Finding buyers for mergers and acquisitions (M&A) is all about identifying the right prospects, creating competition, and ensuring the deal closes successfully. Here’s a quick summary of the process:

- Understand Buyer Types: Buyers fall into two main categories:

- Strategic Buyers: Operating companies like competitors or suppliers seeking synergies and growth.

- Financial Buyers: Private equity firms, family offices, or venture capitalists focused on cash flow and scalability.

- Segment Buyers: Organize potential buyers into:

- Core (A-List): High-priority buyers with proven interest in your industry.

- Opportunistic (B-List): Buyers meeting general criteria but lacking direct industry experience.

- Exploratory (C-List): Long-shot buyers who still add competition.

- Screen and Evaluate: Assess buyers based on:

- Financial capacity (proof of funds, liquidity).

- Industry expertise and operational fit.

- Alignment with your business goals and values.

- Use Tools and Platforms: Leverage AI-powered databases like Grata, PitchBook, and Axial to identify and connect with buyers.

- Expand Search: Explore niche and international buyers while considering regional preferences and regulatory requirements.

The key is to maintain a dynamic buyer list, refine your outreach strategy, and focus on qualified buyers who can maximize deal value.

The Funnel, Ep. 9: Where Do You Find Your Buyer?

How to Segment Your Buyer Universe

M&A Buyer Segmentation Framework: A-List to C-List Strategy

Once you’ve identified the types of buyers you’re targeting, the next step is to organize them into segments. This helps you focus your energy and resources on the prospects most likely to lead to a successful deal.

