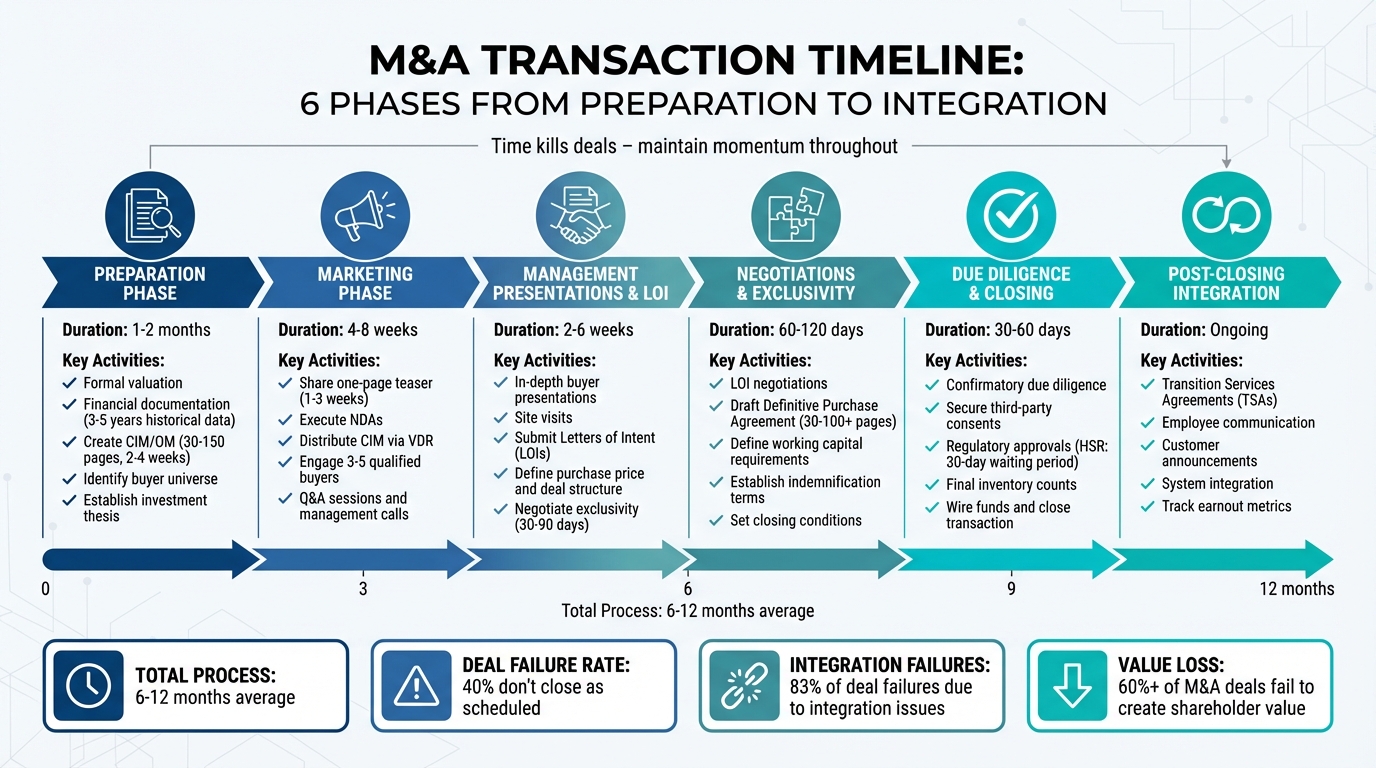

M&A deals are complex and typically take 6–12 months to complete. The process involves multiple phases, from preparation to post-closing integration, each with specific tasks and timelines. Here’s a quick breakdown:

- Preparation Phase (1–2 months): Focus on valuation, financial documentation, and creating a Confidential Information Memorandum (CIM).

- Marketing Phase (4–8 weeks): Share CIM with potential buyers and manage NDAs to gauge interest.

- Management Presentations & LOI Phase: Buyers submit Letters of Intent (LOIs) with key terms like price and exclusivity.

- Negotiations & Exclusivity (60–120 days): Finalize terms and draft the Definitive Purchase Agreement (DPA).

