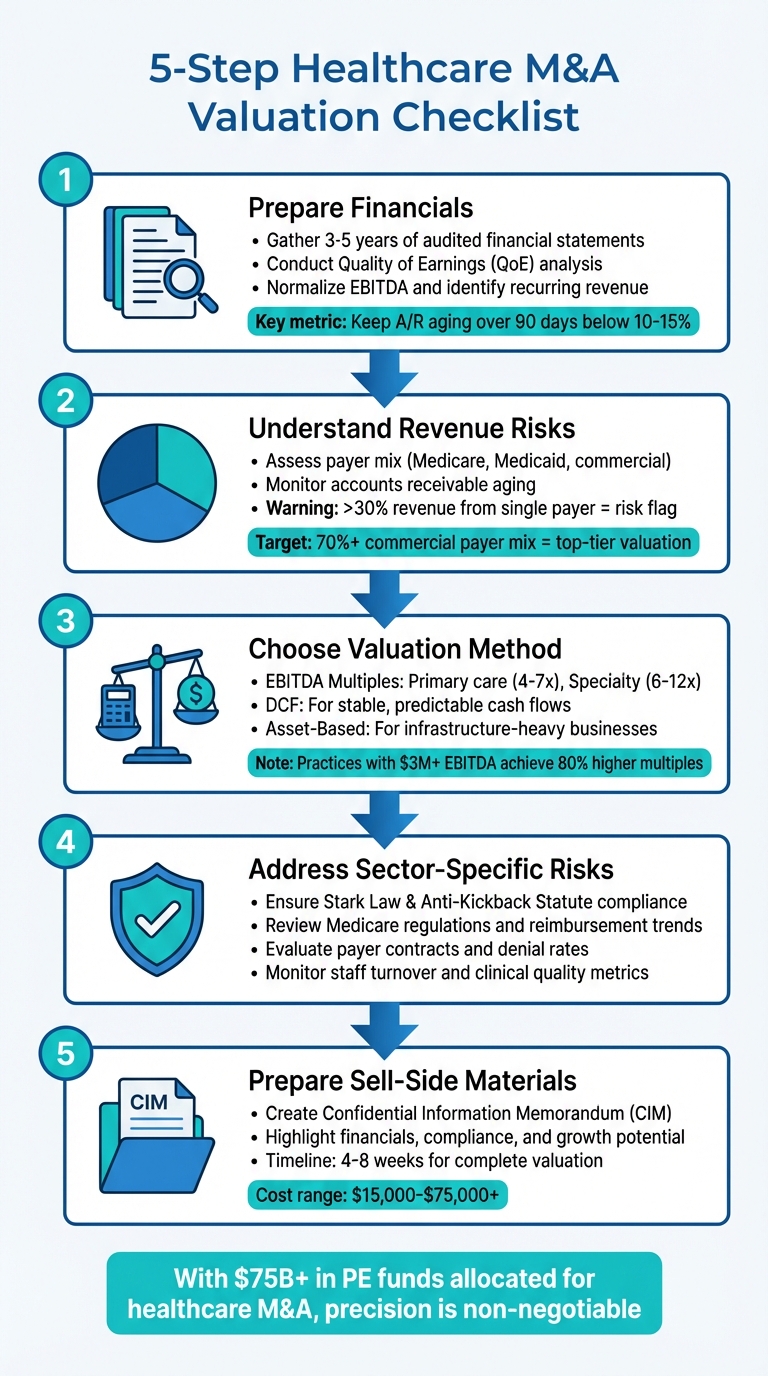

Valuing healthcare companies for mergers and acquisitions (M&A) is complex due to strict regulations, fluctuating reimbursement rates, and intangible assets. Mistakes can lead to financial losses or legal penalties. To avoid pitfalls, follow this structured checklist:

- Prepare Financials: Gather 3–5 years of audited financial statements, tax filings, payer mix data, and aging reports. Conduct a Quality of Earnings (QoE) analysis to normalize EBITDA and identify recurring revenue.

- Understand Revenue Risks: Assess payer mix – revenue heavily reliant on Medicare or Medicaid may pose risks. Monitor accounts receivable (A/R) aging; over 90 days should stay below 10–15%.

- Choose the Right Valuation Method: Use EBITDA multiples for practices, Discounted Cash Flow (DCF) for stable cash flows, or asset-based valuation for infrastructure-heavy businesses.

