Certifications can set you apart in the competitive mergers and acquisitions (M&A) field. They validate your expertise, practical experience, and commitment to professional growth. Here’s a quick rundown of the top certifications for M&A professionals:

- Certified Merger & Acquisition Advisor (CM&AA): Ideal for middle-market deals ($5M–$500M). Costs $2,150–$5,495, offers 40 CPE hours, and includes AM&AA membership.

- Mergers & Acquisitions Master Intermediary (M&AMI): Focuses on proven deal-making success. Requires 3+ years of experience and 3 closed deals over $5M.

- Certified Mergers & Acquisitions Professional (CM&AP): A six-week online program tailored for private company transactions.

- Mergers & Acquisitions Professional (M&AP): Globally recognized by IMAA, with flexible learning formats and no final exam.

- NYIF M&A Certificate: Practical, finance-focused, with self-paced or boot camp options ($1,550–$3,499).

- Certified M&A Specialist (CMAS): Demands both training and transaction experience; lifetime certification for $3,850.

- FMVA Certification with M&A Focus: Great for beginners, emphasizing financial modeling and valuation ($497–$847).

Each certification caters to different career stages and goals. Whether you’re new to M&A or a seasoned advisor, there’s a program to sharpen your skills and enhance your credibility.

M&A Certification Comparison: Cost, Duration, and Requirements

CM&AA Certification through the Alliance of Merger and Acquisition Advisors (AM&AA)

1. Certified Merger & Acquisition Advisor (CM&AA)

The Certified Merger & Acquisition Advisor (CM&AA) is the premier designation offered by the Alliance of Merger & Acquisition Advisors (AM&AA). It’s tailored for professionals working on middle-market M&A deals, typically valued between $5 million and $500 million. This program dives deep into 10 essential areas, such as private capital markets, business valuation, quality of earnings analysis, LBO modeling, due diligence, and legal and tax considerations. It’s designed for CPAs, attorneys, investment bankers, CFAs, and business brokers looking to sharpen their skills to an institutional level. Below, we break down the certification’s costs, structure, and benefits.

Cost

For AM&AA members, virtual courses start at $2,150. The Professional Bundle, which includes a one-year membership, is priced at $2,750. Young professionals (35 or younger) can take advantage of a discounted rate of $2,550. In-person courses come at a higher price – $4,950 for members or $5,495 for the Standard Bundle, which includes meals and a one-year membership.

Format and Duration

The CM&AA certification is offered in two formats: online virtual sessions and in-person classes. Virtual courses are hosted on Zoom over four to five weeks, while in-person programs are condensed into intensive five-day sessions held at university venues. These in-person classes run from 8:00 A.M. to 5:00 P.M. Upcoming sessions in 2026 include Dallas, TX (April 13–17) and Chicago, IL (October 19–23). Both formats award participants 40 CPE hours upon completion.

Prerequisites

Candidates must meet specific requirements to enroll. This includes holding an academic degree or a professional designation (such as CPA or CFA) and having at least two years of M&A experience. After completing the coursework, participants must pass a proctored online exam. To keep the credential active, advisors are required to earn 12 continuing education credits annually and attend at least one AM&AA conference every three years.

Key Benefits

Earning the CM&AA credential comes with several perks. Graduates gain lifelong access to updated course materials, an extensive e-library, and a network of over 1,100 M&A professionals spanning 25 countries. The program’s curriculum, led by experienced practitioners, focuses on tackling real-world challenges in deal-making.

"I have attended hundreds of hours of continuing education courses in my career thus far and I would put the CM&AA up as one of the best I have attended. The content is applicable, informative, and intriguing and it is taught by those with real life experiences that are in the trenches of their expertise daily."

– Braxton Savage, Transaction Advisory Services Manager, Tanner LLC

2. Mergers & Acquisitions Master Intermediary (M&AMI)

The Mergers & Acquisitions Master Intermediary (M&AMI) certification, offered by M&A Source, highlights practical deal-making expertise, giving advisors a distinct edge in the competitive M&A landscape. This certification stands out because it requires both educational credits and the successful completion of multiple transactions, making it especially relevant for intermediaries working in the lower- and middle-market sectors with deals exceeding $5 million.

