In 2026, the M&A industry demands more than just financial expertise. Certifications are now critical for professionals looking to excel in complex transactions, offering specialized knowledge and practical skills. Here’s a quick rundown of the top certifications:

- Mergers & Acquisitions Master Intermediary (M&AMI): For senior advisors with 3+ years of experience and deals exceeding $5M. Requires continuing education.

- Certified M&A Specialist (CMAS): Ideal for seasoned professionals with deal history. Lifetime certification with no renewal needed.

- Certified M&A Advisor (CM&AA): Tailored for middle-market professionals. Offers in-depth knowledge of the M&A sales process.

- Mergers & Acquisitions Professional Certificate (NYIF): Focused on Wall Street analysts; emphasizes financial modeling and deal structuring.

- Certified Financial Modeling & Valuation Analyst (FMVA): Entry-level program for mastering financial modeling and valuation.

- Mergers & Acquisitions Professional (M&AP): Globally recognized, covering all aspects of M&A, with flexible learning options.

Each certification varies in cost, time commitment, and prerequisites, making it essential to choose based on your career stage and goals. Whether you’re starting out or advancing your expertise, these programs can sharpen your skills and help you stand out in a competitive field.

Mergers and Acquisitions (M&A) Certification Course

Top Certifications for M&A Advisors in 2026

In 2026, certifications in mergers and acquisitions (M&A) provide tailored benefits, whether you’re diving into Wall Street’s technical demands, focusing on middle-market transactions, or seeking global recognition. These credentials are designed to align with your career stage and specialization, ensuring your time and resources are well spent.

Many leading programs now offer flexible learning options, including self-paced online courses, live virtual sessions, and onsite training in financial hubs like New York and London. While some certifications require an academic degree or professional designation (like CPA or CFA), others include perks such as professional memberships. These memberships often grant access to deal-matching platforms, extensive e-libraries, and networking directories, positioning you for new opportunities. Here’s a breakdown of the top certifications shaping the M&A field in 2026.

Mergers & Acquisitions Professional Certificate (NYIF)

The New York Institute of Finance (NYIF) offers a skills-focused program tailored for analysts and associates entering Wall Street roles. This certification covers the entire transaction process, from pre-merger planning to post-merger integration, with a strong focus on deal structuring, free cash flow (FCF) modeling, and M&A accounting. Depending on the format, participants earn 35 to 40 CPE credits.

Led by Wall Street practitioners, the program emphasizes hands-on learning. You’ll build Excel-based models, navigate valuation scenarios, and master the technical skills investment banking teams use daily. The practical approach ensures you’re ready to apply your knowledge immediately.

Certified Financial Modeling & Valuation Analyst (FMVA)

The FMVA certification from Corporate Finance Institute (CFI) equips professionals with essential skills like dynamic three-statement modeling, discounted cash flow (DCF) valuation, and advanced Excel techniques. These tools are critical for evaluating acquisitions and advising on deal valuations.

With over 2 million professionals having enrolled in CFI programs, the FMVA boasts a 4.9/5 rating from 38,075 reviews. Recognized by NASBA in the U.S. and CPA organizations in Canada, this certification enhances your credibility in financial modeling.

"Over 85% of executives, supervisors, and HR professionals agree that certified individuals bring value, gain credibility, and are seen as top performers." – Corporate Finance Institute

The program is entirely online and self-paced, available through CFI’s annual subscription plans. Many participants report noticeable improvements in their skills within weeks of starting.

Certified M&A Advisor (CM&AA)

Offered by the Alliance of Merger & Acquisition Advisors, the CM&AA certification is geared toward middle-market deal professionals. A standout feature is its "M&A Sales Process" module, which details 10 transaction steps – particularly useful for sell-side advisors.

Pricing ranges from $2,150 for the online version to $5,495 for in-person bundles. The program includes 40 CPE hours and can be completed in just one week in its intensive format. Both virtual and in-person options are available.

"Deciding to take the CM&AA course was one of the best professional decisions I’ve made… Even though I have been involved in over 30 M&A transactions as CFO in my career, I learned at least twice as much new information in the course as I had in doing all those past transactions!" – Ken Saddler, Partner, Certified Business Transition Expert™

The CM&AA program combines practical knowledge with real-world application. Instructors actively involved in M&A deals bring current insights to the coursework. Membership benefits, such as access to networking opportunities, further enhance the program’s appeal.