- Address Sector-Specific Risks: Ensure compliance with Stark Law, Anti-Kickback Statute, and Medicare regulations. Evaluate reimbursement trends, payer contracts, and operational metrics like denial rates and staff turnover.

- Prepare Sell-Side Materials: Create professional documents like Confidential Information Memorandums (CIMs) highlighting financials, compliance, and growth potential.

In healthcare M&A, precision is non-negotiable – buyers demand thorough due diligence and defensible valuations. Following this checklist ensures a smoother process and stronger deal outcomes.

5-Step Healthcare M&A Valuation Checklist

Finding the Optimal Valuation for Successful Capital Infusion and M&A Deals | LSI USA ’24

Financial Preparation Before Valuation

To accurately value a healthcare company, having clear, complete financials is non-negotiable. Buyers scrutinize every detail, and any gaps or inconsistencies could derail negotiations or lead to steep price cuts. Start by assembling key financial documents, conducting a Quality of Earnings (QoE) analysis, and examining your payer mix to ensure the valuation process is as precise as possible.

Collect Financial Documents

Begin by gathering audited or reviewed financial statements for the last 3–5 years, including income statements, balance sheets, and cash flow statements. Add year-to-date monthly statements, along with federal, state, and local tax returns for the same time frame. Don’t forget payroll tax filings as well.

Break down your revenue by payer type – Medicare, Medicaid, commercial insurance, or self-pay – and by provider or CPT code. Include detailed accounts receivable (A/R) aging reports, write-off histories, and collection agency reports. Keep in mind that A/R aging beyond 60 days is a major concern for healthcare buyers.

You’ll also need a schedule of outstanding debts, loans, and credit lines, as well as copies of all material contracts such as payer agreements, physician employment contracts, real estate leases, and key vendor agreements. Legal and corporate records – such as articles of incorporation, bylaws, operating agreements, and board meeting minutes – should also be included.

Once your financial documents are in order, the next step is verifying the quality of your earnings to ensure they’re sustainable under new ownership.

Conduct Quality of Earnings Analysis

A Quality of Earnings (QoE) analysis goes beyond standard audits. While audits confirm compliance with accounting standards, QoE focuses on whether your earnings can hold steady under new ownership. This analysis helps distinguish recurring expenses from one-time costs, which is crucial for accurate valuation adjustments.

A key part of QoE is EBITDA normalization. This involves identifying "add-backs" – expenses that won’t carry over after the sale. Examples include personal perks like car leases, inflated family salaries, or one-time costs like legal settlements or major software upgrades. Each add-back must be well-documented since buyers will challenge anything that seems dubious.

Switching from cash to accrual accounting can also uncover hidden liabilities and provide a clearer picture of revenue trends. Additionally, "back testing" can reveal operational weaknesses by comparing reported revenue against actual cash collected by service date, helping to flag missed revenue or aging receivables.

Conducting your own QoE analysis before entering the market allows you to address potential red flags proactively. This can prevent buyers from using these issues to negotiate a lower price during due diligence.

Analyze Payer Mix and Accounts Receivable

Understanding your payer mix is vital for assessing revenue stability and potential risks. If more than 30% of your revenue comes from a single payer, it could be seen as a risk factor by buyers. Commercial insurance typically offers better reimbursement rates and stability, while Medicaid can be less predictable. Self-pay revenue, particularly with the rise of high-deductible health plans, carries the highest risk of bad debt.

Thoroughly review A/R aging reports. Healthy practices generally keep accounts receivable aged over 90 days below 10–15%. High denial rates or frequent write-offs can signal revenue cycle management issues, which will concern buyers. These factors directly impact valuation, as healthcare companies are often valued based on a multiple of EBITDA. For example, with a 10x EBITDA multiple, a 2% revenue variance – $100,000 on $5 million in revenue – could cause a 20% EBITDA drop, reducing the deal price by $1 million.

For revenue verification, the "cash waterfall" method is now widely regarded as the gold standard. This approach ties payments back to their original service dates, offering a much clearer view than cash-basis accounting. It also helps establish a "net working capital peg", which sets a target for working capital at closing. If actual working capital falls short, the shortfall is deducted from the seller’s proceeds on a dollar-for-dollar basis.

