Building a buyer universe is key to maximizing the value of an M&A deal. A buyer universe is a list of potential buyers categorized into two groups: strategic buyers (industry peers) and financial buyers (private equity firms, family offices). The goal is to attract multiple qualified buyers to create competition and secure the best offer.

Key points to consider:

- Size Matters: A larger buyer list increases interest. For example, 100 prospects typically result in 11 NDAs, while 400 prospects yield 39 NDAs.

- Buyer Categories:

- Strategic Buyers: Industry players seeking synergies like market access or cost savings. Often pay higher premiums but may move slower due to corporate bureaucracy.

- Financial Buyers: Focus on ROI, often use debt/equity structures, and prefer existing management to stay. Includes private equity firms and family offices.

- Research Tools: Use platforms like PitchBook, Grata, or Mergr to identify buyers. Analyze financial capacity, acquisition history, and sector interest.

- Outreach Strategy: Segment buyers into tiers (e.g., Tier 1 for direct competitors or relevant PE firms) and balance confidentiality with competitive bidding.

- Refinement: Continuously update the list based on market shifts, buyer feedback, and new opportunities.

The process involves defining ideal buyer criteria, conducting market research, and prioritizing prospects to ensure the best deal outcome. A well-prepared buyer universe strengthens negotiations and increases the likelihood of closing with the highest-value buyer.