- Due Diligence & Closing (30–60 days): Verify details, secure third-party consents, and prepare for closing.

- Post-Closing Integration: Transition services, employee communication, and operational readiness are key to success.

Each phase requires careful planning to avoid delays, loss of value, or deal failure. Preparation and organization are critical to maintaining momentum and trust throughout the process.

M&A Transaction Timeline: 6 Phases from Preparation to Integration

The Deal Timeline and Process

Preparation Phase: Getting Ready for the Transaction

The preparation phase, which usually spans 1 to 2 months, sets the stage for the entire transaction process. During this time, sellers collaborate with M&A advisors to conduct a formal valuation, evaluate the business’s readiness for sale, and measure it against the current market landscape. Careful preparation during this stage is key to keeping the deal on track.

Setting Strategy and Goals

Before reaching out to potential buyers, sellers need to establish a clear investment thesis – essentially, a concise explanation of what makes the company an appealing acquisition. This step involves highlighting the business’s sustainable competitive advantages, often referred to as its "economic moat". Advisors also play a crucial role in identifying potential deal-breakers, such as high customer concentration or unresolved legal issues, and crafting strategies to address these challenges proactively.

Once the strategic objectives are in place, the focus shifts to ensuring financial transparency and readiness.

Financial Preparation and Documentation

Sellers should prepare 3–5 years of historical financial data. However, raw financial figures alone don’t always tell the full story. To present the business’s true earning potential, sellers should prepare normalized financial statements, such as an Adjusted EBITDA or Seller’s Discretionary Earnings (SDE) schedule. Commissioning a sell-side Quality of Earnings (QoE) report can further validate these numbers and help preempt buyer concerns.

Consistency is critical – monthly financials should align with bank statements to avoid any discrepancies that could undermine buyer confidence. Additionally, organizing a well-structured data room can significantly speed up the process, shaving weeks off the timeline.

After the financials are in order, attention turns to creating a compelling marketing document.

CIM/OM Creation and Buyer Universe Identification

The Confidential Information Memorandum (CIM), or Offering Memorandum (OM), serves as the primary marketing tool to attract interest from qualified buyers. In the lower-middle market, a typical CIM ranges from 30 to 60 pages, while more complex middle-market transactions may require 80 to 150 pages. Preparing a high-quality CIM takes about 2–4 weeks. This document should include key metrics – such as a "90%+ customer retention rate over 5 years" – and address any potential weaknesses, along with strategies to mitigate them. A well-prepared CIM not only engages buyers but also helps maintain momentum throughout the deal process.

"The CIM is the single most important piece of marketing in the sale process, acting as the bridge between a buyer’s initial curiosity and their decision to submit a Letter of Intent (LOI)."

– Doreen Morgan, Sunbelt Atlanta

At the same time, advisors work on building a buyer universe that includes both strategic and financial buyers. A notable example is Google’s $12.5 billion acquisition of Motorola Mobility in August 2011, which involved using a CIM to evaluate sensitive financial data under a non-disclosure agreement.

For added efficiency, services like Deal Memo offer white-labeled CIM/OM creation and buyer universe identification. Their initial drafts are delivered within 72 hours, enabling M&A firms and investment banking teams to move through this critical phase quickly without sacrificing quality.

Marketing Phase: Reaching Potential Buyers

Once the CIM is ready, the marketing phase begins, lasting about 4 to 8 weeks. During this time, advisors reach out to a carefully selected group of potential buyers, typically engaging 3–5 qualified parties simultaneously. This approach creates competitive tension and keeps the process on track, even if one buyer drops out. The goal here is to generate focused interest and set the stage for formal offers.

Sharing the CIM and Managing NDAs

The process starts with a one-page teaser that highlights the opportunity while keeping the company’s identity confidential. This teaser, shared over 1 to 3 weeks, helps gauge genuine interest before sensitive information is disclosed.

Once a buyer expresses interest, they must sign a Non-Disclosure Agreement (NDA) to receive the full CIM. A well-drafted NDA should clearly state its purpose – evaluating the transaction – and include provisions for non-use, authorization by a company officer, and accountability for any shared information. It should also allow advisors to access the data under strict confidentiality.

