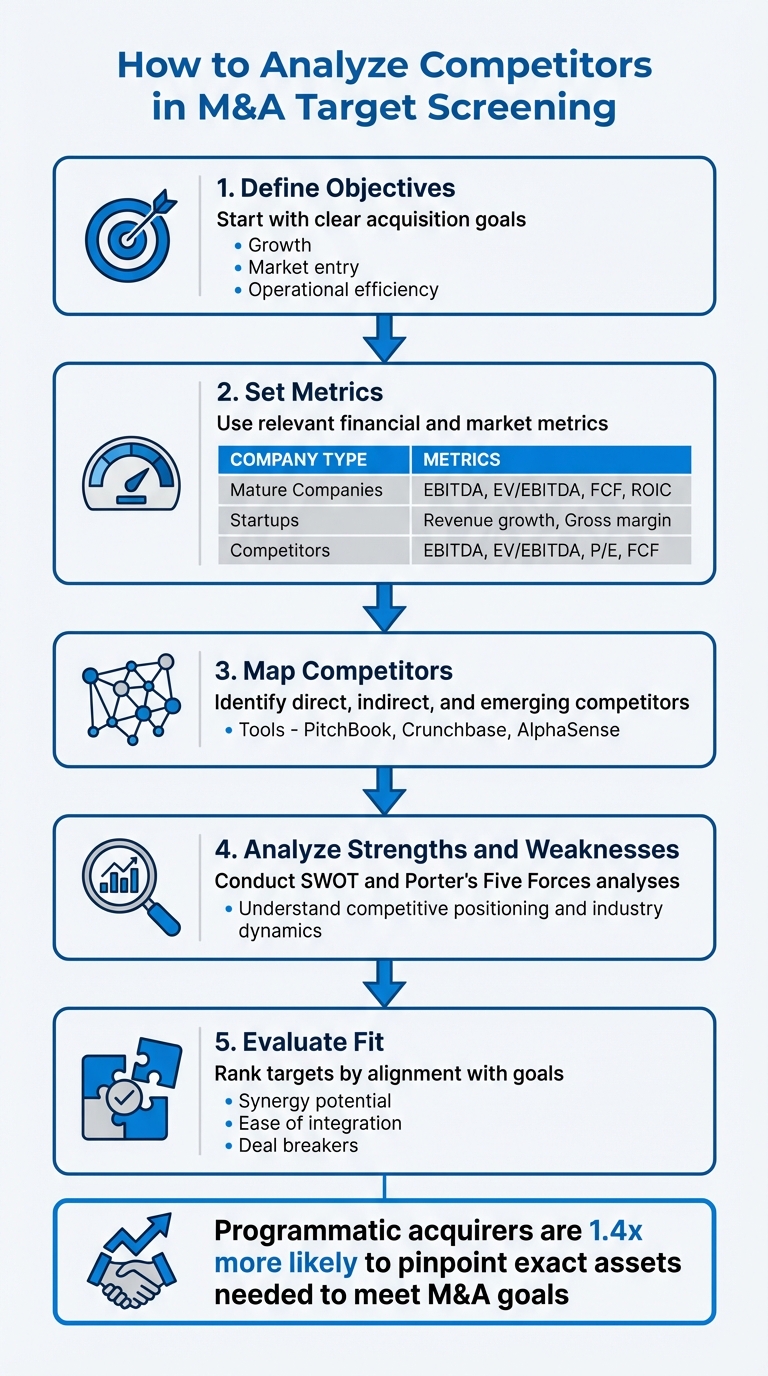

Evaluating competitors is a critical step in M&A target screening. It helps you identify risks, opportunities, and the potential value of a target. Here’s the process in a nutshell:

- Define Objectives: Start with clear acquisition goals – growth, market entry, or operational efficiency.

- Set Metrics: Use relevant financial and market metrics based on the target’s profile (e.g., EBITDA for mature companies, revenue growth for startups).

- Map Competitors: Identify direct, indirect, and emerging competitors. Use tools like PitchBook, Crunchbase, and AlphaSense for insights.

- Analyze Strengths and Weaknesses: Conduct SWOT and Porter’s Five Forces analyses to understand competitive positioning and industry dynamics.

- Evaluate Fit: Rank targets by their alignment with your goals, synergy potential, and ease of integration. Watch for deal breakers like unrealistic pricing or misalignment.

