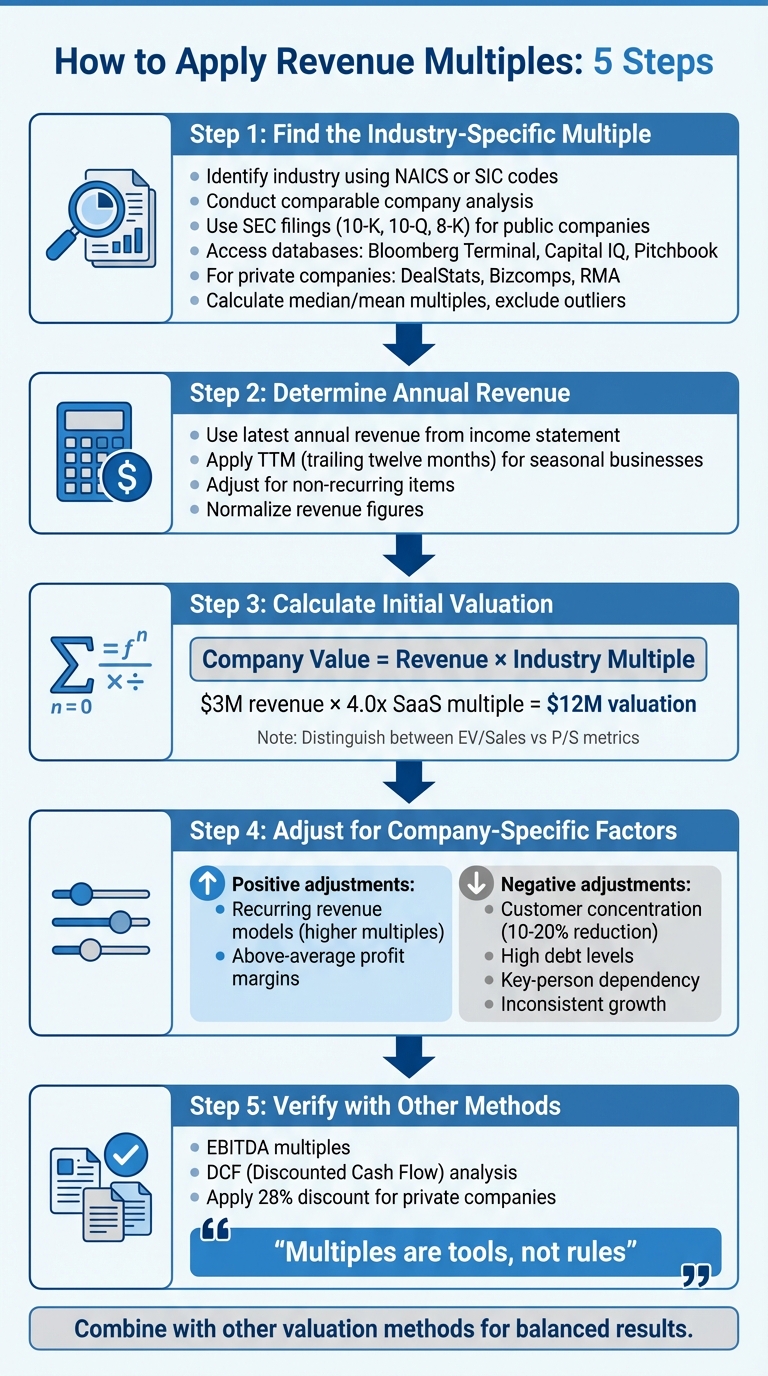

Revenue multiples are a straightforward way to estimate a company’s value by multiplying its annual revenue with an industry-specific factor. They are especially useful for valuing early-stage or high-growth companies that lack consistent profitability. This guide explains how to apply revenue multiples in five steps:

- Find the Industry-Specific Multiple: Use databases or public filings to identify median multiples for comparable companies.

- Determine Annual Revenue: Use normalized revenue, adjusting for one-off items or seasonal fluctuations.

- Calculate Initial Valuation: Multiply revenue by the industry multiple.

- Adjust for Company-Specific Factors: Account for risks like customer concentration or benefits like recurring revenue.

