When selling a business, not every potential buyer is worth your time. That’s why buyer screening and buyer qualification are critical processes. These steps help you focus on serious buyers while protecting your business’s sensitive information. Here’s the difference:

- Buyer Screening: The first step to filter out uncommitted or unqualified inquiries. It protects confidentiality by verifying basic legitimacy before sharing details.

- Buyer Qualification: A deeper dive to confirm a buyer’s financial capability, expertise, and intent to close the deal. This step ensures you’re working with someone who can follow through.

Key Differences:

- Screening happens early (pre-NDA), while qualification occurs later (post-NDA, pre-LOI).

- Screening focuses on legitimacy and initial interest. Qualification confirms financial readiness and alignment with your business goals.

- Screening uses basic documents like NDAs; qualification requires detailed financials and proof of funds.

Why It Matters:

Out of 100 inquiries, only 1–3 typically result in a serious offer. Without proper screening and qualification, you risk wasting time, exposing confidential information, and incurring unnecessary costs. Combining these steps into your sales strategy ensures you focus on buyers who are ready and able to close the deal.

A Christmas Story House owner discusses screening for qualified buyers

What is Buyer Qualification?

Buyer qualification is all about ensuring that you’re dealing with serious prospects who have the means and intent to follow through on a deal. By verifying a buyer’s financial capability, strategic goals, and genuine interest early on, you can save time, protect sensitive information, and avoid chasing leads that won’t materialize into a sale.

Brian Dukes, Founder of Exitwise, explains it clearly:

"A well-qualified buyer is an individual, business, or other kind of entity with the strategic vision, financial ability, and expertise to successfully complete the merger or acquisition".

Take, for instance, a case reported by MidStreet in November 2022. Out of 170 inquiries for a business sale, only 34 buyers (around 15%) passed the qualification process, which involved evaluating their finances, credentials, and alignment with the seller’s goals. This careful filtering led to five final offers from highly suitable buyers. Without such a process, the seller would have wasted countless hours on unqualified prospects.

Main Elements of Buyer Qualification

To qualify buyers effectively, focus on four key criteria:

- Financial capacity: A buyer should be able to provide a 10%–15% down payment and still have at least $100,000 in liquidity post-closing. For businesses under $6 million, most individual buyers rely on SBA 7(a) loans, which demand this level of financial readiness.

- Genuine interest: Serious buyers respond promptly to communication. On the other hand, someone who has spent over two years searching without making a purchase is often flagged as unlikely to close.

- Timeline alignment: The buyer’s acquisition schedule should align with your exit timeline. Once a Letter of Intent (LOI) is signed, it typically takes two to four months to finalize the transaction.

- Industry expertise: A buyer should have the relevant background or resources to manage the acquired business successfully.

These criteria are essential for identifying qualified buyers before moving forward.

| Buyer Type | Primary Qualification Criteria | Key Financial Requirement |

|---|---|---|

| Individual | Industry experience, relocation willingness, search length | 15% down payment + approximately $100,000 liquidity |

| Strategic | Acquisition history, geographic fit, industry synergy | Ability to pay a premium or cash |

| Private Equity | Portfolio growth history, management style | Disclosed "committed" capital |

When to Qualify Buyers

Timing is everything when it comes to buyer qualification. The process should begin immediately after receiving an initial inquiry and a signed NDA, but before sharing the Confidential Information Memorandum (CIM). SellBiz.us describes it well:

"Buyer qualification is the practice of verifying a person or company has a genuine interest in acquiring a business like yours AND has the capability to do so".

A phased approach works best. Start by requesting a summary financial statement, and only ask for more detailed documents, like bank statements, after an offer is made. When the NDA is returned, verify the prospect’s legitimacy by checking details like their full address, phone number, and either a driver’s license or EIN. This ensures you’re dealing with credible buyers from the start.

What is Buyer Screening?

Buyer screening is the next step after initial qualification in the process of selling a business. Think of it as a detailed due diligence process focused on verifying the buyer’s claims. While qualification determines if a buyer has the general interest and ability to purchase, screening digs deeper, confirming those claims with documentation and background checks.

Jacob Orosz, President of Morgan & Westfield, emphasizes its importance:

"One of the most time-consuming yet critical first steps in the sale process is screening potential buyers. Its importance cannot be overstated."

This process ensures you don’t waste time on buyers who are unlikely to close the deal. It also safeguards sensitive information, limiting access to serious and legitimate prospects. Essentially, screening builds on the initial qualification to ensure only verified buyers move forward.

Main Elements of Buyer Screening

Buyer screening typically focuses on four key areas:

- Financial Verification: This involves reviewing bank statements, tax returns, credit reports, and proof of liquid assets. For individual buyers, they should be able to cover a 10–20% down payment and maintain around $100,000 in liquidity.