Prerequisites

To qualify, candidates need at least three years of full-time M&A experience within the last decade and must document three transactions of $5 million or more, which can include real estate deals. Applicants can choose one of three pathways:

- Pathway 1: Hold a CBI designation and complete 20 credit hours.

- Pathway 2: Complete 40 credit hours without a CBI.

- Pathway 3: Complete the CM&AP program.

Additionally, candidates must attend at least two M&A Source conferences and maintain active membership in the organization. These requirements ensure that participants bring both hands-on experience and a solid educational foundation to the program.

Format and Duration

The M&AMI certification combines online learning with in-person events. Candidates can fulfill educational requirements through on-demand or live sessions, but they must also attend two M&A Source conferences, typically held in person. The committee review process for certification generally takes about three weeks.

Cost

The program follows a flexible hybrid model, but costs include an application fee, an annual maintenance fee, and ongoing M&A Source membership. While exact amounts aren’t disclosed, these fees are part of maintaining the certification.

Key Benefits

"The Master designation is the only one to require both educational credits and the successful completion of multiple transactions. As such, it provides a distinct competitive advantage when engaging with clients and prospects." – M&A Source

To maintain the certification, holders must recertify every three years by earning 36 credit hours. Attendance at a single M&A Source conference accounts for 16 of these credits. Additionally, professionals must adhere to an 18-article Code of Ethics, which emphasizes protecting clients from fraud and ensuring all work is conducted in the client’s best interest.

3. Certified Mergers & Acquisitions Professional (CM&AP)

The Certified Mergers & Acquisitions Professional (CM&AP) certification is a collaboration between M&A Source and Kennesaw State University’s Coles College M&A Academy. It’s tailored for professionals working with private companies in the middle market or business owners preparing for acquisitions or sales. This program combines practical, hands-on training with academic expertise, delivered by university faculty. It’s designed to equip participants with the tools they need to navigate the complexities of mergers and acquisitions effectively.

Format and Duration

The CM&AP program is held entirely online, making it accessible and convenient for busy professionals. Spanning six weeks, it runs twice a year and includes access to a comprehensive learning management system (LMS). The LMS provides essential resources like materials, templates, and examples based on real-world scenarios.

Key Benefits

The curriculum covers every stage of the M&A process, from understanding industry trends and maximizing shareholder value to mastering financial analysis, transaction valuation, and deal financing. With the CM&AP credential, participants gain recognition in the industry while sharpening their expertise in areas like due diligence, valuation, and negotiation.

Beyond the basics, the program dives into critical aspects of deal structuring, including tax considerations, financing strategies, and risk management. These skills are essential for guiding clients through the often complex and nuanced world of mergers and acquisitions.

4. Mergers & Acquisitions Professional (M&AP)

The Mergers & Acquisitions Professional (M&AP) certification, offered by the Institute for Mergers, Acquisitions and Alliances (IMAA), is a globally acknowledged credential tailored for executives, directors, and senior professionals. This includes individuals like heads of strategy, investment bankers, transaction lawyers, and private equity investors. According to the IMAA, this certification is "the most internationally recognized designation offered in the field of M&A" and signals to peers, clients, and employers that participants have completed one of the most thorough M&A education programs available. It combines advanced M&A expertise with practical management strategies, making it a bridge between technical knowledge and leadership.

Prerequisites

To enroll, candidates must hold an academic degree (such as a Bachelor’s, MBA, JD, or PhD) or a professional designation like CPA, CFA, or CAIA. The program does not require a final exam; instead, participants must complete 10 hours of continuing education every two years to maintain their certification.

Format and Duration

The M&AP program offers three flexible learning formats:

- Self-paced online: Requires around 60 hours of study, allowing participants to learn at their own convenience.

- Interactive online live and onsite formats: Condense the material into approximately 30 hours. Onsite sessions are held in major cities such as London, New York, Singapore, and Amsterdam.

For those eager to complete the certification quickly, the online version can be finished in as little as two months.

