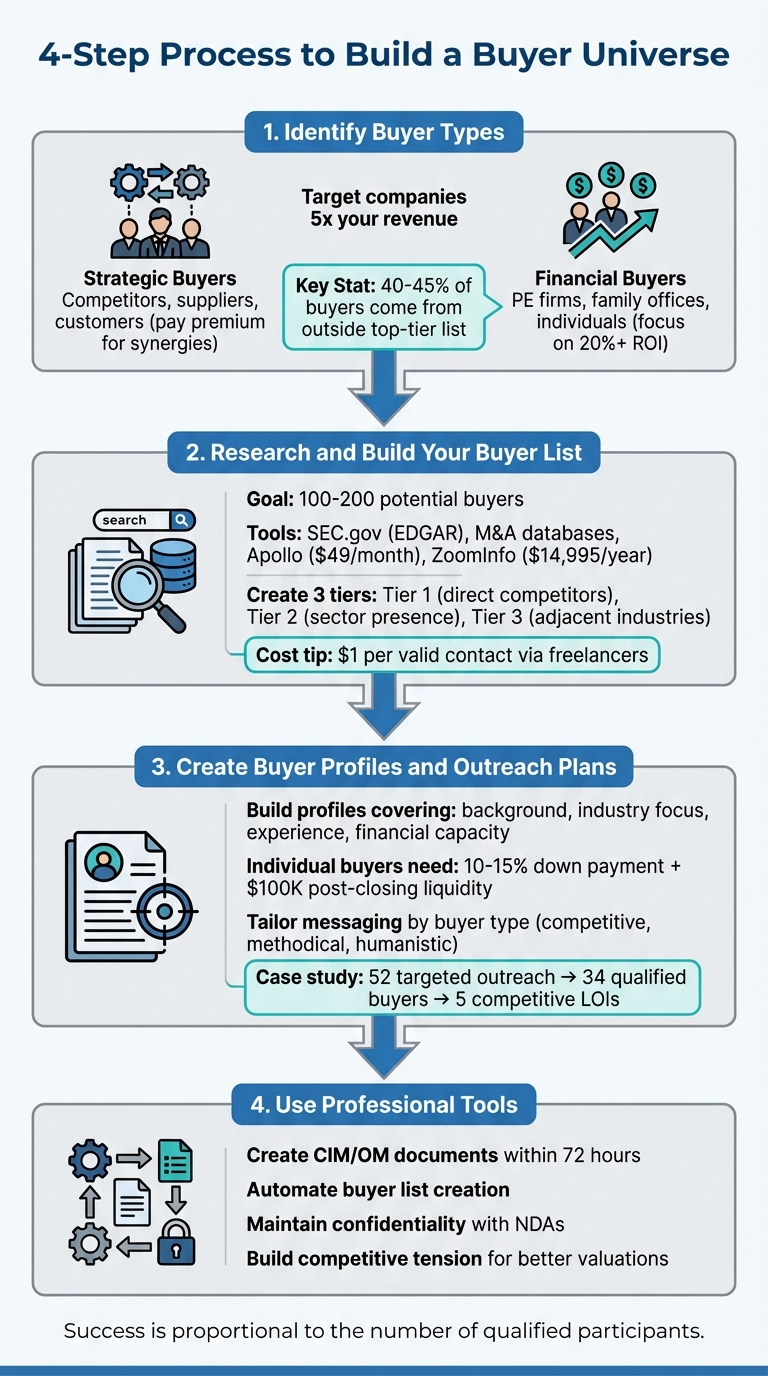

When selling a business, creating a buyer universe – a curated list of potential buyers – is critical for achieving the best possible outcome. This process involves identifying and prioritizing buyers, fostering competition, and leveraging tools to streamline outreach. Here’s a quick breakdown:

- Why It Matters: A well-researched buyer list increases competition, improves negotiations, and can significantly impact the sale price. In some cases, 40–45% of successful sales come from unexpected buyers outside the top-tier list.

- Types of Buyers: Buyers fall into two main categories:

- Strategic Buyers: Competitors or related businesses seeking synergies, often willing to pay a premium.

- Financial Buyers: Private equity firms, family offices, or individuals focused on ROI, often requiring seller involvement post-sale.

- Building the List: Aim for 100–200 potential buyers using tools like public records, M&A databases, and professional networks.

- Outreach Strategy: Tailor communication to buyer types, use NDAs for confidentiality, and provide detailed profiles to keep buyers engaged.