"The Quality of Revenue (QofR) analysis may be the most important part of the FDD process when it comes to healthcare-related transactions, given the unique characteristics and nuances of healthcare revenue." – Grayson Terrell, Manager, Transaction Advisory & Financial Due Diligence, VMG Health

Choosing the Right Valuation Methods

Once you’ve verified your financials and revenue, the next step is selecting a valuation method that aligns with your business model. For healthcare companies, this means choosing an approach that accounts for their unique asset base and regulatory requirements. Commonly used methods include EBITDA multiples, Discounted Cash Flow (DCF), and Asset-Based Valuation. Each method serves different types of healthcare operations, so let’s break them down.

EBITDA Multiples Analysis

EBITDA multiples provide a market-focused way to determine value. For instance, primary care practices generally trade at 4–7x EBITDA, while specialty practices often see higher multiples, ranging from 6–12x EBITDA. Your specific multiple will depend on factors like your subsector, practice size, and revenue quality.

Larger practices with EBITDA exceeding $5 million tend to secure multiples 2–4 times higher than smaller ones. Private equity firms, for example, typically look for a minimum EBITDA of $3 million to $5 million to consider a healthcare business a "platform" investment. Practices with EBITDA above $3 million can achieve up to 80% higher multiples compared to those with EBITDA under $1 million.

Another critical factor is your payer mix. A commercial payer mix over 70% is highly desirable and often results in top-tier valuations, while heavy reliance on Medicaid can lead to discounts. Ancillary revenues – such as those from Ambulatory Surgery Centers (ASCs), imaging services, or pathology labs – can add 1–3 turns to your EBITDA multiple.

| Healthcare Subsector | Typical EBITDA Multiple Range | Key Value Drivers |

|---|---|---|

| Primary Care | 4x – 7x | Patient volume, location, payer mix |

| Specialty Practices | 6x – 12x | Specialized expertise, referral networks |

| ASCs | 6x – 9x (Estimated) | Case volume, outmigration trends |

| Home Health/Hospice | Variable | Caregiver retention, Medicare cap management |

Recent trends show strategic buyers paying significant premiums for vertical integration opportunities. For example, Cencora acquired Retina Consultants of America for $4.6 billion, and Cardinal Health purchased GI Alliance for $2.8 billion – both deals driven by supply chain synergies. Strategic buyers often pay 20–40% more than financial buyers when vertical integration benefits are clear.

Discounted Cash Flow (DCF)

DCF is a forward-looking valuation method that works well for healthcare businesses with stable and predictable cash flows, such as health-tech companies, medical device firms, or established practices with recurring revenue. This approach estimates future cash flow potential and discounts it to present value.

However, applying DCF in healthcare requires careful adjustments for industry-specific risks. For instance, the 2024 Medicare Physician Fee Schedule includes a 3.4% cut to physician payment rates, directly affecting revenue projections. When building a DCF model, it’s essential to normalize earnings to exclude one-time factors like COVID-19 impacts or temporary reimbursement spikes. Buyers are likely to scrutinize any overly optimistic forecasts.

"Historically, valuators gave significant weight to the present value of discounted cash flow however this method is too hypothetical… The changes in healthcare are so dynamic that it is too difficult to predict income with anything but a very general price range." – Bruce Krider, American Healthcare Appraisal

Because of its speculative nature, DCF is rarely used as a standalone method in healthcare M&A. Instead, it’s often combined with EBITDA multiples or asset-based valuation to provide a fuller picture.

Asset-Based Valuation

For operations heavily reliant on physical infrastructure – like imaging centers, surgery centers, hospitals, or skilled nursing facilities – an asset-based approach is often the most appropriate. This method focuses on the value of tangible assets rather than future earnings. It’s also essential for compliance with federal laws like the Stark Law and Anti-Kickback Statute, ensuring that purchase prices don’t include the value of future referrals.

"The asset approach has emerged as the valuation method that complies with federal laws when there is an ongoing referral relationship between the parties." – CBIZ

This method calculates the fair market value of individual assets. For example, an MRI machine purchased a decade ago for $800,000 might have a book value of $0 due to depreciation, but its fair market value could still be $200,000 – requiring an adjustment to reflect its true worth in a transaction.

Don’t forget intangible assets. In healthcare M&A, the value of an "assembled workforce" is often recognized. This refers to the cost savings associated with recruiting and training replacements, which can add significant value even if it’s not listed on the balance sheet.