Cost

The cost of the program depends on the format chosen:

- Online self-paced: $3,290 (bundle price; regular $4,360)

- Interactive online live: $3,790 (early bird) to $4,390

- Onsite: $4,890 (early bird) to $5,490

- Individual modules: $1,090 each

Key Benefits

The M&AP certification stands out for its structured curriculum and focus on practical application. It is divided into four main modules: Essentials of M&A, Due Diligence, Valuation, and Running a Successful M&A Practice. A unique feature of this program is its emphasis on managing an M&A boutique or advisory practice, offering insights into areas like business strategy and mid-market advisory.

The program’s faculty includes over 60 experts – professors and practitioners – from more than 20 countries, ensuring a diverse and comprehensive learning experience. Enrollment also comes with added perks, such as a one-year IMAA charter-holding membership and access to the extensive IMAA eLibrary.

"better value to our clients"

– Chuck Adams, Managing Partner at Coeptis Consulting Group

sbb-itb-798d089

5. Mergers & Acquisitions Professional Certificate from NYIF

The Mergers & Acquisitions Professional Certificate offered by the New York Institute of Finance (NYIF) is designed for financial analysts, associates, and managers who are either advancing in M&A or transitioning from other areas like fixed income or equities. This program equips participants with practical, on-the-job skills through a structured curriculum that spans four key modules: Concepts and Theories, Free Cash Flow Modeling, Structuring the Deal, and Accounting for M&A. These modules guide learners through every stage of the M&A process, from initial analysis to post-merger integration.

Prerequisites

To get the most out of this program, you’ll need a basic working knowledge of Microsoft Excel and a solid grasp of corporate finance fundamentals, including valuation techniques and financial instruments.

Format and Duration

The program is available in two formats to suit different schedules:

- Self-paced online: Approximately 40 hours of content that you can complete at your own pace.

- Intensive boot camp: A 5-day, immersive experience held either in-person at NYIF’s New York campus or live via Zoom. This format condenses the material into a single week, minimizing time away from work.

Online learners have access to discussion forums, where Teacher’s Assistants typically respond within 2–3 business days, ensuring support throughout the learning process.

Cost

The cost depends on the format you choose:

- Self-paced online: $1,550

- In-person or virtual live boot camp: $3,499

Both options include the flexibility of monthly payment plans. Upon completion, participants earn between 35 and 40 Continuing Professional Education (CPE) credits, depending on the chosen format. To receive the certificate, you must pass a 20-question exam with a minimum score of 70%, and you only get one attempt.

Key Benefits

The program is taught by instructors with years of Wall Street experience, offering insights that go beyond textbook theories. Gaurav Sharma, Associate Director at Standard Chartered Bank, highlights its impact:

"This certificate will add a ton of value to your CV. And with the amount of competition for these roles, you need every little bit of advantage that you can get."

Khaled Abouheif, another participant, emphasizes its practical value:

"The key benefit of this course is getting a clear roadmap for M&As on both the sell and buy sides."

This certification is especially beneficial for professionals looking to sharpen their deal-making expertise and stand out in finance, private equity, or consulting roles.

6. Certified M&A Specialist (CMAS)

The Certified M&A Specialist (CMAS) designation, offered by the M&A Leadership Council, is tailored for experienced professionals aiming to formalize and showcase their expertise in mergers and acquisitions. Unlike beginner-level programs, this certification demands both a solid grasp of M&A principles and hands-on deal-making experience before you can earn the credential.

Prerequisites

To qualify, candidates must accumulate 200 credits. Here’s how it breaks down:

- 100 credits come from completing M&A Leadership Council training courses.

- 100 credits are earned by submitting experience forms that detail your leadership role in actual transactions.

The value of each experience submission depends on the size and complexity of the deal as well as your specific contributions, ranging from 25 to 100 credits. A senior executive or deal sponsor must verify your involvement and endorse your submission.

Format and Duration

Once you meet the prerequisites, the program is delivered online through virtual courses, typically spread over three half-day sessions. For corporate teams, there’s an option to arrange custom in-person training at their workplace. After enrolling, participants have one year to complete all requirements, including submitting experience forms and passing the final exam.