4-Step Process to Build a Buyer Universe for Business Sales

Step 1: Identify Buyer Types

When selling a business, it’s crucial to pinpoint potential buyers and classify them into two main categories: strategic buyers and financial buyers. Each group has its own goals, financial capabilities, and expectations for your involvement after the sale. Understanding their motivations is key to tailoring your approach and ensuring effective communication.

Strategic Buyers

Strategic buyers are typically businesses operating in your industry or related sectors. These can include competitors, suppliers, customers, or companies in adjacent markets. Their primary goal is to create synergies, often through horizontal integration (acquiring competitors) or vertical integration (acquiring supply chain partners). For instance, a regional HVAC company might acquire a competitor to expand its service area, while a manufacturer might purchase a supplier to lock in pricing advantages.

When targeting strategic buyers, focus on companies that are approximately five times your revenue. This size ensures they have the financial capacity to acquire your business and can also benefit significantly from the acquisition. Strategic buyers often pay a premium because they can immediately integrate your business’s revenue, customers, or intellectual property into their operations. As Brian Dukes, CEO of Exitwise, explains:

"Strategic buyers are willing to pay more for your business because they know it will add value to their existing businesses".

To maintain confidentiality, use blind listings when reaching out to potential strategic buyers. These listings conceal identifying details until a nondisclosure agreement (NDA) is signed, protecting sensitive information in case the deal doesn’t go through.

Financial Buyers

Financial buyers include private equity firms, family offices, hedge funds, and individual investors. Unlike strategic buyers, their focus is on achieving strong financial returns, typically aiming for ROI and internal rates of return (IRR) above 20%.

Private equity firms often operate under a "2 and 20" fee structure, targeting either platform acquisitions (businesses that can serve as a foundation for growth) or add-on acquisitions (smaller businesses that complement an existing platform). Most private equity firms look for businesses with a minimum EBITDA of $1.2 million.

Individual buyers, on the other hand, often rely on SBA 7(a) loans, which require a 15% down payment and approximately $100,000 in post-closing liquidity. These buyers typically avoid deals exceeding $700,000.

A key difference between financial and strategic buyers is post-sale involvement. Financial buyers often require the seller or management to stay on for a period, while strategic buyers are more likely to allow a complete exit.

| Feature | Strategic Buyers | Financial Buyers |

|---|---|---|

| Primary Goal | Synergies and market expansion | ROI and IRR (20%+ targets) |

| Typical Identity | Competitors, suppliers, customers | PE firms, family offices, hedge funds, individual investors |

| Valuation Approach | Premium for strategic fit | Based on forecasted returns and entry price |

| Post-Sale Role | Usually full exit for seller | Often requires seller/management to stay |

| Integration Style | Full operational integration | Managed as a portfolio asset with growth focus |

There’s also a hybrid category known as quasi-strategic sponsors. These are financial buyers who already own a related business in their portfolio. They combine the benefits of strategic buyers – such as paying premiums for synergies – with the financial discipline and resources of institutional investors.

Step 2: Research and Build Your Buyer List

After pinpointing the types of buyers you’re aiming for, the next move is to compile a solid list of potential prospects. To increase your odds of finding the right buyer and securing competitive offers, you’ll need a buyer list with 100 to 200 names.

Use Tools and Networks

Creating a buyer list means tapping into a variety of data sources. Start with public records like SEC.gov (EDGAR), where you can find 10-K annual reports and investor presentations from publicly traded companies. These documents can help you identify key players and competitors in your industry. For private equity firms and family offices, turn to M&A-specific databases like PrivateEquityInfo.com and Axial, which provide insights into recent deal activity and acquisition criteria.

If you need direct contact information, platforms like Apollo (starting at $49/month) and ZoomInfo (from $14,995/year) offer verified details for decision-makers. On a tighter budget? Consider hiring freelancers on sites like Upwork or Fiverr. Many researchers charge around $1 per valid name and contact information.

Don’t forget to leverage your professional networks. Local business brokers who’ve recently sold similar businesses can be a goldmine – they often keep a "runner-up" list of buyers who missed out on previous deals. Additionally, industry trade associations may connect you with members actively seeking acquisitions.

Once your list is ready, the next step is to evaluate and prioritize these potential buyers for a more focused outreach strategy.

Analyze Buyer Profiles

To streamline your efforts, categorize prospects into three tiers:

- Tier 1: Direct competitors or firms with relevant portfolio companies.

- Tier 2: Firms with a presence in your sector looking to grow.

- Tier 3: Less obvious candidates in adjacent industries.

Interestingly, 40% to 45% of the time, the final buyer comes from outside the "top tier" of expected candidates. So, keep an open mind and don’t dismiss lower-tier prospects too quickly.

