Purchase Price Adjustments (PPAs) are a financial mechanism used in mergers and acquisitions (M&A) to ensure the final transaction price reflects the actual financial state of a business at closing. Since businesses don’t pause between signing and closing, factors like cash, debt, and net working capital (NWC) can change, requiring a post-closing "true-up." Here’s what you need to know:

- What They Do: Adjust the purchase price based on differences between estimated and actual financial figures (e.g., cash, debt, NWC).

- Why They Matter: Protect buyers from unexpected financial shortfalls and ensure sellers are compensated for added value.

- Key Components:

- Net Working Capital Adjustments: Based on agreed "target" NWC, adjustments are made if actual NWC deviates.

- Cash and Debt Adjustments: Reflect surplus cash or assumed debt at closing.

- Other Factors: Include transaction expenses, employee liabilities, and tax-related items.

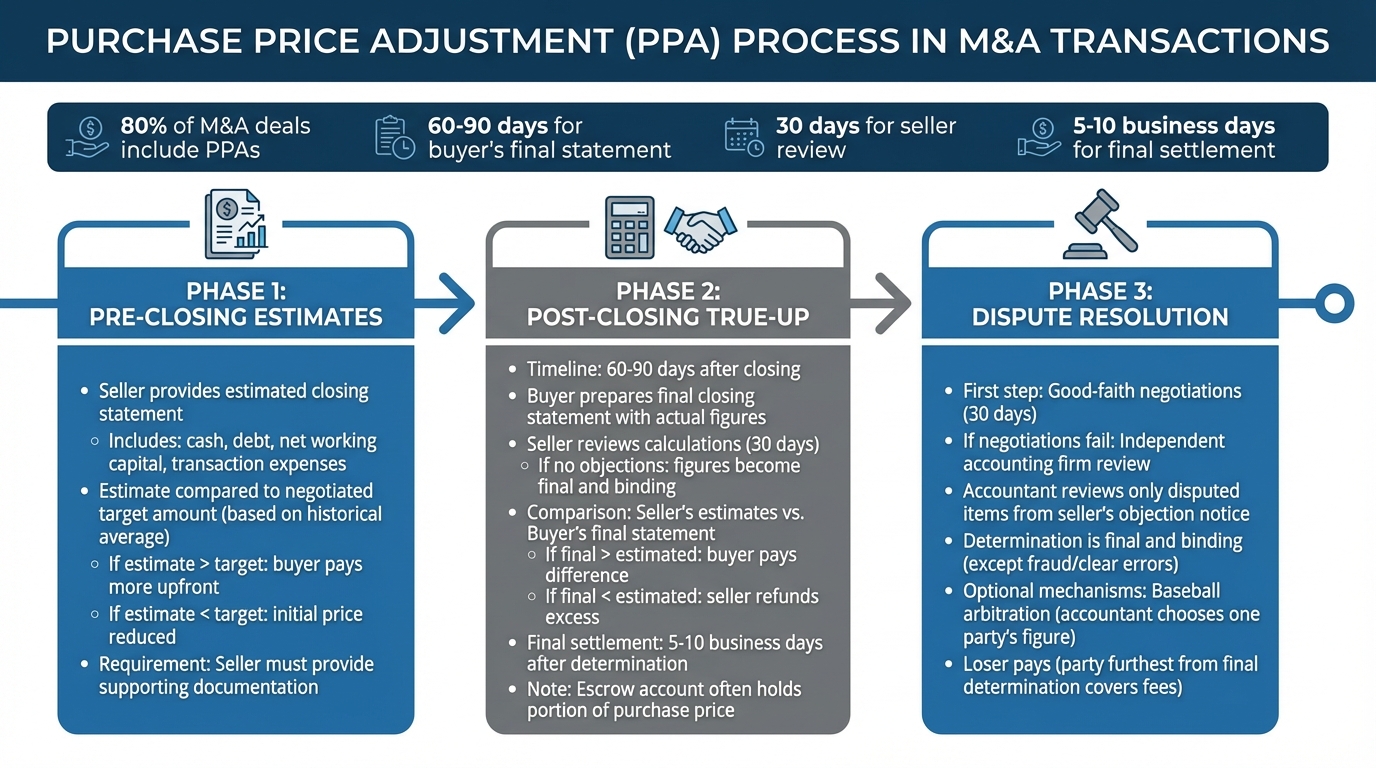

- Process: Includes pre-closing estimates, post-closing true-ups (within 60–90 days), and dispute resolution if needed.

