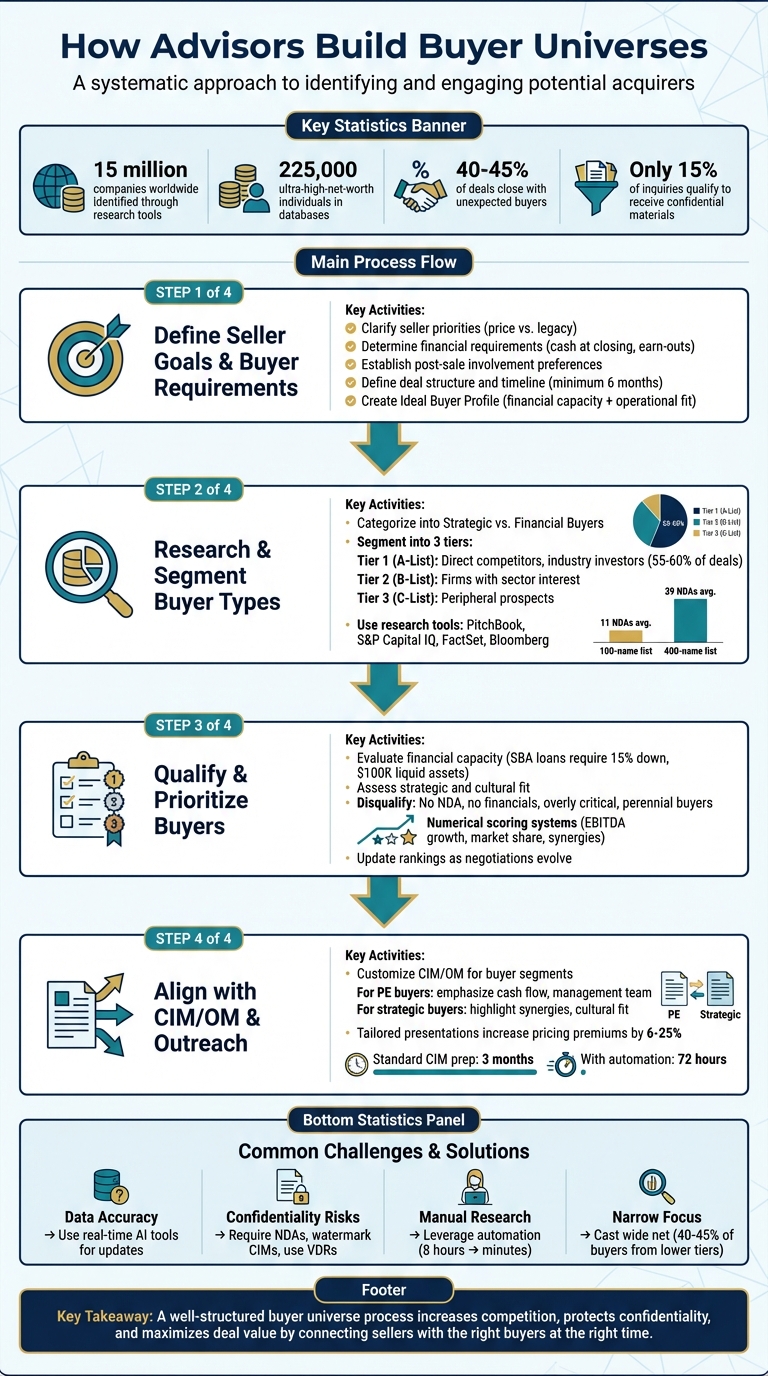

A buyer universe is the complete list of potential acquirers for a business, including private equity firms, strategic investors, family offices, and individuals. For M&A advisors, building this list is critical to closing successful deals. The process focuses on aligning the seller’s priorities – like financial goals, legacy preservation, or growth – with buyers who share similar objectives.

Key insights:

- The right buyer isn’t always the highest bidder. Sellers often prioritize factors like company culture, smooth transitions, or local job security.

- Advisors use tools like PitchBook and S&P Capital IQ to identify up to 15 million companies worldwide and 225,000 ultra-high-net-worth individuals.