When assessing buyers, make sure they have the financial capacity to proceed. A good rule of thumb is to target companies at least three times the size of your own, as most buyers focus on acquisitions that represent 5% to 20% of their company size. For private equity firms, verify they have committed capital. Also, prioritize buyers with a track record of successful acquisitions. As Jacob Orosz, President of Morgan & Westfield, puts it:

"The success of any auction is directly proportional to the number of qualified participants."

Finally, within larger corporations, seek out internal champions – the division managers who stand to benefit most from the acquisition. This targeted approach can significantly boost your chances of generating serious interest and accelerating discussions.

Step 3: Create Buyer Profiles and Outreach Plans

Now that you have a tiered buyer list, the next step is turning it into actionable insights. Using buyer personas can boost conversion rates by up to 73%.

Build Detailed Buyer Profiles

A strong buyer profile should cover four essential aspects: background (including acquisition timeline), industry focus and goals, relevant experience, and financial capacity. Segment these profiles into categories – Individual, Strategic, or Financial – since each group has unique motivations and qualifications [6,11].

For individual buyers, consider factors like their willingness to relocate and experience in on-site management. Many individual buyers using SBA 7(a) loans typically need to provide a 10% to 15% equity injection as a down payment. Ensure they have at least $100,000 in post-closing liquidity to cover working capital needs.

When crafting strategic buyer profiles, focus on synergies – how your business aligns with their existing products, customer base, or distribution network. As Brian Dukes, Founder of Exitwise, puts it:

"Strategic buyers are willing to pay more for your business because they know it will add value to their existing businesses".

Research their recent acquisitions and identify key internal stakeholders, like division managers, who would benefit from the deal [4,7].

For financial buyers, such as private equity firms or family offices, assess their investment timeline (usually 5–7 years), available capital, and whether they’re pursuing "platform" or "add-on" acquisitions [6,15]. Don’t overlook softer elements like alignment on values and the buyer’s vision for post-purchase integration – these factors can ensure smoother transitions and employee retention [3,11].

Once you’ve built these profiles, shift your focus to creating outreach strategies tailored to each buyer type.

Develop Custom Outreach Plans

Effective outreach respects the buyer’s interests and builds competitive tension, which is key to maximizing sale value. Keep your messaging buyer-focused: reference a recent acquisition or milestone they’ve achieved, and explain how your business complements their strategy. Dan Mahoney, CEO of TruSight, emphasizes this approach:

"In modern digital relationship development, it is vital to respect everyone by ensuring your messaging and deal development communications are sent to buyers where the data indicates a strong potential for interest in the opportunity. Otherwise, you are wasting people’s time".

For larger organizations, target individuals with "M&A" or "Corporate Development" titles. In smaller companies, direct your outreach to the CEO, CFO, or COO.

Tailor your approach based on buyer type. Competitive buyers (logical and quick decision-makers) respond well to case studies and clear-cut advantages. Methodical buyers (logical but slower to act) need detailed data to make decisions. Humanistic buyers (emotion-driven and deliberate) appreciate insights into your company’s mission and values [19,21].

Once a buyer signs an NDA, send them a Confidential Information Memorandum (CIM) right away. For instance, in November 2022, the M&A firm MidStreet conducted a sale process where targeted outreach to 52 strategic and private equity acquirers – out of 170 general inquiries – resulted in 34 qualified buyers and 5 competitive Letters of Intent (LOIs).

Branded materials can help establish trust and demonstrate professionalism. Services like Deal Memo can create custom CIMs and Offering Memorandums (OMs) within 72 hours, complete with your branding. This not only captures buyer interest but also safeguards confidentiality and simplifies the engagement process. Follow up with a phone call and a second email within a week to keep the momentum going.

sbb-itb-798d089

Step 4: Use Deal Memo for Buyer Universe Solutions

After laying the groundwork for identifying and reaching out to buyers, Deal Memo steps in to refine the process with its document creation and list automation tools. Building a comprehensive buyer universe can be a major challenge for many M&A advisors due to the significant time and resources required. As Axial points out:

"Building a top-notch buyer list can single-handedly help one investment bank win a deal over another".

Advisors often juggle multiple responsibilities, including managing buyer inquiries, reviewing IOIs and LOIs, vetting capital sources, and maintaining client relationships.

How Deal Memo Helps

Deal Memo tackles these challenges head-on by delivering professionally prepared CIMs and OMs in just 72 hours. It includes unlimited revisions, conducts seller interviews to capture the business’s story, and offers full branding customization. These high-quality documents are essential during the vetting stage, helping buyers quickly determine if a business aligns with their objectives.