Mergers & Acquisitions Professional (M&AP)

The Institute for Mergers, Acquisitions and Alliances (IMAA) offers the M&AP designation, recognized globally in the M&A industry. Covering the entire transaction process – from due diligence to valuation, auditing, and legal considerations – this program provides a broad, international perspective.

The self-paced online option is priced at $3,290 (discounted from $4,360), while onsite early bird pricing starts at $4,890. For those targeting specific skills, individual modules such as Essentials, Due Diligence, Valuation, and Practice are available at $1,090 each. The complete program typically requires 50 hours of study, with some participants finishing in as little as two months.

"The M&AP is the most internationally recognized designation offered in the field of M&A. This charter signals to peers, clients, employers, and other professionals that you have completed the most comprehensive M&A education program available." – Institute for Mergers, Acquisitions and Alliances (IMAA)

The M&AP program offers flexible delivery formats, including self-paced online courses, live virtual sessions, and onsite training in major financial centers. Additionally, the certification includes a one-year IMAA membership, granting access to updated content and networking opportunities that can benefit your career long-term.

How to Choose the Right Certification for Your Career Goals

M&A Certification Comparison: Costs, Requirements, and Career Fit

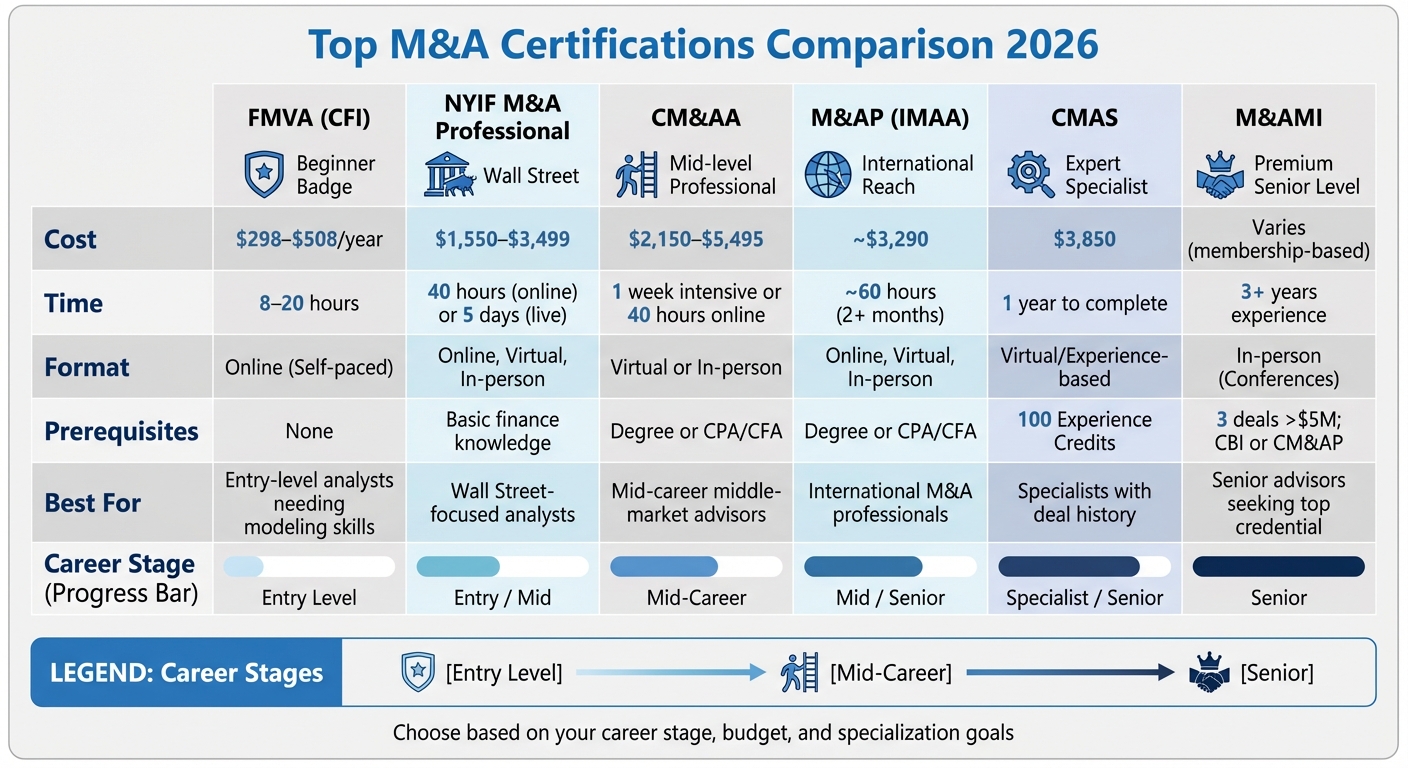

Choosing the best M&A certification depends on where you are in your career, your area of focus, and how much time and money you can invest. For those just starting out, entry-level programs that don’t require prior deal experience are a great fit. Programs like the FMVA from CFI and the M&AP from IMAA focus on foundational skills such as financial modeling and valuation, making them perfect for beginners. Let’s break down the certifications suited for different career stages.