Competitor analysis ensures your M&A decisions are informed, reducing risks and maximizing value. Let’s break it down further.

5-Step M&A Competitor Analysis Framework for Target Screening

Setting Clear Objectives for Competitor Analysis

Before diving into competitor analysis, it’s crucial to define your acquisition purpose. A solid M&A strategy acts as a compass, guiding which targets to assess and how to evaluate them. Without clear objectives, there’s a real risk of overpaying for a business that doesn’t align with your broader goals. Setting these objectives creates the foundation for a focused and efficient competitor evaluation process.

Acquisition goals typically fall into two categories: primary motives (e.g., revenue growth, operational efficiencies, market expansion, or diversification) and secondary motives (e.g., gaining access to technology, acquiring talent, gaining a competitive edge, or tax advantages). Each of these motives demands a tailored approach. For example, horizontal acquisitions – buying competitors – should emphasize market share and economies of scale, while vertical integration – acquiring suppliers or distributors – should focus on supply chain efficiency and profitability.

The type of deal you pursue shapes your entire analysis framework:

- Horizontal acquisitions: Dive deep into market share and economies of scale.

- Vertical acquisitions: Focus on supply chain control and potential efficiency gains.

- Concentric acquisitions: Evaluate cross-selling opportunities between complementary products.

- Conglomerate acquisitions: Prioritize revenue diversification and risk reduction.

Matching Analysis to Acquisition Goals

Start by defining your strategic objective and creating a detailed target profile. This profile should include non-negotiable criteria such as industry sector, company size, market position, and financial benchmarks. For instance, if your goal is to enter a new geographic market, look for targets with established distribution networks and strong local brand recognition.

Companies that adopt a programmatic approach – systematically acquiring smaller businesses to enhance their existing operations – often achieve more consistent results. In fact, programmatic acquirers are 1.4 times more likely than others to pinpoint the exact assets they need to meet their M&A goals. This disciplined method keeps competitor analysis focused and aligned with your strategic priorities.

The current M&A landscape demands precision. In the first half of 2024, global deal volumes dropped by 25% compared to the same period in 2023, but deal values increased by 5%. Additionally, around 65% of buyers report that valuation disagreements between acquirers and targets frequently derail deals. These trends highlight the importance of setting objectives grounded in reliable competitive intelligence.

Selecting Key Metrics for Screening

Once you’ve defined your target profile, the next step is identifying the performance metrics that align with your goals. The metrics you prioritize will depend on the target’s maturity and the type of acquisition strategy you’re pursuing.

| Target Category | Recommended Metrics | Reasoning |

|---|---|---|

| Mature Companies | EBITDA, EV/EBITDA, FCF, ROIC | Evaluates operational performance and liquidity in stable businesses. |

| Startups | Revenue growth, Gross margin | Focuses on scalability and growth potential over immediate profitability. |

| Competitors | EBITDA, EV/EBITDA, P/E, FCF | Highlights synergy potential and competitive positioning. |

| Vertical Targets | EBITDA, EV/EBITDA, FCF, Gross margin | Assesses ability to integrate and maintain supply chain efficiency. |

| Unrelated Industries | EPS, EBITDA, EV/EBITDA, P/E | Provides insights into fair pricing and stable revenue potential. |

Beyond financial metrics, consider market position indicators like market share, brand visibility ("Share of Voice"), geographic reach, and customer base size to evaluate how the target fits into the competitive landscape. Operational factors like production capacity, distribution channels, and labor availability can reveal potential synergies that might justify a higher price.

"The screening process applies a set of criteria to screen for candidates that will best support your M&A (and corporate) strategy. It is a systematic approach to identifying the most suitable candidates through an iterative process." – Navima

In technology-driven industries, innovation metrics are particularly important. Tracking R&D spending, patent portfolios, product pipelines, and licensing agreements can help determine whether a target is positioned to maintain its competitive edge. Regulatory concerns also play a role – over the past four years, more than 40% of cross-border acquisitions have been blocked by regulators. Selecting targets with minimal market overlap can help avoid delays caused by regulatory scrutiny.

Finally, establish clear disqualifiers early in the screening process. These could include unrealistic pricing expectations, insufficient public data, anticipated integration challenges (such as misaligned company cultures), or a lack of meaningful synergy opportunities. These go/no-go criteria save time and resources by filtering out unsuitable targets before you invest in in-depth due diligence.

