M&A deals often fail due to incomplete or inaccurate data, leading to financial losses and legal risks. Missing financial records, inconsistent documentation, and fragmented systems can delay or derail transactions. Buyers risk overpaying, inheriting hidden liabilities, or facing compliance issues when data gaps go unaddressed. Here’s what you need to know:

- Financial Risks: Missing tax records, inaccurate revenue projections, and hidden liabilities affect valuations.

- Operational Issues: Fragmented systems and inconsistent accounting slow integration and create inefficiencies.

- Compliance Problems: Data privacy violations and regulatory oversights lead to fines and reputation damage.

To avoid these pitfalls:

- Conduct thorough pre-diligence reviews.

- Use centralized tools like Virtual Data Rooms (VDRs).

- Standardize data formats and verify sources.

- Work with experienced advisors to prepare accurate documentation.

What Investment Bankers and Advisors Really Do During Due Diligence 2025

How Data Gaps Can Derail M&A Deals

Financial Risks and Valuation Impact of Data Gaps in M&A Due Diligence

Accurate and timely data is the backbone of any successful M&A deal. When critical information is missing or incomplete, it can derail transactions, leading to financial, operational, and legal challenges that may collapse deals entirely. Below, we’ll explore how these gaps can create risks that ripple through the financial, operational, and compliance aspects of a transaction.

