June 2021. Acting quickly, White Deer disclosed the misconduct to the DOJ, replaced key personnel, and strengthened compliance controls. Thanks to these actions, the DOJ declined to prosecute.

"The last thing the Department wants to do is discourage companies with effective compliance programs from lawfully acquiring companies with ineffective compliance programs and a history of misconduct. Instead, we want to incentivize the acquiring company to timely disclose misconduct uncovered during the M&A process."

– Lisa Monaco, Deputy Attorney General, U.S. Department of Justice

Regulatory lapses don’t just invite legal scrutiny – they also carry potentially severe financial consequences.

Financial Transparency and Reliability

Failing to conduct proper regulatory due diligence can be incredibly costly. One U.S. medical device company paid over $30 million in penalties for insufficient compliance checks during an acquisition. And the financial impact doesn’t stop there – reputational damage can multiply the cost by up to 4.5 times. A high-profile example is Yahoo’s sale to Verizon in 2016. After major data breaches were uncovered, Yahoo’s valuation dropped by $350 million.

Operational Stability and Scalability

The fallout from regulatory violations goes beyond fines. Operational disruptions are another major risk. Common pitfalls include breaches of U.S. economic sanctions, export control laws, the Foreign Corrupt Practices Act, environmental regulations under CERCLA, and state sales tax obligations.

To reduce these risks, thorough due diligence is essential. For instance, conducting a Phase 1 Environmental Site Assessment can help identify potential property liabilities, while verifying the tax nexus in each state where the target operates ensures compliance. Post-close diligence is equally critical. Addressing undisclosed liabilities within the first six months after closing can prevent future headaches. The DOJ now offers a "presumption of declination" for companies that disclose misconduct within 180 days of closing and resolve issues within one year. This policy strongly encourages swift action.

4. Over-Reliance on Key Customers or Suppliers

Operational Stability and Scalability

Relying heavily on a small group of customers or suppliers can be a major warning sign in M&A evaluations. Imagine losing a customer that accounts for half of your revenue – that could instantly slash the deal’s value in half. This kind of dependency creates serious vulnerabilities. Jim Fray, Associate at PCE Companies, emphasizes:

"Too much reliance on one customer can be a significant red flag during the acquisition process, so a thorough review of the company’s customer relationships is essential".

The same risks apply to suppliers. If your business depends on a single supplier, any price hike on their end could eat into your margins overnight. This becomes an even bigger issue when you’re trying to expand operations beyond the target’s current capacity. Robert E. Harig, Attorney at Robbins DiMonte, points out:

"Excessive reliance on a single customer or supplier jeopardizes the deal".

Such over-reliance not only disrupts operational stability but also makes revenue projections less reliable.

Financial Transparency and Reliability

A concentrated customer base often leads to fluctuating valuations, making it harder to pin down an accurate price. Strong M&A targets typically boast customer retention rates of at least 90% and net revenue retention of 120%. If customer concentration ratios stray from these benchmarks, a Quality of Earnings (QofE) report can help verify the consistency of revenue streams.

On top of that, the terms of customer contracts can add another layer of complexity.

Legal Compliance and Risk Exposure

"Change-of-control" clauses in contracts are another hurdle to watch out for. These clauses often allow customers or suppliers to terminate agreements if the company changes ownership. If a key customer decides not to approve the assignment of their contract, you could be forced into renegotiations under less favorable conditions – or lose the relationship altogether. To mitigate this risk, it’s crucial to review the contracts of your top 20 revenue-generating customers, paying close attention to renewal dates and any change-of-control clauses.

In some cases, earnout provisions – where up to 25% of the purchase price is deferred – are used to manage these risks. These provisions tie part of the payment to post-acquisition milestones, such as retaining key customers.