The final test is a 60-question, open-book exam conducted online. You’ll have 72 hours to complete it, and you can reference The Art of M&A, 6th Edition, which is included with your enrollment.

Cost

The standard enrollment fee is $3,850 for new members. This covers:

- The e-book version of The Art of M&A, 6th Edition

- A specialized training guide

- Vouchers for three virtual sessions

- Experience form reviews

- The exam fee

If you’re an alumnus of the M&A Leadership Council, you may qualify for custom enrollment options, which factor in credits you’ve already earned from prior training.

Key Benefits

The CMAS designation is a lifetime certification – there’s no need for recertification or continuing education. Upon completion, you’ll receive:

- A frameable certificate

- An official LinkedIn announcement from the M&A Leadership Council

- A digital email signature badge

According to the M&A Leadership Council, "Achieving recognition as a CMAS® is a great way to set yourself apart as an exceptional M&A professional." This credential not only validates your skills in both foundational and advanced M&A strategies but also highlights your ability to lead complex transactions. It’s a powerful way to strengthen your professional reputation in a competitive field.

7. FMVA Certification with M&A Focus

The FMVA® certification from the Corporate Finance Institute is designed to develop hands-on skills in financial modeling and valuation, placing less emphasis on traditional deal-making processes. Like similar certifications, the FMVA® aims to provide professionals with practical tools essential for thriving in competitive M&A advisory roles. The curriculum highlights key areas such as financial modeling, valuation techniques, and Excel-based deal analysis.

The program includes 14 core courses, 3 electives (out of a total of 33 courses), 2,428 lessons, and over 210 exercises. Elective options like M&A Modeling, LBO Modeling, and Advanced Excel Formulas dive into topics such as accretion/dilution analysis, precedent transaction evaluations, and sophisticated deal structures.

"I now possess valuable financial modeling capabilities such as building discounted cash flow models… and accretion/dilution analysis in order to assess the risks and rewards of investment opportunities." – Brandon J. Casamassima, Investment Analyst

Prerequisites

There are no formal prerequisites to enroll. However, the subscription includes eight preparatory courses that cover accounting fundamentals and essential Excel skills, ensuring participants are well-equipped to tackle the program.

Format and Duration

The FMVA® program is entirely online and self-paced, offering flexibility for participants to learn from anywhere. On average, it takes 120–200 hours to complete, typically over 4 to 6 months. To earn the certification, participants must achieve at least 80% on each course assessment and 70% on the proctored final exam.

Cost

The certification is available under two plans:

- Self-Study Plan: $497, which includes all courses, assessments, and the final exam.

- Full Immersion Plan: $847, which adds personalized instructor feedback, access to an AI tutor, and financial model reviews.

There are no extra charges for the exam or the digital certificate.

Key Benefits

With a stellar 4.9/5 rating from over 38,000 users, the program has received high praise, with 75% of participants reporting increased productivity. Graduates earn a blockchain-verified digital certificate recognized by top financial institutions globally. Additionally, the program provides access to over 250 downloadable Excel templates and qualifies for CPE credits through NASBA.

"The skills are actual real-world skills (unlike most financial qualifications) that have already helped me land a new role." – Mark Wheeler, finance professional

This certification broadens the toolkit for M&A professionals, equipping them with advanced financial analysis and strategic decision-making skills.