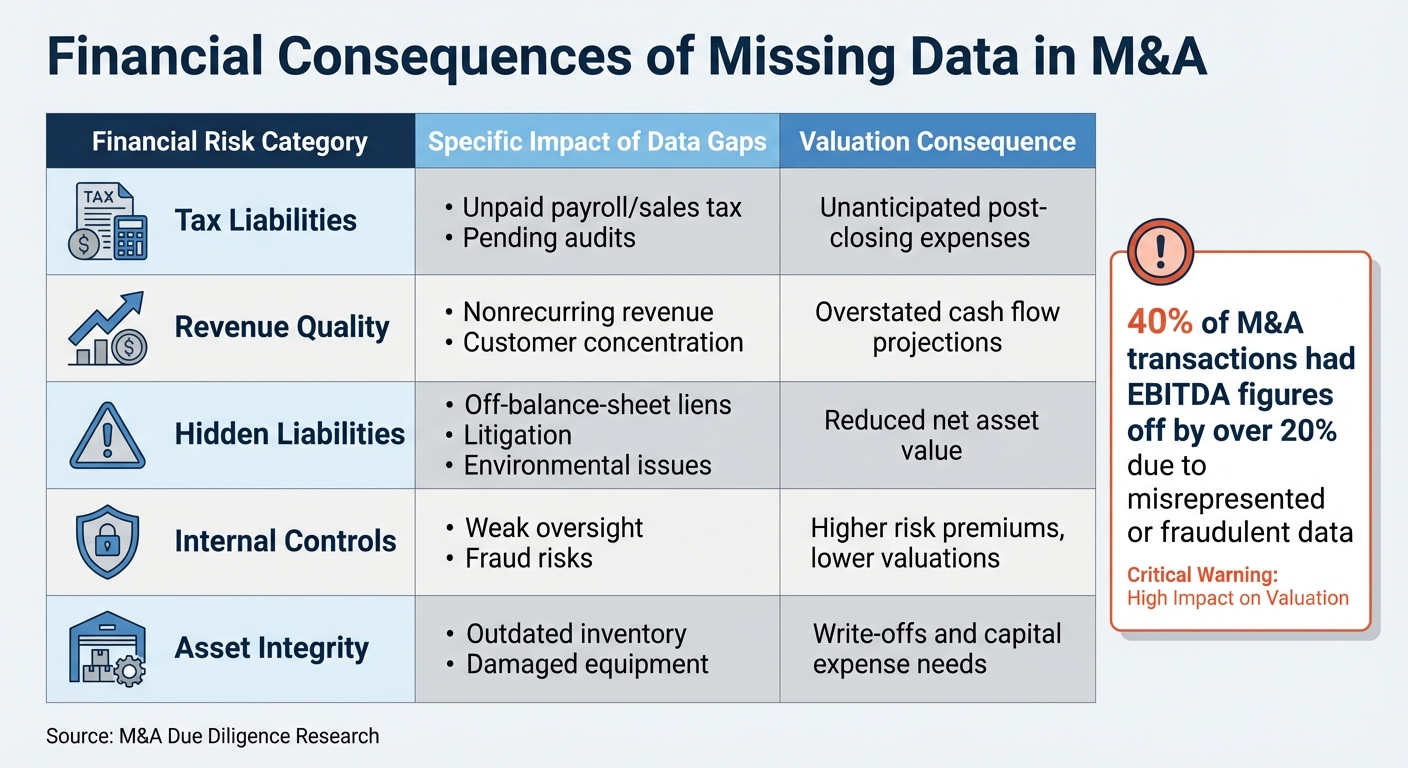

Financial Consequences of Missing Data

When buyers lack a complete picture of a target company, they risk overpaying or inheriting hidden liabilities. Incomplete data can obscure true value, leading to costly surprises. For instance, unpaid payroll taxes, unresolved audits, or undisclosed property liens may only surface after the deal closes, creating unexpected financial burdens.

Another issue arises with inaccurate Quality of Earnings (QofE) reports. Without full access to records, buyers may miss red flags like nonrecurring revenue or accounting irregularities. A study revealed that 40% of M&A transactions analyzed had EBITDA figures off by over 20%, often due to misrepresented or fraudulent data. Elliott Holland of Guardian Due Diligence highlights the importance of reliable data sources, stating:

"The seller will lie, but banks don’t lie. When you use a data source like bank statements that are rigid and conservative, you know that the numbers presented are correct."

Asset discrepancies also pose significant risks. Financial statements might overstate the value of equipment or inventory, only for site visits to reveal obsolete or damaged assets, forcing buyers to account for write-downs and immediate capital expenditures.

| Financial Risk Category | Specific Impact of Data Gaps | Valuation Consequence |

|---|---|---|

| Tax Liabilities | Unpaid payroll/sales tax, pending audits | Unanticipated post-closing expenses |

| Revenue Quality | Nonrecurring revenue, customer concentration | Overstated cash flow projections |

| Hidden Liabilities | Off-balance-sheet liens, litigation, environmental issues | Reduced net asset value |

| Internal Controls | Weak oversight, fraud risks | Higher risk premiums, lower valuations |

| Asset Integrity | Outdated inventory or damaged equipment | Write-offs and capital expense needs |

Operational Problems from Inconsistent Data

Fragmented data systems can create chaos during integration. If financial records, customer data, and inventory systems don’t align, it becomes nearly impossible to streamline operations. This fragmentation delays integration processes, eroding the value that the deal was intended to generate.

Additionally, inconsistent accounting practices between the buyer and seller can complicate reconciliation efforts. For example, a seller using cash-basis accounting while the buyer operates on an accrual basis can lead to time-consuming cleanup efforts. Instead of focusing on synergies, integration teams are left untangling mismatched records.

Compliance and Reputation Risks

Data gaps can hide regulatory violations that jeopardize deals. Missing documentation related to anti-bribery laws, data privacy policies, or environmental standards exposes buyers to fines and legal action. Alarmingly, only 19% of global executives reported conducting environmental assessments during M&A planning. This oversight leaves buyers at risk of costly cleanup efforts or lawsuits from agencies like the EPA.

Data privacy concerns add another layer of complexity. Without a clear understanding of how a target company manages customer information, buyers may inadvertently violate regulations like GDPR (Europe), CCPA (California), PIPL (China), or DPDPA (India). These infractions not only carry hefty fines but can also damage an acquirer’s reputation.

Elyse A. Reilly, a partner at Ernst & Young LLP, cautions against overlooking non-financial risks:

"Companies that merely view diligence as a cost to obtain financing and insurance, and only focus on finance and tax, will miss key risks in today’s market."

Lastly, reputational damage can have long-lasting consequences. When data gaps obscure issues like labor violations, discriminatory practices, or previous data breaches, the acquiring company may inherit these problems – and the negative publicity that comes with them. Such challenges can tarnish a brand and erode stakeholder trust.

Common Data Gaps in M&A Due Diligence

When it comes to mergers and acquisitions, spotting common data gaps early can save a deal from unnecessary complications. These gaps often follow predictable patterns, regardless of the industry or size of the transaction. Below are four of the most frequent data challenges that arise during M&A due diligence.

