Asset-based valuation focuses on determining a company’s net asset value (NAV) by subtracting liabilities from the fair market value of its assets. This approach works best for companies where physical assets define their value, such as real estate firms, manufacturing businesses, or companies in financial distress. It sets a "floor value" for negotiations, ensuring buyers and sellers have a clear baseline.

Key Takeaways:

- Use Cases: Best for capital-intensive businesses, holding companies, or distressed firms.

- Calculation: Adjust assets (e.g., cash, inventory, real estate) and liabilities to their market value.

- Strengths: Establishes a minimum value; ideal for liquidation scenarios or asset-heavy entities.

- Limitations: Ignores future earnings potential and undervalues intangible assets like brand reputation or intellectual property.

While it provides a strong baseline, asset-based valuation is often paired with income or market approaches for a more complete picture in M&A transactions.

Asset-Based Valuation Methods

Adjusted Net Asset Method

The adjusted net asset method updates book values to reflect current market conditions. Instead of sticking with historical costs minus depreciation, this method recalibrates balance sheet items to their present-day sale values.

To calculate the adjusted book value, you subtract adjusted liabilities from adjusted assets. This approach accounts for both tangible and intangible assets, as well as off-balance sheet items and unrecorded liabilities like pending legal settlements or lease obligations. For instance, inventory might be converted from LIFO (Last-In, First-Out) to FIFO (First-In, First-Out). Similarly, adjustments are made to accounts receivable to reflect anticipated uncollectible amounts.

"One needs to keep in mind that when income or market-based valuation approaches indicate values higher than the Adjusted Net Asset Method, it is typically dismissed in reaching the concluded value of the company." – Sean Saari, CPA/ABV, Skoda Minotti

This method is particularly useful for holding companies, capital-intensive businesses, or businesses consistently operating at a loss, where income-based valuations might fall short of asset values. It can be applied under a "going-concern" assumption (where the business is expected to continue operating) or a "liquidation" premise, provided the adjustments align with the valuation objective.

Next, let’s examine how different valuation bases stack up in M&A transactions.

Comparison of Valuation Bases

Valuation bases serve distinct purposes in mergers and acquisitions. Here’s a breakdown of some key approaches:

| Valuation Base | Definition | Calculation Method | Typical Use Case in M&A |

|---|---|---|---|

| Net Book Value | The value recorded on the balance sheet. | Historical cost minus accumulated depreciation. | Initial due diligence; starting point for adjustments. |

| Replacement Value | The cost to replace an asset at current prices. | Estimate acquisition or construction costs for similar assets. | Insurance assessments; evaluating asset coverage. |

| Fair Market Value | The price an asset would fetch in an open market between a willing buyer and seller. | Adjust book values to current market prices using appraisals or market data. | Standard in M&A for ongoing businesses. |

| Orderly Liquidation Value | The potential proceeds from a structured but expedited sale of assets. | Market value minus discounts for forced sale conditions and liquidation costs. | Bankruptcy cases; distressed M&A; company dissolution. |

For most M&A deals involving ongoing businesses, fair market value is the go-to standard. On the other hand, orderly liquidation value is more relevant in cases of financial distress or company dissolution. To ensure accuracy, third-party appraisers are often engaged to determine the fair market value of real estate and specialized equipment, as book values rarely reflect current market realities.

Asset-Based Business Valuation Methods

When to Use Asset-Based Valuation

Asset-based valuation shines when a company’s worth is closely tied to its physical assets. This method is particularly useful in situations where tangible assets provide a clear and accurate reflection of the business’s value. Knowing when to apply this approach can help avoid missteps in valuation or selecting an unsuitable method.

Liquidation or Distress Situations

When a company faces bankruptcy or severe financial trouble, asset-based valuation often becomes the go-to method for determining its worth. In these scenarios, the focus shifts from future earnings potential to a more immediate question: What can the company recover by selling off its assets?