PPAs are included in over 80% of M&A deals today and require clear definitions, accurate targets, and aligned accounting practices to avoid disputes. Whether you’re buying or selling, understanding these adjustments is critical to ensuring a fair deal.

Adding Value as Advisors: Purchase Price Adjustment Strategies and Best Practices (Update) (Preview)

Key Components of Purchase Price Adjustments

In the world of M&A, purchase price adjustments play a critical role in aligning the final deal value with the initial estimates. These adjustments ensure that both buyers and sellers account for how the closing balance sheet impacts the agreed purchase price. Let’s break down the three key components that influence these adjustments.

Net Working Capital Adjustments

Net working capital (NWC) represents the liquidity a business needs to keep its daily operations running smoothly. In M&A transactions, NWC is typically calculated as:

(Accounts Receivable + Inventory + Prepaid Expenses) – (Accounts Payable + Accrued Liabilities).

To set expectations, the buyer and seller agree on a baseline or "target" NWC, which is often based on a 12-month average and reflects the amount necessary to operate the business under normal conditions.

Here’s how it works:

- If the closing NWC exceeds the target, the buyer compensates the seller for the excess.

- If the closing NWC falls short of the target, the seller receives less, as the buyer must inject additional funds to maintain operations.

"The rationale for a Net Working Capital Adjustment is that the target business needs a minimum amount of net working capital in order for its operations to be continued by the buyer in the ordinary course after the closing."

To avoid disputes, these adjustments are generally calculated using Generally Accepted Accounting Principles (GAAP) or consistent historical methods. Including a sample NWC calculation schedule in the agreement is a smart move, as it clarifies how key items like accounts receivable will be treated.

Now, let’s look at how cash and debt adjustments further refine the purchase price.

Cash and Debt Adjustments

Most M&A deals are structured on a cash-free/debt-free basis. This means the seller is expected to withdraw any surplus cash and settle outstanding debts before or at the time of closing. The final purchase price is then adjusted as follows:

- Increased by any cash left on the balance sheet.

- Decreased by any debt assumed by the buyer.

"The purchase price paid by the buyer is decreased by the amount of the target company’s debt and increased by the amount of cash left on its balance sheet."

- Adam Pretty, Partner, Calfee

The target for both cash and debt is typically zero, in line with the cash-free/debt-free principle. These adjustments are calculated separately from NWC and are included in roughly 80% of M&A deals today. To ensure a smooth process, it’s critical to define terms like "cash" (e.g., restricted vs. unrestricted) and "debt" (e.g., long-term liabilities vs. shareholder loans) clearly. Providing sample calculations can also help streamline the reconciliation process, which usually occurs within 60–90 days of closing.

Beyond NWC, cash, and debt, other factors can also come into play when fine-tuning the final price.

Other Adjustment Factors

Several additional items may influence the final purchase price, including:

- Transaction expenses: Costs such as legal fees, accounting charges, commissions, and insurance are typically deducted on a dollar-for-dollar basis.

- Employee-related liabilities: These include transaction bonuses, associated payroll taxes, and accrued paid time off.

- Tax-related items: Deferred tax assets and liabilities may either be included in or excluded from NWC definitions to prevent distortions.

- Contingent liabilities: Pending litigation or unresolved issues (e.g., environmental concerns) might also impact the purchase price if not addressed separately.

In deals using a "lockbox" structure – where the price is set based on an earlier balance sheet date – leakage provisions are often included. These provisions deduct any value extracted by the seller, such as dividends or intra-group payments, between the lockbox date and closing.

"The more precise you can be, the less likely there will be surprises for the buyer and the seller."

- Scott Van Vooren, Senior Partner, Lane & Waterman

To avoid confusion or disputes, it’s essential to clearly outline all adjustment factors in the agreement, along with detailed schedules. This ensures transparency and prevents overlapping adjustments, often referred to as "double-dipping."

The Purchase Price Adjustment Process

Purchase Price Adjustment Process Timeline in M&A Transactions

Grasping the details of purchase price adjustments – covering net working capital, cash, and debt – is essential for both buyers and sellers to navigate the process effectively. This adjustment process unfolds in three key phases, each with distinct timelines and responsibilities.

Pre-Closing Estimates

Before the deal closes, the seller provides an estimated closing statement that includes figures for cash, debt, net working capital, and transaction expenses. This statement sets the initial purchase price. The seller’s estimate of working capital is compared to a negotiated target amount, which is typically based on the historical average needed to run the business . If the estimate exceeds the target, the buyer pays more upfront; if it falls short, the initial price is reduced .