After the NDA is signed, the full CIM is shared through a Virtual Data Room (VDR). This secure online platform organizes key documents, tracks access, and monitors which files buyers view. Preparing the VDR ahead of time is crucial – delays in access can give the impression of poor organization.

"Slow responses signal either disorganization or something to hide – both kill momentum."

– Livmo

Buyer Outreach and Early Offers

Once buyers review the CIM, they may request Q&A sessions or management calls to better understand the business model and its growth potential. Maintaining strong performance during this phase is critical, as any decline in metrics could lower buyer interest and reduce valuation.

After initial discussions, interested buyers submit non-binding Indications of Interest (IOIs). These offers outline valuation ranges and potential deal structures, helping sellers narrow the field to 2 to 4 top candidates before entering deeper negotiations. The timeline from NDA execution to receiving Letters of Intent (LOIs) typically spans 2 to 6 weeks. Without expert guidance, first-time founders risk leaving 20% to 30% of the deal’s value untapped.

For public companies, NDAs should also include standstill and anti-clubbing provisions to maintain control over the process and maximize the sale price.

Management Presentations and LOI Phase

After the initial buyer outreach during the marketing phase, the process shifts to more focused steps: in-depth management presentations and the submission of Letters of Intent (LOIs). At this stage, a shortlist of top candidates is invited to participate in detailed meetings, often held in person. These sessions, which may also include site visits, allow buyers to evaluate the company’s leadership and overall fit while gaining a deeper understanding of its growth potential – beyond what’s outlined in the Confidential Information Memorandum (CIM).

Buyer Meetings and Presentations

These presentations are designed to build on the CIM, emphasizing the company’s investment appeal. They typically cover the business model, competitive strengths, and specific growth opportunities. Sellers must come prepared to justify their Adjusted EBITDA with clear, itemized reconciliations for any add-backs, as transparency in financials is key to maintaining buyer confidence.

It’s also essential to address potential concerns upfront. Issues like customer concentration or pending litigation should be accompanied by well-thought-out mitigation plans. Buyers expect concrete, actionable growth strategies – such as plans for market expansion or detailed headcount increases – rather than vague or overly optimistic projections.

Stable performance during this phase is critical. A drop in revenue or a noticeable increase in customer churn can alarm buyers, leading them to either walk away or revise their offers. Additionally, having a well-organized Virtual Data Room (VDR) is crucial. This allows sellers to respond quickly – often within the same day – to follow-up requests, showcasing professionalism and a commitment to transparency.

These presentations set the stage for the next step: the formal LOI phase, where buyers outline their intentions in writing.

LOI Submission and Key Terms

Once the presentations are complete, interested buyers submit Letters of Intent (LOIs). These documents summarize the key terms of the proposed transaction before the buyer commits to full due diligence. While many LOI terms – such as the purchase price and deal structure – are non-binding, some provisions, like exclusivity, confidentiality, and expense allocation, are binding.

A standard LOI typically includes the following elements:

- Purchase price and deal structure (e.g., asset purchase versus stock purchase).

- Working capital requirements and earnout provisions tied to future performance.

- Closing conditions, such as obtaining regulatory approvals.

Exclusivity periods, which often last 30 to 90 days, prevent the seller from negotiating with other buyers during this time. This provision can shift leverage toward the buyer.

"The LOI is the most significant agreement in an M&A transaction, even eclipsing the importance of the purchase agreement."

– Jacob Orosz, President, Morgan & Westfield

Sellers hold the most leverage before signing the LOI, making this the ideal time to negotiate critical terms. Items like working capital calculations, escrow amounts, and employment agreements should be addressed early rather than postponed. If a buyer proposes a price range (e.g., $8M–$10M), sellers should push for a fixed number, as buyers often aim for the lower end during final negotiations. Additionally, limiting the exclusivity period and setting milestones can help ensure that negotiations proceed in good faith.

sbb-itb-798d089

Negotiations and Exclusivity Phase

Once the LOI is signed, the buyer gains a significant edge in negotiations. The exclusivity clause, often lasting 60 to 120 days, ensures the seller cannot engage with other potential buyers during this period. This "no-shop" provision safeguards the buyer’s investment in due diligence, which typically costs between $50,000 and $200,000.