- Verify with Other Methods: Cross-check against EBITDA multiples or discounted cash flow (DCF) models.

Revenue multiples vary by sector. For example, SaaS companies often trade at 2.0x–6.0x revenue, while restaurants fall between 0.3x–0.6x. These differences reflect factors like scalability, margins, and market dynamics. While simple, revenue multiples have limitations – they ignore profitability and operational efficiency. Combining them with other valuation methods can provide a more balanced view.

5-Step Process for Applying Revenue Multiples in Company Valuation

How to Apply Revenue Multiples: 5 Steps

Step 1: Find the Industry-Specific Multiple

Start by identifying the industry using standard codes like NAICS or SIC, and conduct a comparable company analysis. Filter peers based on geography, size, growth, and profitability to ensure a meaningful comparison . For public companies, you can pull data from SEC filings, such as Forms 10-K, 10-Q, and 8-K. Subscription services like Bloomberg Terminal, Capital IQ, and Pitchbook also provide aggregated multiples . For private companies, databases like DealStats, Bizcomps, or industry-specific sources, such as the Risk Management Association, are great resources.

Once you’ve gathered the data, calculate the median or mean multiples, making sure to exclude any outliers that could skew the results. If your business spans multiple sectors, evaluate each segment separately to account for their unique risks and growth opportunities.

"A rigorous benchmarking analysis establishes a defensible, data-driven multiple that clarifies value and reduces confusion." – BerryDunn White Paper

This provides a solid foundation for evaluating revenue in the next steps.

Step 2: Determine Annual Revenue

Use the latest annual revenue figures from the company’s income statement. If the business experiences seasonal fluctuations or one-off sales, consider using a trailing twelve months (TTM) figure to smooth out anomalies. Adjust for non-recurring items, such as asset sales or unusual seasonal spikes, to reflect the normalized revenue a buyer can reasonably expect.

Step 3: Calculate the Initial Valuation

Now, apply the industry multiple to the normalized revenue using the formula:

Company Value = Revenue × Industry Multiple

For example, if a software company generates $3 million in annual revenue and the median SaaS multiple is 4.0x, the initial valuation would be $12 million.

It’s important to note which metric the multiple represents. For instance, EV/Sales considers both debt and equity for a more comprehensive view, while P/S focuses solely on equity value.

Step 4: Adjust for Company-Specific Factors

Fine-tune the initial valuation based on factors unique to the company. Businesses with recurring revenue models, like subscription-based SaaS, often command higher multiples compared to those reliant on one-time sales . Similarly, companies with margins that surpass industry norms may justify a higher multiple .

On the flip side, certain risks can lower the valuation. For example, if 40% of a company’s revenue comes from one client, this high customer concentration could warrant a 10–20% reduction until the risk is addressed. Other concerns, such as high debt, key-person dependency, or inconsistent growth, may also impact the multiple .

To illustrate, an analysis of JEK Construction in 2018 compared the company with public peers that had EBITDA multiples ranging from 6.6x to 18.2x, with a median of 10.4x. JEK’s weaker performance in total assets, EBITDA margin (6.0% vs. 7.0%+), and EBITDA growth (10.0% vs. 22.4%+) led analysts to select a lower multiple than the median.

Once adjustments are made, it’s time to validate the valuation.

Step 5: Verify with Other Valuation Methods

Cross-check your revenue multiple valuation with other methods that consider costs and profitability, such as EBITDA multiples or discounted cash flow (DCF) analysis .

EBITDA multiples are especially helpful as they account for operating expenses, giving a clearer picture of cash flow. If the revenue-based valuation is significantly higher than the EBITDA-based valuation, it could signal an overvaluation relative to profitability.

"Multiples are tools, not rules, and they should be applied with judgment and understanding." – FasterCapital

For private companies, remember to apply a discount – typically around 28% – when comparing to public company benchmarks, as private firms lack the liquidity premium.

Revenue Multiples by Industry

Revenue Multiple Benchmarks by Sector

Now that we’ve covered how to calculate revenue multiples, let’s dive into how these benchmarks vary by industry. Revenue multiples differ significantly depending on the sector, reflecting how businesses create and sustain value. As of January 2026, Semiconductors lead the public market with a Price-to-Sales ratio of 15.46x, supported by net margins of 30.45%. Software (System & Application) companies follow closely at 11.01x, benefiting from scalable business models and 25.49% margins.

