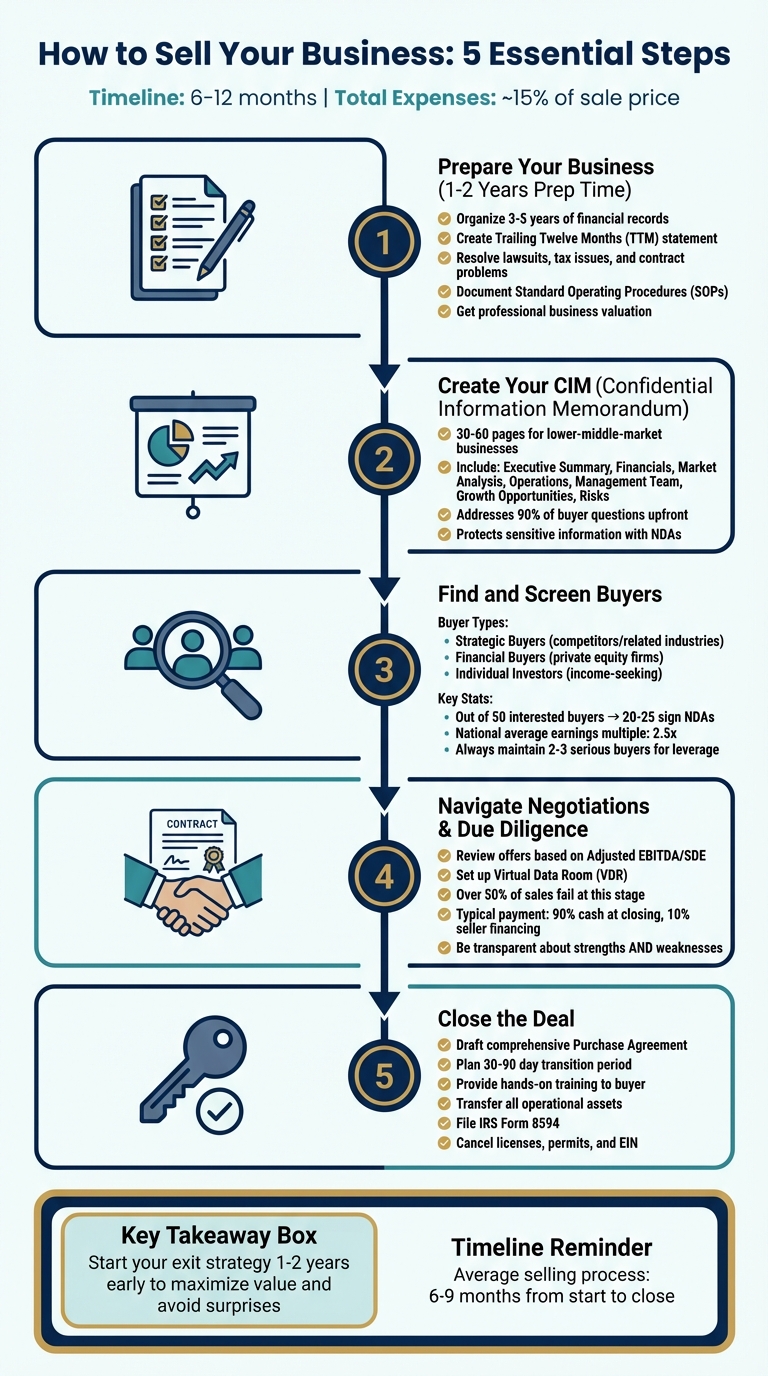

Selling your business can be complex, but with careful preparation, you can simplify the process and maximize your returns. Here’s a quick breakdown of the key steps:

- Prepare Your Business: Organize financial records, address risks, and improve operations. Aim for 1–2 years of prep time.

- Create a Confidential Information Memorandum (CIM): This document outlines your business’s financials, operations, and growth potential for buyers.

- Find Buyers: Screen potential buyers carefully, using NDAs to protect sensitive information.

- Negotiate and Handle Due Diligence: Resolve buyer concerns, provide clear documentation, and stay organized to avoid delays.

- Close the Deal: Finalize the purchase agreement, transfer ownership, and ensure a smooth transition.