- Background Checks: Confirm the buyer’s identity using documents like driver’s licenses or EINs. Conduct online searches, check litigation history, and for larger deals, consider hiring private investigators.

- Experience Assessment: Evaluate the buyer’s industry knowledge, past acquisition experience, and management style to determine if they can successfully operate the business.

- Motivation and Intent: Understand why the buyer is interested in your business, assess their risk tolerance, and check if they’re open to meeting in person or relocating if necessary.

When to Screen Buyers

Screening typically happens after the initial qualification phase. Early screening – such as collecting a signed NDA, buyer profile, and basic financial statement – takes place before sharing the Confidential Information Memorandum (CIM). At this point, you should verify the NDA’s completeness and confirm its legitimacy by contacting the number provided.

More thorough screening, including requests for tax returns, bank statements, and detailed background checks, usually occurs after a Letter of Intent (LOI) is accepted or just before sharing highly sensitive business documents. As Jacob Orosz explains:

"Releasing information in phases saves time, preserves confidentiality, and ensures that unqualified buyers aren’t provided sensitive information about your business."

If a buyer requires constant follow-ups – more than two or three times – it’s a sign they may not be serious about closing. Similarly, buyers who have been searching for over two years are often red flags. Serious buyers typically find a business and make an offer within 6 to 12 months.

sbb-itb-798d089

How Qualification and Screening Differ

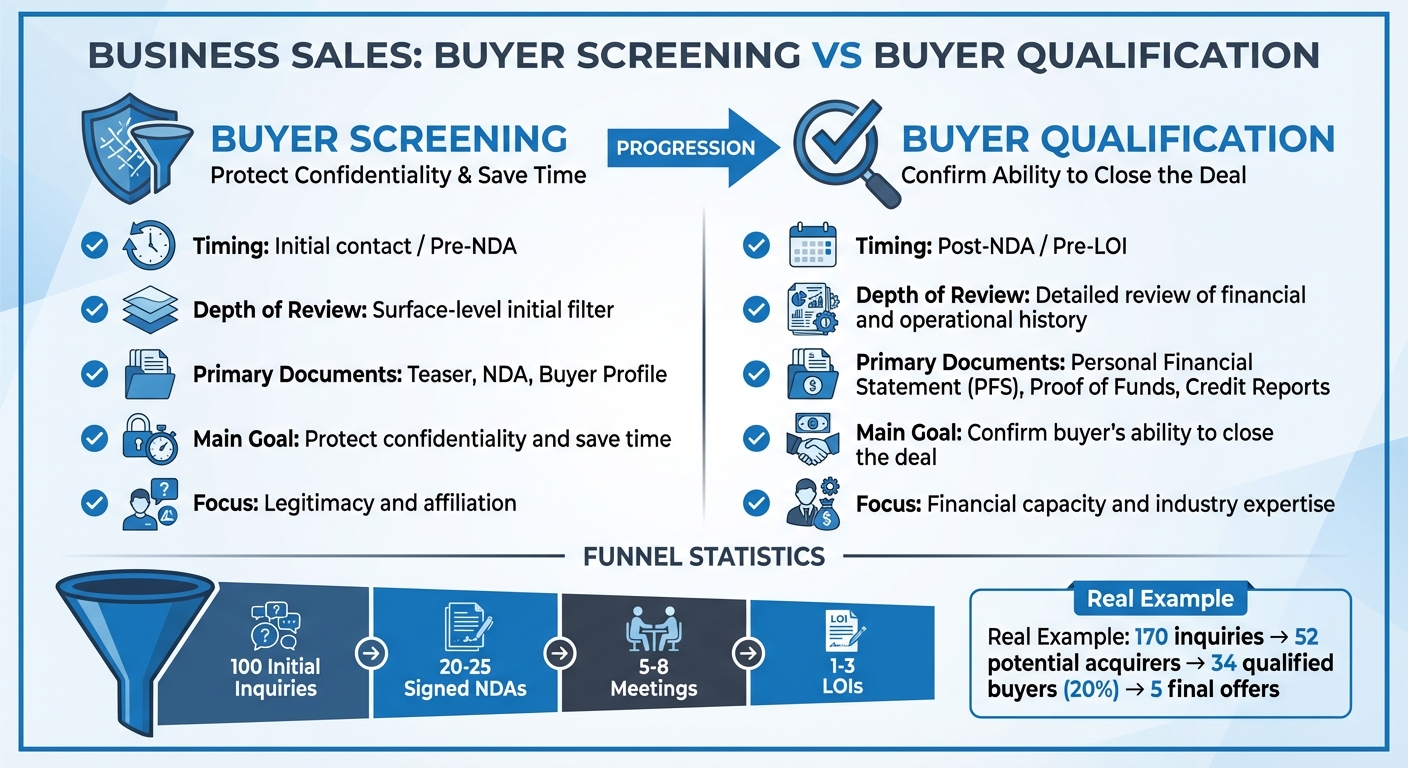

Buyer Screening vs Buyer Qualification: Key Differences and Process Flow

Building on earlier definitions, this section breaks down the differences between screening and qualification. While these terms are often used interchangeably, they play distinct roles in evaluating potential buyers. Recognizing this distinction helps safeguard sensitive business information while identifying buyers who are truly capable of closing the deal.