5. High Employee Turnover or Culture Conflicts

Operational Stability and Scalability

High employee turnover is often a red flag for deeper management or operational problems. It disrupts daily workflows, making it harder for a company to function smoothly. A turnover rate below 10% is generally considered healthy. If a company is losing employees at a rapid pace, it can destabilize operations and make scaling efforts much more difficult.

Another major concern is dependency on key individuals. When a business relies heavily on one owner or a small group of people, even minor changes can have a ripple effect on its performance. As Jim Fray from PCE Companies explains:

"A company’s most valuable asset is its employees, which means it’s vital to ensure that the target company has a culture and business model that can be integrated into your own".

Additionally, a low average employee tenure – less than 8 years – may indicate weak management depth. This lack of leadership capacity can hinder critical growth initiatives, such as expanding into new regions or launching new products.

Cultural inconsistencies within a company can also lead to financial and legal risks, further complicating the situation.

Legal Compliance and Risk Exposure

When internal instability is present, it doesn’t just disrupt operations – it can also expose a company to legal risks. For instance, significant pay disparities for similar roles might lead to widespread resignations after a deal is finalized. Companies without formal employment agreements or those with unresolved labor disputes could face expensive litigation down the road. The departure of key executives, such as a CEO or CFO, often signals deeper internal issues that could complicate post-acquisition integration.

Cultural misalignment carries its own set of challenges. In some cases, it can result in what’s been called "cultural contagion", where toxic workplace behaviors spread to your organization. In fact, 20% of dealmakers identify cultural alignment as the biggest hurdle in M&A execution. Before closing any deal, it’s essential to conduct a thorough review of the target company’s HR policies, analyze historical attrition rates, and evaluate whether key leadership is likely to stay on board after the acquisition.

6. Weak Intellectual Property Protection or Ownership Disputes

When it comes to mergers and acquisitions, safeguarding intellectual property (IP) is a cornerstone of protecting deal value. Overlooking this area can lead to significant financial and legal headaches.

Valuation Risks and Documentation Gaps

For many companies – especially in software and tech – intellectual property is their crown jewel. But when ownership of that IP is murky, the value of the deal can take a hit. Here’s a key stat: IP indemnification caps often range from 25% to 50% of the purchase price, compared to just 5% to 15% for other types of representations. That’s a big difference. Missing records for patents, trademarks, or invention assignment agreements only add to the uncertainty, making it harder to pin down the true value of the acquisition. And where there’s valuation uncertainty, legal risks aren’t far behind.

Legal Compliance and Risk Exposure

From a legal standpoint, having a clear chain of title for all intellectual property is non-negotiable. Buyers need rock-solid proof that the company owns its code, content, and inventions outright – not the founders, contractors, or former employees. As Sajai Singh of the American Bar Association puts it:

"The integrity of the chain of development, acquisition, and transfer of intellectual property from the creator to the eventual beneficial ‘owner’ often surfaces as the biggest risk in transactions".

Open-source software can also throw a wrench in the works. If a company uses open-source components governed by copyleft licenses like GPL, it may face obligations to disclose proprietary source code. This could erode its competitive edge. Richard Harroch, Managing Director and Author at AllBusiness.com, highlights the stakes:

"For an acquirer relying on the ability to exclusively use the seller’s technology, open source issues could become a deal killer".

Other warning signs to watch for include ongoing IP litigation, liens on IP assets held by banks, and "springing licenses" that grant third parties rights automatically when control of the company changes hands. To avoid surprises, buyers should take proactive steps like using specialized tools (e.g., Black Duck or Palamida) to scan for open-source components and running global database searches to verify IP registrations and uncover gaps in ownership. Additionally, ensuring invention assignment agreements use precise present-tense language – such as "hereby assigns" – is critical.

sbb-itb-798d089

7. Revenue Recognition Problems or Aggressive Accounting Methods

Aggressive revenue recognition is a major red flag when evaluating a company’s financial health. This happens when a company records revenue before delivering goods or services, creating a distorted picture of its performance. Such practices can indicate financial manipulation or weak internal controls, which are risks that can derail an M&A deal.