Selling a business typically takes 6–12 months, with expenses around 15% of the sale price. Planning early, maintaining transparency, and working with professionals can make the process smoother and more profitable.

5 Steps to Sell Your Business: Complete Timeline and Checklist

How to SELL a Business (Step by Step System I Use)

Step 1: Get Your Business Ready for Sale

First impressions are everything. Potential buyers often form their opinions within minutes of reviewing your business, and any signs of disorganization or unresolved issues can derail a deal before negotiations even begin. To avoid this, dedicate at least a year to preparing your business and financial documents. This gives you the time to address potential red flags that buyers might use as leverage to negotiate a lower price. A key part of this preparation involves organizing your financial and operational records.

Organize Your Financial and Operational Records

Start by gathering three to five years of tax returns, profit and loss statements, balance sheets, and general ledgers. Make sure these documents align – discrepancies between tax returns and financial statements can raise concerns. As Taylor Wallace from Baton Market puts it, "Buyers can live with ‘not perfect.’ They rarely live with ‘not explainable’".

You’ll also want to prepare a Trailing Twelve Months (TTM) statement. This provides a snapshot of your business’s current financial performance, ensuring buyers don’t rely on outdated numbers during negotiations. Collaborate with your accountant to recast your financials by adding back discretionary expenses like personal travel, family salaries, or one-time costs that a new owner wouldn’t inherit. This adjusted view gives buyers a clearer picture of your true profitability.

Beyond financial records, organize key operational documents. These should include your business formation papers (like articles of incorporation and bylaws), real estate and equipment leases, supplier and customer contracts, professional licenses, and employment agreements. Additionally, create written Standard Operating Procedures (SOPs) for recurring tasks to show that your business can run smoothly without you. Buyers and their lenders typically expect at least three years of audited financial statements during due diligence.

Find and Fix Major Risks

Unresolved issues like pending lawsuits, tax delinquencies, or problematic contracts can derail your sale or lead buyers to lower their offers. Before going to market, resolve any discrepancies in your general ledger. Clear up lawsuits, complete audits, and address outstanding tax penalties to present a clean and organized business.

Review your commercial contracts for any "change of control" or assignment clauses that might require third-party consent before finalizing a sale. Another common risk is high customer or supplier concentration – when a single relationship accounts for a large portion of your revenue. Buyers may view this as a vulnerability and adjust their offers accordingly. To mitigate this, consider implementing retention plans for key employees to ensure your team stays intact during the transition.

"A clean slate heading into due diligence reduces uncertainty discounts buyers may otherwise apply."

- Wendy G. Marcari, Member of the Firm, Epstein Becker & Green, P.C.

Increase Your Business Value

Even small changes can make a big difference. Simple upgrades like painting, repairing equipment, or refreshing your website can enhance the overall impression of your business without costing much. These "broken window" fixes signal to buyers that your business is well-maintained and professional.

Focus on building recurring revenue streams through long-term contracts or subscription models, as steady income is a major draw for buyers. Additionally, reduce your personal involvement in daily operations by transferring key relationships from personal accounts to shared CRM systems. This makes your business more attractive by showing it can operate independently of you.

Finally, work with a professional appraiser to determine a realistic valuation range based on your adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Proper pricing is crucial – overpricing can scare off buyers, while underpricing leaves money on the table.

"The decisions you make and actions you take before initiating a sale process often determine how successful the outcome will be. Preparing early not only protects value but also creates opportunities to improve it."

- Wendy G. Marcari

Taking these steps lays the groundwork for crafting an effective Confidential Information Memorandum.

Step 2: Create a Confidential Information Memorandum (CIM)

When your business is ready for sale, the next step is crafting a Confidential Information Memorandum (CIM). This document serves as a bridge between initial buyer interest and a Letter of Intent (LOI), addressing around 90% of the questions buyers typically ask upfront. By providing this information early, you can focus on running your business instead of repeatedly answering the same inquiries.

With fewer than one-third of businesses transitioning smoothly to new ownership, your CIM must strike a balance: it should back up your asking price with solid data while also presenting a compelling narrative about your company’s potential. Below, we’ll outline what to include in your CIM and how to share it securely.