Asset-based valuation is also ideal for distressed businesses, facilities being repurposed, or companies that are no longer viable as ongoing concerns. If your operation’s value lies more in its physical assets than its business performance, this method will likely yield the most accurate results.

sbb-itb-798d089

Healthcare-Specific Risk Adjustments

When valuing a healthcare business, it’s crucial to account for risks unique to the sector. While financial preparation is essential, addressing these specific risks can refine your valuation and help avoid unexpected challenges during negotiations. Buyers typically focus on regulatory compliance, payer relationships, and operational performance to identify potential vulnerabilities. Tackling these issues early and aligning them with your valuation approach ensures a more complete and reliable appraisal.

Regulatory and Compliance Risks

After selecting a valuation method, regulatory compliance can become a major hurdle. Buyers will thoroughly examine your adherence to federal fraud and abuse laws, including the Anti-Kickback Statute (AKS) and Stark Law. Violations of these laws can lead to significant financial penalties – some hospitals have faced settlements exceeding $30 million for Stark Law violations. Even worse, if a compliance issue is uncovered during due diligence, you may be required to self-report it to the government, which could jeopardize the entire transaction.

"If a material compliance issue is uncovered in diligence, the target may be required to self-disclose the violation to the government – which can be fatal to a transaction." – Healthcare Law Insights

Buyers will also scrutinize whether physician compensation, medical directorships, and lease agreements adhere to fair market value (FMV), supported by independent third-party valuations. They’ll check that no employees or contractors are listed on the OIG’s exclusion database, as hiring excluded individuals can result in penalties and repayment of funds. In states with Corporate Practice of Medicine (CPOM) restrictions, transactions might require a "friendly PC" model, where a physician owns the professional corporation and enters into a management agreement with the buyer. Additionally, deals may trigger Change of Ownership (CHOW) requirements for Medicare and state licenses, which often require 30 days’ notice to avoid fines or payment delays.

Antitrust concerns are also on the rise. In 2024, the U.S. Department of Justice blocked UnitedHealth Group’s $3.3 billion bid for Amedisys, signaling stricter scrutiny of large healthcare mergers. Similarly, in 2014, St. Luke’s Health System was ordered to unwind its acquisition of Saltzer Medical Group after a court ruled the deal violated antitrust laws by creating a dominant market position. Transactions valued at over $75 million generally require Hart-Scott-Rodino Act pre-merger notification.

Payer and Reimbursement Risks

Payer relationships and reimbursement structures play a critical role in buyer evaluations. Heavy reliance on a single payer – whether government or commercial – can create significant risks. If that payer changes contract terms or ends the relationship, it can severely impact the business’s value. For example, Medicare’s 2024 Physician Fee Schedule introduced a 3.4% cut to physician payment rates, affecting revenue forecasts for many clinics.

Buyers will closely examine revenue by CPT code, provider, and payer to uncover any hidden risks, such as overdependence on one payer or unprofitable service lines. High denial rates, lengthy appeals, and increased accounts receivable (A/R) days often signal operational weaknesses. To prepare, review 12–24 months of denial and A/R data to identify and address any issues. Be ready for buyers to challenge "adjusted EBITDA" calculations, especially if they mask rising operational costs like labor or fuel.

Clinical Quality and Operational Metrics

Clinical performance and operational efficiency are increasingly critical in healthcare valuations. Metrics like readmission rates provide insight into the quality of care and procedural accuracy. Buyers also assess Medicare Star Ratings, patient satisfaction scores (HCAHPS), and accreditation status with organizations like The Joint Commission. Poor documentation, which can lead to reimbursement clawbacks or penalties, is another area of focus.

Operationally, workforce stability is a key consideration. High turnover among physicians, nurses, or administrative staff can diminish the value of your team’s expertise. Technology is another focal point. Buyers will evaluate your use of Electronic Health Records (EHR), AI diagnostic tools, and automated billing systems, along with your cybersecurity measures. In 2024, ransomware attacks on healthcare providers compromised the records of 25.6 million patients. A history of data breaches or outdated IT systems can be seen as liabilities, potentially leading to price adjustments or indemnity requirements during negotiations.

"New entrants should take steps to ensure that they and any business partners possess a solid understanding of the Federal fraud and abuse laws… and that they possess an understanding of the critical role an effective compliance program plays in preventing, detecting, and addressing potential violations." – Office of Inspector General (OIG)

Taking proactive steps – like conducting a compliance review, strengthening revenue cycle management, and improving clinical metrics – before entering negotiations can significantly reduce risk and enhance your valuation. This preparation ensures that your business is in the best possible position when buyers begin their evaluation.