On the other end of the spectrum, Retail (Grocery and Food) trades much lower, with a revenue multiple of 0.34x, largely due to slim margins of just 1.32%. Across all U.S. public companies, the Total Market Average sits at 3.07x Price-to-Sales. These variations highlight the key factors that influence valuation.

When it comes to small businesses, the picture changes. Different risks and market conditions lead to distinct valuation metrics. For example, Financial Services leads with an average revenue multiple of 1.19x and a median sale price of $450,000. Meanwhile, Online and Technology businesses average 1.09x, with a higher median sale price of $850,000. At the lower end, Food and Restaurants trade at 0.42x with a median sale price of $200,000. On average, small business sectors maintain a 0.67x revenue multiple.

Private companies generally trade at a discount compared to public companies. For instance, while public SaaS companies may achieve valuations of 14.7x revenue, private SaaS firms are often valued at 10.6x, reflecting a typical 28% private-company discount.

What Drives Revenue Multiple Differences

Several factors explain why revenue multiples vary so much across industries:

- Scalability: Businesses like technology and SaaS grow efficiently by adding customers with minimal extra costs, which supports higher multiples. In contrast, industries such as manufacturing or transportation face rising costs as they scale.

- Revenue predictability: Companies with subscription models or long-term contracts are valued more highly due to their stable and predictable cash flows. For example, SaaS businesses with retention rates above 90% and growth exceeding 30% often command top-tier valuations. Asset-light models, such as freight brokerage, also benefit from this premium compared to asset-heavy operations like trucking, which require ongoing capital investment.

"Recurring revenue businesses across all sectors consistently achieve premium multiples due to cash flow predictability and reduced buyer risk."

- ExitsHub Editorial Team

- Profit margins: Higher margins translate directly into higher valuations. For instance, Software companies with 25.49% net margins trade at 11.01x revenue, while Retail (Grocery and Food) businesses, with margins of just 1.32%, trade at 0.34x.

- Market dynamics: External factors like regulatory barriers and demographic trends also influence multiples. In Healthcare, for example, strict regulations create competitive "moats" that support higher valuations. Similarly, an aging population drives consistent demand, further boosting value in certain sectors.

These factors provide deeper insight into the valuation adjustments discussed in Step 4.

Advantages and Limitations of Revenue Multiples

Benefits of Using Revenue Multiples

Revenue multiples offer a straightforward way to estimate a company’s value, making them a popular tool for quick assessments. Their simplicity is a significant advantage – they’re easy to calculate and interpret, allowing analysts to arrive at estimates without diving into complex financial models. Unlike metrics tied to earnings, revenue multiples are particularly useful for evaluating companies that lack consistent profitability.

Another key benefit is their neutrality when it comes to accounting practices. Revenue figures are less influenced by varying accounting methods, making them more comparable across companies operating in different regions or industries. As Aswath Damodaran, a Finance Professor at NYU Stern, puts it:

"The advantage of using revenue multiples, however, is that it becomes far easier to compare firms in different markets, with different accounting systems at work, than it is to compare earnings or book value multiples".

Additionally, Enterprise Value (EV) to Sales multiples provide a more comprehensive view by accounting for both equity and debt. For instance, in early 2020, the SaaS Capital Index reported a median revenue run-rate multiple of 14.7x for public SaaS companies. This highlights how revenue multiples can reflect market sentiment effectively.

While these advantages make revenue multiples appealing, they do come with some notable drawbacks.

Drawbacks of Revenue Multiples

Despite their ease of use, revenue multiples have significant limitations. One major issue is that they overlook profitability. Two companies with identical revenues can have vastly different margins and cost structures, leading to misleading valuations. For example, a software company with high gross margins operates in a completely different financial space compared to a manufacturing firm with lower margins. Yet, a revenue multiple might treat them as if they were financially similar.

Another limitation is the oversimplification of complex financial dynamics. Revenue multiples fail to account for factors like operational efficiency and cash flow, which are crucial for understanding a company’s financial health. Additionally, they can be skewed by leverage. Highly leveraged companies may show inflated multiples because their expected returns on equity are higher, but this can distort valuations if debt isn’t properly adjusted for.