What to Include in Your CIM

A well-structured CIM for lower-middle-market businesses usually spans 30–60 pages and focuses on clear, concise information. Here’s a breakdown of the key sections:

- Executive Summary: Provide a snapshot of your business, including Trailing Twelve Months (TTM) revenue, Adjusted EBITDA, your unique selling proposition, and key growth initiatives.

- Business Overview: Share your company’s history, legal structure, mission, and a detailed explanation of your products or services.

- Financial Performance: Include three to five years of profit and loss statements, balance sheets, and a detailed add-back reconciliation to explain how you calculated your Adjusted EBITDA.

- Market Analysis: Highlight the Total Addressable Market (TAM), current industry trends, and your competitive positioning.

- Operations: Provide details on production processes, equipment, facilities, and supply chain specifics.

- Management Team: Introduce key personnel, emphasizing their expertise and tenure. If you plan to exit fully, consider excluding your own profile.

- Growth Opportunities: Lay out specific plans for expansion, such as entering new markets, launching new products, or building sales teams. Avoid overly optimistic projections that lack supporting data.

- Risks & Mitigations: Be upfront about challenges like customer concentration or pending litigation, but include clear strategies to address these issues. Transparency builds trust.

| Key CIM Component | Essential Details to Include |

|---|---|

| Executive Summary | TTM revenue, Adjusted EBITDA, unique selling proposition, and top growth initiatives |

| Business Overview | History, structure, mission, and detailed description of products/services |

| Financial Performance | 3–5 years of P&L and balance sheets, plus add-back reconciliation |

| Market Analysis | TAM, industry trends, and competitive landscape |

| Operations | Production processes, equipment, facilities, and supply chain details |

| Management Team | Profiles of key personnel, tenure, and expertise |

| Growth Opportunities | Specific, actionable plans for expansion |

| Risks & Mitigations | Transparent disclosure of challenges and mitigation strategies |

How to Share Information Without Revealing Too Much

Sharing your CIM requires a careful balance between transparency and confidentiality. To protect sensitive information, start by requiring all potential buyers to sign a legally binding Non-Disclosure Agreement (NDA). Typically, out of 50 interested buyers, only about 20–25 will sign an NDA and receive the CIM.

Use a phased approach to disclosure. Begin with a Blind Teaser – a one-page document that provides high-level, anonymous details about your business to gauge interest without revealing its identity. Once buyers sign the NDA, they can access the full CIM, which includes detailed financial summaries and operational insights. However, save the most sensitive details, like customer names or proprietary data, for later stages of due diligence or after an LOI is signed.

To further safeguard your CIM, redact or generalize sensitive information. For instance, refer to a key employee as "Head of Operations" instead of using their name. Additionally, use Virtual Data Rooms (VDRs) to control access. These platforms allow you to assign read-only permissions, apply digital watermarks, and track document views or downloads. Include a confidentiality notice on every page, and assign unique identification numbers to each CIM copy to deter unauthorized sharing.

Using Professional CIM Writing Services

Creating a polished CIM can be daunting, especially when you’re deeply involved in your business. Professional intermediaries, such as business brokers or investment bankers, bring an outsider’s perspective to highlight your business’s strengths and address any weaknesses. These experts have extensive experience drafting CIMs and know exactly what buyers are looking for.

A professionally prepared CIM conveys strong management and builds trust with potential buyers. As Doreen Morgan of Sunbelt Atlanta explains, "A professionally prepared CIM is your first and best opportunity to tell your company’s story your way, before a buyer begins their own deep due diligence". A well-crafted CIM can also spark competitive bidding among buyers, potentially driving up your business’s valuation.

Professional services tailor the CIM to the target buyer, emphasizing return on investment, operational efficiency, and growth potential. They also help you avoid common pitfalls like unrealistic projections, typos, or premature disclosure of sensitive information.

Some services, like Deal Memo, offer on-demand CIM creation with perks such as delivery within 72 hours, unlimited revisions, and white-labeled branding options. This allows you to present a professional document without diverting your focus from day-to-day operations. Keep in mind that selling expenses, including CIM preparation, generally account for about 15% of the final sale price.

"A professionally prepared CIM – one that is professional, transparent, and compelling – is the pivot point for attracting multiple, high-quality bids."

- Doreen Morgan, Sunbelt Atlanta

A completed CIM not only showcases your business effectively but also helps screen and attract the right buyers.