Identifying and Mapping Competitors

After setting your acquisition goals and determining key metrics, the next step is to thoroughly understand the competitive landscape. This involves pinpointing not just direct competitors but also indirect players and emerging challengers that could influence the value of your target.

Defining Hunt Zones

To get started, divide competitors into two main groups: direct and indirect. Direct competitors are those offering similar products to the same audience. For example, a direct competitor to a premium sandwich shop might be another upscale sandwich chain. Indirect competitors, on the other hand, provide alternative solutions to meet the same customer needs – like a grocery store deli offering ready-made sandwiches.

It’s also helpful to categorize competitors based on specific product features. For instance, in the tech space, you might separate competitors into those focusing on market monitoring versus those specializing in sales enablement. This approach helps you measure competitive intensity and spot potential gaps. Keep an eye on emerging startups, especially those leveraging new technologies. In SaaS, where technology barriers are lower, competitors can appear quickly and disrupt the market.

Another powerful method for identifying competitors is conducting churn and win-loss analysis. By examining why customers leave a product and where they go next, you can uncover hidden threats. As Hunter Sones, Competitive Enablement Manager at Klue, puts it:

"Churn analysis is critical for understanding adjacent competitors because people who leave your product know it intimately –– they understand your value prop and limitations, so their next choice tells you a lot".

These adjacent competitors often pose the greatest risks – or opportunities – because they address the same customer pain points in ways that appeal to dissatisfied users.

Geographic and operational mapping can also provide valuable insights. For instance, you might identify key players dominating brick-and-mortar locations in specific regions or uncover online rivals targeting the same audience. In technology-driven industries, tracking patents and intellectual property can help you detect emerging competitors before their products hit the market, offering a glimpse into their R&D strategies.

Once you’ve mapped out the competitive landscape, industry reports and digital tools can help refine and validate your findings.

Using Industry Reports and Screening Tools

To complete your competitor analysis, tap into multiple data sources. Platforms like PitchBook and Crunchbase offer detailed information on private companies, including funding histories, valuations, M&A activity, and leadership structures. PitchBook’s "Market Maps" feature is particularly useful for visualizing how competitors – both primary and secondary – interact within an industry.

AI-powered tools such as AlphaSense use natural language processing to compile broker research, expert interviews, and regulatory filings. AlphaSense provides insights from over 1,500 Wall Street firms and includes a vast library of expert call transcripts from former employees, partners, and competitors. These interviews often reveal internal strategies and vulnerabilities that aren’t disclosed in public filings.

For analyzing digital presence and marketing reach, tools like SEMrush and SimilarWeb track website traffic, SEO keywords, and advertising spend. Meanwhile, industry-specific reports from sources like IBISWorld, Statista, and Gartner offer high-level data on market share and growth trends. Customer review platforms such as G2 and Capterra provide a ground-level view of how competitors are perceived and where their weaknesses lie.

Don’t forget about internal data sources. Your CRM, as well as tools like Gong and Salesforce, can reveal which competitors frequently show up in early-stage deals or active sales cycles. These insights can highlight competitive dynamics that external reports might miss entirely.

Analyzing Competitors’ Strengths, Weaknesses, and Market Position

Once you’ve mapped out your competitors, the next step is to dig deeper. This means identifying their strengths, weaknesses, opportunities, and potential red flags that could impact their market position.

Using SWOT and Porter’s Five Forces

Start by categorizing your findings into internal factors (strengths and weaknesses) and external factors (opportunities and threats). To make this process more effective, group competitors into tiers: Tier 1 for direct competitors, Tier 2 for niche players, and Tier 3 for emerging or indirect competitors. Each tier will require a tailored set of questions, such as:

- What makes their products or services stand out (e.g., unique selling points or patents)?

- Where are they falling short compared to rivals?

- Are there untapped market segments they could target?

- What risks do they face from regulatory changes or disruptive technologies?

For example, a successful acquisition might highlight a competitor’s robust defensive strategies. As Tim Vipond, CEO of Corporate Finance Institute, explains:

"The objective is not just to sell, but to sell for maximum value."

Complement your SWOT analysis with Porter’s Five Forces to get a broader view of the industry. This framework looks at five critical forces: the threat of new entrants, buyer bargaining power, supplier bargaining power, the threat of substitutes, and the intensity of competition. By doing this, you can assess how competitive the industry is and whether it’s attractive for long-term growth. For instance, if a competitor operates in a market with low barriers to entry and strong buyer power, their current profitability might not hold up over time.