If you’re a mid-career advisor looking to level up, certifications that highlight both education and practical experience are key. The CM&AA, for instance, is ideal for professionals with a degree or credentials like a CPA or CFA. This program, which includes a six-week virtual option, is tailored for advisors working on middle-market transactions. For those with a strong track record of deal-making, the CMAS is a strong choice. It requires at least 100 "Experience Credits", which are based on the size and complexity of past deals, making it a mark of expertise that can attract clients.

For senior advisors aiming to reach the pinnacle of recognition in the M&A field, the M&AMI designation is the gold standard. To qualify, you’ll need at least three years of full-time experience and proof of closing three transactions valued at $5 million or more. This credential is designed for those at the top of their game.

Budget and scheduling are also critical factors. Self-paced online programs like the M&AP (priced at $3,290) or the FMVA (ranging from $298 to $508 annually) are flexible options for working professionals. On the other hand, in-person programs require a more intense time commitment – typically a full week – but offer immersive learning and networking opportunities, albeit with a higher financial investment.

It’s also important to consider recertification requirements. Some programs, like the CMAS, are lifetime certifications with no renewal needed. Others, like the M&AP, require 10 hours of continuing education every two years, while the M&AMI demands 36 credit hours every three years, including mandatory conference attendance. These ongoing requirements are crucial for staying sharp and maintaining your credentials in the competitive M&A industry.

Comparison Table: Key Factors to Consider

| Certification | Cost | Time Commitment | Delivery Format | Prerequisites | Best For |

|---|---|---|---|---|---|

| FMVA (CFI) | $298–$508/year | 8–20 hours | Online (Self‑paced) | None | Entry-level analysts needing modeling skills |

| NYIF M&A Professional | $1,550–$3,499 | 40 hours (online) or 5 days (live) | Online, Virtual, In‑person | Basic finance knowledge | Wall Street‑focused analysts |

| CM&AA | $2,150–$5,495 | 1 week intensive or 40 hours online | Virtual or In‑person | Degree or CPA/CFA | Mid-career middle-market advisors |

| M&AP (IMAA) | $3,290 | ~60 hours (2+ months) | Online, Virtual, In‑person | Degree or CPA/CFA | International M&A professionals |

| CMAS | $3,850 | 1 year to complete | Virtual/Experience‑based | 100 Experience Credits | Specialists with deal history |

| M&AMI | Varies (membership‑based) | 3+ years experience | In‑person (Conferences) | 3 deals >$5M; CBI or CM&AP | Senior advisors seeking top credential |

sbb-itb-798d089

Certification Costs and Career ROI

When choosing a certification aligned with your career goals, it’s essential to weigh both the financial investment and the potential long-term benefits. M&A certifications range in cost, from around $1,090 per module to over $5,500 for comprehensive programs. For example, the CMAS certification is priced at $3,850, which includes three virtual education programs, a textbook, and lifetime certification. Meanwhile, the CM&AA costs $2,150 for the online version and up to $5,495 for in-person programs, which often include perks like networking meals and direct access to instructors.

The return on investment (ROI) for these certifications extends far beyond salary increases. They offer professionals a competitive edge in the job market. M&A analysts typically earn between $50,000 and $75,000 annually, while directors can command salaries exceeding $190,000. With global M&A activity surpassing $5 trillion in 2025, having a recognized certification can set you apart on platforms like LinkedIn and in job applications. As Gaurav Sharma, Associate Director at Standard Chartered Bank, aptly puts it:

"M&A continues to be one of the most rewarding careers within investment banking but it’s also one of the hardest to break into… you need every edge you can get your hands on".

The ROI isn’t just about immediate pay raises. Certifications like the CM&AA also provide 40 Continuing Professional Education (CPE) hours in just one week, which can help professionals, such as CPAs, meet continuing education requirements. Lifetime credentials, such as the CMAS, eliminate ongoing recertification costs, whereas others, like the M&AMI, require periodic maintenance – such as 36 credit hours every three years, along with conference attendance and maintenance fees.