Forward multiples, while often more forward-looking than historical data, can also be problematic. These figures rely on revenue projections, which can be overly optimistic – especially in high-growth industries where expectations often vary widely .

Comparison Table: Advantages vs. Limitations of Revenue Multiples

| Advantage | Limitation | Impact on Valuation |

|---|---|---|

| Simplicity: Quick and easy to calculate | Oversimplification: Misses key dynamics like cash flow and efficiency | May overlook signs of financial distress or high capital requirements |

| Broad Applicability: Useful for pre-profit or high-growth firms | Ignores Profitability: Doesn’t account for margin differences | Can overvalue companies with high revenue but poor financial performance |

| Accounting Neutrality: Less influenced by accounting policies than net income | Leverage Sensitivity: Can overstate values for highly leveraged firms | May misrepresent companies with significant debt |

| Market-Based: Reflects current investor sentiment | Market Sensitivity: Prone to temporary market trends or hype | Valuations may not align with a company’s true fundamentals during bubbles or downturns |

sbb-itb-798d089

When to Use Revenue Multiples

Best Use Cases for Revenue Multiples

Revenue multiples come into play when traditional earnings-based metrics aren’t an option. This is particularly useful for startups, early-stage companies, or businesses that are not yet profitable. In these cases, revenue multiples become a key valuation tool.

Industries experiencing rapid growth, like Software-as-a-Service (SaaS), often rely on this approach. These companies tend to focus on scaling and gaining market share rather than generating immediate profits, making revenue a more relevant metric for evaluation.

Take the example of Elon Musk’s acquisition of Twitter (now X) in October 2022. The deal was valued at $44 billion, based on Twitter’s 2021 revenue of $5.077 billion. This translates to a revenue multiple of about 8.7x. Since Twitter reported a net loss of $221 million in 2021, revenue multiples were the most practical way to assess its value.

Another advantage of revenue multiples is their simplicity and consistency. Unlike earnings metrics, which can be influenced by factors like depreciation methods, inventory policies, or R&D spending, revenue figures are more straightforward and less prone to manipulation.

However, for revenue multiples to hold weight, there must be a credible plan for profitability. Without a clear path to generating positive cash flow, a revenue-based valuation loses its relevance.

In practice, combining revenue multiples with other valuation methods often provides a more balanced and thorough perspective.

Using Revenue Multiples with Other Methods

While revenue multiples are useful on their own, pairing them with other valuation methods can improve accuracy. For example, they are often used to calculate the terminal value in a Discounted Cash Flow (DCF) analysis. This helps estimate the business’s value beyond the projection period and grounds long-term assumptions.

Revenue multiples can also act as a sanity check for intrinsic valuation models. If your DCF analysis produces a multiple far above the market average for similar companies, it’s a sign to reassess your assumptions. As noted by Wall Street Prep:

"Revenue-based multiples are seldom used in practice and are perceived as a last resort, unprofitable companies often have no other option."

When valuing private companies, it’s important to apply a discount to public market multiples. SaaS Capital, for instance, recommends a 28% discount for private SaaS businesses to account for their lack of liquidity.

For SaaS and subscription-based businesses, it’s critical to separate revenue streams. High recurring revenue deserves a premium multiple, while one-time service or professional services revenue should be valued differently.

| Valuation Method | Best Use Case | Role in Combined Valuation |

|---|---|---|

| Revenue Multiples | Startups, high-growth, or unprofitable companies | Primary tool for pre-profit firms; checks growth assumptions |

| EBITDA Multiples | Stable, profitable businesses with significant assets | Standard benchmark to compare with revenue-based results |

| DCF Analysis | Firms with predictable cash flows | Provides intrinsic value; incorporates multiples for terminal value |

| PEG Ratio | Companies driven by growth | Adjusts earnings multiples to reflect growth rates |

To ensure a well-rounded valuation, always cross-check your results with at least one other method, like comparable company analysis, EBITDA multiples, or a DCF model. This approach helps account for factors like growth rates, margins, and capital needs that revenue multiples alone might overlook. Combining methods strengthens the reliability of your overall valuation strategy.