- Casting a wide net increases competition, with 40%-45% of deals closing with unexpected buyers.

- Steps include defining seller goals, profiling buyers, segmenting them into tiers, and qualifying them based on financial and strategic fit.

- Tailored marketing materials, like Confidential Information Memorandums (CIMs), help attract serious buyers and boost deal value.

4-Step Process for Building a Buyer Universe in M&A Transactions

Step 1: Define Seller Goals and Buyer Requirements

Clarify Seller Goals

The first step in any successful business sale is setting clear objectives. Advisors play a crucial role in helping sellers decide whether their top priority is maximizing the sale price or preserving their legacy. For some, the focus may be securing a specific dollar amount – often referred to as their "number" – to fund retirement or launch their next venture. Others may place greater importance on keeping the company name intact or safeguarding local jobs.

Key topics to address include the desired asking price, how much cash is needed at closing, and the seller’s willingness to consider earn-outs or seller financing. Additionally, sellers should clarify their post-sale involvement – whether they want to exit immediately or retain a stake to participate in future growth. Axial emphasizes this point:

"Exiting your business successfully means securing a deal that aligns with your future goals".

It’s also essential to discuss deal structure, timeline, and non-compete terms early in the process. Most deals take at least six months to close, and once a Letter of Intent is signed, exclusivity agreements typically range from 30 to 120 days. To avoid setbacks, advisors should test the seller’s goals against market conditions and recent industry transactions. This ensures expectations remain realistic and achievable.

With seller goals clearly defined, the next step is to build a detailed buyer profile.

Determine Key Buyer Characteristics

After establishing the seller’s objectives, advisors shift their focus to identifying the right buyer by crafting an Ideal Buyer Profile. This profile evaluates both financial capacity and operational fit. Financially, it includes metrics like liquid assets, total net worth, and the ability to meet equity requirements – such as the SBA’s standard 10% equity injection for acquisitions. Operationally, it considers factors like relevant industry experience, necessary licenses, and a proven history in management or business integration.

Beyond finances and experience, alignment on strategy and values is often the deciding factor in a deal’s success. Advisors assess whether a buyer’s vision for the company, plans for employees, and corporate culture align with the seller’s priorities. These considerations tie directly back to the goals established earlier. Serious buyers typically exhibit clear motivation through actions like timely responses, having a well-defined acquisition timeline, and assembling a strong support team (e.g., attorneys, accountants). As the BizBuySell Team explains:

"A well-crafted buyer profile helps sellers spot serious prospects while giving buyers a competitive edge in today’s business-for-marketplace".

Building an Acquisition Universe: Moments from Paul’s M&A Masterclass

Step 2: Research and Segment Buyer Types

After defining the ideal buyer profile, the next step is to create a detailed list of potential acquirers and organize them into a structured framework. This involves grouping buyers by type, examining their industry focus, and reviewing their acquisition history. This segmentation lays the groundwork for categorizing buyers into distinct groups.

Categorize Buyer Types

Advisors generally classify potential buyers into two main groups: Strategic Buyers and Financial Buyers. Strategic buyers – such as competitors, customers, or suppliers – are typically looking for long-term gains like increasing market share or achieving vertical integration. On the other hand, financial buyers – like private equity firms, family offices, venture capital funds, and hedge funds – prioritize return on investment (ROI) and often plan to exit within five to seven years. Interestingly, many private equity firms also act as quasi-strategic buyers due to their deep industry knowledge.

Within these categories, buyers are further divided into three tiers based on their industry focus and acquisition history:

- A-List (Tier 1): Includes direct competitors or firms that have already invested in the industry.

- B-List (Tier 2): Features firms with a demonstrated interest in the sector or related areas, meeting general criteria like size and location.

- C-List (Tier 3): Consists of peripheral prospects that align with basic size and geographic requirements.

Top-tier buyers tend to secure deals around 55% to 60% of the time, but it’s worth noting that many successful transactions involve buyers outside the top tiers. Data from Axial in 2023 highlights the importance of list size: a buyer list with 100 names resulted in an average of 11 signed NDAs, while a list of 400 names produced an average of 39 NDAs.