Core, Opportunistic, and Exploratory Buyer Categories

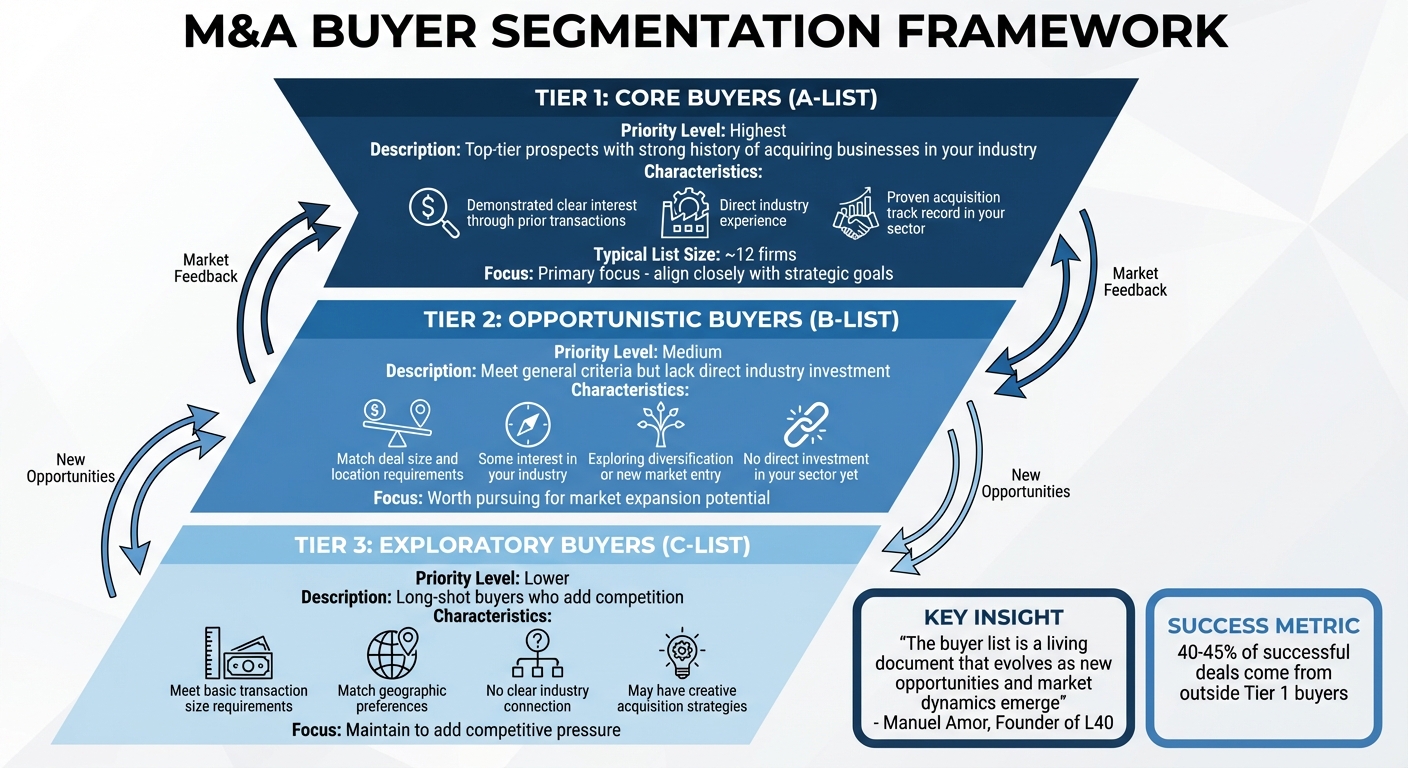

A practical way to segment your buyer list is by dividing it into three groups: Core (A-List), Opportunistic (B-List), and Exploratory (C-List). This method allows you to prioritize the most engaged prospects while still keeping options open for competition.

Core buyers are your top-tier prospects. These are firms with a strong history of acquiring businesses in your industry. They’ve demonstrated a clear interest in companies like yours through prior transactions. As Andy Jones from Private Equity Info puts it:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment".

Your A-List should typically include about a dozen firms that align closely with your strategic goals.

Opportunistic buyers meet your general criteria – like deal size and location – and have shown some interest in your industry. However, they haven’t yet made a direct investment in your sector. These B-List buyers may be exploring diversification or entering new markets, which makes them worth pursuing even if they lack direct experience in your field.

Exploratory buyers make up your C-List. These firms meet your basic transaction size and geographic preferences but don’t have a clear connection to your industry. While they might seem like a long shot, they can still add competition to the process and occasionally surprise you with creative acquisition strategies.

Your primary focus should be on the A-List, but it’s important to keep all three tiers in play. Manuel Amor, Founder of L40, highlights the importance of flexibility:

"The buyer list is a living document that evolves as new opportunities and market dynamics emerge".

As you gather feedback from conversations, you’ll adjust and refine which prospects belong in each category.

Building High-Potential Buyer Profiles

Once you’ve segmented your buyers, the next step is to create detailed profiles for each group. Start by looking at direct competitors – companies that would gain immediate market share by acquiring your business. Then expand to adjacent-market companies – those operating in related industries that could benefit from your expertise, location, or customer base.

A useful guideline is the "5x Rule": target companies with revenues roughly five times your own. For instance, if your business generates $2 million annually, focus on buyers in the $10 million range. These companies typically have the financial strength to complete the acquisition while still benefiting significantly from the deal.

Don’t overlook suppliers, vendors, and customers as potential buyers. These groups already understand your business and may see opportunities for vertical integration. Similarly, consider "affinity businesses" – companies serving the same customer base but offering complementary products or services.

When targeting private equity buyers, precision is key. Andy Jones advises:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response".

Instead of generic emails, reach out to the executive who holds a board seat for a similar portfolio company. This person is more likely to understand your industry and make quicker decisions.

When evaluating potential buyers, focus on two main factors: financial capacity (cash reserves, assets, and financing ability) and strategic motivation (synergies or growth opportunities). Keep in mind that the SBA typically requires a 10% equity injection for acquisitions, so individual buyers need more than just financing approval – they need liquidity.

Trade associations can also be a goldmine for building your buyer list. Sharing a confidential teaser with trade group leaders can help identify members actively looking for acquisitions. These insiders often have insights into which companies are in growth mode and have budgets allocated for deals.

This segmentation process sets the stage for the next step: screening and evaluating potential buyers.

Screening and Evaluating Potential Buyers

Once you’ve segmented your buyer universe, the next step is to carefully assess each potential buyer’s qualifications. This process not only protects sensitive information but also ensures your time is spent on buyers who have the ability to finalize the deal.

Criteria for Evaluating Buyers

Start by examining the financial capacity of each buyer. Before sharing anything beyond the initial teaser, ask for proof of funds – this could include bank statements, tax returns, or documentation of committed capital. For individual buyers, they should be able to pay at least 15% of the purchase price in cash and still have around $100,000 in liquid assets after the closing.

When dealing with private equity buyers, pay close attention to the difference between committed capital and pledged capital. A firm that cannot clearly show proof of committed capital should not move forward.