Financial Transparency and Reliability

An income statement should reflect a company’s true performance. When revenue recognition is overly aggressive, it often points to over-reporting or a lack of proper financial oversight. As iDeals explains:

"Aggressive revenue recognition… may indicate financial manipulation, over-reporting, or a lack of financial controls".

One key metric to watch is net income consistently outpacing operating cash flow. If profits look strong on paper but cash flow is lagging, it’s a sign the company may be covering up deeper issues. Charles Rotblut, Lead Instructor at AAII, highlights this concern:

"When net income consistently outpaces operating cash flow, it raises questions about the persistency of earnings".

Another warning sign is a sudden spike in revenue just before a deal. It’s crucial to verify the authenticity of these numbers by reviewing customer payments. Missing sales records or an unusual number of voided discounts can also hint at fraud. Overlooking such discrepancies can lead to serious financial consequences, including large write-downs. Past cases have shown how these issues can severely impact a company’s financial stability.

Operational Stability and Scalability

The problems with aggressive revenue recognition go beyond financial reporting – it can also reveal operational instability. It’s not just about how much revenue a company generates but the quality of that revenue. For instance, a SaaS company might highlight recurring revenue, but if most of it comes from low-margin, one-time services, the business model may not be as scalable as it seems. Aging accounts receivable can signal unstable revenue streams and potential liquidity challenges. Similarly, revenue from one-off projects instead of long-term contracts points to a lack of operational consistency.

To safeguard against these risks, consider bringing a forensic accounting expert onto your due diligence team. They can identify subtle warning signs like excess inventory or suspicious new vendor relationships. Dive deep into historical collection cycles to verify cash flow projections. And don’t just take customer logos in a pitch deck at face value – some of those "big names" might represent past clients or one-time deals rather than ongoing revenue streams.

8. Off-Balance Sheet Liabilities or Contingent Risks

Financial Transparency and Reliability

Off-balance sheet liabilities are financial commitments that don’t appear on traditional balance sheets but can still carry significant financial risks. These include unused commitments, letters of credit, unfunded pension obligations, and post-retirement healthcare liabilities, which can cost millions if overlooked. Melik Salmi, Director of Corporate Development & Strategy at SAP, cautions:

"Look out for off-balance sheet financial instruments like unused commitments, letters of credit, etc., weakening working capital trends."

Failing to identify these hidden risks can lead to disastrous outcomes. History has shown that undiscovered accounting issues and concealed liabilities during acquisitions can result in multi-billion dollar write-downs and impairment charges.

To protect your investment, it’s wise to request a Quality of Earnings (QofE) report that includes a thorough review of off-balance sheet items. Additionally, setting aside 10%–25% of the purchase price in escrow can help cover potential hidden liabilities.

But financial statements aren’t the only source of risk – legal and regulatory factors can also pose significant challenges.

Legal Compliance and Risk Exposure

Contingent risks often extend into legal and regulatory areas, creating additional hurdles for buyers. Pending lawsuits, product liability claims, intellectual property disputes, and environmental contamination are just a few examples of risks that may transfer to the buyer after closing. Tax exposure is another critical concern. For instance, if a target company has mismanaged its nexus obligations, it could carry undisclosed tax liabilities. As PCE Companies highlights:

"A company that is not compliant with the obligations that correspond with its nexus in all states is sending up an acquisition red flag."

Environmental liabilities governed by CERCLA can be particularly costly, with cleanup expenses potentially exceeding the purchase price. A Phase 1 Environmental Site Assessment is an essential step to identify any property contamination before finalizing the deal. It’s also crucial to verify pending litigation and secure warranties to ensure there are no hidden accounting issues or undisclosed disputes. If significant problems are uncovered, you may need to exclude specific liabilities from the acquisition scope to avoid inheriting costly issues.

