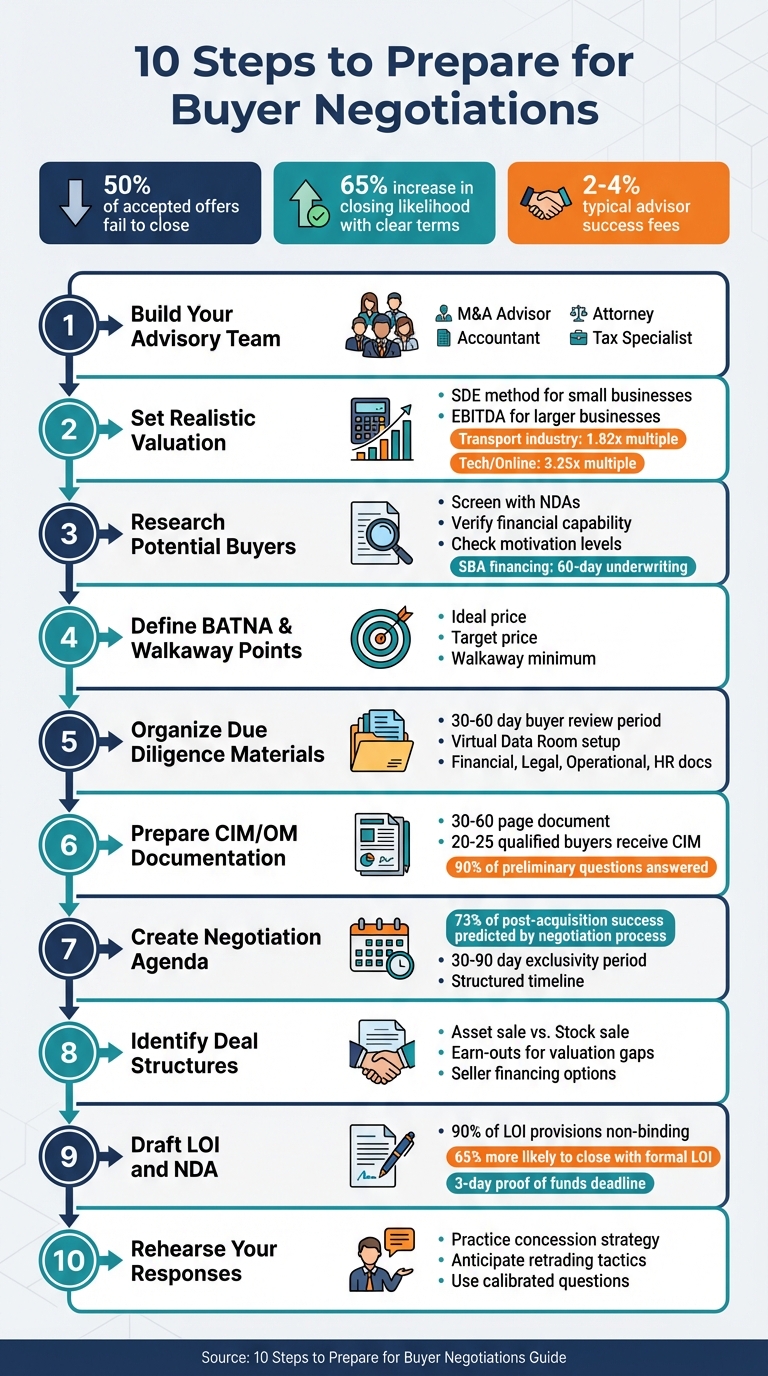

Selling your business? Preparation is your biggest advantage. Nearly 50% of accepted offers fail to close, often due to poor planning or incomplete documentation. But when you’re fully prepared, you can:

- Boost buyer confidence with well-organized records.

- Avoid price reductions by addressing issues early.

- Increase the likelihood of closing by 65% with clear terms.

This guide walks you through the 10 essential steps to maximize deal value and close successfully. From building the right advisory team to crafting a strong Letter of Intent, every step is designed to help you stay in control. Ready to get started? Let’s dive in.