Use Research Tools and Databases

To build and segment the buyer universe effectively, advisors turn to specialized tools and databases. Platforms like PitchBook, S&P Capital IQ, FactSet, and Bloomberg provide extensive market data, while tools such as Affinity and DealCloud help manage outreach efforts. For identifying private equity portfolio companies and key executives, tools like Private Equity Info and SourceScrub are invaluable. Marketplaces like Axial broaden the initial pool of potential buyers. For publicly traded companies, SEC.gov (EDGAR) offers a free resource for researching acquisition history and strategic goals.

Personalized outreach is critical when targeting potential buyers. Andy Jones, Founder of Private Equity Info, underscores this point:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response."

Advisors must identify the executive responsible for a relevant portfolio company instead of sending generic emails. If standard filters yield limited results, keyword searches focusing on the seller’s specific products or services can help uncover similar portfolio companies and their investors. Advanced automated tools now streamline this process, visiting company websites in real time to categorize buyers into groups like PE-owned, private, and public companies – reducing what used to take eight hours of manual research to just a few minutes.

With accurate data in hand, advisors can fine-tune their approach by targeting the right decision-makers. This structured segmentation sets the stage for the next step: qualifying and prioritizing buyers.

Step 3: Qualify and Prioritize Buyers

Evaluate Buyers for Fit

After segmenting the buyer universe, the next step is to evaluate each potential buyer’s financial, experiential, and strategic fit. This process helps weed out unqualified candidates while protecting the seller’s confidentiality. Interestingly, only about 15% of inquiries typically qualify to receive confidential materials.

When it comes to financial capacity, the requirements differ depending on the buyer type. For instance, individual buyers looking at businesses valued under $6 million often rely on SBA 7(a) loans, which require a 15% down payment and about $100,000 in liquid assets. On the other hand, private equity firms are assessed based on their financial strength and history of successful transactions. Strategic buyers are scrutinized for their financial stability and prior deal performance, with advisors often seeking references from past sellers to ensure smooth integrations and fair dealings.

Another critical factor is strategic and cultural fit. Does the buyer’s vision align with the seller’s priorities, such as preserving the existing team, maintaining the business location, or upholding the company’s culture? As Becky Kaetzler from McKinsey’s M&A practice points out:

"Culture is important in all deal types but particularly when you bring two large groups of people together. Then, the potential friction would be much more visible".

Buyers who refuse to sign NDAs, fail to provide financial information, or display excessive criticism early in discussions are often disqualified. Jacob Orosz, President of Morgan & Westfield, highlights this issue:

"Overly critical buyers usually do not have serious intentions of buying a business".

Additionally, perennial buyers – those who have been searching for years without closing a deal – are typically excluded from consideration.

Rank and Prioritize the Buyer List

Once buyers are qualified, advisors rank them based on their overall fit. Buyers are often grouped into three tiers: Tier 1 includes direct competitors and highly committed private equity firms, Tier 2 covers firms with a sector interest, and Tier 3 includes peripheral prospects who meet basic criteria. Although Tier 1 buyers account for 55% to 60% of successful deals, the remaining 40% to 45% often involve buyers from lower tiers, proving the value of maintaining a broad pool of candidates.

To bring objectivity to this ranking process, advisors frequently use numerical scoring systems. These systems evaluate factors like EBITDA growth, market share, leadership quality, and potential synergies. Jonah Pollone of MidStreet explains the advisor’s role in this stage:

"Your broker is there to safeguard this information and qualify the buyer, not the other way around".

Rankings aren’t static – they’re updated as negotiations evolve. This structured approach ensures that the development of Confidential Information Memorandums (CIMs) or Offering Memorandums (OMs) aligns with the seller’s goals, ultimately streamlining buyer outreach and selection.

sbb-itb-798d089

Step 4: Align Buyer Universes with CIM/OM and Outreach

Incorporate Buyer Insights into CIM/OM Development

Once you’ve ranked your buyer list from Step 3, the next move is to shape your Confidential Information Memorandum (CIM) or Offering Memorandum (OM) to resonate with those buyers. To stand out, your marketing materials need to reflect the specific priorities of each buyer segment.