Step 3: Find and Screen Buyers

With your Confidential Information Memorandum (CIM) in hand, the next step is to identify buyers who not only have the financial means but also align strategically with your business. At this stage, your CIM becomes a critical tool in attracting the right buyers while balancing confidentiality with targeted outreach. Typically, buyers fall into three main groups: strategic buyers (competitors or businesses in related industries), financial buyers (private equity firms looking to expand their portfolios), and individual investors (those seeking income-generating businesses).

Start by creating a "no contact" list of competitors or individuals who should not receive any information about your sale. Then, implement a phased outreach approach. Begin with a blind teaser – a one-page document that provides high-level financials and general location details without disclosing your business name.

"Managing confidentiality is key to having a successful exit for your business. The longer your company is on the market, the more likely it is that word will get out that you are for sale." – John Norton, Managing Director at ACT Capital Advisors

These initial steps lay the groundwork for securing your business’s confidentiality while reaching a pool of qualified buyers.

Build a List of Potential Buyers

Your buyer list should extend beyond the obvious candidates. Strategic buyers often pay more because they see potential for synergies, like expanding market share or accessing your customer base. However, they also pose the greatest confidentiality risk, especially if they are direct competitors. Private equity firms bring a professional approach and may retain your management team, but they come with strict ROI targets and rigorous due diligence requirements. Individual investors, on the other hand, are often drawn to reliable income streams but may require seller financing since they rarely have full cash available.

Tap into your professional network by consulting trusted advisors, business colleagues, and industry contacts who can connect you with qualified leads. You can also list your business on online marketplaces to broaden your reach, though careful vetting of inquiries will be essential. Pre-qualifying your business for an SBA loan can make it more appealing to individual buyers who need financing. Keep in mind that the national average earnings multiple for private business acquisitions is about 2.5, and the entire sales process usually takes six to twelve months.

| Buyer Type | Primary Motivation | Advantages | Disadvantages |

|---|---|---|---|

| Strategic/Corporate | Synergies, market share, or integration | Often pay more for strategic value | High confidentiality risk with competitors |

| Financial (Private Equity) | Portfolio expansion or new opportunities | Professional process; may retain management | Strict ROI requirements; complex due diligence |

| Individual Investors | Seeking steady income | Direct negotiations with the owner | May lack capital; often need seller financing |

After identifying potential buyers, the next priority is safeguarding your information with well-drafted NDAs.

Use Non-Disclosure Agreements (NDAs)

The NDA is the first legal step in any transaction and sets the tone for the negotiations. A well-written NDA signals that you’re professionally represented and discourages buyers from attempting aggressive tactics. Most NDAs in mergers and acquisitions are unilateral, meaning only the buyer is bound to confidentiality while you, the seller, disclose information.

Never share your detailed CIM before securing a signed NDA.

"The non-disclosure agreement (NDA) is the first document to be signed in a transaction and sets the tone for negotiations." – Jacob Orosz, President of Morgan & Westfield

Modern NDAs often include non-solicitation clauses to prevent buyers from poaching employees during the sales process. Standard NDA terms range from one to five years. To further protect your information, use Virtual Data Rooms (VDRs) to monitor document access, apply watermarks with recipients’ names, and set expiration dates for sensitive files. Include a "return or destroy" clause requiring buyers to delete confidential information if the deal doesn’t proceed.

Evaluate Buyer Qualifications

Screening buyers thoroughly is essential. Start by verifying their financial capacity – request proof of funds, such as bank statements or letters from financial institutions, to confirm they can afford the down payment or full purchase price. For buyers relying on financing, ensure they are pre-approved for an SBA loan or other funding sources. For individual buyers, consider requesting a credit report or conducting a background check.

Beyond financial readiness, assess the buyer’s strategic fit and credibility. For corporate or private equity buyers, ask about their acquisition history – how many deals they’ve completed – and request to speak with executives of businesses they’ve previously acquired. This due diligence helps you gauge whether they have the expertise to manage your business, especially if specialized knowledge is required.

