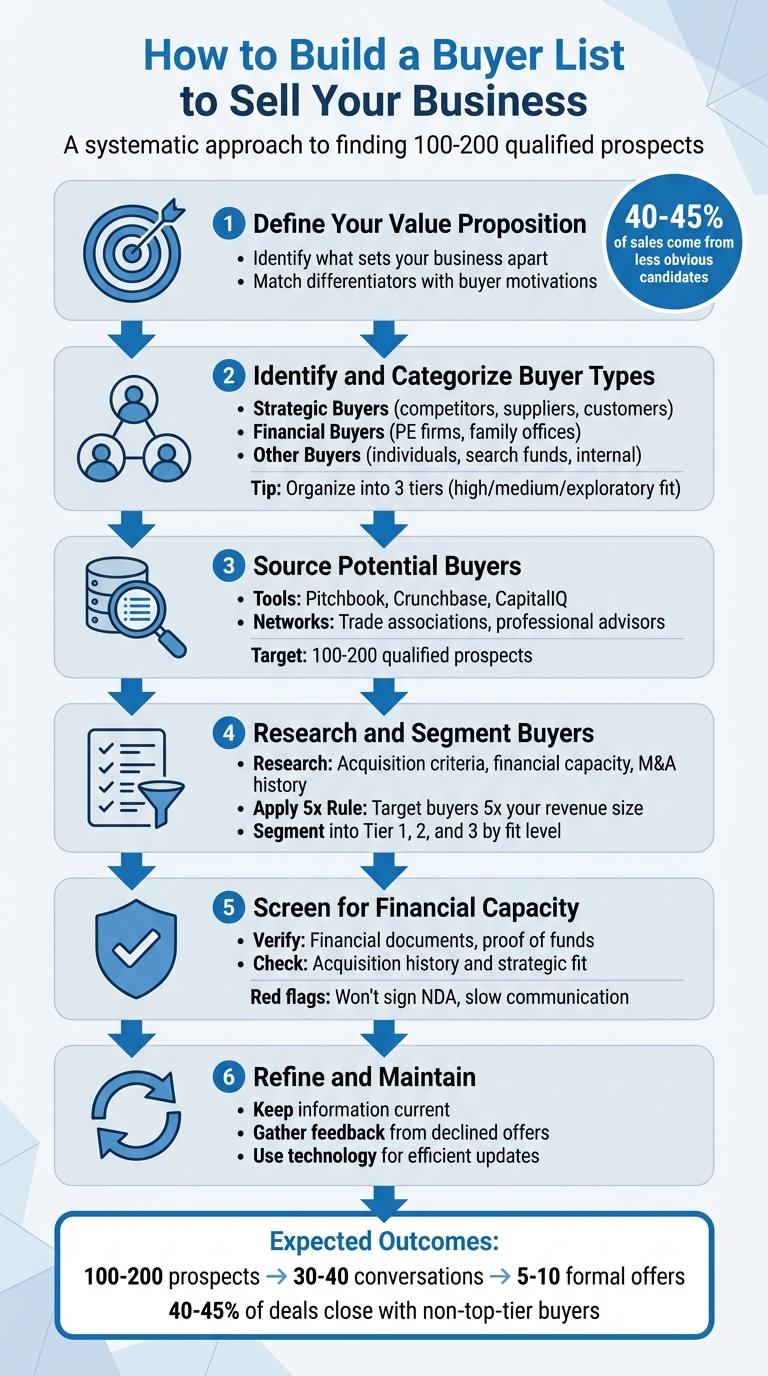

If you’re planning to sell your business, building a strong buyer list is essential. A well-prepared list increases competition, reduces risks, and helps connect you with the right buyers. Here’s a quick summary of how to create one:

- Define your value proposition: Identify what sets your business apart and align it with buyer motivations.

- Categorize buyer types: Group buyers into strategic, financial, or other categories based on their goals and acquisition strategies.

- Source buyers effectively: Use databases, networks, and tools like Pitchbook or Crunchbase to find qualified prospects.

- Segment your list: Organize buyers into tiers (high, medium, exploratory fit) to prioritize outreach.

- Screen buyers: Verify financial capacity and strategic alignment to ensure serious interest.

- Maintain and refine your list: Regularly update buyer details and adjust your strategy based on feedback.

Starting with a list of 100–200 prospects can lead to 30–40 conversations and 5–10 formal offers. By following these steps, you’ll increase your chances of finding the right buyer and achieving your goals.