Building an Acquisition Universe: Moments from Paul’s M&A Masterclass

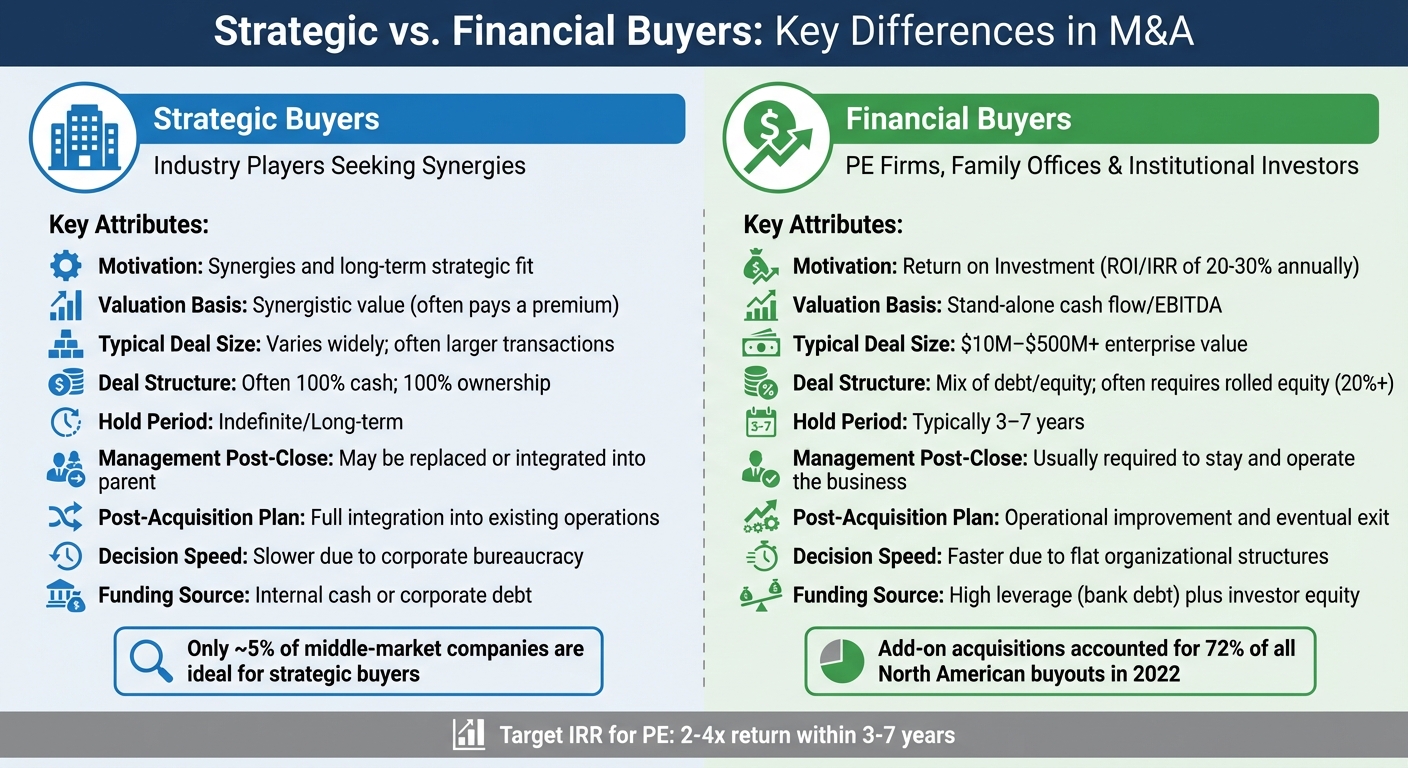

Types of Buyers: Strategic vs. Financial

Strategic vs Financial Buyers in M&A Transactions Comparison

Grasping the distinction between strategic and financial buyers is crucial when mapping out your potential buyer pool. These groups differ significantly in motivation, valuation methods, and acquisition approaches – understanding these differences can shape your outreach and negotiation strategies.

Strategic buyers are typically companies within your industry, such as competitors, customers, or suppliers. They acquire businesses to strengthen their market position, often seeking faster growth, new technology, or expanded market access – goals that would take longer to achieve organically. Thanks to synergies like shared distribution channels, vendor relationships, and cost reductions, strategic buyers are often willing to pay a premium. As Jacob Orosz, President of Morgan & Westfield, notes:

"Strategic buyers are the holy grail of buyers and may pay a higher multiple than others if they cannot easily replicate what the seller’s company has to offer."

Financial buyers, on the other hand, include private equity groups (PEGs), family offices, and institutional investors. They evaluate businesses based on standalone performance metrics, focusing on cash flow and EBITDA rather than potential synergies. As Orosz explains:

"Financial buyers primarily consist of private equity groups (PEG) and value a business based solely on its numbers without taking into account the impact of any synergies."

Private equity groups typically aim for an internal rate of return (IRR) between 20% and 30% annually, seeking to double or quadruple their investment within three to seven years.

Interestingly, only about 5% of middle-market companies are considered ideal for strategic buyers. This makes financial buyers a dominant presence in most buyer pools. However, the ultimate goal is securing the best offer, which is why engaging both types can be advantageous.

Below, we explore the unique characteristics and needs of each buyer type.

Strategic Buyers: Who They Are and What They Want

Strategic buyers aim to achieve specific goals, such as entering new markets, acquiring proprietary technology, expanding customer bases, or streamlining supply chains through vertical integration. Their willingness to pay a premium often stems from the potential to realize synergies after the acquisition. For instance, integrating your customer base into their operations or eliminating redundant overhead costs can justify a higher purchase price.

Strategic buyers generally acquire 100% of the target company to ensure full integration and often have the financial resources to fund deals entirely in cash. However, working with them carries confidentiality risks. If your intention to sell becomes public, competitors might exploit this information or target your employees and customers. To manage these risks, advisors often use serialized Confidential Information Memorandums (CIMs) to control sensitive data.

Another challenge with strategic buyers is their slower pace, as corporate bureaucracy often involves multiple layers of approval, integration reviews, and board sign-offs. Once a deal closes, they usually hold the business indefinitely, with no defined exit strategy, and may replace or integrate existing management into their organization.

A notable example of strategic acquisitions is the acqui-hire, popular in the tech industry, where companies are purchased primarily for their talent.

Financial Buyers: Who They Are and What They Want

Financial buyers, such as private equity groups, family offices, and institutional investors, look at companies purely as investments. PEGs often use a mix of equity and debt to structure deals and may require sellers to retain a minority stake – typically 20% or more – to align management interests during the three-to-seven-year holding period. This setup can be beneficial if the business grows significantly before the exit.