"Asset-based valuation is often preferred because of its applicability in instances where a business is suffering from challenges relating to liquidity." – CFI Team, Corporate Finance Institute

In such cases, two approaches are commonly used: orderly liquidation or forced liquidation. Orderly liquidation assumes the assets will be sold over a reasonable period to maximize their value, while forced liquidation involves selling them quickly, often at reduced prices. The resulting net asset value often serves as a baseline for negotiations.

For example, as shown in Alphabet Inc.’s earlier valuation, these calculations can provide a minimum value for businesses in distress.

Businesses with Significant Tangible Assets

This method is also ideal for companies where physical assets play a dominant role in their overall value. Real estate holding companies, manufacturing firms with substantial machinery and equipment, and investment portfolios are all great examples.

"The asset approach is appropriate for valuing real estate holding companies, investment holding companies, and capital-intensive operating companies." – Mercer Capital

Asset-based valuation is particularly useful for businesses that lack a clear equity value or have an unstable earnings history, where income-based methods might fall short. In mergers and acquisitions, adjusted net asset value often acts as a benchmark for setting a minimum purchase price.

However, this approach is not suitable for service-oriented companies whose value lies in human expertise or recurring revenue streams. For instance, a consulting firm with few physical assets would be better evaluated using an earnings-based approach.

sbb-itb-798d089

Pros and Cons of Asset-Based Valuation

Comparison of M&A Valuation Approaches: Asset-Based vs Income vs Market

Advantages

Asset-based valuation sets a clear "floor value" for a company – the minimum it would be worth if all its assets were sold and debts paid off. This baseline can be extremely useful, especially when negotiating deals involving distressed businesses or companies with significant tangible assets.

Another key benefit is the flexibility it offers in determining which assets and liabilities to include in the valuation. Analysts can adjust calculations to reflect current market trends and conditions rather than relying solely on outdated book values. This adaptability helps provide a more realistic picture of a company’s tangible worth, factoring in the actual condition of assets and market dynamics.

While these advantages are clear, this approach is not without its drawbacks.

Disadvantages

The most significant drawback of asset-based valuation is that it overlooks future earnings potential. It focuses entirely on the value of a company’s current assets, ignoring what the business could achieve in the future. This makes it a poor fit for high-growth companies or service-oriented businesses, where much of the value lies in human capital or intellectual property.

"There is no theoretical support, conceptual reason, or empirical data to suggest that the value of a business will necessarily equal a company’s accounting book value." – Shannon Pratt, Author of Valuing A Business

Another challenge is valuing intangible assets like brand reputation or proprietary technology. These elements rarely appear on balance sheets, and even when they do, assigning an accurate value is highly subjective. Additionally, this method evaluates assets individually, failing to account for the synergies created when those assets operate together in a functioning business. A profitable, ongoing business is almost always worth more than the sum of its parts. These shortcomings explain why income and market approaches are often favored when future performance is a key consideration.