"Thoroughly screen all potential buyers before releasing any information. Buyers should be screened financially and direct competitors should be screened with extra due diligence." – Jacob Orosz

Maintain a shortlist of two to three serious buyers at all times to retain leverage and keep the process moving in case your primary deal falls through. Create urgency by setting an "indication of interest" deadline – typically three to four weeks – for buyers to submit non-binding offers. Keep a detailed deal log to track key dates, questions, and commitments from each buyer, ensuring smooth negotiations. Buyers unwilling to sign an NDA can often be dismissed as "tire kickers", saving you time and effort.

sbb-itb-798d089

Step 4: Handle Negotiations and Due Diligence

When you’ve narrowed your options to a few serious buyers, it’s time to focus on negotiations. This phase determines the final price, deal structure, payment terms, and how risks are shared. Keeping two or three buyers in the mix creates competitive tension and provides a backup if one deal falls through. Carefully evaluate all aspects of each bid and negotiate with precision.

Review Offers and Negotiate Terms

Offers are typically based on metrics like Adjusted EBITDA or Seller’s Discretionary Earnings (SDE). These metrics adjust your financials by removing one-time expenses, such as legal settlements or personal benefits paid through the business. When reviewing bids, it’s crucial to address buyer concerns while proactively mitigating risks. For example, if your business has weaknesses like customer concentration or operational gaps, outline clear solutions in your marketing materials.

Another critical point is defining the working capital peg – essentially, what constitutes "normal" operating capital. This should be clearly agreed upon in the Letter of Intent (LOI). Also, ensure your tax returns match your financial statements. Any discrepancies discovered during due diligence could lead to "retrades", where buyers attempt to renegotiate the price downward.

"The fastest way to slow a sale is to float a number you cannot defend, then spend months educating buyers who will not meet it anyway." – Taylor Wallace, Baton Market

Interestingly, many professional M&A processes avoid including a specific asking price in the Confidential Information Memorandum (CIM). This strategy encourages buyers to submit bids based on their own valuation models, which might even exceed your expectations.

Get Ready for Due Diligence

Due diligence is a make-or-break stage – over half of business sales fail at this point. To avoid pitfalls, resolve any outstanding issues like unpaid taxes, discrepancies in your ledgers, or legal problems before entering this phase. Assemble a team of trusted advisors, such as a business attorney, accountant, and HR professional. Designate one person, like your CFO or General Counsel, to manage all requests and keep things organized.

Set up a Virtual Data Room (VDR) to securely store and share your financial, legal, operational, and HR documents. Information should be shared in stages: start with a sanitized teaser, move to the full CIM after an NDA is signed, and finally open the complete data room for serious buyers. Review the buyer’s initial document request list early and negotiate any overly demanding or impractical requests. For instance, if they ask for hundreds of employee NDAs, offer a standard template or a small sample instead. Use a shared tracker to categorize requests by finance, legal, operations, and HR, making it easier to show progress and avoid frustration.

"Due diligence should be a routine process if you are adequately prepared. Stay on track, be organized, keep a checklist, and keep the momentum going." – Jacob Orosz, President, Morgan & Westfield

Prepare comprehensive documentation across all areas, including:

- Financials: Tax returns, general ledger, accounts payable/receivable.

- Legal: Articles of incorporation, intellectual property records.

- Operations: Marketing plans, supply chain contracts.

- HR: Employee rosters, benefit details.

- Contracts: Leases, vendor agreements.

Keep in mind that selling expenses, including broker fees and legal costs, often amount to about 15% of the total sale price. Once your documents are in order, be ready to address specific buyer questions promptly.

Answer Common Buyer Questions

During due diligence, buyers will have detailed questions about your business. Address these thoroughly and early to minimize follow-ups and avoid giving buyers leverage in negotiations. Be transparent about both the strengths and weaknesses of your business. Surprises discovered during this stage – especially negative ones – can lead to price reductions or even derail the deal entirely.

"Make sure you have told your potential buyer everything – negative and positive – before they find anything. If they find any unexpected surprises, they can try to negotiate the sale price downwards." – Nadia Macleod, Director at RP Emery & Associates

Common concerns include:

- Customer Retention: Can the business maintain key relationships without your involvement?

- Legal Risks: Are there pending lawsuits or compliance issues?

- Growth Potential: Are your projections realistic and defensible?

Be prepared to explain and justify your business plans and growth assumptions. To ease concerns about key-person risk, document standard operating procedures (SOPs) that show the business can run smoothly without your daily oversight. Sensitive information, like detailed customer lists or intellectual property specifics, should be withheld until the final stages.