These buyers usually prefer to keep the existing management team in place, as they depend on experienced professionals to run daily operations. For sellers looking to step away completely, this model might not be ideal. Family offices, however, often hold investments for over a decade, making them a good choice for sellers who prioritize preserving their company’s legacy.

In some cases, private equity firms act as strategic buyers. If a PE firm already owns a platform company in your sector, they may acquire your business as an add-on to create synergies within their portfolio. This hybrid approach combines the strategic benefits of synergy realization with the financial discipline of private equity. In fact, add-on acquisitions accounted for 72% of all North American buyouts by deal count in 2022.

Andy Jones from Private Equity Info highlights this trend:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment."

This means that if a PE firm already owns a business similar to yours, they are more likely to show interest – and might even pay a premium similar to a strategic buyer.

Comparison Table: Strategic vs. Financial Buyers

| Feature | Strategic Buyers | Financial Buyers (PE) |

|---|---|---|

| Motivation | Synergies and long-term strategic fit | Return on Investment (ROI/IRR) |

| Valuation Basis | Synergistic value (often pays a premium) | Stand-alone cash flow/EBITDA |

| Typical Deal Size | Varies widely; often larger transactions | Typically $10M–$500M+ enterprise value |

| Deal Structure | Often 100% cash; 100% ownership | Mix of debt/equity; often requires rolled equity |

| Hold Period | Indefinite/Long-term | Typically 3–7 years |

| Management Post-Close | May be replaced or integrated into parent | Usually required to stay and operate the business |

| Post-Acquisition Plan | Full integration into existing operations | Operational improvement and eventual exit |

| Decision Speed | Slower due to corporate bureaucracy | Faster due to flat organizational structures |

| Funding Source | Internal cash or corporate debt | High leverage (bank debt) plus investor equity |

Finding Potential Buyers Through Market Research

Understanding buyer types is just the beginning. Market research is the next step, helping you identify prospects that align with your transaction goals. This involves leveraging specialized databases, industry networks, and focused search strategies to create a shortlist of 100–200 qualified buyers. This approach sets the stage for identifying both strategic and financial buyers effectively.

How to Find Strategic Buyers

Strategic buyers – such as competitors, suppliers, and customers – are often uncovered through thorough database research and industry insights. Public resources like SEC.gov can be a great starting point. By reviewing 10-K filings and annual reports, you can identify larger competitors and their acquisition strategies. These documents often reveal which companies are actively pursuing growth through acquisitions and the markets they’re targeting.

For private company data, platforms like PitchBook, Grata, and Mergr are invaluable. PitchBook, for instance, provides data on over 3 million private companies and tracks emerging markets. Grata’s AI-driven tools, such as the "Similar Company Search", can help you find businesses with comparable operations, even if they don’t share the same NAICS code. When standard filters fall short, using specific keywords can uncover niche players that might otherwise go unnoticed.

Focus your efforts on companies with a history of acquisitive growth. Ideal buyers are typically at least three times the size of your target company, ensuring they have the necessary resources and risk tolerance for the deal.

Dan Mahoney, CEO of TruSight, highlights the importance of networking:

"The tried and true method of attending industry trade shows, conferences, and local business networks provide great opportunities to meet and develop your business network – because trust is how relationships are built over time."

Trade associations can also be a goldmine for identifying strategic buyers. Organizations like the National Association of Manufacturers or industry-specific groups connect you with key players – competitors, suppliers, and customers – who may have an interest in your client’s business. Joining these associations gives you access to member directories and forums, and attending their conferences can help you build relationships with decision-makers. Additionally, consultants, accountants, and retired executives within these networks often have insider knowledge about companies looking to expand through acquisitions.

Another useful strategy is analyzing recent divestitures. Companies that have recently sold off a division may be in the midst of a strategic review and could be open to further acquisitions or sales. Platforms like Mergr can help you track these transactions and identify potential buyers reshaping their portfolios.