Start by customizing key sections of your CIM/OM, particularly the Investment Thesis. As Kuhn Capital explains:

"Your banker may modify this [Investment Thesis] and other CIM sections to fit the perceived strategy of the CIM recipient".

For private equity buyers, emphasize aspects like steady cash flow, a strong management team, and opportunities for operational improvements. On the other hand, strategic buyers will likely be more interested in synergies, cultural compatibility, and how your business enhances their current capabilities.

Make sure your financials are presented in a way that helps buyers quickly assess fit. Break down revenue by geography, product line, or segment. For example, a tech-focused strategic buyer might be drawn to scalable technology, while private equity buyers tend to focus on consistent cash flow and operational efficiency.

This level of customization can pay off. Tailored presentations have been shown to increase pricing premiums by 6% to 25%. As John Ferrara, Founder & President of Capstone Partners, notes:

"Part due diligence document, and part marketing collateral, the CIM is central to positioning the client for maximum market receptiveness".

If this sounds like a lot of work, don’t worry – tools like Deal Memo can make the process much smoother.

How Deal Memo Delivers Results

Creating multiple versions of a CIM can be a lengthy process, often stretching to three months before you’re ready to go to market. That’s where Deal Memo steps in to save time for business brokers, M&A firms, and investment banking teams.

Deal Memo provides white-labeled CIM and OM packages, delivering each draft within just 72 hours. Their service includes everything from building a buyer universe to conducting seller interviews, with unlimited updates and revisions to ensure the final product meets your standards.

Common Challenges and Best Practices

Challenges and Solutions

Building a robust buyer universe comes with its share of hurdles. These challenges, if not addressed, can lead to wasted time or even derail a deal entirely. However, by identifying these obstacles early and employing effective strategies, you can navigate the process more smoothly. Here’s a closer look at some common challenges and how to tackle them.

Data accuracy is one of the biggest hurdles. Financial information from private companies is often voluntarily disclosed and can quickly become outdated. This can lead to incorrect assumptions about a buyer’s financial standing. To avoid this, keep your buyer list updated regularly using real-time AI tools. Cross-checking data with SEC filings is another way to ensure accuracy and confirm financial health.

Confidentiality risks are another major concern. Broad auctions increase the likelihood of competitors joining the process with no real intent to buy, instead fishing for sensitive information. To protect your seller, implement strict access controls. Require signed NDAs before sharing any detailed information, watermark all CIMs with the recipient’s name, and use read-only VDRs with access logs. Doreen Morgan of Sunbelt Atlanta highlights the importance of a well-prepared CIM:

"A weak, confusing, or incomplete CIM stops the sale process cold, as buyers will move on to other, more professionally presented opportunities".

Manual research can be a significant drain on time and resources, pulling management away from their core responsibilities. AI tools and specialized databases can streamline this process, allowing you to segment and engage buyers more efficiently. These tools not only save time but also help you cast a wider net, which is crucial since 40% to 45% of successful buyers often come from outside the top-tier list. For example, on the Axial platform in 2023, buyer lists with 100 names yielded an average of 11 signed NDAs, while lists with 400 names resulted in 39 signed NDAs.

Here’s a summary of these challenges and their solutions:

| Common Challenge | Best Practice / Solution |

|---|---|

| Data Maintenance: Private company data is often outdated or voluntary. | Continuous Updates: Use real-time AI tools to keep buyer lists current and accurate. |

| Confidentiality: Risk of leaks to competitors or bad-faith bidders. | Vetted Access: Require NDAs, watermark CIMs, and use read-only VDRs with access logs. |

| Resource Intensity: Manual research is slow and disrupts operations. | AI & Automation: Leverage specialized databases and automation to streamline buyer engagement. |

| Narrow Focus: Overlooking buyers outside the immediate sector. | Go Broad: Include financial sponsors, "quasi-strategics", and industry specialists to increase competition. |

| Information Asymmetry: Buyers discovering deal-breaking issues during due diligence. | Proactive Disclosure: Address risks like customer concentration upfront in the CIM, with clear mitigation plans. |

| Unrealistic Expectations: Overly optimistic projections hurt credibility. | Defensible Data: Base projections on historical performance and clear, measurable drivers. |