Next, evaluate their industry expertise and operational fit. Buyers without relevant industry knowledge or necessary licenses should be ruled out. For strategic buyers, look for clear synergies like expanded distribution, cost reductions, or increased market share. Financial buyers, on the other hand, should present realistic growth plans and a clear exit strategy, typically aiming for a profitable exit within five to eight years.

Don’t overlook cultural alignment. The buyer’s vision for your team, leadership, and overall legacy should align with your own values. Brian Dukes, Founder of Exitwise, emphasizes this point:

"A well-qualified buyer is an individual, business, or other kind of entity with the strategic vision, financial ability, and expertise to successfully complete the merger or acquisition".

Require all buyers to sign NDAs upfront. Any refusal to sign a Non-Disclosure Agreement or provide basic financial documentation is an immediate red flag. Also, keep initial face-to-face meetings short – 90 minutes is usually enough to gauge their background and motivations.

Once you’ve established financial and operational qualifications, the next step is to verify these claims by looking into their track record.

Researching Buyer Track Records

After narrowing down your list based on financial and strategic criteria, dig into each buyer’s history to assess their ability to close deals. Contact references from their prior acquisitions to get a sense of how they handled transitions, treated employees, and followed through on their commitments.

For private equity firms, analyze their acquisition history and portfolio performance. Look for patterns – do they have a strong track record of successful integrations, or do they struggle with failed deals? Use M&A databases to identify key executives responsible for managing portfolio companies similar to yours. These individuals often hold decision-making authority and can provide valuable insights.

Deal discipline is another critical factor. Buyers with extensive experience in M&A processes, such as financial sponsors, tend to execute deals more smoothly. They’re familiar with standard timelines and documentation, which often makes the process more efficient. Pay attention to how buyers handle your Confidential Information Memorandum (CIM). A well-organized response is usually a good indicator of serious intent and strong internal management.

Be cautious of buyers who raise red flags, such as rushing the sale process, offering unwarranted criticism, or failing to provide timely updates. Watch out for buyers who have a history of "re-pricing" deals during the verification stage, as this can signal bad faith. For individual buyers, confirm their willingness to relocate if the business requires hands-on management; reluctance to move may indicate a lack of commitment.

If seller financing is part of the deal, running a credit check on the buyer is essential, as it involves extending credit. Additionally, reviewing their acquisition history in your industry or related sectors can build confidence in their ability to execute. Statistics show that investment bankers close deals with a "top tier" buyer list candidate 55% to 60% of the time, which highlights the importance of thorough screening.

Tools and Platforms for Finding Buyers

Finding buyers today relies heavily on advanced, data-driven tools. These platforms go beyond traditional networking, helping you uncover potential buyers that might otherwise remain hidden. By using these tools, you can build targeted outreach strategies with the help of comprehensive databases and search platforms.

Buyer Databases and Search Tools

AI-powered platforms have transformed the way buyer lists are built. Tools like Grata and Inven use artificial intelligence to sift through millions of data points from company websites, news articles, and social media, uncovering niche buyers that traditional databases often overlook. For instance, Grata’s database includes a staggering 19 million companies, 3 million financial records, and 800,000 deals. As Ben Hughes, Head of Business Development, highlighted:

"The fact that Grata was already focusing on AI before it became a widespread trend shows they’re ahead of the curve, positioning AI as the future".

Other platforms, like PitchBook and Capital IQ, provide detailed insights into private market activities and investment criteria. Jay Santoro, Vice President at Tarsadia Investments, shared:

"I initiated a cold outreach using all the information I found within PitchBook, and ultimately, that effort led to a deal".

These tools allow you to filter potential buyers using specific criteria, such as revenue ranges ($2.5 million to $250 million), EBITDA ($250,000 to $25 million), geographic location, and transaction types.

Meanwhile, middle-market networks like Axial take a more tailored approach. Instead of functioning as public listing sites, Axial uses algorithms to privately match sell-side opportunities with over 4,500 active buyers in North America’s lower middle market. The platform handles over 10,000 deals annually. Data shows the importance of list size: a buyer list of 100 names typically generates 11 signed NDAs, while expanding the list to 400 names yields 39 signed NDAs.

To identify the right decision-makers, tools like LinkedIn, Lead411, and ZoomInfo can verify key executive contact details. For public companies, the SEC.gov EDGAR database offers access to 10-K annual reports and investor presentations, helping you spot potential strategic acquirers. For tracking private equity firms, their portfolio companies, and investment criteria, PrivateEquityInfo.com is a valuable resource. Together, these tools not only identify potential buyers but also refine your outreach strategy with precise market data and transactional insights.