10 Essential Steps to Prepare for Business Sale Negotiations

Easy Tips To Negotiate a Business Acquisition From a Pro – Jonathan Jay 2025

Step 1: Build Your Advisory Team

Selling a business can be complex, and having the right advisory team is crucial to navigating the legal, financial, and strategic hurdles while keeping negotiations on track and objective.

Your core team should include these key players: an M&A advisor to identify potential buyers and oversee the sale, an attorney to handle legal drafting and negotiations, an accountant to provide at least three years of audited financials, and a tax specialist to structure the deal in a way that optimizes tax outcomes.

When selecting advisors, look for those with experience in your specific industry and a proven track record in similar transactions. Whether they come from a large firm or a smaller, more nimble one, make sure they have the bandwidth to fully dedicate themselves to your deal. Paul Ormsby, Senior Vice President of Operations at STS Capital, highlights the importance of trust and experience:

"By focusing on factors such as trust, experience, and transparency, you can identify an advisor who will adeptly guide you through the complexities of the M&A process and facilitate a successful transaction".

Take the time to independently verify references by reviewing past transactions and speaking directly with their previous clients. It’s also important to confirm that your advisor can evaluate buyer financing early in the process. Success fees for advisors typically fall between 2% and 4% of the deal’s value. When negotiating, aim for a short "tail" period to ensure fees only apply when the advisor directly introduces the buyer.

Be cautious of advisors who promise overly high valuations just to win your business. As Piotrek Sosnowski, Chief People & Culture Officer at natu.care, puts it:

"M&A advisors need impeccable people skills. Without them, even the best financial understanding won’t be enough to make a deal successful".

A carefully chosen advisory team sets the stage for smooth negotiations and a successful sale.

Step 2: Set a Realistic Valuation and Asking Price

Once your advisory team is ready, the next move is determining what your business is truly worth. This isn’t about choosing a number that sounds good – it’s about using financial metrics, market data, and industry benchmarks to back up your asking price and attract serious buyers.

For smaller businesses, the Seller’s Discretionary Earnings (SDE) method is commonly used. SDE is calculated by taking your revenue, subtracting the cost of goods sold and operating expenses, and then adding back your salary and any personal expenses that aren’t essential to the business. Larger businesses typically use EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which highlights the business’s core operational performance. Keep in mind that earnings multiples differ across industries – transportation, for example, averages 1.82, while online and technology businesses often see multiples around 3.25.

Work with your accountant to "normalize" your financials by adjusting for non-recurring expenses, such as one-time legal fees or personal travel. This process helps present the business’s true earning potential to buyers. Additionally, prepare at least three years’ worth of key financial documents, including income statements, balance sheets, cash flow statements, and federal tax returns. As CFO Consultants, LLC explains:

"Earn-outs and contingent payments are inventive negotiation methods that can overcome valuation gaps when the buyer and seller have different opinions about the organization’s prospects".

To establish a solid valuation, combine multiple approaches: market comparables, income-based methods like Discounted Cash Flow (DCF), and asset-based evaluations. Once you’ve determined a realistic valuation range, define three price points: your ideal target, a realistic minimum, and a walkaway figure. This range keeps your expectations grounded in market realities while giving you room to negotiate. Finally, complete your preparation by gathering all supporting documents and ensuring your valuation is well-documented and defensible.

Step 3: Research Your Potential Buyers

Once you’ve set a realistic valuation, the next step is to thoroughly research potential buyers. This ensures that only serious and financially capable individuals or groups move forward in the negotiation process. Why is this so important? Because, as Jacob Orosz, President of Morgan & Westfield, points out, nearly 50% of accepted offers on businesses fail to close. Screening buyers early can save you from wasted time and the frustration of deals falling apart.

Start with a phased screening process that prioritizes confidentiality while gathering key details. Begin by having buyers sign a nondisclosure agreement (NDA) and provide a basic profile that outlines their background and intentions. Once a signed offer is in hand, take it a step further – ask for personal financial statements, bank records showing funds for the down payment, tax returns, and credit scores. As Orosz advises:

"Before you invest time and energy in negotiating with prospective buyers, you first want to establish that they are motivated and financially capable of purchasing your business".