Well-crafted CIMs and detailed buyer profiles do more than just inform – they build trust with sellers and show a serious commitment to the process. This level of professionalism is often critical for gaining access to sensitive financial data. Additionally, Deal Memo customizes its materials to cater to the unique priorities of strategic buyers versus financial buyers, ensuring the messaging resonates with their goals.

These polished documents seamlessly feed into the next step: creating an effective buyer list.

Making Buyer List Creation Easier

Beyond document creation, Deal Memo simplifies the process of building a buyer list. By automating this step, it removes the need to manually sift through large commercial databases. This automation is especially valuable given the strong link between the size of a buyer list and the level of initial interest. Interestingly, studies show that 40% to 45% of the time, the final buyer comes from outside the advisor’s initial top-tier list.

With Deal Memo, advisors can save time, improve efficiency, and expand the potential pool of buyers – all while maintaining a high standard of professionalism.

Conclusion

Building a strong buyer universe involves a series of deliberate steps that work together to increase the likelihood of securing an ideal deal. It starts with identifying the right types of buyers – whether they are strategic buyers looking for synergies or financial buyers focused on investment returns. Next, compile a comprehensive list of 100 to 200 potential buyers to create competitive tension, which can help push valuations higher. As Axial points out, "The best buyer isn’t always the most obvious". In fact, 40% to 45% of successful buyers often come from outside the initial top-tier list, making it crucial to cast a wide net.

Once your buyer list is in place, the next step is effective profiling and screening. Creating detailed buyer profiles and conducting early financial screenings ensures you focus on qualified prospects. For example, in a case from November 2022, 170 inquiries were narrowed down to 34 qualified buyers, resulting in 5 competitive Letters of Intent. This kind of focused approach saves time and increases the chances of finding the right match.

Tools like Deal Memo simplify the process further by delivering professional Confidential Information Memorandums (CIMs) and Offering Memorandums (OMs) within 72 hours, while also automating the creation of buyer lists. This eliminates manual work without compromising the professionalism needed to build trust between sellers and buyers.

Ultimately, a well-crafted buyer universe fosters competitive tension and helps achieve the best possible market value. As Jacob Orosz, President of Morgan & Westfield, states, "The success of any auction is directly proportional to the number of qualified participants". By combining thorough research, strategic outreach, and professional tools, you set the stage to connect with the right buyer at the right price, maximizing the value of your business sale.

FAQs

How can I find and prioritize the right buyers for my business?

To identify and prioritize the best buyers for your business, start by building a buyer profile that clearly defines your ideal candidate. Think about factors like their experience in the industry, their financial resources, and their motivation for making the purchase. This approach ensures your efforts are directed toward serious prospects who are more likely to see the deal through.

Once your profile is ready, take proactive steps to reach out to potential buyers. These might include competitors, suppliers, or businesses in related fields that could see strategic value in acquiring your company. By actively seeking out candidates instead of waiting for them to approach you, you’ll increase your chances of connecting with the right people.

The final step is to carefully screen and prioritize buyers. Confirm their financial capabilities, evaluate their experience, and get a clear understanding of their goals. This methodical process not only helps narrow down your options but also improves the likelihood of securing a successful sale.

What is the difference between strategic buyers and financial buyers when selling a business?

Strategic buyers are businesses operating within the same or a related industry, aiming to acquire companies that align with their broader goals. Their focus is often on creating synergies – whether that means increasing market share, breaking into new markets, or enhancing their product lineup. Because these acquisitions tie directly into their long-term objectives, strategic buyers are often willing to pay a premium for the right fit.

On the flip side, financial buyers, like private equity firms, prioritize investment returns. Their main goal is to improve the business’s operations, scale it effectively, and eventually sell it for a profit. Unlike strategic buyers, they’re less concerned with integrating the business into their existing operations and more focused on driving up its value over time.

Recognizing these distinct motivations can help you craft your outreach and negotiation strategies to attract the type of buyer that best matches your business goals.

What are the best ways to build a buyer list when selling a business?

Building a strong list of potential buyers is essential when preparing to sell your business. Start by conducting thorough market research to identify likely candidates, and develop detailed profiles for each. Pay attention to groups like private equity firms, strategic buyers, and local competitors – these are often the most interested and aligned with your business’s goals.

To stay organized, consider using tools like CRM systems to manage and track your prospects. Expand your network by tapping into professional connections, attending industry events, and utilizing market research platforms. When reaching out, make it personal – customized emails or calls can go a long way in capturing a buyer’s attention. By blending these approaches, you’ll build a focused list of qualified buyers, increasing your chances of a successful sale.