Conclusion

Key Points for Sector Valuations

Revenue multiples are particularly effective for early-stage, high-growth companies or those with negative EBITDA. To get the most accurate results, start by building a peer group of companies with similar products, markets, and scale – look for revenue within ±50% or market capitalization between 0.5× and 3×. Then, normalize the financial data by removing non-recurring items, as detailed in Steps 2 and 4, and rely on the median multiple to minimize the impact of outliers.

To calculate the implied Enterprise Value, multiply the peer group’s median multiple by the target company’s revenue. From there, subtract net debt and minority interests to determine the equity value. As noted by DCFmodeling.com:

"The single biggest driver of error is a mismatch between the multiple and the business economics".

Adjust the valuation as needed by factoring in qualitative elements such as management quality, intellectual property, or customer concentration. For private companies, apply the previously discussed discount for lack of marketability. Finally, ensure that comparable companies have sufficient trading volume, with an average daily trading value exceeding $1 million, to ensure reliable market pricing.

These steps form the foundation for delivering a well-rounded valuation.

Final Recommendations

While revenue multiples offer a quick, market-based snapshot, they have limitations – they don’t account for margins, costs, or long-term profitability. To address this, combine revenue multiples with other methods. If your revenue multiple valuation deviates by more than 20% from the DCF analysis, revisit your assumptions. Venture capitalist Sean Ammirati sums it up well:

"While business leaders point out that no single metric completely reflects the totality of a business… calculating several of these different ratios can give you a strong directional sense of a business’s value".

Present your findings as a range – 25th percentile, median, and 75th percentile – to account for uncertainty. If the target company is growing faster than its peers, adjust the multiple to reflect this growth differential. To capture a complete picture, integrate revenue multiples with at least one additional method, such as DCF, EBITDA multiples, or precedent transactions. This combined approach highlights not only the unique characteristics of the company but also its realistic path to generating future cash flow.

How to value a company using multiples – MoneyWeek Investment Tutorials

FAQs

How do revenue multiples vary across industries?

Revenue multiples can vary significantly across industries, largely due to differences in growth potential, profitability, and market conditions. For instance, sectors like technology and healthcare, known for their rapid growth and scalability, often see revenue multiples ranging from 2x to 6x or higher. On the other hand, industries such as manufacturing, retail, or construction typically have lower multiples, usually between 0.3x and 2x, as they tend to experience slower growth and demand greater capital investment.

These variations stem from factors like recurring revenue models, competitive landscapes, and the level of capital intensity required. Grasping these distinctions is key to making accurate comparisons and valuations across sectors, as they shed light on how investors evaluate businesses in different markets.

What are the drawbacks of using revenue multiples for valuation?

Revenue multiples are a useful tool for quick comparisons, but they come with some limitations that are worth noting. For starters, they don’t factor in profitability or cost structure. This means a company with impressive revenue but slim or even negative profits could end up looking more valuable than it really is. Plus, these multiples can vary greatly between industries, making it tricky to compare companies across different sectors.

Another issue is that revenue figures can be influenced by accounting practices, like aggressive revenue recognition, which can paint an inaccurate picture. And let’s not forget – revenue multiples don’t tell you anything about cash flow potential or operational efficiency, both of which are crucial for a full valuation. To get a clearer picture, it’s best to use revenue multiples alongside other valuation methods.

When is it best to combine revenue multiples with other valuation methods?

Revenue multiples are a common way to value companies, especially in industries with rapid growth or for early-stage businesses where earnings might not yet be stable. But these multiples work best when paired with other valuation methods to provide a more complete understanding of a company’s worth.

By combining revenue multiples with tools like discounted cash flow (DCF) analysis or earnings-based multiples, you can factor in key elements such as profitability, growth potential, and industry-specific risks. For example, if a company shows impressive revenue growth but has uncertain profitability, using both revenue multiples and DCF analysis can balance the snapshot of current performance with a view of long-term projections.

Using multiple valuation methods together offers a more thorough and balanced evaluation – an approach particularly useful in mergers and acquisitions, investment decisions, or strategic planning. It allows you to address unique risks and market dynamics, leading to more informed and confident choices.