This initial screening lays the groundwork for understanding buyer intentions and capabilities.

Watch for Telltale Signs of Motivation

Pay attention to how buyers behave during the early stages. Serious buyers tend to respond quickly to calls and emails and show genuine enthusiasm to move forward. On the flip side, overly critical or uncooperative buyers may lack commitment. A quick online search of their name, phone number, or email can also uncover their past deals, reputation, or any potential red flags.

Understanding a buyer’s motivation can also give you insight into their negotiation style. For example, individual buyers might be looking for a business to improve their income or lifestyle, while private equity groups are often driven by financial returns. These groups may even stretch out negotiations to wear you down. The types of documents buyers request during due diligence – like intellectual property records, licenses, or equipment inspections – can reveal their main concerns. Similarly, conditions tied to their offer, such as lease approvals or equipment checks, often highlight perceived risks.

Screening Outside Investors and SBA Buyers

If a buyer is working with outside investors, make sure those investors also sign NDAs and go through the same screening process. For situations where you’re staying on as a lease guarantor, it’s wise to vet the buyer as thoroughly as a bank would to reduce your risk of default.

Finally, if a buyer plans to use SBA financing, be aware that the underwriting process can take about 60 days. From there, closing typically happens two to four months after the Letter of Intent is accepted. Planning for these timelines can help you manage expectations and stay on track.

Step 4: Define Your BATNA, Target, and Walkaway Points

Before sitting down with any buyer, you need to have a clear understanding of your position. This starts with defining your BATNA – your Best Alternative to a Negotiated Agreement. In simple terms, your BATNA is your backup plan if the current deal doesn’t work out. It’s your safety net and a source of leverage during negotiations. As the Program on Negotiation at Harvard Law School explains:

"An awareness of your BATNA – particularly if it’s a strong one – can give you the confidence you need to walk away from a subpar agreement".

A strong BATNA empowers you to reject offers that don’t meet your standards or compromise your values. Once you’ve established your BATNA, it’s time to outline three key points to guide your strategy: your Ideal, Target, and Walkaway thresholds.

- Ideal: The price that would make you accept the deal without hesitation.

- Target: A market-driven value based on normalized EBITDA and comparable sales.

- Walkaway: The absolute minimum offer you’d accept.

Jacob Orosz, President of Morgan & Westfield, highlights the importance of maintaining a strong position:

"The key to positioning is wanting to sell but not having to sell. Avoid desperation at all costs".

This mindset ensures you stay focused on value rather than fear, preventing hasty decisions.

When setting your numbers, use precise, non-rounded figures (e.g., $1,255,000 instead of $1,200,000). This signals that your valuation is based on careful analysis and data. Also, keep in mind that the first price mentioned often shapes the entire negotiation. If the buyer’s offer falls short of your target, you can explore options like earn-outs, seller financing, or performance-based payments to bridge the gap.

Using a Comparison Table for BATNA

Negotiations can be emotionally draining, and it’s easy to lose sight of your goals under pressure. A comparison table can help you stay objective by mapping out different scenarios – optimistic, realistic, and pessimistic – and comparing them against your BATNA. This approach protects you from “deal fatigue,” which can lead to settling for unfavorable terms just to end the process.

| Scenario | Target Price (Ideal) | Minimum Acceptable (Bottom Line) | Stretch Goals / Terms | BATNA Comparison |

|---|---|---|---|---|

| Optimistic | Highest justifiable valuation based on market peaks | High-end of the acceptable range | All cash upfront; no transition period | Deal significantly exceeds the value of the best alternative |

| Realistic | Professional valuation or market average | Mid-range of the acceptable price | Standard earn-out; 6-month handover | Deal is moderately better than the best alternative |

| Pessimistic | Lowest price in the acceptable range | The absolute "Walk-away" number | Heavy seller financing; long-term commitment | Deal is equal to or slightly better than the BATNA; if lower, walk away |

This table serves as your anchor during negotiations. If the buyer’s offer drops below your walkaway point, it’s time to pivot to your BATNA – whether that means selling to another buyer, continuing to run the business, or exploring liquidation. Beyond price, the table also helps you identify other deal-breakers, like an overly long handover period or unfavorable earn-out terms, that could trigger your decision to walk away.