Missing or Outdated Financial Records

Incomplete or outdated financial records can create serious roadblocks in M&A transactions. For instance, the financial data shared in the Confidential Information Memorandum (CIM) can quickly become irrelevant as negotiations drag on. Considering that due diligence for small businesses typically lasts 45 to 60 days – and for larger deals, 60 to 180 days – financial circumstances can shift significantly during this time.

Weak internal controls, such as poor inventory management or insufficient checks and balances, often lead to inaccuracies in financial reporting. In some cases, there’s even the risk of intentional manipulation, which can severely impact valuation.

Scott Levy, CPA at DLA LLC, cautions:

"Hasty due diligence can result in costly oversights. Buyers should conduct comprehensive, methodical reviews of financial statements, legal agreements and operational structures before finalizing deals."

To mitigate these risks, buyers often conduct a two- to three-year financial review during due diligence, compared to the one-year scope of a standard audit. Conducting preliminary due diligence before submitting a Letter of Intent (LOI) can help uncover major discrepancies early. Additionally, commissioning a Quality of Earnings (QofE) report can identify irregularities, such as nonrecurring revenue or accounting inconsistencies, that might not be evident in standard financial statements.

Ensuring all financial data is consolidated and current is equally important to avoid unnecessary delays.

Data Scattered Across Multiple Systems

When financial records, customer data, inventory logs, and employee files are stored in disconnected systems, due diligence becomes a logistical headache. This fragmentation not only slows down the process but also increases the risk of missing critical liabilities, legal risks, or declining revenue trends.

Fragmented systems can significantly extend the timeline, requiring buyers to allocate extra resources to reconcile data. Virtual Data Rooms (VDRs) are often employed to centralize and secure all necessary documents for easy access. However, the success of a VDR hinges on the seller’s ability to collect and organize data from various internal systems. To overcome this, buyers should clearly define data requests early in the process and verify accuracy across departments through cross-functional collaboration.

Beyond fragmented systems, inconsistent accounting practices can further complicate matters.

Different Accounting and Reporting Methods

Disparities in accounting standards between buyer and seller can obscure the financial reality of a target company. For example, if a seller uses cash-basis accounting and the buyer relies on accrual accounting, reconciling these differences can delay integration and even diminish the deal’s value.

The International Financial Reporting Standard 3 (IFRS 3) highlights the importance of consistency:

"The objective of this IFRS is to improve the relevance, reliability and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects."

Despite these guidelines, differences in accounting methods remain a common issue. Buyers often review financial data spanning two to three years during due diligence, while standard audits typically cover just one fiscal year. These mismatches can lead to confusion, especially when nonrecurring revenue or working capital needs are not clearly documented.

Adding to the complexity is the lack of transparency around where data originates.

Missing Documentation on Data Sources

Unclear or incomplete documentation about data sources can make it difficult to verify the accuracy of information, leaving buyers unsure of its reliability. This is particularly problematic for critical metrics like revenue projections, customer lifetime value, and inventory valuations. The issue becomes even more pronounced when records fail to capture the details of system migrations or the consolidation of acquired subsidiaries.

TREP Advisors points out a common pitfall:

"The relevance of the information it [the CIM] contains can wane over time as the data may become outdated, impacting its utility in ongoing discussions with a prospective buyer."

To address this, buyers should request thorough documentation detailing data origins, transformation processes, and system migrations. Forensic accounting techniques can also help uncover hidden liabilities or off-balance-sheet items. Cross-referencing the seller’s financial records with state tax filings and industry benchmarks is another effective way to identify potential exaggerations.

sbb-itb-798d089

How to Fix Data Gaps in M&A Due Diligence

Addressing the risks of incomplete or inconsistent data, as highlighted earlier, requires a clear strategy. Success in mergers and acquisitions (M&A) hinges on proactive planning and thorough data validation by both sellers and buyers. Here’s how to tackle these challenges head-on.

Assess Data Quality Before Starting Due Diligence

Begin by conducting an internal IT audit to uncover system weaknesses or outdated software that might undermine data reliability. Starting this process early gives you time to upgrade systems and clean up data as needed. As W. Edwards Deming aptly put it:

"In God we trust; all others bring data".