Final Valuation Review and Presentation

When wrapping up your valuation, it’s important to double-check your numbers, evaluate your assumptions, and prepare professional sell-side documents for potential buyers. This final step builds on earlier financial and risk assessments, ensuring your valuation can hold up under scrutiny and present your company in the best light during negotiations.

Cross-Check Valuation Results

Relying on just one valuation method can leave you vulnerable to blind spots. Instead, compare outcomes from the Market Approach (using comparable transactions), Income Approach (Discounted Cash Flow analysis), and Asset Approach to identify any inconsistencies. If discrepancies arise, dig deeper to uncover the root causes.

In healthcare valuations, it’s common to find significant differences between book value and fair market value. For instance, an MRI machine might have a $0 book value due to depreciation, but its fair market value could be much higher. Similarly, intangible assets like brand equity, patient data analytics, or workforce expertise often require separate valuation. Stress tests can help confirm your valuation’s strength under realistic scenarios. For example, check if Free Cash Flow (FCF) aligns with EBITDA. If FCF conversion is weak despite high EBITDA, this could signal heavy capital expenditures or working capital needs.

"Bankers apply copious makeup to companies… it’s up to you to go beneath the dress and see what it looks like without the makeup and the plastic surgery."

– Brian DeChesare, Founder, Mergers & Inquisitions

It’s also critical to ensure your valuation complies with Stark Law and the Anti-Kickback Statute (AKS), which require transactions to reflect fair market value without factoring in potential referrals. To ensure consistency, verify that all valuation methods point toward a similar outcome.

Test Valuation Assumptions

Even a well-constructed valuation can falter when market conditions shift. Use sensitivity analyses to evaluate how changes in key metrics like EBITDA, multiples, or reimbursement rates might impact your numbers. For example, recent adjustments to physician payment rates have directly affected revenue projections for many clinics.

Take a close look at adjusted EBITDA and recurring revenue, as buyers often challenge overly optimistic projections. Confirm that historical data accurately reflects costs such as hospital overhead, rent, and management fees that might change after the transaction. Also, benchmark your multiples against specific practice types – primary care practices often trade at 4–7x EBITDA, while specialty practices can command 6–12x EBITDA.

"The projections should be based on how the entity can perform without the buyer. If [buyer-specific synergies are considered], the value is likely strategic and not FMV."

– Karen Kole, Senior Manager, ECG Management Consultants

Run a "buy-side skim test" by reviewing your financials to ensure the math holds up under target internal rates of return (IRR) and leverage assumptions. Be prepared for U.S. GAAP revaluations at closing, which can lead to adjustments like deferred revenue write-downs or changes to gross margins. Earnouts are increasingly common – featured in 33% of deals in 2023 compared to 20% in 2021 – and can help bridge valuation gaps when assumptions differ.

Once your assumptions have been thoroughly tested, consolidate your findings into professional, compliant sell-side documents.

Create Professional Sell-Side Materials

Your Confidential Information Memorandum (CIM) or Offering Memorandum (OM) is the cornerstone of your presentation to buyers. These documents should emphasize key investment highlights – such as growth potential, competitive positioning, and operational stability – while showcasing your management team to underscore reliability. In healthcare, it’s essential to include documentation of compliance with regulations like Stark Law, AKS, and HIPAA, as well as an evaluation of intangible assets like proprietary technology or patient data analytics.

Typically, CIMs range from 50 to 150 pages and don’t include an asking price. Instead, they provide the data buyers need to make their own offers. A shorter teaser document (5–10 pages) can be used to gauge initial interest before sharing the full CIM under a non-disclosure agreement (NDA). These materials should present the company favorably by highlighting "Adjusted EBITDA" and value drivers like patient outcomes and cost-efficiency, while steering clear of any misrepresentation.

Deal Memo offers specialized CIM and OM writing services for brokers, M&A firms, and investment banks. Their white-labeled packages include unlimited revisions and delivery within 72 hours, ensuring your sell-side materials are polished, accurate, and ready for buyer review.

Stay vigilant for potential blind spots by regularly updating your materials to reflect regulatory changes, such as shifts in Medicare Physician Fee Schedules. As buyers become more selective, sellers must adopt realistic valuation strategies to stay competitive. A well-prepared CIM or OM not only simplifies the due diligence process but also positions your company as a credible and attractive investment opportunity.