Step 5: Organize Your Due Diligence Materials

Once you’ve defined your negotiation limits, it’s time to get your supporting documents in order. These materials will back up your asking price and demonstrate the value of your business.

Buyers typically spend 30 to 60 days combing through your business during the due diligence phase. Missing or poorly organized information during this period can lead to price renegotiations – or worse, cause the deal to fall apart. As M&A Adage wisely puts it, "Time kills deals".

A well-structured Virtual Data Room (VDR) is key to keeping the process smooth and avoiding unnecessary delays or doubts. Start by organizing your documents into clear, logical categories:

- Financial: Include 3–5 years of audited profit and loss statements, tax returns, bank statements, and EBITDA recast schedules.

- Legal: Gather articles of incorporation, bylaws, intellectual property registrations, and any litigation history.

- Operational: Provide customer and supplier lists, marketing plans, and fixed asset inventories.

- HR: Compile employee rosters with salaries, benefit plans, and non-compete agreements.

This level of organization not only helps the due diligence process move forward efficiently but also reinforces the credibility of your valuation.

Address any potential issues before setting up your VDR. Clear up tax delinquencies, renew expired licenses, and resolve ledger discrepancies. If you spot red flags – like a high concentration of revenue from a single customer or ongoing litigation – create a mitigation plan to tackle these concerns upfront. This proactive approach builds trust and reduces the chances of buyers using these issues to negotiate a lower price.

To maintain consistency, assign a single person – such as your CFO or general counsel – to oversee document management and buyer communications. Use a secure VDR platform with features like read-only access, dynamic watermarking, and access logs to safeguard your sensitive data. And remember, never grant access without a signed NDA.

Your Confidential Information Memorandum (CIM) should align seamlessly with the data room’s contents. Every document in the VDR should support the narrative you’ve shared in the CIM, reinforcing your claims and helping to expedite the deal. A well-prepared, meticulously organized data room strengthens your position as buyers dive deeper into due diligence.

sbb-itb-798d089

Step 6: Prepare Your CIM or OM Documentation

Your Confidential Information Memorandum (CIM) or Offering Memorandum (OM) plays a central role in the sale process – it’s the key marketing document that connects a buyer’s initial interest to their decision to submit a Letter of Intent (LOI). As Doreen Morgan from Sunbelt Atlanta explains:

"A weak, confusing, or incomplete CIM halts the process, prompting buyers to move on."

This document lays the groundwork for everything that follows, from due diligence to negotiations.

When paired with a well-organized data room, a well-crafted CIM can address nearly 90% of a buyer’s preliminary questions. It should include an executive summary that emphasizes your earnings potential and competitive edge, alongside detailed sections on your products and services, market analysis, management team bios, and realistic, data-backed growth opportunities. Avoid overly rosy projections – they can backfire. If there are challenges, such as customer concentration or pending litigation, it’s best to acknowledge them upfront and outline mitigation plans. Transparency now can save you from surprises during due diligence that could lead to price reductions.

The presentation of your CIM also matters. Typos, poor formatting, or inconsistent data can erode buyer confidence. Out of 50 interested buyers, only 20 to 25 will qualify to receive your CIM after signing an NDA. Don’t risk losing those qualified buyers with documentation that looks unprofessional.

Creating a polished, 30–60 page CIM takes both time and expertise. That’s where services like Deal Memo come in (https://dealmemo.com). They offer white-labeled CIM and OM writing solutions designed for M&A professionals, delivering drafts within 72 hours and allowing unlimited revisions. Their service also includes seller interviews and data room setup, ensuring your documentation is thorough and presentation-ready.