"The moment you sign an LOI that contains such an exclusivity clause, your negotiating position disintegrates."

– Jacob Orosz, President, Morgan & Westfield

Sellers should aim to limit the exclusivity period to 60 to 90 days and include exit clauses that allow them to terminate if the buyer misses milestones or tries to alter key deal terms.

LOI Negotiations and Exclusivity Agreements

After signing the LOI, sellers must ensure that critical terms are clearly defined, as these will form the foundation of the definitive purchase agreement. Ambiguities in the LOI can lead to buyers attempting to renegotiate terms later. For instance, specifying the working capital target and how it will be calculated can prevent disputes over "price chipping" during final negotiations.

Indemnification terms – such as caps, baskets, and survival periods – should also be outlined early to avoid last-minute disagreements. Sellers should push back against buyers who demand "sole discretion" to terminate agreements, instead requiring that any due diligence concerns be both "material" and "reasonable". Spending $2,000 to $5,000 for an attorney to review the LOI before signing can help sellers avoid months of wasted effort or unfavorable terms.

By confirming these terms upfront, both parties set the stage for drafting the Definitive Purchase Agreement.

Drafting the Definitive Purchase Agreement

After the LOI, the buyer takes the lead in drafting the Definitive Purchase Agreement (DPA), which typically spans 30–100+ pages and formalizes the transfer of ownership. This phase generally lasts 60 to 120 days from the signing of the LOI to closing. Key sections include Representations and Warranties (20 to 30 pages) and Indemnification (10 to 15 pages), which allocate risks between the buyer and seller.

The buyer’s initial draft often serves as a tool to elicit detailed disclosures from the seller. For example, a representation stating that "all equipment is in good working order" shifts the responsibility for any undisclosed issues to the seller. The DPA also includes covenants that outline each party’s obligations from signing to closing. One critical "negative covenant" prevents the seller from making major changes – such as hiring staff or purchasing equipment – without the buyer’s consent.

Certain conditions must be met before closing, such as verifying the accuracy of representations, obtaining third-party consents, and ensuring no Material Adverse Change (MAC) has occurred. MAC clauses, which hold sellers accountable for significant downturns, should be carefully narrowed to exclude general economic conditions and include specific thresholds, like a revenue decline exceeding 20%. Addressing these details early helps keep the transaction on track.

"Time kills all deals. Either you waste it bickering over minutiae, or you aim to close, balancing the need for documentation and good faith."

– Jacob Orosz, President, Morgan & Westfield

Starting with a balanced draft – rather than one heavily favoring the buyer – can streamline negotiations and reduce friction. Referencing resources like the American Bar Association (ABA) Deal Points Studies can provide insight into standard terms for similar transactions. Additionally, responding quickly to document requests and revisions is crucial, as delays can signal disorganization or hidden issues that may jeopardize the deal.

Due Diligence and Closing Phase

Confirmatory Due Diligence and Approvals

After the Letter of Intent (LOI) is signed, the buyer enters the confirmatory due diligence phase, typically lasting 30 to 60 days. During this time, buyers carefully verify the business’s condition and confirm that all representations made by the seller are accurate. Meanwhile, sellers finalize disclosure schedules, which highlight any exceptions, such as leased equipment, pending litigation, or outstanding liens.

Securing third-party consents is another critical part of this phase. These include approvals from landlords for lease assignments or from major customers and vendors for change-of-control provisions in their contracts. These consents are usually required 30–60 days before closing. Additionally, buyers often conduct final inventory counts and inspect equipment just before closing to make any necessary adjustments to the purchase price.

For larger transactions, the Hart-Scott-Rodino (HSR) Act requires premerger notifications to the FTC and DOJ. This process includes a mandatory 30-day waiting period, which can be shortened to 15 days for all-cash tender offers. However, if regulators request additional information (a "Second Request"), the waiting period extends until compliance is achieved and further review is completed. Transactions involving foreign investment may also require a review by the Committee on Foreign Investment in the United States (CFIUS) to address national security concerns.

"More deals fall apart in M&A closing process than at any other point."