How to Find Financial Buyers

Financial buyers, such as private equity firms, require a more data-driven approach. The key is to identify firms whose investment criteria align with your client’s business. Andy Jones from Private Equity Info advises:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment."

This means focusing on quasi-strategic sponsors – private equity firms that already own a platform company in your sector. These buyers often pay higher premiums due to operational synergies while maintaining the efficiency of financial buyers.

To pinpoint these firms, use tools like PrivateEquityInfo, PitchBook, and Axial. These platforms allow you to filter firms by investment size, sector, and geographic focus. PrivateEquityInfo is particularly helpful for relationship mapping, enabling you to identify the executive who holds a board seat at a portfolio company similar to your client’s business.

Dan Mahoney emphasizes:

"The single best first contact is the executive who holds the board seat to a portfolio company most similar to your client’s company."

Target private equity portfolios that have held companies for 6 to 8+ years. These businesses are often nearing an exit, and the firm may be interested in acquiring your client as a final add-on before selling the entire platform.

Avoid generic outreach. Andy Jones warns:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response."

Instead of mass emails, organize your targets into categories: an A-List for firms with direct industry investments, a B-List for those meeting general criteria, and a C-List for firms that fit size and geographic preferences. Interestingly, about 40% to 45% of the time, the final buyer comes from outside the top-tier list.

Using Deal Memo for Buyer Sourcing

Deal Memo simplifies the process of creating buyer lists by combining seller insights with targeted research. It begins with an in-depth interview to understand the seller’s unique value, competitive strengths, and ideal buyer profile. This information shapes the development of both the Confidential Information Memorandum (CIM) or Offering Memorandum (OM) and the buyer universe.

Using specialized databases and industry knowledge, Deal Memo identifies both strategic and financial buyers that fit your criteria – whether it’s competitors pursuing horizontal integration, suppliers aiming for backward integration, or private equity firms with relevant platform companies.

All materials, including the buyer universe, are delivered within 72 hours and are fully white-labeled for your firm. This allows you to maintain client relationships while benefiting from expert research. Additionally, the service includes unlimited updates, ensuring your buyer list evolves with market conditions or new opportunities. By aligning CIM/OM development with precise market research, Deal Memo strengthens outreach efforts to both strategic and financial buyers.

sbb-itb-798d089

Prioritizing and Qualifying Buyers for Outreach

Evaluating Buyer Fit and Financial Capacity

Once you’ve identified your pool of potential buyers, it’s time to narrow it down by assessing each prospect’s fit and financial strength. Start with financial capacity – this is your first filter. For public companies, dive into their 10-K filings to understand their financial standing. For private firms, look into their private equity backing. Even smaller companies can have substantial resources through their sponsors, sometimes amounting to hundreds of millions of dollars.

Next, evaluate transaction readiness. A buyer’s track record of acquisitions often speaks louder than their stated intentions. Companies with a history of growth through acquisitions are far more likely to follow through on deals than those focused solely on organic expansion. Be on the lookout for recent leadership changes or strategic shifts, as these can disrupt even well-funded buyers. Andy Jones from Private Equity Info sums it up well:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment".

Organize your prospects into three tiers to streamline your efforts:

- Tier 1: Direct competitors or private equity firms with highly relevant portfolio companies.

- Tier 2: Firms with some presence in the sector or stated ambitions to grow in it.

- Tier 3: Adjacent industry players or those that meet only basic size and geography criteria.

Interestingly, about 55% to 60% of deals close with Tier 1 buyers, while 40% to 45% involve buyers from outside the top tier. This highlights the importance of casting a wide net while keeping your strongest prospects front and center.

Once you’ve quantified financial and strategic fit, the next challenge is navigating confidentiality during outreach.

Balancing Confidentiality with Competitive Bidding

Confidentiality is paramount during the outreach process. A narrow auction, which targets fewer prospects, minimizes the risk of leaks, safeguarding sensitive information from employees, competitors, and customers. On the other hand, a broad auction involves more buyers, increasing competition and potentially boosting valuation. Recent data from 2023 shows that a list of 100 prospects typically results in 11 signed NDAs, while a broader list of 400 prospects yields 39 NDAs.