Step 7: Create a Negotiation Agenda and Timeline

Walking into a buyer meeting without a clear plan is like setting off on a road trip without a map – it wastes time, causes confusion, and can derail the entire process. To avoid this, start by negotiating the process itself. This means agreeing on things like how often meetings will happen, who will attend, and the order of discussion topics – before diving into price or deal structure. As the Program on Negotiation at Harvard Law School advises:

"Don’t assume you and your counterpart share the same expectations about how negotiations will unfold. Instead, negotiate the process before negotiating substance."

Each meeting should have a specific goal and a solid opening strategy. Begin by presenting your company’s background, key operations, and the factors driving its value, such as growth opportunities and financial highlights that support your valuation. Avoid rushing into price discussions too early, as this can sidetrack the conversation and overshadow the broader value of your business. End every meeting with clear, actionable next steps, like scheduling follow-up calls or setting deadlines for document submissions.

A realistic timeline is more than just a tool for staying organized – it’s a way to maintain your leverage. Some buyers intentionally drag out negotiations to wear you down and push for lower terms. In fact, about 50% of accepted offers never make it to the closing table, often due to delays that sap momentum or uncover problems during extended timelines. To counter this, set a short exclusivity period – 30 to 90 days – to encourage quick due diligence and avoid being locked into a drawn-out process. A structured timeline can help keep things on track: dedicate weeks 1–2 to financial reviews, week 3 to management meetings, and weeks 4–5 to customer and vendor verifications.

Taking control of the agenda from the start sets the tone for the entire negotiation. Theodore E. Guth, Partner at Manatt, Phelps & Phillips LLP, puts it this way:

"Agendas matter; get your interests on the table in a way that accelerates the process, enhances the outcome and minimizes disruptions and delays."

It’s worth noting that the way negotiations are handled predicts 73% of post-acquisition success. By sticking to a structured agenda and timeline, you not only build trust but also pave the way for a smoother closing process.

Step 8: Identify Your Preferred Deal Structures

Now that you’ve outlined your negotiation agenda, it’s time to decide on the deal structure that best suits your needs and maximizes your preparation efforts.

The structure of a deal plays a major role in determining risk allocation, tax implications, and how quickly the transaction can be finalized. Before sitting down with potential buyers, it’s crucial to understand which structure aligns with your goals. As Jacob Orosz, President of Morgan & Westfield, notes:

"The more assurances you’re willing to provide the buyer, the lower their risk and the higher the purchase price they can potentially pay – and vice versa."

The two most common deal structures are asset sales and stock sales. In an asset sale, the buyer selects specific assets to purchase while leaving out liabilities. This approach minimizes risk for the buyer but often results in higher tax obligations for the seller. Additionally, it may require renegotiating contracts and transferring titles, adding complexity. On the other hand, a stock sale involves the buyer acquiring the entire legal entity, including all its assets and liabilities. This structure is generally quicker and offers tax advantages for the seller, particularly through capital gains treatment, but it transfers all liabilities to the buyer. Both structures can also be used creatively to address valuation gaps.

If there’s a mismatch between your valuation expectations and the buyer’s offer, tools like earn-outs can help bridge the gap. With an earn-out, part of the purchase price is contingent on the business meeting specific performance goals after the sale. This aligns the interests of both parties and can build trust. Another option is seller financing, where you accept a promissory note for part of the purchase price. This approach not only demonstrates your confidence in the business but also helps buyers secure funding and navigate financial hurdles.

BizBuySell sums it up well:

"Making an owner keep some ‘skin in the game’ means it’s in their best interest to pass on a business to you that’s in tip-top condition."

As you finalize your deal structure, establish clear boundaries. Define minimum cash requirements at closing and set limits on the maximum allowable debt service. If you’re countering a lower offer, consider requesting more upfront cash or shortening the earn-out period. Always communicate any concessions explicitly – small adjustments in the buyer’s favor can encourage them to compromise on larger points. By aligning your deal structure with your negotiation strategy, you can maintain leverage and protect your interests effectively.