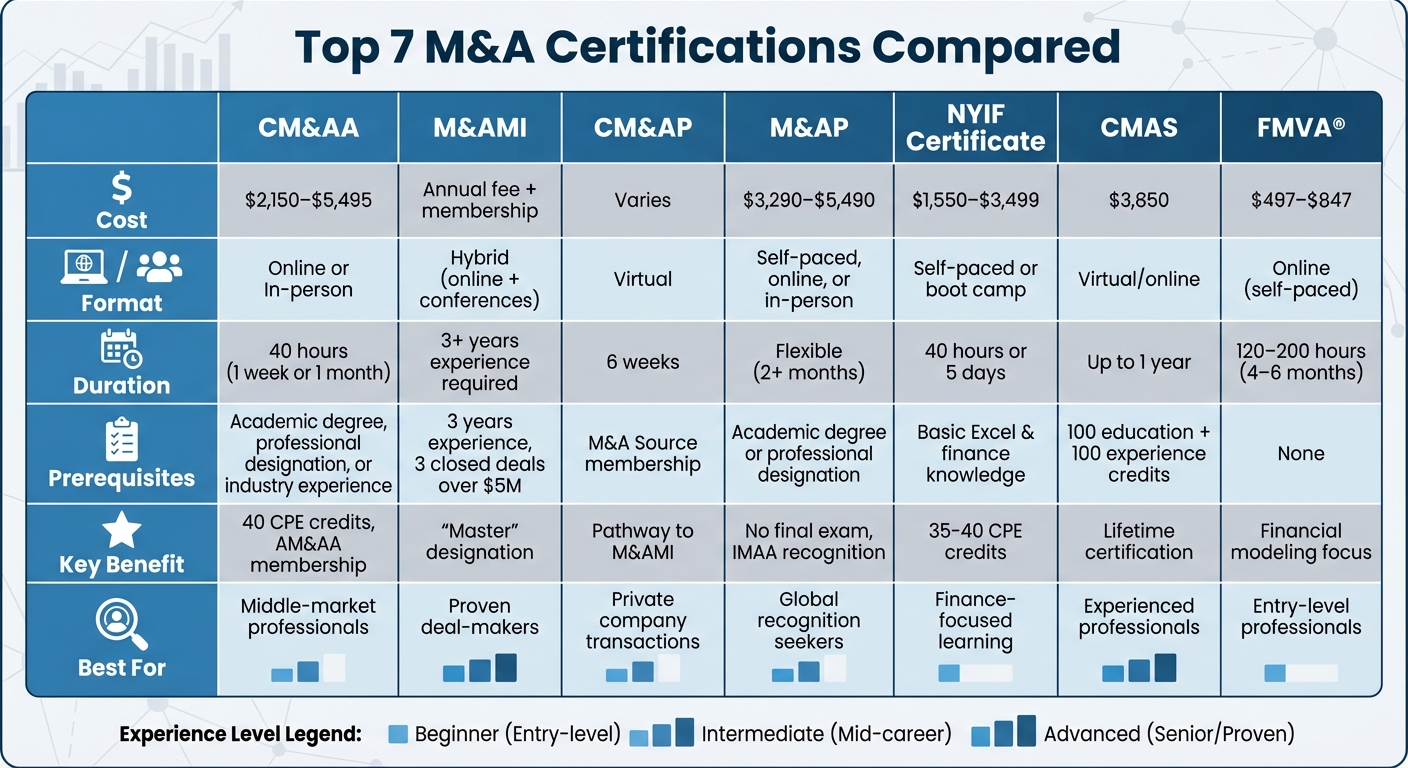

Certification Comparison Table

Find the M&A certification that suits your experience, budget, and schedule. Below is a quick-reference table summarizing key details, followed by highlights of what sets each credential apart.

| Certification | Cost | Format | Duration | Prerequisites | Key Benefits |

|---|---|---|---|---|---|

| CM&AA | $2,150–$5,495 | Online or In-person | 40 hours (1 week or 1 month) | Academic degree, professional designation, or industry experience | 40 CPE credits, AM&AA membership, middle-market focus |

| M&AMI | Annual fee + M&A Source membership | Experience-based coursework | 3+ years | 3 years full-time experience, 3 closed deals over $5 million each | "Master" designation, competitive edge in middle-market transactions |

| CM&AP | Varies | Virtual | 6 weeks | M&A Source membership | Pathway to M&AMI designation |

| M&AP | Varies | Self-paced, online, or in-person | Flexible | Academic degree or professional designation (e.g., CPA, CFA) | IMAA recognition, no final exam required |

| NYIF M&A Certificate | Varies | Online | Flexible | None | Practical, finance-focused curriculum |

| CMAS | $3,850 | Virtual/online | Up to 1 year | 100 education credits + 100 experience credits | Lifetime certification with no re-certification required |

| FMVA® | $497–$847 | Online (self-paced) | 120–200 hours (4–6 months) | None (preparatory courses included) | Entry-level focus on financial modeling skills at an accessible cost |