– Joe Anto, Managing Director, PCE Companies

Statistics show that about 40% of M&A deals fail to close as scheduled, with nearly two-thirds experiencing delays of three months or more. Regulatory challenges can add even more time – transactions flagged for anti-competitive concerns often face delays averaging 12 months. To mitigate these risks, sellers should secure tax clearances (e.g., payroll and sales tax) and ensure all loans and liens are resolved before the closing process begins.

Once due diligence is complete and all approvals are secured, the focus shifts to final negotiations and preparing for closing.

Final Negotiations and Closing Activities

After confirmatory due diligence, the final stretch involves intense preparation for closing. Both parties work on finalizing documents and coordinating funds during these last weeks. Buyers often establish any necessary legal entities and obtain an Employer Identification Number (EIN) before the closing date, while sellers prepare a detailed closing statement outlining all debits and credits. Increasingly, M&A closings are conducted virtually, with documents signed electronically and held by an escrow agent pending confirmation of the wire transfer.

Conducting a "dry run" with an M&A advisor can help identify potential issues ahead of time, such as missing signatures, incorrect wire account details, or title discrepancies. Buyers usually wire funds to escrow at least three business days before the scheduled closing. During this period, sellers are advised to maintain regular business operations, including payroll and inventory management, while avoiding significant capital expenditures or key hires without the buyer’s approval. This helps prevent triggering Material Adverse Change (MAC) clauses, which could jeopardize the deal.

"Trust is the glue that holds the deal together until closing and you must do everything you can to build and maintain it."

– Jacob Orosz, President, Morgan & Westfield

Timing the closing for the last day of the month, ideally during morning business hours, can simplify the balance sheet and ensure banks are open for wire transfers. Once all conditions – such as regulatory approvals, third-party consents, and the absence of material adverse changes – are met, the escrow agent releases the funds, and the transaction is officially completed.

"The closing is – or should be – an anticlimactic event nearly every time."

– Jacob Orosz, President, Morgan & Westfield

Post-Closing Integration Phase

Transition Services and Integration

Once the deal closes, the priority shifts from finalizing the transaction to making the integration process as smooth and effective as possible. This phase is crucial – studies show that integration challenges are responsible for 83% of deal failures. To avoid becoming part of that statistic, businesses must act quickly on key tasks like communicating with employees, announcing changes to customers, and ensuring day-to-day operations remain uninterrupted.

Transition Services Agreements (TSAs) play a pivotal role during this period. These agreements allow the seller to temporarily provide critical services – such as IT hosting, payroll, or accounting – while the buyer transitions to full operational control. To prevent prolonged reliance on these services, it’s essential to define the scope clearly, establish accurate cost models, and set a firm timeline for exiting the agreement.

Lessons from Integration Success Stories

The importance of early integration planning cannot be overstated. Successful examples highlight how preparation during the due diligence phase sets the stage for smoother transitions. For instance, in October 2023, Emerson leveraged the diligence period to identify synergy targets and understand National Instruments‘ technology infrastructure before the deal was finalized. This proactive approach enabled them to hit the ground running once the integration began. Similarly, after Dell‘s $67 billion acquisition of EMC in 2016, the company immediately mobilized its sales teams to focus on cross-selling opportunities. This strategy resulted in multibillion-dollar revenue synergies within just one year.

Addressing Cultural and Leadership Challenges

Cultural alignment is another critical factor in successful integrations. It requires more than just surface-level adjustments. When Hitachi acquired GlobalLogic in July 2021, they took deliberate steps to preserve GlobalLogic’s innovation-driven culture. By organizing workshops, facilitating face-to-face meetings, and forming cross-functional teams, they identified and addressed potential "fault lines" – differences in work styles that could disrupt collaboration.

Leadership also plays a key role. Filling top-level roles quickly is essential to prevent uncertainty and retain talent during the transition. These cultural and leadership initiatives create a strong foundation for operational readiness.

"Frequent acquirers are getting better, but when deals fail, integration is at the root 83% of the time."

– Bain & Company

Ensuring Operational Readiness

To keep the business running smoothly, Ready Checkpoints (RCPs) are used to evaluate operational readiness across functions like HR, IT, and Finance before and after Legal Day One. These checkpoints help ensure critical activities – such as shipping products, sending invoices, and collecting payments – continue without disruption. The first 30 days post-closing should focus on key tasks like finalizing working capital adjustments, integrating accounting systems, and tracking earnout metrics.