Conclusion

Creating a buyer universe is a step-by-step process that starts with understanding your seller’s goals and ends with outreach that turns qualified prospects into buyers. The key elements – clarifying seller objectives, researching and segmenting buyer profiles, qualifying and prioritizing prospects, and crafting outreach tied to a strong Confidential Information Memorandum (CIM) – work together to drive competition and increase deal value. This strategy ensures you connect with the right buyers at the right moment, setting the stage for meaningful engagement.

The numbers back up the importance of thinking broadly. Between 40% and 45% of successful buyers come from outside the top-tier list. This highlights the value of expanding your search to include financial sponsors and quasi-strategic buyers, boosting the likelihood of finding the one willing to pay top dollar.

Efficiency plays a huge role here. Automated tools have transformed the process, cutting CIM preparation time from months to minutes and reducing initial buyer identification from eight hours to just a few minutes. This shift allows advisors to focus more on building relationships and executing deals.

Streamlining these processes makes it easier to produce high-quality marketing materials quickly. Deal Memo, for instance, delivers white-labeled CIMs within 72 hours, complete with buyer research, seller interviews, and unlimited revisions. By addressing 90% of a buyer’s initial questions upfront, these materials help create momentum, moving prospects from curiosity to a Letter of Intent. By combining professional preparation with data-driven targeting, you lay the groundwork for a transaction that not only meets but often exceeds your seller’s expectations.

FAQs

What should sellers focus on when setting their goals for an M&A transaction?

When planning for an M&A transaction, sellers should concentrate on a few critical factors to ensure everything runs smoothly. One of the most important steps is clarifying the main reason for selling, as this will shape the overall strategy and influence the choice of potential buyers. For example, if the focus is on maximizing financial gain, maintaining the business’s operations, or planning a strategic exit, these priorities will guide each decision throughout the process.

It’s also crucial for sellers to outline their preferences regarding the structure of the deal, the timeline for completion, and their level of involvement after the sale. Deciding on the ideal type of buyer – whether it’s an internal party like the management team or an external group such as a private equity firm or a strategic acquirer – ensures the process stays aligned with their goals. Lastly, taking the time to prepare the business for sale and conducting thorough research on potential buyers helps ensure the transaction meets both immediate objectives and future aspirations.

How do advisors use tools like PitchBook and S&P Capital IQ to create a buyer universe?

Advisors often turn to platforms like PitchBook and S&P Capital IQ to craft a well-informed list of potential buyers. These tools offer access to extensive databases filled with private market transactions, investor activities, and company financials. By leveraging this data, advisors can pinpoint buyers whose interests and profiles align with the seller’s objectives.

For instance, these platforms allow advisors to narrow down potential buyers by applying filters such as industry specialization, geographic reach, past deal activity, and growth performance. By diving into transaction details and analyzing market patterns, advisors can compile a focused list of strategic and financial buyers. This tailored approach not only ensures a comprehensive buyer universe but also boosts the likelihood of finding the right match and closing a successful deal.

Why is cultural fit important when choosing the right buyer for a business?

When selling a business, cultural fit is a critical factor that can influence both the transition process and the company’s long-term success. A buyer who aligns with the business’s values, management style, and overall culture can make the integration process much smoother. This alignment helps prevent conflicts and keeps operations running without major disruptions.

Cultural fit also plays a big role in maintaining stability within the company. It can help retain employees, nurture customer relationships, and safeguard the company’s reputation. When a buyer shares the same mission and approach as the business, it sets the stage for a seamless transition and helps preserve the company’s value over time. In short, evaluating cultural fit is a key step in ensuring a successful and harmonious sale.