To ensure these estimates are accurate, buyers should include a contractual requirement for sellers to provide reasonable supporting documentation. Once the deal closes, the post-closing true-up process reconciles these preliminary figures with the actual numbers as of the closing date.

Post-Closing True-Up

After the transaction closes, the buyer gains access to the financial records and has 60–90 days to prepare a final closing statement with the actual figures. The seller is then given about 30 days to review these calculations. If the seller does not raise any objections, the figures become final and binding.

"A typical closing statement sets out the balances required to calculate the final purchase price – usually some combination of cash, indebtedness, working capital and seller transaction expenses."

This true-up process compares the seller’s pre-closing estimates to the buyer’s final statement. If the final values are higher than estimated, the buyer pays the difference; if they are lower, the seller refunds the excess . Final settlements are usually completed within 5 to 10 business days after the adjustment amount is determined. Many agreements also include an escrow account to hold part of the purchase price for these adjustments .

Dispute Resolution Mechanisms

Disagreements over the final statement are fairly common. Most purchase agreements require the parties to first engage in good-faith negotiations, typically lasting around 30 days . If these efforts fail, the matter is escalated to an independent accounting firm.

"The closing statement and the counterparty’s dispute notice are each side’s only chance to put their pricing position on the table, so they should do so thoughtfully."

- Jill Jackson, Partner, PwC US

The independent accountant acts as an expert, reviewing only the specific disputed items raised in the seller’s objection notice . Their determination is usually final and binding, except in cases of fraud or clear errors. Some agreements use "baseball arbitration" to discourage extreme positions – this approach forces the accountant to choose one party’s proposed figure rather than finding a middle ground. Additionally, fee allocation clauses, like "loser pays" provisions, encourage reasonable positions by requiring the party furthest from the final determination to cover a larger portion of the accountant’s fees .

Negotiating Purchase Price Adjustments

Negotiating purchase price adjustments (PPAs) is a cornerstone of deal structuring, requiring both parties to agree on clear parameters before closing. These adjustments have become increasingly common – rising from about 50% of M&A deals a decade ago to 80% today – making them a critical focus during negotiations.

Defining Targets and Ranges

A key step in negotiating PPAs is setting the working capital "peg." This is often calculated using a Trailing Twelve Month (TTM) average, adjusted for seasonal or cyclical trends to ensure fairness and avoid giving one party an undue advantage at closing.

"The calculation of the actual net working capital as of the closing should be consistent with the methodology used in setting the target amount so that any comparison to the target amount is not distorted and is on an ‘apples to apples’ basis." – Craig Circosta and Jocelyn K. O’Brien, Attorneys, Ballard Spahr LLP

To minimize post-closing disputes, precise definitions are essential. Specify whether Generally Accepted Accounting Principles (GAAP) or consistent historical practices will be used. While GAAP ensures standardization, sticking to historical practices protects sellers from being penalized for long-standing accounting methods. Including a sample calculation exhibit can further reduce ambiguity.

In addition, many negotiations include de minimis thresholds or collars, which prevent adjustments unless the variance exceeds a specific dollar amount. This approach helps avoid disputes over minor fluctuations that are typical in day-to-day business operations.

Once the targets and ranges are clearly defined, the next priority is determining how risks will be shared between the buyer and seller.

Risk Allocation Strategies

The way an adjustment mechanism is structured directly impacts how risk is distributed. A two-way adjustment allows the purchase price to increase or decrease, depending on whether the actual working capital exceeds or falls short of the target. This approach ensures both parties are equally invested in the outcome. On the other hand, a one-way adjustment typically only moves downward, favoring the buyer and placing more risk on the seller.

| Adjustment Mechanism | Description | Risk Allocation |

|---|---|---|

| Dollar-for-Dollar | Every dollar above or below the target results in a price change. | Shared equally between parties. |

| De Minimis / Threshold | No adjustment is made unless the variance exceeds a specified amount. | Reduces minor disputes for both parties. |

| Capped Adjustment | The adjustment amount is limited by a maximum ceiling. | Protects either party from excessive losses or payouts. |

| One-Way Adjustment | Adjustments occur in only one direction (typically downward). | Heavily favors one party, often the buyer. |

To encourage fair behavior during disputes, some agreements include fee-shifting provisions. For example, under a "loser pays" structure, the party whose estimate is furthest from the final determination bears more of the independent accountant’s fees. Another approach is "baseball arbitration," where the arbitrator must choose one party’s figure, discouraging extreme proposals.