These certifications also play a vital role in improving deal success rates. With 60% of M&A transactions failing due to due diligence gaps, certifications that focus on valuation and risk assessment can significantly enhance the likelihood of deal completion while minimizing liabilities. In 2023, 37% of U.S. M&A firms raised advisory fees due to increasing deal complexities. Success fees typically range from 5–10% for deals under $10 million and drop to 1–3% for transactions over $50 million. Even one additional successful deal could cover certification costs many times over.

When selecting a certification, it’s crucial to align the investment with your career stage. Entry-level professionals might benefit most from programs that provide practical, ready-to-use skills, while mid-career advisors should look for credentials that validate their expertise and experience. For example, the CMAS requires 100 Experience Credits, roughly equivalent to two completed deals, while the M&AMI demands proof of three transactions valued at $5 million or more. As Rachel Zhang, Founder & CEO of Kalalau Capital, explains:

"It’s a valuable investment in one’s career".

These insights underscore the strategic importance of certifications in boosting deal success and advancing your career trajectory.

Conclusion

By 2026, earning an M&A certification can set you apart in a competitive job market, showcasing your expertise and fast-tracking your career growth. The right certification equips you with essential technical skills, industry recognition, and a valuable professional network – key assets for thriving in the challenging world of mergers and acquisitions.

Certification costs and purposes vary widely, making it important to choose one that aligns with your career goals and current experience. These programs, with their differing price points and rigorous standards, cater to professionals at various stages of their careers. Advisors frequently emphasize the practical advantages of these certifications, from improving deal-making skills to enhancing professional credibility.

When selecting a certification, think about your career stage and area of focus. For those just starting out, technical programs like the FMVA are ideal for building foundational skills. On the other hand, mid-to-senior-level professionals should look for credentials that highlight transaction experience and foster networking opportunities. The comparison table above can help you quickly identify which certification matches your needs. Also, consider the format that works best for your lifestyle – self-paced online courses offer flexibility, while in-person programs provide immersive networking opportunities.

As outlined earlier, the right certification does more than just sharpen your technical skills – it boosts your professional credibility and signals your commitment to excellence. Investing in a certification today can pay off in the long run by enhancing your ability to structure deals, perform due diligence, and manage integrations effectively. Explore your options, review the factors discussed in this guide, and choose the certification that will take your M&A career to the next level.

FAQs

What should I consider when selecting an M&A certification?

When choosing an M&A certification, it’s important to focus on what aligns best with your career ambitions and long-term professional development. Start by considering the reputation and recognition of the certification within the M&A industry. Programs like CMAS® or M&AMI® are widely respected and can boost your credibility in the field.

Take a close look at the eligibility requirements as well. These typically include factors like educational background, work experience, and passing specific exams. Make sure you meet these criteria before committing. Also, factor in the costs – not just the price of the certification itself, but also the potential return on investment in terms of career growth, networking opportunities, and enhanced professional standing.

Lastly, don’t overlook the ongoing commitments that may come with the certification, such as recertification processes or continuing education requirements. These ensure the certification remains relevant but may require additional time and effort down the line.

Selecting a certification that aligns with your goals, is achievable, and carries industry respect can set you apart as a standout M&A advisor.

How can certifications boost your career in M&A?

Certifications are a powerful way to boost your career in the M&A industry. They highlight your expertise, enhance your credibility, and open doors to leadership roles. Credentials such as the Certified M&A Specialist (CMAS®), M&AMI, and CM&AP show your dedication to professional excellence and your in-depth knowledge of M&A strategies, legal frameworks, and industry best practices. These qualifications can set you apart in a competitive market, making you more attractive to both clients and employers.

To earn these certifications, you typically need to meet specific education and experience criteria, successfully close deals, and pass demanding assessments. This process not only confirms your skills but also positions you for higher earnings, access to exclusive professional networks, and chances to work on high-profile deals. For professionals looking to stand out and fast-track their career growth, obtaining recognized industry certifications is a smart and worthwhile step.

Do M&A certifications require ongoing maintenance?

Many M&A certifications come with ongoing requirements to keep them valid. For instance, the CBI® (Certified Business Intermediary) designation needs to be renewed every three years. This process involves earning specific educational credits and maintaining good standing. Likewise, the M&AMI® (Merger & Acquisition Master Intermediary) certification requires periodic recertification and continuing education to stay active. On the other hand, certifications like the CMAS® (Certified M&A Specialist) are lifetime credentials and don’t require any recertification.

It’s important to check the specific guidelines for your certification to ensure you’re meeting all the necessary criteria to maintain your credentials.