Step 9: Draft Key Agreements like LOI and NDA

Before diving into serious negotiations, it’s essential to have two critical documents ready: the Non-Disclosure Agreement (NDA) and the Letter of Intent (LOI). These agreements play a vital role in protecting your interests and setting clear expectations for the deal process.

Start with the NDA before sharing any sensitive information. This document should clearly define what constitutes confidential data and include clauses like a no-hire provision to safeguard your key employees. As Jacob Orosz, President of Morgan & Westfield, wisely notes:

"A confidentiality agreement is not bulletproof. You should avoid sharing some sensitive information during the due diligence process even if you have a signed confidentiality agreement in place, especially if the buyer is a direct competitor".

To mitigate risks, release information in stages and reserve the most sensitive details for the final due diligence phase.

Once your confidential data is protected, shift your attention to the LOI, which solidifies the buyer’s commitment. The LOI is a key document in negotiations, even though about 90% of its provisions are non-binding. However, sections like exclusivity, confidentiality, and expense provisions are legally enforceable. Mark G. Metzler, Director at Kreischer Miller, offers this insight:

"The highest price that the seller will be offered is in the LOI. After the LOI is signed, the buyer constantly chips away at the offering price, as the seller has lost its leverage".

To avoid retrading – when buyers attempt to renegotiate for a lower price – be as specific as possible in your LOI. Define critical elements like working capital calculations and set firm deadlines for proof of funds (typically within 3 days) and financing commitments (usually within 45 days). Additionally, outline the transaction structure, total purchase price, payment terms, and detailed asset allocation. Including a firm expiration date for the LOI and exclusivity period helps prevent unnecessary delays. Requiring earnest money to be held in escrow further demonstrates the buyer’s seriousness about closing the deal. Interestingly, deals that formalize terms in an LOI are 65% more likely to reach a final closing.

Step 10: Develop Strategies and Rehearse Your Responses

Once you’ve outlined your negotiation framework, the next step is to sharpen your strategic responses. The way you position yourself in negotiations often has a greater impact than any advanced tactics you might employ. As Jacob Orosz, President of Morgan & Westfield, puts it:

"The key to negotiating is positioning… The key to positioning is wanting to sell but not having to sell".

This principle should serve as the foundation for your strategy.

Plan Your Concessions in Advance

Before negotiations even begin, map out your concession strategy. Focus on identifying concessions that are low-cost to you but offer meaningful value to the buyer. For instance, you might offer transition services or a more flexible handover schedule. The golden rule? Never give something away without securing something in return. Use phrases like, "If you… then I…" to ensure a balanced exchange. For example, if a buyer requests a longer handover period, you could say: "If you need me for 12 months instead of 6, then I’ll need the purchase price paid upfront rather than in installments."

With this framework in place, prepare for the tactics buyers often use to gain leverage.

Anticipate Buyer Tactics and Prepare Responses

Sophisticated buyers may employ strategies like retrading – lowering their offer just before the deal closes. Chris Voss, a former FBI hostage negotiator, explains:

"Two days before close, they’ll call and say: ‘We found a few issues. Now it’s $7.5 million, not $10 million.’ They assume your emotional commitment will prevent you from walking away".

To counter such moves, keep relationships with backup buyers active and include penalties in the Letter of Intent (LOI) for any last-minute changes. This safeguards your position and ensures you’re not caught off guard.

Practice Tactical Empathy and Calibrated Questions

During team rehearsals, focus on using tactical empathy and calibrated questions to handle difficult scenarios. When faced with unreasonable demands, try asking, "How am I supposed to do that?" This encourages collaboration without immediately conceding. If a buyer pushes back on your handover timeline, acknowledge their concerns and respond with a question like, "It sounds like you’re worried about continuity. How can we ensure a smooth transition in 6 months?" This approach validates their perspective while keeping the terms favorable to you.

Rehearse and Refine with Your Team

Rehearsals are essential to building confidence and identifying weak spots in your preparation. Role-play challenging scenarios, such as objections to valuation, customer concentration, or operational risks. Practice using strategic silence – pausing during negotiations can often prompt buyers to reveal their true priorities. Collaborate with your lawyers, accountants, and brokers to ensure everyone is aligned and presenting a consistent message.