Conclusion

This checklist simplifies the intricate process of healthcare M&A valuations by pulling together essential financial, regulatory, and operational factors. With over $75 billion in private equity funds currently allocated for healthcare acquisitions, buyers are demanding thorough due diligence and defensible valuations. A structured checklist ensures that critical regulatory requirements – like Stark Law and the Anti-Kickback Statute – along with changing transaction terms, are carefully addressed.

Recent developments, such as the DOJ blocking a $3.3 billion deal and a 3.4% Medicare cut, highlight how quickly regulatory shifts can impact valuations. By using a checklist, these changes can be accounted for, helping to normalize earnings and reveal the true operational potential of a business.

"Simply having an opinion letter that states the purchase price is within FMV does not necessarily mean the purchase truly is FMV; rather, it means one expert thinks it is."

– Karen Kole, Senior Manager, ECG Management Consultants

This underscores the importance of bringing in expert advisors early in the process. Professional advisors can enhance both efficiency and accuracy. On average, healthcare valuations take 4–8 weeks to complete and cost between $15,000 and $75,000+. These professionals go beyond the numbers, identifying intangible assets like proprietary technology, patient data analytics, and brand equity – factors that often drive long-term value beyond what’s visible on the balance sheet. They also conduct independent Fair Market Value assessments, offering regulatory safeguards and strengthening your negotiating position through transparent, data-backed analysis.

Deal Memo specializes in crafting white-labeled Confidential Information Memorandums (CIMs) and Offering Memorandums (OMs) for brokers, M&A firms, and investment banking teams. They deliver customized, sell-side materials within 72 hours and offer unlimited revisions. Engaging advisors like Deal Memo early – ideally 12 to 18 months before a planned exit – can help address potential challenges, such as litigation or cybersecurity risks, optimize tax strategies, and enhance investment credibility. With earnouts now featured in 33% of deals (up from 20% in 2021), finalizing your checklist and working with experienced advisors ensures a stronger negotiating position and better deal outcomes.

FAQs

What financial documents are essential for valuing a healthcare company during an M&A deal?

To properly assess the value of a healthcare company in an M&A transaction, you’ll need to gather key financial documents. These include the profit and loss statements, balance sheets, and cash flow statements – all of which offer insight into the company’s financial performance. Beyond these, financial forecasts and other relevant data play a crucial role in evaluating potential profitability and identifying risks.

Having these documents ensures you can thoroughly examine the company’s financial health, laying the groundwork for informed decisions throughout the deal-making process.

How do regulatory risks affect the valuation of healthcare companies in M&A deals?

Regulatory risks are a major factor in determining the value of healthcare companies during M&A transactions. Laws like Stark, Anti-Kickback, and HIPAA demand strict compliance, as violations can lead to hefty fines, legal troubles, or even operational constraints – all of which can significantly lower a company’s valuation. During due diligence, these risks are thoroughly examined to ensure the company’s worth isn’t overestimated.

Regulatory changes or uncertainties can also disrupt future cash flows, especially for businesses involved in R&D, licensing, or reimbursement-based models. Companies with a proven track record of compliance often stand out to buyers and investors, as they offer a sense of stability and reduce the risk of unforeseen liabilities. Meeting regulatory requirements isn’t just about staying on the right side of the law; it plays a crucial role in shaping a company’s appeal and value in M&A negotiations.

What are the best valuation methods for different types of healthcare businesses?

Valuing healthcare businesses involves selecting methods that suit the specific type of operation and its unique features. For medical practices, the income approach is often a strong choice. This method focuses on future earnings and cash flow, making it particularly useful when revenue is steady and predictable. On the other hand, businesses with significant intangible assets, like patient relationships or proprietary technology, might benefit more from the market approach, which compares similar recent transactions to determine value.

When it comes to hospitals, a mix of the income and market approaches is typically applied. The choice often depends on factors like operational stability and long-term strategic goals. For specialty healthcare entities, such as outpatient clinics or diagnostic centers, the asset approach might be the best fit. This is especially true if their value is heavily tied to tangible assets or specific technologies.

The ultimate decision on which valuation method to use depends on several factors, including the type of healthcare operation, the makeup of its assets, how consistent its revenue is, and the purpose of the valuation – whether it’s for mergers, acquisitions, or regulatory compliance.