Screening serves as the first line of defense. It filters out uncommitted or unqualified prospects before they gain access to sensitive information. This step significantly reduces the number of inquiries – often narrowing down a pool of 100 interested parties to around 20–25 who sign an NDA.

Qualification goes a step further, ensuring that a prospect has the financial resources, strategic vision, and relevant expertise to successfully complete and manage an acquisition. This process dives deeper than screening, focusing on a buyer’s ability to close the deal.

Side-by-Side Comparison

| Feature | Buyer Screening | Buyer Qualification |

|---|---|---|

| Timing | Initial contact / Pre-NDA | Post-NDA / Pre-LOI |

| Depth of Review | Surface-level initial filter | Detailed review of financial and operational history |

| Primary Documents | Teaser, NDA, Buyer Profile | Personal Financial Statement (PFS), Proof of Funds, Credit Reports |

| Main Goal | Protect confidentiality and save time | Confirm buyer’s ability to close the deal |

| Focus | Legitimacy and affiliation | Financial capacity and industry expertise |

Screening is about protecting confidential information early in the process, while qualification confirms whether a buyer is truly capable. The timing is key: screening happens before or at the NDA stage, while qualification intensifies after the NDA is signed, often justifying the release of the Confidential Information Memorandum (CIM). For instance, in November 2022, MidStreet received 170 inquiries and identified 52 potential acquirers. After thorough screening, only 34 buyers (20% of the original pool) were deemed eligible to receive the CIM, ultimately resulting in 5 final offers.

How the Two Processes Work Together

Screening and qualification work hand in hand, forming a structured system that filters prospects at different stages. Jacob Orosz, President of Morgan & Westfield, likens this process to a sales funnel:

"The sale of a business can be compared to a sales funnel. There are major steps along the way, and buyers drop off at each step".

This phased approach is effective because buyers are often hesitant to share detailed personal information – like tax returns – before they’ve reviewed the business details. Screening eliminates non-serious inquiries early, protecting confidentiality and saving time. Qualification, on the other hand, ensures that remaining buyers have the financial means, creditworthiness, and motivation to close the deal before significant costs, such as professional advisor fees, are incurred. By gradually releasing information, this process keeps serious buyers engaged while naturally filtering out those who are unwilling to cooperate, ensuring that only the most capable and committed buyers make it to the closing table.

Using Both Processes in Your Sales Strategy

Building on the concepts of screening and qualification, combining these processes into a unified approach can make your sales efforts more efficient and focused.

Step-by-Step Buyer Evaluation Process

A well-structured buyer evaluation process helps filter prospects effectively, ensuring that your efforts are concentrated on serious leads. Statistics suggest that out of 100 initial inquiries, only about 20–25 result in signed NDAs, 5–8 lead to meetings, and ultimately just 1–3 progress to Letters of Intent (LOIs).

The process unfolds in distinct stages. Initial screening happens during the first contact. At this stage, you collect basic information through a teaser and buyer profile before sharing any identifying details. Once an NDA is signed and financial documentation is submitted, the qualification phase begins. Here, you confirm the buyer’s identity, verify that they can cover at least 15% of the purchase price in cash, and ensure they will retain around $100,000 in liquid assets after the deal. For strategic buyers, you’ll want to assess their acquisition history and industry alignment, while for private equity firms, focus on confirming committed versus pledged capital.

After qualification, you can move forward by releasing the Confidential Information Memorandum (CIM). This document addresses about 90% of a buyer’s initial questions, allowing them to self-assess whether the business aligns with their goals. To maintain momentum, schedule brief, in-person meetings (typically 90 minutes) at a neutral location. Once an LOI is submitted, the screening process intensifies. At this point, you’ll request documents like tax returns, bank statements, and customer contracts. Allocate 1–2 months for due diligence and another 1–2 months for closing.

It’s important not to automate the release of the CIM immediately after an NDA is signed. A manual review ensures that confidential information remains secure. If a buyer starts requesting excessive documents without making meaningful progress, ask them to submit an offer – this helps identify who’s genuinely interested.