9. Declining Revenue or Excessive Debt Levels

Financial Transparency and Reliability

Spotting declining revenue or rising debt early is essential to protecting the value of any deal. Both issues can bring substantial risks to the buyer. Alejandro Cremades, Founder of StartupFundraising.com, puts it plainly:

"A high amount of debt transfers to the acquirer, who will be responsible for paying it off. This factor poses a substantial risk."

Some companies try to obscure these red flags by sharing only two years of financial history instead of the usual three to five years, hiding trends like revenue or margin declines. Others might inflate revenue numbers just before a sale to mask weak performance. History shows that such tactics, including aggressive accounting practices, have led to massive write-downs worth billions of dollars. These financial warning signs often point to deeper operational problems.

To safeguard your investment, consider obtaining a Quality of Earnings (QofE) report from an independent firm. This report can help verify the accuracy of financial statements and determine if poor results are due to systemic operational issues or temporary management missteps. Additionally, examine capital expenditure requirements and use tools like contractual earnouts and escrow agreements to secure 10% to 25% of the purchase price. Keep in mind that financial troubles often go hand in hand with operational instability.

Operational Stability and Scalability

Declining revenue often hints at broader operational challenges that may limit a company’s ability to grow. One common issue is customer concentration risk – where just one or two major clients account for a significant portion of revenue. If these clients leave, the company could lose up to 50% of its value. Another concern is weak cash flow, which is often reflected in aging accounts receivable and slow payment collections. This can force the company to rely on expensive short-term financing, further straining its finances.

To address these risks, pro-buyer net working capital (NWC) price adjustments are included in 55% of private M&A deals. Also, make sure to conduct thorough due diligence on tax compliance and potential undisclosed liens. Hiring a consultant to review federal and state filings can help ensure there are no IRS penalties or other liabilities that might transfer to you as the buyer.

10. Antitrust Concerns or Sanctions Exposure

Legal Compliance and Risk Exposure

Antitrust issues and sanctions exposure can derail even the most promising deals. In fiscal year 2024, antitrust agencies intervened in 32 transactions, leading to 26 deals either being abandoned or significantly restructured. While this represents only 1.6% of the 2,031 transactions reported under the Hart-Scott-Rodino (HSR) Act, most of the affected deals were valued at $1 billion or more.

Some high-profile cases underline the risks tied to antitrust scrutiny. Take the UnitedHealth/Amedisys case, for example. Amedisys faced a $1.1 million civil penalty from the Department of Justice for allegedly providing incomplete information during the merger investigation. The settlement also required the divestiture of 164 home health and hospice locations across 19 states to resolve antitrust concerns. Similarly, the Synopsys/Ansys merger faced Federal Trade Commission (FTC) scrutiny, forcing the divestiture of key software tools, including optical and photonic software, to address competitive concerns.

Sanctions exposure presents an equally serious threat. A prime example is Microsoft’s attempted acquisition of TikTok’s U.S. operations, which collapsed in late 2020 and early 2021 due to U.S. government sanctions and national security concerns tied to TikTok’s parent company, ByteDance. More recently, between February and June 2025, the U.S. government issued over a dozen rounds of sanctions targeting entities like "shadow fleet" tankers, oil brokers, and front companies. These enforcement actions can have devastating effects, including asset seizures and supply chain disruptions.

To mitigate these risks, thorough preparation is key. Conduct pre-filing audits before submitting HSR notifications. Screen the target company’s parent organization and geographic operations for potential sanctions exposure. Pay special attention to entities with limited online presence but significant recurring transactions or maritime assets that frequently change names and flags. Bill Rinner, Former Assistant Attorney General for Antitrust, emphasized the consequences of non-compliance:

"The division will seek judicial sanctions where parties systematically abuse legal professional privilege or recklessly disregard professional duties by withholding or altering documents required by the HSR Act".