Finally, agreements should explicitly state that buyers cannot recover the same item through both purchase price adjustments and indemnification. This ensures that each mechanism fulfills its intended role without overlapping.

sbb-itb-798d089

Common Challenges and How to Avoid Them

Even well-structured deals can fall apart after closing if Purchase Price Adjustments (PPAs) aren’t carefully planned. Despite being a key feature in over 90% of private-target M&A transactions, poorly executed PPAs often lead to disputes that could have been avoided with clearer terms and realistic expectations.

Undefined or Misaligned Adjustment Criteria

One of the most common issues is vague language in agreements. For instance, using a term like "Closing Date" without specifying an exact time leaves room for confusion about whether transactions on that day should be included. A straightforward fix? Define the adjustment time as "12:01 a.m. EST on the Closing Date" to eliminate ambiguity.

Another frequent problem arises from discrepancies between GAAP and historical accounting practices. GAAP often doesn’t specify calculations for certain reserves, making it difficult to reconcile a target "peg" based on the seller’s methods with a closing statement prepared under strict GAAP. These inconsistencies can drag out disputes.

"Having accounting methodology in the agreement that states all calculations should be in accordance with GAAP does not provide enough clarity." – Fiona Boger, Managing Director, Wilmington Trust

To avoid such conflicts, attach a sample PPA calculation as an exhibit to the agreement. This ensures both parties agree on the mechanics upfront. Also, clarify whether GAAP or "GAAP consistent with historical practices" takes precedence, and define specific terms like "saleable" inventory or the timeframe for "aged" receivables.

| Common Mistake | Recommended Solution |

|---|---|

| Ambiguous "Closing Date" | Define as "12:01 a.m. EST on the Closing Date" |

| GAAP vs. Past Practice conflict | Specify which standard takes priority |

| Seasonal working capital spikes | Use a 6–12 month average for the target "peg" |

| Double counting liabilities | Add a "no double dipping" clause |

| Missing submission deadlines | Waive true-up rights if deadlines are missed |

Overly Aggressive Targets

Unrealistic working capital targets often lead to disputes. If the target is set too high or too low, significant adjustments can create friction. Buyers sometimes push for aggressive adjustments, like demanding reserves for accounts receivable or inventory that weren’t required under GAAP or historical practices. This tactic can give buyers an unfair advantage.

"In challenging economic times, it is more likely that a buyer may try to take aggressive positions in the closing accounts. For example, a buyer may attempt to record more conservative inventory reserves at closing if there is a precipitous drop in sales post-closing." – Jill Jackson, Melanie Fry, and Jared Bourgeois, Partners, PwC US

A practical solution is to use a 12-month trailing average to set the working capital "peg." This approach smooths out seasonal fluctuations and anomalies. For businesses with significant monthly variations in sales or inventory, a 3–6 month average might be more appropriate, especially if the closing date shifts. This ensures the target reflects the actual working capital needed for normal operations, avoiding artificially inflated or deflated numbers.

Inadequate Estimation Processes

Disputes often stem from inconsistent estimation methods. If the pre-closing and true-up processes use different methodologies, the results can be skewed, leading to avoidable conflicts.

"Consistency and alignment in expectations can reduce the risk of disputes regarding accounts receivable, inventory, and accrued expenses." – Brian Lappen and Michelle McHale-Adams, Plante Moran

To minimize disputes, sellers should secure contractual access to the company’s books and records post-closing for a thorough review of the buyer’s adjustments. Surprisingly, 80% of M&A transactions lack provisions addressing what happens if a buyer fails to deliver an updated closing statement on time. Including a clause that waives the right to a true-up if deadlines are missed can protect both parties from prolonged uncertainty.

How Deal Memo Can Support Your M&A Process

When it comes to purchase price adjustments, presenting your business professionally to potential buyers is a critical first step. Deal Memo offers white-labeled CIMs and OMs, enabling M&A firms, business brokers, and investment banking teams to create polished sell-side materials without internal delays. Delivered within 72 hours, these documents help maintain momentum during the crucial period between initial valuation and closing. This clarity early on lays the groundwork for smoother collaboration when preparing documentation.

Creating M&A materials typically involves contributions from financial experts, attorneys, and external brokers. By outsourcing document preparation to Deal Memo, you can focus on high-priority tasks like setting working capital targets, negotiating risk allocation, and overseeing due diligence. Given that post-closing adjustments are common in M&A agreements, precise financial details in your initial offering materials are essential.

High-quality offering materials also serve as a strong foundation for negotiations. These documents establish the "representative" historical working capital level that buyers rely on to assess the business. When complex financial metrics – like Net Working Capital and adjustment mechanisms – are presented clearly, ambiguity is minimized. Including sample purchase price adjustment calculations as exhibits further reduces confusion during the post-closing true-up.