Comparison with Income and Market Approaches

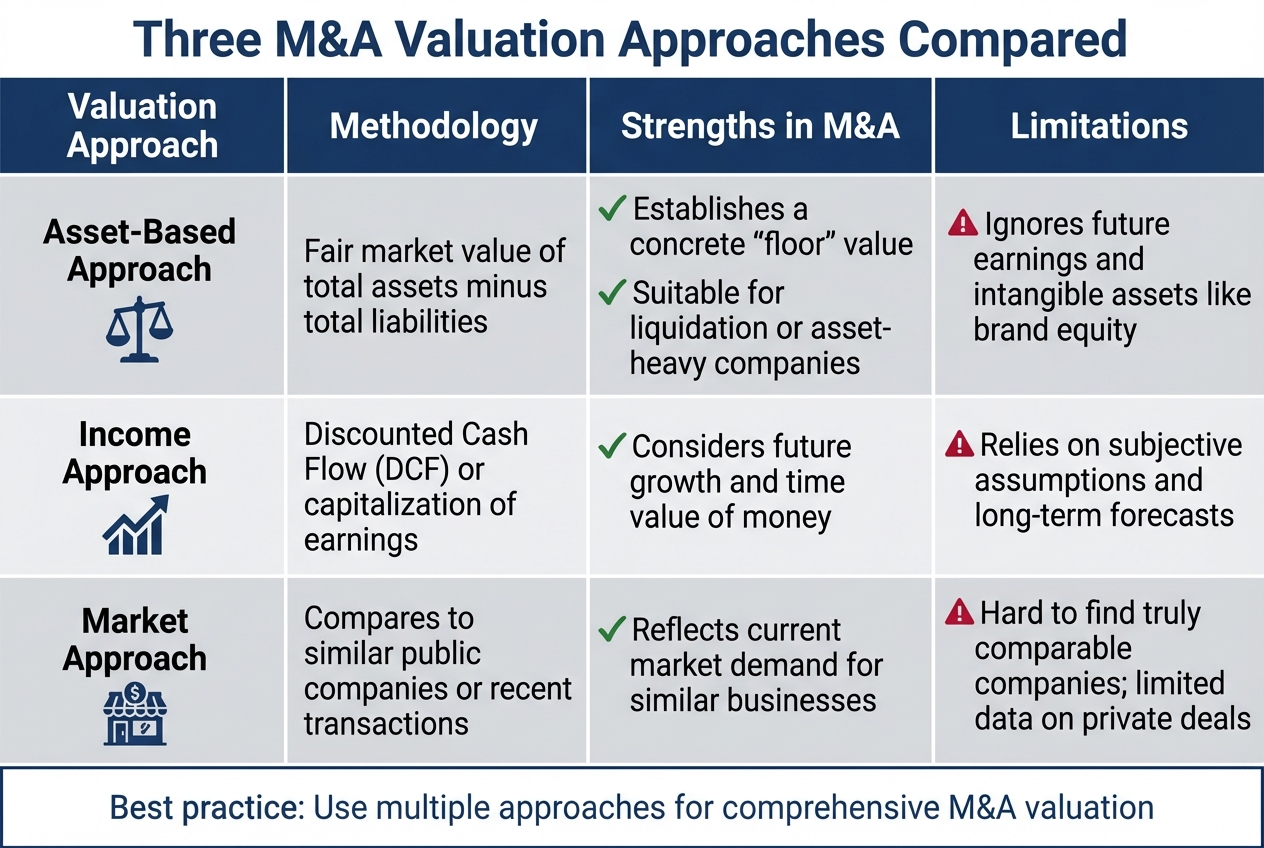

The table below highlights the differences between asset-based valuation and two other common methods, the income and market approaches:

| Valuation Approach | Methodology | Strengths in M&A | Limitations |

|---|---|---|---|

| Asset-Based | Fair market value of total assets minus total liabilities | Establishes a concrete "floor" value; suitable for liquidation or asset-heavy companies | Ignores future earnings and intangible assets like brand equity |

| Income Approach | Discounted Cash Flow (DCF) or capitalization of earnings | Considers future growth and time value of money | Relies on subjective assumptions and long-term forecasts |

| Market Approach | Compares to similar public companies or recent transactions | Reflects current market demand for similar businesses | Hard to find truly comparable companies; limited data on private deals |

Each method has its own role in mergers and acquisitions. Asset-based valuation is often used as a benchmark to cross-check values derived from income or market approaches. It’s especially relevant for capital-intensive businesses or distressed scenarios where cash flow projections are less reliable.

How to Apply Asset-Based Valuation in M&A Deals

Calculation Steps

Start by creating a detailed inventory of all assets and liabilities. This includes tangible assets like cash, inventory, and equipment; intangible assets such as patents, trademarks, and goodwill; and non-operating assets like vacant land or marketable securities. To ensure accuracy, inspect equipment, review inventory reports, and cross-check asset registers.

Next, adjust all values to reflect their fair market value. This involves converting inventory valuation methods, hiring third-party appraisers, and accounting for off-balance-sheet items, such as pending lawsuits or guarantees. To avoid surprises, conduct title searches and review lien filings to confirm the assets are free from legal claims that might lower their value.