Using Market Data and Past Transaction Analysis

A buyer’s acquisition history is often the best indicator of their interest. As Andy Jones from Private Equity Info explains:

"The best gauge of a private equity firm’s appetite for a specific industry is that the PE firm has already made a similar investment".

Market intelligence tools help pinpoint firms with a history of investing in businesses like yours, enabling you to create a focused list of high-potential prospects. This approach, combined with thoughtful screening, ensures your efforts target buyers with proven interest in your sector.

Analyzing past transactions can also reveal key market trends. For example, it can identify active consolidators and indicate whether buyers are pursuing platform investments or add-on opportunities. This analysis also sheds light on "quasi-strategic" sponsors – financial buyers who already own related businesses and often behave like strategic buyers. These sponsors may show heightened interest and even pay premiums for the right acquisition.

Beyond identifying firms, it’s critical to find the specific decision-maker. Databases can help you locate the individual at a private equity firm who holds a board seat for a portfolio company similar to yours. Reaching out to the right person ensures your message goes directly to someone with the authority to act.

sbb-itb-798d089

Reaching Niche and International Buyers

Targeting Specialized Industry Buyers

Specialized buyers often see opportunities that generalists might miss. These buyers understand the specific forces driving your industry and can spot synergies that justify higher valuations. The key is to focus on buyers who are already invested in your sector.

Take a tailored approach by prioritizing buyers with direct experience in your industry. Consider targeting quasi-strategic sponsors – financial buyers who already own related businesses. These firms act like strategic buyers, often paying premiums for synergies, while still offering the speed and flexibility typically associated with financial buyers.

If industry filters don’t yield results, refine your search using targeted keywords to identify similar portfolio companies and their investors. It’s also crucial to pinpoint the exact executive responsible for board-level decisions at these firms. Andy Jones from Private Equity Info emphasizes this point:

"If you contact the wrong person at the right firm, you will often get the wrong answer. Or, more likely, no response".

While targeting niche buyers demands deep industry knowledge, connecting with international buyers introduces additional layers of complexity, including cultural and regulatory nuances.

Cross-Border M&A Considerations

International buyers can bring fresh perspectives and may offer higher valuations, but reaching them requires a different strategy. In 2024, cross-border deals accounted for roughly 30% of global M&A activity. Interestingly, intra-regional deals – those within the same geographic region – outperformed the market, delivering an average two-year relative total shareholder return of 1.2%.

Cultural understanding is just as important as financial due diligence. Tailor your approach to regional preferences: some cultures prioritize quick decisions, while others rely on slower, consensus-driven processes. Engage local M&A, legal, and tax advisors early to address unique approval requirements, foreign investment restrictions, and national security concerns. For U.S.-based businesses, resources like the U.S. Commercial Service’s "Gold Key Service" can help identify, vet, and arrange meetings with overseas partners.

Deals between the U.S. and Europe represent 44% of total transaction volume in the EMEA region, highlighting strong existing relationships and familiarity with regulatory frameworks. To securely share sensitive documents during these transactions, leverage Virtual Data Rooms while ensuring compliance with international data privacy laws, such as GDPR. Don Mulligan, former CFO of General Mills, underscores the importance of pursuing these opportunities:

"People think of cross-border deals as risky, but my view is that it is more risky for the long-term health of the business not to pursue these deals".

Building and Maintaining Your Buyer List

Keeping Your Buyer List Current

Keeping your buyer list up to date is an ongoing process, especially as market dynamics shift. AI tools can scan millions of websites to identify potential buyers by tracking new titles like "Corporate Development" or "M&A Manager". Regularly reviewing resources such as PrivateEquityInfo, Pitchbook, SEC filings, and 10-K reports can help you stay ahead of trends. Additionally, analyzing feedback from declined offers can refine both your messaging and positioning.

To make your outreach more effective, consider segmenting your buyer list into three tiers:

- Tier 1: Direct competitors or firms with similar portfolio companies.

- Tier 2: Companies with a clear interest in expanding within your sector.

- Tier 3: Players in adjacent industries.

Interestingly, about 40% to 45% of successful deals come from outside the top tier. This highlights the importance of casting a wide net while maintaining a targeted approach. By continually refining your list, you increase the likelihood of finding the right buyer. Collaborating with M&A advisors can further enhance this process.