6-Step Process to Build a Buyer List for Selling Your Business

Step 1: Define Your Business’s Value Proposition

Your value proposition is the cornerstone of building a targeted buyer list. It helps you zero in on buyers who not only value your business but are also willing to pay a premium for it.

"Identify companies with an ability to pay – and an interest in paying a premium." – Derek van der Plaat, Managing Director, Veracap M&A International Inc.

A well-defined value proposition does more than attract obvious prospects – it uncovers hidden opportunities. While about 55%–60% of sales come from "top-tier" buyers, a significant 40%–45% can originate from less obvious candidates. By understanding what makes your business stand out, you pave the way for identifying and categorizing potential buyers in the next steps.

Identify Your Business’s Key Differentiators

Start by analyzing what sets your business apart. This could include proprietary technologies, strong R&D capabilities, competitive market positioning, pricing power, or operational advantages like economies of scale. Does your business provide immediate access to new markets or regions? Could it help reduce earnings volatility?

Also, consider how your business might integrate with a buyer’s operations. For instance:

- Vertical integration: Acquiring a supplier to cut costs.

- Horizontal integration: Merging with a competitor to expand market share.

These differentiators are crucial in understanding how your business could create value for the right buyer.

Match Your Value Proposition with Buyer Motivations

Once you’ve outlined your differentiators, align them with what potential buyers are looking for. Strategic buyers – such as competitors, suppliers, or even customers – are often willing to pay more for businesses that strengthen their competitive edge. This could mean acquiring companies with strong R&D, valuable intellectual property, or opportunities for market expansion.

Clarify your priorities for the sale. Are you aiming to maximize the sale price, or is preserving your brand’s legacy more important? Keep in mind the differences between strategic and financial buyers:

- Strategic buyers might phase out existing brands or eliminate redundant departments to streamline operations.

- Financial buyers tend to maintain operations as they are, acting as stewards of the business.

Step 2: Identify and Categorize Buyer Types

After defining your value proposition, the next step is to use it as a guide to classify potential buyers based on their acquisition strategies. Buyers vary in their goals, financial capacity, and plans for the business post-sale. By categorizing them, you can fine-tune your outreach strategy and set realistic expectations about pricing, deal terms, and the future of your business after the transaction.

A practical way to organize potential buyers is to create three tiers:

- Tier 1: Direct competitors or buyers with a high likelihood of acquisition.

- Tier 2: Companies within your sector or those showing interest in growth opportunities.

- Tier 3: Adjacent industries or less likely prospects.

This system helps prioritize your efforts while keeping options open. Interestingly, about 40% to 45% of deals are closed with buyers outside the top tier.

Strategic Buyers

Strategic buyers are often competitors, suppliers, or customers aiming to enhance their market position by acquiring your business. They might be drawn to your R&D capabilities, intellectual property, customer base, or geographic reach. These buyers are usually willing to pay a premium because your business offers them advantages that are hard to replicate.

However, selling to a strategic buyer comes with trade-offs. They often integrate the acquired company into their existing operations, which could mean losing your brand identity and eliminating overlapping roles. If you’re targeting this group, focus on companies that would benefit from either:

- Vertical integration: Gaining control over more of the supply chain.

- Horizontal integration: Expanding their market share within the same industry.

When narrowing down strategic buyers, prioritize those that are at least three times the size of your company. Larger companies tend to have the financial resources and risk tolerance to close the deal. Most corporate buyers prefer acquisitions that fall within 5% to 20% of their own size.

Financial Buyers

Financial buyers, such as private equity firms, family offices, and search funds, approach acquisitions with a focus on return on investment. Unlike strategic buyers, they are less concerned with operational synergies and more interested in cash flow and long-term value growth. These buyers typically maintain your business as a standalone entity, working to increase its value before reselling it or going public – usually within a 3 to 7-year timeframe.

"Financial sponsors help with deal discipline and pacing… they tend to have an excellent grasp of the standard process, structure, and pacing." – Axial

Private equity firms are particularly valuable in maintaining deal momentum, as they are well-versed in mergers and acquisitions. That said, not all financial buyers operate under the same model. For instance, "patient capital" investors, such as family offices and holding companies, don’t adhere to strict exit timelines and may prioritize preserving your legacy. If you’re interested in staying on as CEO for a “second bite of the apple,” financial buyers are often more open to such arrangements than strategic buyers.

Another noteworthy group is "quasi-strategic" sponsors – financial buyers who already own related businesses. These buyers behave like strategic acquirers and may offer higher prices due to potential synergies.