For companies operating in highly concentrated markets or with ties to sanctioned jurisdictions, identifying potential divestiture candidates early in the process can help satisfy regulators without jeopardizing the entire deal. Additionally, financial institutions must remain vigilant. They are required to file Suspicious Activity Reports (SARs) if they suspect a transaction involves sanctioned entities or evasion tactics. Failing to disclose sanctions exposure can result in hefty fines, the loss of critical banking relationships, and long-term reputational harm.

Conclusion

Identifying red flags early in the M&A target screening process can safeguard your capital, timeline, and reputation. The difference between a successful acquisition and a costly mistake often hinges on how carefully potential issues are investigated before committing substantial resources. Overlooking financial irregularities, hidden liabilities, or operational challenges can lead to problems that undermine the value of the entire transaction.

Consider past high-profile deals, such as those involving Hewlett-Packard and Caterpillar Inc., which resulted in billions of dollars in write-downs due to missed warning signs. These examples highlight the importance of a strong deal team and explain why 55% of private M&A deals now include pro-buyer net working capital adjustments to reduce the risk of overpayment.

Having an experienced deal team is essential. As Jim Fray, Associate at PCE Companies, explains:

"A skillful, accomplished deal team with a thorough understanding of the due diligence process can save you time and money by identifying potential warning signs regarding a target company’s financials; performance; customer and supplier relationships; environmental and safety record; taxes; employee retention; or legal problems."

Engaging professional services can provide the expertise needed to conduct targeted "red flag due diligence" early in the process. These experts verify financial accuracy with Quality of Earnings reports and implement contractual safeguards when risks are identified but the deal still holds strategic value.

To further reduce risk, professional M&A services can be instrumental. For instance, Deal Memo offers white-labeled CIM and OM writing services, completed within 72 hours and including unlimited revisions, to streamline due diligence and minimize potential issues.

Ultimately, addressing red flags during the screening stage ensures better valuations, smoother integrations, and fewer post-closing complications. When severe financial instability or deliberate misrepresentation is uncovered, walking away from the deal is often the most cost-effective decision. Early detection of red flags remains critical to preserving capital, protecting your reputation, and ensuring a successful integration.

FAQs

What are the key red flags to watch for during M&A target screening?

When assessing a potential M&A target, it’s essential to look out for financial red flags. These might include manipulated earnings, overly complicated or inconsistent financial statements, or an overdependence on just a few customers or suppliers. Such signs often point to underlying financial vulnerabilities.

Beyond the numbers, pay attention to legal and compliance issues. Unresolved lawsuits or regulatory breaches can signal deeper problems. On the operational side, outdated technology, frequent employee turnover, or unstable leadership should raise concerns. Don’t overlook potential environmental liabilities or signs that the target may not align with your strategic objectives.

Spotting these risks early can save you from unexpected challenges and help ensure a smoother transaction.

Why is due diligence important for controlling costs in M&A deals?

When it comes to mergers and acquisitions (M&A), doing your homework – aka due diligence – is a non-negotiable step. Why? Because it’s the best way to spot potential red flags early on. Whether it’s financial inconsistencies, legal liabilities, or operational hiccups, uncovering these issues ahead of time puts you in a stronger position to negotiate and make well-informed decisions.

Plus, addressing these problems before they snowball into major headaches can save you from costly surprises down the line. By tackling risks head-on, you’re not just protecting your wallet – you’re also setting the stage for a smoother integration process post-deal. And let’s be honest, fewer complications mean more long-term savings and a better chance of success.

Why is reviewing a company’s financial statements critical during an acquisition?

Taking a close look at a company’s financial statements is a crucial step in identifying risks that could jeopardize the success of a deal. Problems like overstated earnings, undisclosed debts, or unexplained irregularities in the financials can have a major impact on the company’s actual worth and future stability.

A detailed review of these records allows you to confirm the company’s real performance, ensure clarity, and steer clear of expensive surprises after the acquisition. This process is a key part of due diligence, ensuring you make well-informed decisions and safeguard your investment.