The Role of the Confidential Information Memorandum

Once the buyer evaluation process is in motion, the Confidential Information Memorandum becomes a key tool in moving the deal forward. The CIM bridges the gap between a buyer’s initial interest and their decision to submit a formal offer. As Doreen Morgan of Sunbelt Atlanta puts it:

"The CIM is the single most important piece of marketing in the sale process, acting as the bridge between a buyer’s initial curiosity and their decision to submit a Letter of Intent (LOI)".

For lower-middle market deals, a professionally crafted CIM typically spans 30–60 pages and includes normalized financials with adjusted EBITDA, detailed operational insights, and a "Risks & Mitigations" section. By addressing potential concerns upfront, the CIM not only builds trust but also helps risk-averse buyers self-select out early, saving everyone time.

Maintaining control over the CIM is critical. Assign a unique identification number to every copy and use read-only Virtual Data Rooms with watermarking to prevent unauthorized sharing. Release the CIM only after verifying the buyer’s identity, securing a signed NDA, and confirming their financial capability through bank statements or letters of credit.

For brokers and M&A advisors looking to streamline this process, Deal Memo offers professional, white-labeled CIM preparation services. Their package includes unlimited revisions, seller interviews, data room setup, and branding customization – all delivered within 72 hours. This ensures that qualified buyers receive polished, comprehensive materials that help drive deals forward efficiently.

Conclusion

Main Points to Remember

Combining screening and thorough qualification is essential for safeguarding your business while zeroing in on serious buyers. Screening acts as your first defense, weeding out casual inquiries and competitors before sensitive details are disclosed. Meanwhile, qualification digs deeper to confirm that a buyer has the financial resources, relevant expertise, and genuine interest to see the deal through.

A step-by-step approach works best here. Start with screening to eliminate non-serious prospects, then move into qualification to ensure each buyer meets critical criteria before sharing confidential documents. This method minimizes unnecessary risks and keeps the process focused on viable candidates.

Confidentiality is better maintained when information is shared gradually. As Jacob Orosz, President of Morgan & Westfield, wisely points out:

"The major mistakes most entrepreneurs make during the early phases of a transaction are wasting energy on buyers who aren’t qualified and judging the attractiveness of an offer without first obtaining background information on the buyer."

This highlights why releasing information in stages is so important.

The data supports this approach: individual buyers should meet specific financial benchmarks. Skipping this verification step can lead to wasted months on deals that ultimately fall apart.

These insights underline the value of a disciplined and structured buyer evaluation process. By following this strategy, you can better protect your business and focus on buyers who are ready to close.

FAQs

How can I maintain confidentiality while ensuring buyers are qualified?

Balancing the need for confidentiality with the task of qualifying buyers requires a careful strategy to protect sensitive details while identifying serious prospects. Start by implementing an initial screening process. This could involve verifying a buyer’s background, assessing their financial capabilities, and confirming their intent. Tools like non-disclosure agreements (NDAs), proof of funds, or even preliminary conversations can help with this step.

Once a buyer has proven their qualifications, you can gradually provide more detailed information – such as a Confidential Information Memorandum (CIM) – but always in a controlled and deliberate way. This step-by-step approach ensures sensitive data is shared only with trustworthy and financially capable individuals, reducing risks and filtering out unqualified candidates. To add an extra layer of protection, consider using secure platforms or confidentiality agreements to safeguard information throughout the process.

What are the key red flags to watch for when screening potential buyers?

When evaluating potential buyers, keeping an eye out for red flags can help you avoid complications and wasted effort down the line. Here are a few warning signs to watch for:

- Financial troubles: If a buyer can’t provide proof of funds, has a history of credit problems, or struggles to secure financing, it might indicate they lack the resources to complete the purchase.

- Communication issues: A buyer who is unresponsive, gives vague answers, or hesitates to share necessary details might not be fully committed or transparent.

- Unrealistic goals or unclear plans: Buyers without a clear purpose, overly optimistic expectations, or limited experience in the industry could create challenges that derail the deal.

Spotting these signs early can help you focus your energy on serious, well-prepared buyers who are ready to move forward.

How do buyer screening and qualification affect the timeline of selling a business?

Buyer screening and qualification are key steps in making the business sale process smoother and faster by focusing on buyers who are genuinely ready and able to make a deal.

Buyer screening comes first. This step involves assessing potential buyers based on their financial resources, motivation, and relevant experience. By filtering out casual or unqualified inquiries early on, you can avoid wasting time and effort.

Next is buyer qualification, which digs deeper to confirm a buyer’s ability to finalize the purchase. This includes verifying their proof of funds and overall financial stability. By ensuring buyers are prepared, you reduce the risk of delays and keep everything moving forward as planned.

Together, these steps help keep negotiations efficient and minimize disruptions, ensuring the sales process stays focused and on schedule.