Other Buyer Categories

In addition to strategic and financial buyers, there are other groups with unique motivations:

- Individual buyers: Entrepreneurs or those pursuing passion projects. While they may bring enthusiasm, they often lack the financial resources or industry expertise.

- Search funds: Individuals backed by investors to find and manage a company.

- Internal buyers: These include family members, key employees, or management teams. They often prioritize preserving the company’s legacy and ensuring operational continuity, though they might require seller financing to complete the deal.

Each buyer type comes with its own set of advantages and challenges, so understanding their motivations is key to aligning your sales strategy effectively.

Step 3: Source Potential Buyers Using Tools and Networks

Now that you’ve categorized your buyer types, the next step is to efficiently source potential buyers. This means using specialized tools, databases, and professional networks to compile a list of 100–200 qualified prospects.

Use Industry Databases and CRM Systems

Financial and M&A databases are essential for finding qualified buyers. Platforms like Pitchbook, Crunchbase, and CapitalIQ allow you to filter for strategic acquirers and private equity firms based on factors like investment preferences, fund sizes, and acquisition history. With access to as many as 15 million companies worldwide, narrowing your search to realistic matches is critical.

Focus on roles such as "M&A Manager" or "Corporate Development" and align deal size preferences with your business value. For private equity firms, check their available capital (dry powder) and recent investments in your sector. For example, a PE firm accustomed to acquiring $1 billion companies likely won’t pursue a $100 million business – it simply doesn’t align with their focus.

AI-driven tools like Inven and Scend can refine your search by analyzing company websites and private equity portfolios, helping you identify niche buyers that traditional filters might miss. Once you’ve identified target firms, you can secure direct contacts through platforms like Zoominfo, Apollo.io, and Hunter.

While specialized M&A CRMs are available, many advisors prefer using structured spreadsheets to track critical details like buyer type, fund size, dry powder, EBITDA targets, geographic preferences, and acquisition history. Additionally, deal marketplaces like Axial and BizBuySell offer platforms where you can list your business to attract pre-qualified buyers and generate competitive interest.

Tap Into Professional Networks

While databases are powerful, personal connections often uncover buyers that algorithms miss. Industry trade associations are particularly helpful – leaders within these groups often know which members are actively seeking acquisitions. Sharing a "blind teaser" (a summary that excludes your company’s name and location) through these networks can help your opportunity reach decision-makers at key companies.

Professional advisors – such as accountants, lawyers, and consultants – can also leverage their industry connections to introduce you to potential buyers. Similarly, business brokers often maintain lists of buyers who were runner-ups in similar deals. Larger companies’ division managers can act as internal advocates for acquisitions that benefit their departments. Even retired executives may provide valuable referrals through their extensive networks, free from conflicts of interest. Lastly, suppliers, vendors, and indirect competitors you meet at trade shows might be interested in integration opportunities, whether vertical or horizontal.

Leverage Deal Memo‘s Buyer Universe Services

Deal Memo’s Buyer Universe Services simplifies the process of identifying and organizing potential buyers. With advanced filtering options, you can sort acquirers by revenue, EBITDA, enterprise value, and minimum check size. The platform also lets you refine results based on transaction type, whether you’re targeting Venture Capital, Growth Capital, Majority Recap, or Control Buyout.

When traditional industry codes fall short, Deal Memo’s keyword search feature can help find investors with similar portfolio companies. It also pinpoints key decision-makers, such as the private equity executive holding a board seat for a portfolio company similar to yours. As Dan Mahoney, CEO of TruSight, explains:

"The single best first contact is the executive who holds the board seat to a portfolio company most similar to your client’s company." – Dan Mahoney, CEO, TruSight

Deal Memo enables you to organize buyers into a three-tier system, helping you prioritize outreach while maintaining a comprehensive backup list. The platform delivers organized buyer lists within 72 hours, allowing you to act quickly. Confidentiality is preserved through blind teasers, which are only lifted after NDAs are signed. These tools streamline outreach and help you focus on the most relevant prospects.

Step 4: Research and Segment Buyers

After building your initial list of potential buyers, the next step is to refine your focus by aligning each prospect’s acquisition criteria with what your business offers. This involves digging deeper into buyer preferences and organizing them into targeted groups to make your outreach more efficient and effective.

Research Buyer Acquisition Criteria

Start by gathering detailed information about each buyer’s acquisition preferences. This includes interviewing the business owner to identify key competitors and any legacy concerns. From there, filter potential buyers based on factors like revenue, profit size, geography, NAICS codes, and their history with mergers and acquisitions (M&A).