"Understanding your working capital and its variances early, get your accountants involved, and know what to expect before you negotiate." – Sarah George, Permanent Equity

Deal Memo integrates smoothly into your existing workflow, offering unlimited calls, revisions, seller interviews, and data room setup – fully branded as your own. With businesses constantly evolving, the platform’s quick turnaround ensures that pricing data remains up-to-date. Considering that 90% of buyers now handle the initial post-closing adjustment calculations, having a well-documented financial history from the start helps sellers avoid aggressive buyer positions during the true-up phase. Maintaining accurate and consistent data throughout the process ensures alignment and reduces friction during price adjustments.

Conclusion

Purchase price adjustments (PPAs) play a crucial role in ensuring both buyers and sellers receive the economic value they agreed upon. With 85% of private company M&A transactions now including post-closing adjustments, understanding how these mechanisms work is essential for anyone involved in a deal.

At the heart of effective PPAs are clear definitions and precise accounting methods. Ambiguity in agreements can lead to disputes, so it’s critical to define what qualifies as “normal” working capital and to establish exact accounting methodologies upfront. As SRS Acquiom emphasizes: "A well-crafted purchase price adjustment section of the agreement in which the language and methods for adjustment are clear is critically important in avoiding disputes after the deal closes".

Timing and preparation are equally important. With 90% of buyers now responsible for preparing the initial post-closing calculations, sellers must ensure they have access to historical financial records before the deal closes. This preparation allows both parties to verify calculations and remain aligned during the true-up process.

Finally, successful transactions rely on teamwork. Financial experts, accountants, and legal advisors should collaborate to set clear targets, establish dispute resolution frameworks, and manage both purchase price adjustments and indemnifications. This level of coordination helps prevent missteps like double-dipping, which can cause unnecessary friction and damage trust. A collaborative, multidisciplinary approach strengthens the overall integrity of the deal.

FAQs

What are purchase price adjustments, and how do they benefit both buyers and sellers in M&A transactions?

Purchase price adjustments play a critical role in making sure the final transaction price reflects the actual financial health of a business at the time of closing. These adjustments safeguard buyers from paying too much by factoring in unexpected liabilities or a shortfall in working capital. At the same time, they ensure sellers receive fair compensation based on the true value of their business.

By tying the purchase price to the business’s current financials, both parties can work toward a fairer and more transparent agreement. This approach helps reduce potential conflicts and builds trust throughout the transaction process.

What challenges can arise when implementing purchase price adjustments?

Implementing purchase price adjustments isn’t always straightforward. Challenges often arise from issues like timing, data access, and contract clarity. Since these adjustments are calculated after the deal closes, both parties need to agree on when the closing-date numbers are finalized and how quickly the adjustment – or "true-up" – process will take place. If there are delays, disputes can crop up over who is responsible for changes that occur in the interim.

Having accurate and up-to-date financial records is another critical factor. Without reliable access to current balance sheet data or with incomplete accounting systems, it becomes harder to calculate key components such as accounts receivable, inventory, and payables. This lack of clarity can increase the risk of disagreements between buyers and sellers.

Lastly, poorly defined adjustment clauses in contracts are a common source of confusion. Terms like "working capital" or "excluded liabilities" can be interpreted differently if they aren’t clearly defined, leading to post-closing disputes. To address these challenges, buyers and sellers should involve accountants early in the process, use clear and precise language in agreements, and establish a transparent adjustment framework. Services like Deal Memo can provide expert guidance in drafting tailored provisions to help reduce potential conflicts.

How can buyers and sellers prevent disputes over purchase price adjustments after closing?

To avoid conflicts over purchase price adjustments after closing, it’s essential to lay out clear and detailed terms in the agreement before the deal is finalized. One effective approach is to establish a specific baseline, like a working capital "peg", that accurately reflects the business’s typical operations. This baseline can often be calculated by averaging key balance sheet items from the past 12 months, while factoring in any seasonal trends or one-time events. Be sure to clearly define which accounts are included, the calculation method, and any thresholds, caps, or deadlines for adjustments.

Adding procedural safeguards to the agreement can also help reduce potential disputes. For instance, specify timelines for preparing and reviewing the adjustment statement, and agree on how disputes will be resolved – whether through arbitration, expert review, or another method. Using tools like escrow or holdback amounts can provide additional protection for both parties while final adjustments are confirmed. By making the terms of purchase price adjustments precise and easy to understand, you can help both sides steer clear of unnecessary disagreements after closing.