It’s worth noting that nearly 50% of accepted offers for business sales fail to reach the closing table. By anticipating challenges, refining your strategies, and rehearsing thoroughly, you’ll be better equipped to navigate negotiations and bring your deal to a successful close.

Conclusion

Achieving successful buyer negotiations starts with careful and strategic preparation. The 10 steps outlined in this guide offer a practical roadmap for business brokers and M&A advisors to approach negotiations with confidence and control. From assembling a reliable advisory team to practicing your responses, each step builds on the previous one, creating a structured approach that protects your client’s interests while maximizing deal value.

Thorough preparation, as highlighted in the 10 steps, helps eliminate unexpected challenges that can derail a transaction. By conducting pre-sale due diligence, organizing essential documentation, and setting clear boundaries before negotiations begin, you create a strong foundation for success. As Wendy G. Marcari of Epstein Becker Green aptly states:

"The decisions you make and actions you take before initiating a sale process often determine how successful the outcome will be".

This level of preparation doesn’t just minimize risks – it also enhances your credibility throughout the sale process.

A well-prepared Confidential Information Memorandum (CIM) plays a key role in this process. It informs potential buyers, sets the tone for the narrative, addresses concerns proactively, and builds trust. For professionals needing fast, high-quality documentation, Deal Memo offers white-labeled CIMs and Offering Memorandums delivered within 72 hours. This ensures your clients are represented professionally and keeps the process moving forward seamlessly.

FAQs

What are the main reasons business sale negotiations fail?

Business sale negotiations often hit roadblocks because of inadequate preparation and unrealistic expectations. Buyers tend to lose confidence when they uncover missing or inconsistent financial records, operational weak points, or a heavy reliance on the owner for day-to-day operations. These issues usually come to light during due diligence and can bring the deal to a grinding halt.

From the seller’s perspective, overpricing the business or expecting an unattainable financial outcome can create a gap that’s tough to close. Additionally, hidden issues like undisclosed liabilities or incomplete paperwork can damage trust, even if the business itself is solid.

To sidestep these challenges, make sure all documentation is thorough and accurate, set reasonable valuation goals, and address operational dependencies ahead of time. Tools like Deal Memo can simplify this process by offering clear, buyer-focused Confidential Information Memorandums (CIMs) and Offering Memorandums (OMs) designed to highlight your business in the best possible way.

What’s the best way to screen potential buyers for my business?

Screening potential buyers begins with establishing clear qualification standards. Outline financial benchmarks, such as minimum cash reserves or verified funding sources, and ensure the buyer has relevant industry experience that aligns with your business objectives. A short questionnaire can help confirm their financial capacity and intent. Additionally, always require a signed nondisclosure agreement (NDA) before sharing any sensitive information.

Follow this up with interviews – whether in person or virtual – to dig deeper into their motivations, management style, and long-term vision for the business. Ask about their past acquisition experience, how they plan to lead the company, and their overall goals. Be thorough when reviewing their financials, requesting audited statements and proof of funds. Stay alert for warning signs such as incomplete due diligence or buyers pushing for rushed timelines.

Once a buyer meets these qualifications, you can move forward by sharing your Confidential Information Memorandum (CIM). Need a polished CIM in a hurry? Deal Memo offers tailored, on-demand solutions to create professional, secure documents quickly and efficiently.

What key elements should a strong Confidential Information Memorandum (CIM) include?

A strong Confidential Information Memorandum (CIM) serves as a focused yet detailed document designed to give qualified buyers an in-depth understanding of a business opportunity. It usually begins with an Executive Summary, which outlines the company’s business model, financial performance, market standing, and growth prospects. This section helps buyers quickly grasp the essence of the opportunity.

Key components of the CIM include sections on the company’s history, an analysis of the industry, operational insights, financial statements, and future projections. The document should be well-structured, professionally crafted, and ensure confidentiality while presenting all the critical details buyers need to make an informed evaluation.