Understanding a buyer’s financial capacity is crucial. For public companies, you can review their filings, while for private firms, consider their relationships with private equity (PE) groups. A helpful guideline is the 5x Rule – focus on corporate buyers with revenues at least five times larger than yours. Additionally, check their recent investments to confirm their financial strength and strategic alignment. For private equity firms, look into their activity within your sector to gauge their interest level.

It’s also important to review a buyer’s acquisition history. Look for patterns: Are they consistently acquiring businesses? What types of companies do they target? Have there been recent shifts in strategy or leadership that might indicate new priorities? As Derek van der Plaat, Managing Director at Veracap M&A International Inc., advises:

"The best way to find the company that will pay the most is to approach all possible buyers, talk to them and discuss the possible fit".

Once you’ve identified potential buyers, pinpoint the right contact person within each organization. For larger corporations, this might be someone in "M&A" or "Corporate Development." For smaller firms, reach out to the CEO, CFO, or COO. If this research feels overwhelming, you can hire freelance researchers on platforms like Upwork or Fiverr, often for around $1 per valid lead.

Create Buyer Segments by Fit Level

To streamline your efforts, organize your buyer list into three tiers based on how well they align with your business and their likelihood of being interested. Research from Axial in 2023 shows that a buyer list of 100 names typically results in 11 signed NDAs, while a list of 400 names yields 39. Interestingly, only 55% to 60% of deals are closed with buyers from the top-tier group, meaning 40% to 45% of deals are finalized with buyers outside that category.

| Tier | Fit Level | Description | Typical Buyer Types |

|---|---|---|---|

| Tier 1 | High-fit | Direct competitors or companies with closely related portfolio businesses; strong synergy and immediate interest | Direct competitors, "Quasi-strategic" PE sponsors |

| Tier 2 | Medium-fit | Companies active in your sector or those looking to expand their capabilities | Indirect competitors, industry specialists |

| Tier 3 | Exploratory | Buyers in adjacent markets or those considering diversification; less predictable but worth including | Adjacency players, non-traditional acquirers |

Tier 1 buyers should be your primary focus, receiving personalized outreach as they represent the best strategic fit. These include direct competitors or private equity firms with portfolio companies similar to yours. Tier 2 buyers are solid backup options; they are active in your industry but may not be as closely aligned. Meanwhile, Tier 3 buyers are more exploratory – companies in adjacent markets or looking to diversify. While less predictable, they can still present valuable opportunities.

sbb-itb-798d089

Step 5: Screen Buyers for Financial Capacity and Fit

After segmenting your potential buyers, the next step is to ensure they are financially capable and aligned strategically with your business. This process helps weed out buyers who lack the resources or compatibility to see the deal through.

Start with a gradual approach. Begin by having the buyer sign an NDA and provide a basic profile instead of sensitive documents like tax returns or bank statements. As their interest progresses – especially when they submit a Letter of Intent (LOI) – request more detailed financial documents, such as Personal Financial Statements (PFS), proof of funds, and bank statements.

"The major mistakes most entrepreneurs make during the early phases of a transaction are wasting energy on buyers who aren’t qualified and judging the attractiveness of an offer without first obtaining background information on the buyer." – Jacob Orosz, President, Morgan & Westfield

For buyers utilizing SBA 7(a) loans, ensure they can provide at least 15% as a down payment and have around $100,000 in liquidity post-closing. If dealing with private equity buyers, be cautious about claims of "pledged" capital; verify they also have "committed" capital.

"If they claim to have ‘pledged’ capital but won’t disclose their committed capital, they will likely be disqualified." – Jonah Pollone, MidStreet

To further vet potential buyers, review their acquisition history. This can reveal whether they have the financial expertise and experience needed to complete your transaction successfully.

Strategic fit is equally important. Ask questions about their plans for your business – will they retain your employees, preserve the brand, or relocate operations? Watch for warning signs like hesitance to sign an NDA, excessive negativity during initial discussions, or slow communication.

"If you have to chase a buyer or ‘push’ them through the sales process, it’s unlikely they will follow through to closing the sale." – Morgan & Westfield

Finally, conduct background checks. Verify their name, phone number, and email, and reach out to previous sellers they’ve worked with to learn about their approach to transition management. This extra diligence can save you months of wasted effort by focusing your time on buyers who are genuinely qualified and serious.