Working with M&A Advisors

M&A advisors bring a wealth of expertise and tools to the table. Their proprietary CRMs are packed with real-time data on buyer behavior, financial capacity, and transaction trends. This allows them to fine-tune your Ideal Buyer Profile and connect you with buyers who are not only interested but also well-equipped to make a deal.

One of their key strengths is identifying the exact executive to contact at each firm, often someone with a board seat at a comparable portfolio company. This targeted approach ensures your message reaches decision-makers who have the authority to act.

When it comes to costs, business brokers typically charge a commission of 8% to 10% of the final sale price. M&A advisor fees, on the other hand, are usually structured on a sliding scale: around 4% for a $5 million deal (approximately $200,000) and about 0.6% for a $50 million transaction (roughly $300,000). Their expertise saves you countless hours of research while ensuring your outreach is both efficient and effective.

Conclusion

Success in finding the right buyers for an M&A transaction hinges on smart segmentation, thorough screening, and using the right tools. Dividing potential buyers into A-List, B-List, and C-List helps you focus on quality leads, avoiding the pitfalls of generic outreach that could harm your reputation.

The numbers back this up: a carefully curated list of 100 to 200 potential buyers often leads to 30 to 40 meaningful conversations, ultimately resulting in 5 to 10 letters of intent. As Jacob Orosz, President of Morgan & Westfield, aptly states:

"The success of any auction is directly proportional to the number of qualified participants".

This private auction approach fosters the competitive environment needed to drive up your final purchase price. It highlights why leveraging modern tools is so critical in today’s M&A landscape.

AI-powered platforms and M&A databases simplify the process, helping identify firms with relevant portfolios and connect with key decision-makers. When paired with strategic segmentation, these tools ensure your outreach efforts are both precise and impactful. Interestingly, 40% to 45% of successful deals come from outside the top-tier buyers, underscoring the importance of balancing a broad reach with targeted focus.

Whether you’re navigating the process independently or working with M&A advisors, the priority should always be on finding qualified buyers and creating competition to secure the best deal. The formula is straightforward: identify the right buyers, engage decision-makers, and build competitive pressure to maximize value. An updated and well-maintained buyer list is the cornerstone of a winning M&A strategy, supporting every stage from initial research to final negotiations.

FAQs

How can I prioritize potential buyers for an M&A deal effectively?

To prioritize potential buyers effectively in an M&A deal, start by organizing them into categories based on how well they align with the seller’s goals and their ability to close the transaction. A practical way to do this is by grouping buyers into tiers like A-list, B-list, and C-list. These tiers are typically determined by factors such as their interest in the industry, financial resources, and track record with acquisitions. Buyers on the A-list generally demonstrate strong interest and are closely aligned with the seller’s industry, making them more likely to lead to a successful deal.

You can also use specialized research tools and databases to pinpoint and assess high-potential buyers. Pay attention to their financial stability, strategic alignment, and ability to fulfill the seller’s specific needs. By focusing your efforts on the most qualified buyers, you can simplify the negotiation process and improve the chances of successfully closing the deal.

What should I consider when assessing a buyer’s financial ability in an M&A deal?

When assessing a buyer’s ability to complete a transaction, two key areas deserve attention: financial stability and access to funding. It’s essential to determine if the buyer has enough liquidity, dependable financing options, or established financial resources to proceed without adding unnecessary risk. This means carefully reviewing their financial statements and confirming their funding sources to ensure they can follow through.

Equally important is understanding the buyer’s motivation and how well they align with the business. Look into their experience in the industry, the reasons behind their interest in acquiring the business, and their plans for managing it after the deal closes. Conducting due diligence – like background checks and financial evaluations – helps confirm the buyer’s ability to meet their commitments while preserving the business’s value. These steps are crucial for identifying serious buyers who can successfully close the deal.

How can AI tools help identify potential buyers in M&A transactions?

AI tools are transforming how potential buyers are identified in mergers and acquisitions (M&A) by streamlining critical tasks like research, screening, and outreach. Through advanced algorithms, these tools can quickly sift through data to filter companies based on specific criteria – such as industry, financial metrics, and investment history – allowing you to build highly targeted buyer lists with speed and precision.

By examining data like previous acquisitions and sector preferences, AI tools pinpoint buyers who are most likely to be interested, including private equity firms, strategic acquirers, or venture capitalists. This not only cuts down on the time spent searching but also improves the likelihood of finding the right fit, making the deal process more efficient and accurate. In essence, AI takes the complexity out of identifying qualified buyers, letting you focus on closing successful deals.