Map out the flow of data from systems like ERP and CRM, tracking key data lifecycles to pinpoint integration gaps. Dive into error logs for master data sets – such as customer lists and product catalogs – to identify recurring problems and reduce manual reporting efforts. It’s also critical to ensure that the data in your Confidential Information Memorandum (CIM) aligns seamlessly with the raw data in your Virtual Data Room (VDR). Any mismatch here can quickly erode buyer confidence.

Use Technology to Validate Data

Leverage automated data pipelines to clean, standardize, and validate information before it reaches the analysis stage. This helps establish a reliable "single source of truth". Tools like Power BI, Tableau, and Qlik can provide real-time analytics, while centralized data warehouses make it easier to spot and resolve reconciliation issues. Virtual Data Rooms further enhance this process by securely centralizing documents and maintaining a comprehensive audit trail.

Once your data is validated, standardizing formats becomes much more manageable.

Align Data Formats and Definitions

Agreeing on common data standards among all parties involved can significantly reduce discrepancies and streamline integration efforts. Standardized data reduces financial and operational risks, making the entire process smoother. Automated pipelines can help normalize data formats, but this requires upfront consensus on how key metrics will be calculated and reported. Review your existing data governance policies and assign clear roles for data ownership and quality checks to ensure consistent enforcement of these standards.

Work with Specialists for Data Preparation

Experienced M&A advisors bring an objective perspective, helping you identify potential data weaknesses and develop proactive solutions. These specialists can also refine your CIM, ensuring it effectively communicates with sophisticated buyers. As Ryan Kuhn, Founder of Kuhn Capital, advises:

"The wise seller confirms that experienced advisors are actively involved in your CIM’s composition, and that the advisor’s representatives you meet are the same ones buyers will also meet".

Specialists can streamline the CIM by clearly outlining financial adjustments, which helps avoid disputes during due diligence. A well-prepared CIM not only addresses 90% of a buyer’s initial questions but also creates the competitive tension needed to maximize the deal price.

For sellers needing quick turnaround, Deal Memo offers on-demand CIM writing services with a 72-hour delivery window. Their packages include seller interviews, data room setup, and unlimited revisions, ensuring your transaction materials are accurate, complete, and aligned with buyer expectations from the outset.

Taking these steps not only resolves data gaps but also strengthens your position in meeting regulatory and governance requirements.

Regulatory and Data Governance Requirements

Navigating data gaps during M&A due diligence means tackling a maze of data privacy and security laws. Ensuring data accuracy isn’t just a technical necessity – it must align with ever-changing regulatory standards. Stephen Toland, Head of Austin Office at FBFK Law, emphasizes the growing importance of this shift:

"Privacy and information security due diligence used to be a ‘nice-to-have.’ Now that personal data collection is subject to a complex and inconsistent mix of both state, federal and global data privacy regulations, due diligence is at the core of why many deals happen – or don’t."

This regulatory landscape highlights the importance of strong data-sharing protocols and indemnification strategies.

Data Privacy and Regulatory Requirements

When sharing data during due diligence, it’s essential to establish a solid legal foundation and ensure the original purposes for collecting data remain valid after the transaction. Start by mapping out personal data – where it comes from, how it’s stored, and how it’s processed. Be particularly mindful of cross-border data transfer restrictions, as regions like APAC are implementing rules similar to the European Union’s GDPR. For example, the Data (Use and Access) Act, effective June 19, 2025, has already influenced UK GDPR guidance and reshaped data-sharing practices.

Scrutinize the security measures and compliance of third-party vendors and data processors. A cautionary tale: when Verizon acquired Yahoo in 2017, undisclosed data breaches affecting 3 billion accounts led to a $350 million price reduction. Yahoo later faced fines and settlements exceeding $100 million.

Secure Data Sharing Methods

Once compliance is addressed, safeguarding data during exchanges becomes critical. Virtual Data Rooms (VDRs) equipped with encryption and data masking can protect sensitive information during due diligence. To minimize exposure, share aggregated or redacted data whenever possible and enforce strict access controls to ensure only authorized personnel can view confidential files. Before integrating data systems, seek technical guidance to prevent issues like data loss or corruption. Additionally, verify data storage locations to comply with local access laws, and maintain meticulous records of all data-sharing activities for accountability.