Conclusion

Tracking milestones is essential to safeguarding value and reducing risks in the sell-side M&A process. From initial preparation to final integration, each phase plays a vital role in determining the outcome. Whether it’s thorough due diligence or crafting a compelling CIM, every step helps protect deal value. Together, these milestones create the foundation for a strong and successful transaction.

On average, the sell-side M&A process spans six to nine months, with the due diligence phase alone often taking 90 days or more. Skipping or rushing through these critical steps can jeopardize the entire deal. As Warren Buffett wisely stated:

"The mistakes [in mergers and acquisitions] are always about making an improper assessment of the economic future".

Careful planning and execution are the antidotes to such costly errors.

Timing is important, but execution quality is equally critical. A well-prepared CIM leaves a strong first impression, while a detailed LOI with exclusivity provisions ensures serious buyer engagement. During due diligence, the guiding principle is straightforward: verify everything. Confirming the accuracy of the target company’s information is essential to avoid the pitfalls of incomplete or inaccurate due diligence.

The stakes couldn’t be higher. Over 60% of M&A deals fail to create shareholder value, often due to poor strategic alignment or inadequate integration planning. Keeping the larger strategic goals in focus – whether it’s achieving cost savings, expanding into new markets, or consolidating market share – can make all the difference. As Forbes aptly noted:

"Even a deal that makes strategic sense can come awry if those involved have not done proper due diligence… or carried out the ground work required to get a deal done".

The takeaway? Strategic clarity and careful execution go hand in hand. Success depends on meticulous attention to every stage of the process. For businesses aiming to simplify the preparation phase, Deal Memo offers on-demand CIM and OM writing services, delivering results in just 72 hours, complete with buyer universe creation and tailored sell-side materials.

FAQs

What are the main risks to watch out for during an M&A process?

Mergers and acquisitions (M&A) come with their fair share of risks, and if these aren’t managed carefully, they can derail even the most promising deals. One major pitfall is inadequate due diligence. Skipping over crucial details can mean missing hidden liabilities, overestimating the target company’s value, or overlooking critical legal, financial, or operational issues. Taking the time to conduct thorough due diligence is key to spotting potential roadblocks and making well-informed decisions.

Another challenge lies in poor post-closure integration planning. Without a clear plan, companies can face cultural clashes, operational hiccups, or even lose essential employees. A strong integration strategy is vital to ensure the deal delivers on its promise, from operational efficiency to long-term growth.

Lastly, unclear strategic goals or miscommunication with stakeholders can lead to mismatched expectations, throwing the entire process off course. To prevent this, it’s essential to define objectives clearly, maintain transparent communication, and align all parties involved. Tackling these risks head-on can pave the way for a smoother, more successful M&A journey.

Why is a well-prepared Confidential Information Memorandum (CIM) crucial for a successful M&A deal?

A well-crafted Confidential Information Memorandum (CIM) is essential for ensuring the success of an M&A deal. It serves as a comprehensive guide, showcasing the target company’s value, financial standing, and strategic advantages. By providing potential buyers with a clear understanding of the opportunity, it helps reduce uncertainties and builds trust in the transaction.

An effective CIM not only attracts serious and qualified buyers but also simplifies the due diligence process and speeds up negotiations. It bolsters the seller’s credibility, aligns buyer expectations with the seller’s objectives, and helps avoid unnecessary delays. Simply put, a well-prepared CIM is a critical tool for maximizing value and paving the way for a smooth and successful deal.

Why is post-closing integration important in an M&A deal?

Post-closing integration plays a critical role in the success of any M&A deal, as it determines whether the transaction delivers on its strategic and financial promises. This stage is all about bringing together operations, systems, and workplace cultures to realize benefits like cost savings, improved efficiency, and revenue growth.

When done right, integration aligns assets, processes, and teams seamlessly, reducing disruptions and helping retain top talent. It also tackles potential hurdles, such as cultural clashes and system unification, which are essential for keeping the business running smoothly and setting the foundation for long-term success. Without a well-executed integration plan, companies risk falling short of their goals and losing the value they aimed to gain from the deal.