To strike the right balance, use a tiered outreach strategy. Start with Tier 1 buyers – those most likely to close – and require NDAs before sharing anything beyond a basic teaser. Avoid reaching out to direct competitors in the early stages to reduce the risk of sensitive information being exposed. If you do engage competitors, approach the executive responsible for M&A decisions directly, rather than using mass emails. As Andy Jones puts it:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response".

Including private equity firms in your outreach can also help maintain a smooth process. These firms are familiar with standard NDA and LOI timelines, making them reliable participants who can keep the deal moving forward.

This tiered approach not only protects confidential information but also ensures you’re focusing on buyers with genuine interest and capacity.

Qualifying Buyers for Outreach

With confidentiality measures in place and a targeted list of buyers, the next step is to rigorously qualify each prospect. Start the qualification process immediately by securing an NDA, verifying intent during initial discussions, and requesting documented proof of funds or financing commitments. Ask pointed questions to understand their motivations – are they drawn to the company’s culture, or are they primarily interested in acquiring its customer base? Checking their past M&A track record by speaking with former owners of acquired companies can also provide valuable insights.

Stay vigilant for warning signs like hesitation to sign an NDA, negative early feedback, or poor follow-through. Use your tier-based segmentation to focus your energy on the buyers most aligned with the seller’s financial and strategic goals.

Finally, rank buyers not just on price but also on how well they align with non-financial priorities. Consider factors like retaining staff, preserving the company’s brand, or maintaining local employment. With only 0.5% to 2% of initial prospects typically converting into a closed deal, it’s crucial to concentrate on those who demonstrate both strong financial backing and a clear strategic fit.

Using Industry Insights to Finalize the Buyer List

Using Industry Mapping to Identify Buyers

Industry mapping is a powerful tool for spotting gaps and uncovering new buyer opportunities. Start by evaluating how potential buyers might integrate with your client’s business. This could involve horizontal integration (competitors), vertical backward integration (suppliers), vertical forward integration (distributors), or product extension (complementary products).

Pay close attention to quasi-strategic sponsors – financial buyers who own related portfolio companies. These buyers often act like strategic acquirers and may offer higher premiums compared to traditional private equity firms. Focus on private equity firms with investment professionals specializing in your target’s niche. These experts bring sharper insights and greater deal certainty. Instead of casting a wide net, aim to connect with the exact executive who sits on the board of a relevant portfolio company, avoiding generic outreach to entire firms.

Market intelligence tools can help you analyze fragmentation data. Highly fragmented industries, especially ones dominated by founder-owned businesses, present strong opportunities for buyers interested in roll-up strategies. If a potential buyer passes on your deal, don’t hesitate to ask why. Their feedback can reveal flaws in your messaging or highlight market shifts, helping you refine your approach.

By weaving these insights into your Confidential Information Memorandum (CIM) or Offering Memorandum (OM), you can craft a targeted strategy for each buyer tier.

Connecting Buyer Lists with CIM/OM Development

Once you’ve mapped out your buyer insights, use them to tailor your CIM/OM to meet the specific needs of each buyer tier. For Tier 1 buyers, such as direct competitors or firms with similar portfolio companies, include detailed synergy analyses and integration plans. Tier 2 buyers, who have some presence in the sector, will need more context about market positioning and growth potential. For Tier 3 buyers from adjacent industries, focus on educating them about the business model and industry dynamics.

Deal Memo offers white-labeled CIMs/OMs within 72 hours, complete with unlimited revisions. Their service includes seller interviews and customized materials designed to resonate with different buyer tiers, ensuring your outreach aligns with each group’s priorities.

Refining Your Buyer Universe Over Time

Creating a buyer list is just the beginning – refining it over time is essential to staying aligned with market changes. Building a strong pipeline is an ongoing process, not a one-and-done task. Review your list monthly to add new prospects, update opportunities, and remove inactive entries.