Warranties and Indemnities for Data Issues

To mitigate risks, include specific representations and warranties in the purchase agreement. These should cover data security practices, network vulnerabilities, past breaches, and adherence to state, federal, and global regulations. Extend these warranties to third-party vendors handling sensitive information. Buyers should also secure indemnification for third-party claims and regulatory penalties resulting from the seller’s non-compliance with data privacy laws or undisclosed breaches.

The stakes are high. Under GDPR, fines can reach €20 million or 4% of global annual revenue, with over 1,878 fines totaling more than €4.4 billion issued between May 2018 and October 2023. Meanwhile, under the California Consumer Privacy Act (CCPA), statutory damages can hit $750 per consumer per incident, with intentional violations carrying penalties of up to $7,500 each. To further protect against liabilities, review the target company’s cyber liability insurance and conduct a gap analysis of its data privacy framework. This can help determine whether specific indemnity carve-outs are necessary.

Conclusion

Missing or inaccurate data is responsible for 70%-90% of M&A deals falling short of their expected value, leading to massive financial risks and even regulatory penalties.

When sellers take the initiative to address data issues early, they not only build trust with buyers but also allow for more accurate valuations. This level of transparency eliminates unpleasant surprises during the critical due diligence phase. For example, in 2023, a manufacturing company leveraged advanced analytics during outside-in diligence and identified cost synergies that were more than double the initial estimate. This discovery enabled them to make a winning bid and achieve a smooth integration.

Using advanced data validation tools can help companies quickly address data gaps. Success in this area often hinges on combining the right expertise with reliable technology. Tools like Virtual Data Rooms securely centralize documentation, while skilled professionals transform raw data into compelling, clear analysis. As John Ferrara, Founder & President of Capstone Partners, aptly puts it:

"Part due diligence document, and part marketing collateral, the CIM is central to positioning the client for maximum market receptiveness".

Services such as Deal Memo further streamline this process by delivering white-labeled Confidential Information Memorandums within 72 hours. These include data validation, seller interviews, and unlimited revisions, ensuring a polished and reliable presentation for buyers.

Looking ahead to 2025, with 47% of directors placing M&A as a top priority, focusing on data quality, compliance, and professional preparation can set companies apart. Clean, accurate data not only maximizes deal value but also minimizes risks after closing and ensures a smoother integration process.

FAQs

What are the most common financial data gaps in M&A due diligence, and why do they matter?

When it comes to M&A due diligence, financial data gaps can be a major stumbling block. Common issues include incomplete tax records, accounting discrepancies, and hidden liabilities like liens or unresolved legal disputes. These gaps can distort a company’s actual financial standing, potentially leading to expensive surprises after the deal is closed.

Another frequent problem? Overestimated financial projections. Overly optimistic forecasts can drive up the purchase price, leaving buyers at a disadvantage. To avoid this, it’s essential to cross-check projections with historical data and current market trends. Tackling these issues early in the process helps ensure a smoother transaction and more confident decision-making.

What challenges can fragmented data systems create during M&A due diligence?

Fragmented data systems often cause headaches during M&A due diligence, leading to data inconsistencies, gaps in information, and delays in analysis. These obstacles can complicate the process of spotting risks, assessing opportunities, and making sound decisions.

When data is inaccurate or incomplete, it can throw off valuations, hide liabilities, or let critical warning signs slip through the cracks – opening the door to costly errors. To keep the due diligence process on track and effective, having centralized and easily accessible data is absolutely key.

How can companies ensure compliance with data privacy regulations during M&A due diligence?

When it comes to mergers and acquisitions, ensuring compliance with data privacy laws is non-negotiable. Here’s how companies can tackle this crucial aspect effectively:

Start by conducting a detailed review of the target company’s data privacy practices. This includes examining how personal data is collected, stored, processed, and shared. Make sure their practices align with laws like GDPR, CCPA, or any other applicable regulations. Beyond that, assess their cybersecurity measures – policies, employee training programs, and vulnerability testing – to uncover any potential risks.

Another critical step is setting up clear governance for data sharing during and after the transaction. Confirm that there’s a lawful basis for sharing personal information, update privacy notices where necessary, and keep a record of all compliance efforts.

By following these steps, companies can reduce the chances of fines, lawsuits, or reputational harm, paving the way for a smoother and legally compliant M&A process.