Gather your data from sources like Confidential Information Memoranda (CIM), annual reports, SEC filings, and industry research from firms like Gartner, IDC, or Forrester. A typical CIM can be over 50 pages, offering detailed insights, while shorter "Teaser" summaries are usually 5–10 pages. Be cautious of overly optimistic language in these documents – terms like "stable EBITDA" could be hiding stagnating growth despite increasing revenue.

Once you’ve compiled qualitative insights, shift your focus to the numbers to evaluate financial and operational strength.

Assessing Financial Health and Operations

Understanding the financial health of competitors helps you see how their market position translates into actual performance. Key metrics to focus on include:

- Revenue growth rates

- Profitability (e.g., EBITDA, net income, and profit margins)

- Debt levels

- Efficiency ratios, such as Return on Equity (ROE) and Return on Invested Capital (ROIC).

Ideal acquisition targets typically show annual growth rates of 5–10% and EBITDA margins between 10–20%.

Beyond the financials, evaluate their operational strength. This involves looking at market share, total addressable market (TAM), customer base, workforce size, and R&D efforts. For publicly traded companies, annual reports and SEC filings can provide detailed data on revenue, liabilities, and debt levels. Automated tools can help you track quarterly filings for subtle changes in their operations.

Pay close attention to pricing power. If a competitor relies heavily on competitive bidding to win contracts, it may indicate limited leverage in pricing. Look for "moat" factors like high switching costs, network effects, or proprietary technology that give them a competitive edge and make them harder to displace.

Don’t overlook internal stability. Employee retention rates and satisfaction scores from platforms like Glassdoor can reveal how stable and healthy their operations are. Additionally, experiencing their customer service firsthand – by subscribing to their newsletters, purchasing their products, or trying their services – can uncover operational weaknesses that financial data alone won’t show.

sbb-itb-798d089

Evaluating Target Fit Within the Competitive Landscape

This step refines your competitive insights into actionable priorities by assessing how potential targets align with your strategic goals. By building on competitor analysis, you can determine which targets deserve your focus.

Ranking Targets by Value

To streamline your decision-making, create a tiered ranking system that highlights top candidates. A competitor matrix can help rank targets based on weighted criteria like synergy potential, profitability (e.g., EBITDA/EBIT), market share, and integration complexity. For instance, prioritize targets with strong EBITDA and complementary offerings over those with overlapping products or services.

Strategic fit and operational feasibility are key considerations. Strategic fit involves assessing how well the target addresses gaps in your portfolio, expands geographic presence, or aligns with your corporate strategy’s "Hunt Zone". Operational feasibility examines factors like cultural compatibility, management alignment, and the complexity of merging systems and processes.

"Target profiles of short-listed candidates will be the basis for prioritising targets – determining which targets to pursue and in what order".

Using Ansoff’s Matrix can further refine your approach by categorizing targets based on strategic intent. Whether you’re aiming for market penetration, product development, market expansion, or diversification, this framework helps prioritize efforts. For example, a target that opens a new geographic market might rank higher than one that simply deepens your current footprint. Keep your ranking criteria flexible, updating them as your corporate strategy or market conditions evolve.

Another important factor is the "perceived ease of getting the deal done". A high-value target that’s unlikely to sell – perhaps due to family ownership or other barriers – can drain resources unnecessarily. Assess both the target’s willingness to engage and the feasibility of closing the deal.

Once you’ve ranked potential candidates, identify specific deal breakers that could disqualify them from consideration.

Identifying Deal Breakers and Disqualifiers

Certain red flags can immediately disqualify a target, saving you time and effort.

Financial issues are a major concern. Unrealistic pricing or declining cash flow often signal trouble. For example, if the asking price is based on EBITDA multiples far above industry norms, it’s usually better to walk away than risk overpaying.

Strategic misalignment is another critical factor. Targets located in unsuitable geographies, offering products that don’t complement your portfolio, or lacking synergy opportunities should be removed from consideration.

Operational challenges can also raise concerns. High integration complexity – stemming from incompatible systems or processes – is a major obstacle. Other issues include insufficient data transparency (common in competitive auctions) or technological obsolescence, where the target’s offerings are at risk of being disrupted by newer innovations. Additionally, a lack of internal deal negotiation resources or anticipated integration hurdles may warrant disqualification.