Step 6: Refine and Maintain the Buyer List

Keep Buyer Information Up-to-Date

Once you’ve segmented your buyer list, it’s important to keep it current. Markets shift, companies evolve, and buyer profiles change – so staying on top of these updates ensures your list remains relevant. Keep an eye on acquisition trends, leadership transitions, and strategic adjustments. For example, if a private equity firm reallocates its capital, they might no longer be a suitable candidate.

"The buyer list is an evolving document. While an advisor has tremendous resources and many relationships at his/her disposal, they will never identify all potential buyers before engaging in the process." – Derek van der Plaat, Managing Director, Veracap M&A International Inc.

To streamline your efforts, organize buyers into tiers. Tier 1 might include direct competitors with strong synergy potential, Tier 2 could focus on companies with an established presence in your sector, and Tier 3 may cover businesses in adjacent industries. If a buyer declines your deal, ask for feedback. Their reasons can uncover weaknesses in your approach or point you toward better-aligned prospects.

Leverage Deal Memo for Efficient List Management

While manual updates to your buyer list are crucial, technology can make the process smoother. Deal Memo’s tools are designed to keep your list accurate and help you discover new opportunities. With features like unlimited updates within 72 hours, you can quickly adjust your Confidential Information Memorandum (CIM) and outreach materials based on feedback from the market. The platform’s dedicated account team also assists in identifying new buyers as they emerge.

As you gather insights into buyer motivations and capabilities, tailor your outreach materials for each segment. Personalized messaging not only keeps your communications relevant but also helps avoid deal fatigue caused by generic or delayed responses. This constant fine-tuning ensures your buyer list stays sharp and ready to adapt to changing conditions.

Conclusion

Building a targeted buyer list is the backbone of a successful sale. It’s a step-by-step process: defining what makes your business valuable, identifying different types of buyers, sourcing prospects through industry databases and professional networks, digging into their acquisition criteria, ensuring they have the financial capacity, and constantly fine-tuning your list to adapt to market changes. Each step layers on the next, creating a well-rounded approach that increases your chances of landing the right buyer at the right price.

When done right, the results speak for themselves. For instance, a buyer list with 100 to 200 prospects typically leads to 30 to 40 meaningful conversations, which can result in 5 to 10 letters of intent. Interestingly, about 40% to 45% of the time, the final buyer isn’t even on the original "top-tier" list. This highlights the importance of casting a wide net and not limiting your options too early.

"The thing that has the highest impact on the success of a closed transaction is the strength of their buyer list." – Axial

Having the right tools can make this process much smoother. Platforms like Deal Memo offer features such as unlimited updates within 72 hours and support from a dedicated account team to help identify new buyers. CRM integration and secure data room features ensure you can manage the M&A process efficiently while maintaining confidentiality through blind listings and secure NDA distribution.

FAQs

How can I identify what makes my business stand out to attract the right buyers?

To bring in the right buyers, you need to start by identifying what makes your business stand out. Is it your specialized products or services, a strong and loyal customer base, proprietary technology, or some other edge over competitors? Pinpointing these strengths is key to showcasing what makes your business attractive.

After identifying these unique qualities, develop a clear buyer profile. Think about their background, financial resources, and strategic objectives, ensuring these align with the strengths your business offers. By emphasizing your business’s standout features in your marketing materials and outreach, you’ll attract buyers who genuinely see the value in what you’ve built, increasing your chances of a successful sale.

What are the best ways to find potential buyers for my business?

To find buyers for your business, start by tapping into your personal and professional networks. Reach out to industry contacts, competitors, suppliers, and trade associations – they can often point you toward potential buyers or provide useful insights.

You can also broaden your search using industry databases and online platforms. CRM tools and specialized databases can help you identify prospects based on their past investments and interests. Don’t overlook trade shows or industry events either; these gatherings are excellent for making direct connections with interested buyers.

If you’re looking for a more focused approach, consider partnering with an experienced M&A advisor. These professionals bring deep market expertise and a strong network to the table, helping you build a tailored list of potential buyers that align with your business’s strengths. By combining these strategies, you’ll increase your chances of finding the right buyer and achieving a successful sale.

How can I make sure potential buyers are financially qualified and a good fit for my business?

To identify buyers who are both financially prepared and a good match for your business, start by verifying their financial stability. This might involve requesting documents like proof of funds or financial statements to ensure they have the means to complete the purchase.

Once financial capacity is confirmed, take a closer look at their strategic fit. Learn about their goals, industry background, and how their vision aligns with what makes your business stand out. Conversations can reveal their motivations, while background checks help validate their commitment and suitability.

Screening buyers early helps you concentrate on those who are not only capable but also aligned with your business’s direction, paving the way for a smoother and more successful sale.