Finally, calculate the net value by subtracting total adjusted liabilities from total adjusted assets. This figure establishes the minimum value of the business. As CBIZ explains:

"The Adjusted Net Asset Method allows the analyst to establish a ‘floor-value’ of a company based on the amount that would be realized upon a sale of a company’s assets and satisfaction of its liabilities".

Once you’ve determined the net asset value, incorporate it into your Confidential Information Memorandum (CIM) or Offering Memorandum (OM) to strengthen your negotiation position.

Using Asset-Based Valuation in CIM/OM Preparation

With the net asset value calculated, use it to enhance your CIM/OM. In the Financial Performance section, include historical adjusted balance sheets that showcase the normalized value of the business. Add clear footnotes explaining adjustments, such as changes to inventory valuation methods, real estate appraisals, or receivable write-downs.

Make sure to highlight assets that may not be adequately valued in traditional balance sheets. For instance, recently acquired capital equipment or real estate with significant appreciation can add weight to your valuation. This asset-based approach provides a credible baseline for negotiations.

For professionals tasked with preparing asset-focused CIMs and OMs, tools like Deal Memo can simplify the process. They deliver white-labeled materials within 72 hours, clearly presenting adjusted valuations and positioning asset-heavy businesses to achieve maximum enterprise value.

Conclusion

Asset-based valuation serves as a solid baseline for determining the minimum value in M&A transactions. By focusing on a company’s tangible assets, this method establishes a clear starting point for negotiations, rooted in the current value of physical resources rather than speculative future earnings.

However, this approach has its blind spots. It overlooks intangible assets like brand reputation or intellectual property and ignores the potential value of synergies created when buyers and sellers come together. For companies in service industries or those with minimal physical assets – where human capital often drives value – this method may fall short.

To address these gaps, combining asset-based valuation with income and market approaches creates a more comprehensive picture. When preparing a Confidential Information Memorandum (CIM) or Offering Memorandum (OM), including adjusted asset values alongside normalized financials provides buyers with a broader view of the company’s worth. This strategy is particularly effective for industries like manufacturing, real estate, or other capital-intensive sectors.

In practice, pairing this calculation with robust CIM/OM preparation enhances your position at the negotiating table. Deal Memo offers white-labeled CIMs and OMs within 72 hours, incorporating adjusted valuations that underline the value of tangible assets. This ensures that deal prices not only reflect the true worth of a company’s resources but also strengthen your ability to secure favorable terms.

FAQs

When should you use asset-based valuation in an M&A deal?

Asset-based valuation works best in M&A scenarios where a company’s worth is closely linked to its physical assets, like real estate, machinery, or inventory. This approach is commonly applied when a business is being liquidated or to calculate the minimum value of a company by deducting liabilities from the total value of its assets.

This method is particularly relevant for industries that rely heavily on tangible assets or in situations where buyers and sellers prioritize understanding the company’s net worth based purely on its physical and financial holdings, rather than its potential for future earnings.

What makes asset-based valuation different from income and market approaches in M&A deals?

Asset-based valuation determines a company’s value by calculating the fair market value of its assets and subtracting its liabilities. This approach is especially useful for businesses where tangible assets play a major role in their overall worth or in situations involving liquidation.

On the other hand, the income approach focuses on the company’s ability to produce future earnings or cash flows. A common method used here is discounted cash flow (DCF) analysis. Meanwhile, the market approach assesses value by comparing the company to similar businesses that have recently been sold or are publicly traded.

While asset-based valuation works well for companies with substantial physical assets, the income and market approaches are more appropriate for businesses with consistent earnings or when there are active markets for comparable companies.

What challenges arise when using asset-based valuation for service-focused companies?

Asset-based valuation often falls short when applied to service-oriented companies. Why? Because it mainly focuses on tangible assets like property or equipment. This method tends to sideline intangible assets – things like a strong brand reputation, loyal customer relationships, or the specialized knowledge and skills of employees. Yet, these are often the true engines of value for service businesses. Plus, this approach doesn’t capture a company’s potential for future earnings or growth, which is crucial in industries that thrive on long-term profitability and innovation.