Keep an eye on ownership and leadership changes, as these often signal evolving strategic priorities that could open doors to new buyers. Specialist funds without current portfolio companies in your sector can also be valuable – they often act as internal advocates for deals. Use feedback from declined buyers to fine-tune your CIM and adjust your target criteria. Regular updates ensure your buyer list stays relevant and maximizes your chances of securing the right deal at the best price.

Conclusion

The buyer universe is constantly evolving, and understanding its dynamics is key to driving successful deal outcomes. Start by grouping buyers into strategic and financial categories, then prioritize them based on their fit and likelihood of interest. This structured approach ensures you don’t overlook opportunities beyond your initial top prospects.

Once you’ve built your buyer list, the next step is targeted outreach. Here, precision matters more than volume. Instead of blasting emails to entire firms, focus on the specific executive tied to a relevant portfolio company. As Andy Jones from Private Equity Info points out:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response".

Leverage tools like market research platforms and industry mapping to refine your approach, and use feedback from declined buyers to adjust your strategy over time.

Maintaining disciplined outreach is equally important. Protecting confidential data while fostering competitive tension can significantly impact deal outcomes. Tailor your CIM/OM for each buyer tier, ensuring sensitive information is safeguarded while highlighting synergies for strategic buyers and potential returns for financial sponsors. This balance helps create deal discipline and maximizes valuation.

Professional services like Deal Memo can streamline this process. With their ability to deliver white-labeled CIMs/OMs in just 72 hours and offer unlimited revisions, you can dedicate more time to building relationships and executing the deal. Their seller interviews and customized materials ensure your outreach aligns with the priorities of each buyer group.

Ultimately, managing your buyer universe requires a proactive mindset. Treat it as a living document – review it monthly, update it with new prospects as market conditions shift, and remove inactive entries. This ongoing effort keeps your list relevant and positions you to secure the best possible deal terms.

FAQs

How can I decide if a strategic or financial buyer is the right fit for my business?

Choosing the right buyer for your business sale comes down to understanding your goals and the results you’re aiming for. Strategic buyers are usually companies that acquire businesses to enhance their operations, broaden their market presence, or create efficiencies through integration. In contrast, financial buyers, like private equity firms, are focused on the investment’s financial returns.

When deciding between the two, think about what matters most to you: the buyer’s motivations, their knowledge of your industry, and how their plans align with your vision for the business after the sale. Strategic buyers might pay more because of the synergies they can create, while financial buyers often bring funding and operational know-how to help the business grow. Clarifying your priorities will guide you toward the buyer that best matches your goals for the transaction.

What are the best tools and strategies for finding potential buyers in M&A?

Identifying potential buyers in an M&A process requires a thoughtful mix of data analysis and strategic thinking. Start by tapping into market research platforms like PitchBook or Crunchbase. These tools let you filter potential buyers based on key factors such as industry, company size, and location, helping you zero in on firms that align with your transaction goals.

Next, deepen your understanding by applying industry expertise. Attend conferences, participate in networking events, and keep an eye on current market trends. Use this insight to categorize buyers into tiers based on their strategic alignment and past investment activity. This approach ensures you’re prioritizing the most promising prospects.

By combining detailed research with active market engagement, you’ll create a targeted and effective list of potential buyers tailored to your specific M&A objectives.

How do I protect confidentiality when contacting potential buyers in an M&A deal?

Protecting confidentiality is a critical part of the M&A process, especially during buyer outreach. A good starting point is creating a teaser document – a short, anonymized summary of the business. This document highlights key aspects without giving away sensitive or identifying details, allowing you to gauge buyer interest safely.

When a buyer expresses genuine interest, you can move forward by sharing more detailed information – but only after they’ve signed a confidentiality agreement (NDA). To further protect sensitive details, it’s smart to organize potential buyers into tiers, such as primary and secondary groups. This way, you can focus on the most qualified prospects while reducing unnecessary exposure.

By sharing information in phases and sticking to strict confidentiality protocols, you can ensure sensitive business details remain secure throughout the outreach process.