Cultural mismatches should not be overlooked. Early warning signs, such as negative employee reviews on platforms like Glassdoor, often indicate deeper compatibility issues. If the cultural fit seems off, it’s wise to move on.

"Knowing the competitive landscape helps you make informed decisions. It reveals potential threats and opportunities, ensuring you invest wisely".

Table: Target Evaluation Criteria

| Factor Category | High-Priority Indicators | Deal Breakers |

|---|---|---|

| Financials | Strong EBITDA, healthy free cash flow, within budget | Unrealistic pricing, financial instability |

| Strategic Fit | Fills product gaps, aligns with growth strategy | Wrong geography, mismatched offerings |

| Operations | Advanced R&D pipeline, superior distribution | Technological obsolescence, insufficient synergies |

| Integration | Compatible culture, manageable locations | High cultural friction, extreme complexity |

| Market Position | Sustainable competitive advantage, growing share | Declining market share, intense competition |

Conclusion and Key Takeaways

Summing up the analysis, competitor evaluation during M&A target screening is all about making decisions that align with your strategic goals. By understanding the competitive landscape, you can uncover both potential risks and opportunities, evaluate a target’s long-term viability, and pinpoint synergies that could add value to the deal.

Keep your objectives front and center throughout the process. Whether your aim is market expansion, diversifying your offerings, or advancing product development, the analysis should directly support these goals. Look closely at the target’s financial stability, innovation capabilities, and competitive advantages. This helps you identify potential risks, such as emerging technologies that might make a target’s offerings obsolete. Comparing the target’s unique strengths to its competitive environment ensures it aligns with your growth strategy.

How you present your findings matters just as much. A well-crafted CIM (Confidential Information Memorandum) transforms raw data into a clear and compelling story, highlighting the key drivers of value. As Michael Hofer, Ph.D., puts it:

"The CIM is more than just a document; it’s a powerful marketing tool designed to attract potential buyers and provide them with insights for an initial assessment of the company’s value and strategic fit".

For M&A professionals, platforms like Deal Memo streamline the process by delivering tailored, white-labeled CIMs in just 72 hours. These CIMs include data-driven analysis and strategic insights customized for your audience, helping you maintain alignment with your goals and build momentum for the deal.

FAQs

What are the most important metrics to focus on when evaluating M&A targets?

When assessing potential M&A targets, it’s essential to dive into financial and operational metrics for a well-rounded evaluation. Start with financial indicators like revenue growth, profitability (including EBITDA and EBITDA margin), and cash flow to get a clear picture of the company’s performance. Don’t overlook leverage ratios such as debt-to-equity and valuation multiples like EV/EBITDA, which can help you understand the company’s financial standing and how it stacks up in the market.

Operational metrics are just as important. Look at market share, customer retention rates, and employee turnover to gauge the company’s competitive edge and internal stability. Tools like Net Promoter Score (NPS) and Lifetime Value (LTV) can offer valuable insights into customer satisfaction levels and the potential for long-term profitability.

How does competitor analysis help identify risks during M&A target screening?

Competitor analysis plays a key role in M&A target screening, offering insights into a target company’s market position, competitive hurdles, and potential threats. These insights help buyers pinpoint vulnerabilities or risks that could arise after the acquisition is finalized.

By examining the competitive environment, buyers can prepare for challenges like evolving market trends or new technological advancements. This understanding allows them to craft strategies to address potential risks effectively. Ultimately, a clear grasp of the competitive landscape leads to better-informed decisions and minimizes unexpected issues after the deal closes.

What are the best tools for analyzing competitors during M&A target screening?

When screening potential M&A targets, analyzing competitors becomes much easier with the help of specialized tools. These tools can deliver detailed market insights, keep tabs on competitor actions, and highlight emerging trends, all of which are crucial during the evaluation process.

Competitive intelligence platforms are particularly useful for tracking critical factors like market share, pricing strategies, and recent transactions. Some platforms go a step further, offering features such as automated data aggregation, deal-flow tracking, and qualitative analysis frameworks. For instance, tools equipped with SWOT analysis, market share modeling, and transaction history overlays can provide a clearer picture of consolidation patterns and help pinpoint promising acquisition opportunities.

These insights play a key role in understanding the competitive landscape, identifying synergies, and making well-informed decisions throughout the M&A journey.