Conclusion

Selecting the right certification can play a pivotal role in shaping your career in M&A advisory. For those aiming to work on middle-market deals ranging from $5 million to $500 million, certifications like CM&AA and M&AMI align well with client expectations for demonstrated expertise. Entry-level professionals might find programs like FMVA or CMAS to be an ideal starting point, while seasoned advisors with multiple successful transactions may benefit most from experience-based credentials like the M&AMI.

The value of specialized certifications is widely recognized within the industry. As Gaurav Sharma, Associate Director at Standard Chartered Bank, puts it:

"M&A continues to be one of the most rewarding careers within investment banking but it’s also one of the hardest to break into. A lot of very smart people are vying for a small number of opportunities and you need every edge you can get your hands on".

These certifications not only validate your ability to navigate complex transactions but also signal your dedication and expertise to clients. Beyond the certification itself, many programs offer additional perks. Membership benefits from organizations like AM&AA or M&A Source often include access to deal-sourcing platforms and connections to a global network of M&A professionals, providing tools that can make an immediate difference in your career.

In a competitive and evolving M&A landscape, demonstrating both theoretical knowledge and practical skills is essential. Whether you’re just starting out or adding to a long list of closed deals, the right credential can solidify your position in the market. Align your choice of certification with your career goals, experience, and resources to take your expertise to the next level.

FAQs

What sets the CM&AA and M&AMI certifications apart for M&A professionals?

The CM&AA (Certified Mergers & Acquisitions Advisor) and M&AMI (Mergers & Acquisitions Master Intermediary) certifications serve different purposes and cater to varying levels of expertise within the M&A industry.

The CM&AA, offered by the Alliance of M&A Advisors (AM&AA), is designed to establish a solid understanding of M&A fundamentals. It’s a great option for professionals aiming to build their knowledge base and demonstrate a commitment to the field.

In contrast, the M&AMI, awarded by M&A Source, is a more advanced credential that emphasizes deep experience and specialized skills in M&A transactions. This designation is often seen as a higher-level achievement, requiring candidates to meet strict educational and professional benchmarks, along with ongoing education to maintain the certification.

Both designations hold value, but your choice should align with where you are in your career and what you aim to achieve in the M&A space.

Which M&A certification is best for my career stage?

Choosing the right M&A certification depends on where you are in your career and what you’re aiming to achieve. If you’re just starting out or transitioning into the mergers and acquisitions field, entry-level programs are a smart move. These typically cover the basics, like deal structuring, valuation, and negotiation – key skills to establish a strong foundation and build credibility early on.

For professionals with some experience who want to take on more complex deals or leadership roles, advanced certifications can be a game-changer. Programs like the Certified M&A Advisor (CM&AA) or Certified M&A Specialist (CMAS®) offer in-depth training and are widely respected in the industry. They’re a solid choice for sharpening your expertise and boosting your professional profile.

If you’re already a seasoned advisor or an industry leader, higher-level certifications may be the next step. Options like the M&AMI® or Certified Mergers & Acquisitions Professional (CM&AP) not only provide advanced education but also open doors to valuable networking opportunities and a prestigious credential. Choosing the right certification at the right time can help you align your skills with your career goals and make a lasting impact.

What are the key benefits of earning an M&A certification?

Earning an M&A certification does more than just add a title to your resume – it strengthens your professional reputation, demonstrates your dedication to industry standards, and helps you stand out in a crowded field. These certifications often require continuous learning and a commitment to best practices, keeping you up-to-date with the latest trends and strategies in mergers and acquisitions.

On top of that, certifications signal to clients and peers that you have advanced expertise, building trust and confidence in your abilities. Many certification programs also open doors to valuable networking events, exclusive resources, and tools designed to support your career growth and establish you as a leader in the M&A world.