Step 5: Complete the Sale and Close the Deal

After navigating negotiations and due diligence, it’s time to finalize the sale. This phase involves preparing legal documents, organizing the handover, and wrapping up all administrative tasks to transfer ownership. On average, the selling process takes about 6 to 9 months from start to finish. Keep in mind that selling expenses, including broker fees and legal costs, often amount to around 15% of the sale price. With that groundwork in place, let’s dive into how to formalize agreements and ensure a smooth transition for the new owner.

Draft the Purchase Agreement

The purchase agreement is the cornerstone of the sale – it officially documents the terms you and the buyer have agreed upon. This legally binding document should include:

- The full legal names of both parties.

- The business name and background information.

- The agreed-upon closing date.

Financial details are crucial here. The agreement should clearly state the purchase price, payment terms, and schedule. Often, 90% of the payment is made in cash at closing, while the remaining 10% comes through seller financing. If seller financing is involved, a promissory note needs to outline the loan terms and interest rates.

To protect both parties, the agreement should include several key clauses:

- Representations and warranties: These confirm the business’s condition and the validity of the sale.

- Indemnities: These allocate risk and protect the purchase price if any representations are breached.

- Restrictive covenants: These may include non-compete clauses (to prevent you from starting a rival business) and non-solicit clauses (to stop you from recruiting employees or customers).

- Price adjustments: Include a clause to adjust the final price based on an agreed working capital peg.

- Escrows or holdbacks: These safeguard against potential indemnity claims or undisclosed liabilities.

"The agreement to sell a business is standard in most states. It should provide all of the information necessary for transferring the business." – Rocket Lawyer

It’s essential to document all verbal agreements in writing, as oral agreements are unenforceable under the Statute of Frauds. Additionally, specify a dispute resolution method – whether mediation or arbitration – to avoid costly legal battles later on.

Once the agreement is in place, the next priority is ensuring a smooth transition for the new owner.

Plan the Ownership Transition

A well-thought-out transition plan is critical to preserving the business’s value and ensuring its continued success. This plan should involve a dedicated team – including you, the buyer, key employees, and advisors – and a clear timeline with specific milestones. Many sellers find it effective to outline a 30- to 90-day plan that includes training schedules, customer communications, and vendor transitions before the closing date.

"The transition team should include you as the seller, the buyer, key employees, and professional advisors to oversee the entire process." – Brian Dukes, CEO, Exitwise

Here’s what a smooth transition might look like:

- Provide hands-on training to the buyer and their team.

- Introduce the buyer to key clients, vendors, and employees.

- Announce the ownership change to employees, vendors, and customers, addressing any concerns about roles, benefits, or operations.

Some sellers stay on as consultants or employees for a set period – usually six months to a year – to guide the new owner through the transition. Training and support typically last 60 to 90 days, depending on your agreement.

Once the transition is underway, it’s time to wrap up the final administrative steps.

Complete Final Closing Steps

The closing meeting marks the official transfer of ownership. This is where all necessary documents are signed, funds are exchanged, and operational items are handed over. Key steps include:

- Executing the Bill of Sale and transferring titles.

- Signing lease assignments and other relevant agreements.

- Using a closing checklist to ensure all operational assets and access credentials are transferred.

You’ll also need to handle tax and legal formalities:

- File IRS Form 8594 with your tax returns to report the sale.

- If selling the entire business entity, dissolve the LLC or corporation with your state to avoid ongoing taxes or filing requirements.

- Cancel business licenses, permits, trade names, and your Employer Identification Number (EIN).

- File final income and sales tax returns, and settle any outstanding debts.

"The closing is the meeting at which you transfer the business to the buyer." – Fred S. Steingold, Attorney

Make sure to verify the buyer’s financial capability and experience before the deal closes, especially if seller financing is involved. If necessary, use a succession agreement to transfer employee benefits and profit-sharing plans to the new owner.

With all documents signed, funds transferred, and administrative tasks completed, the sale of your business is officially finalized.

Conclusion

Selling a business isn’t something you can rush. It’s a detailed, multi-step process that demands careful planning, precise execution, and a good dose of patience. On average, it takes around 6 to 9 months from the initial stages to the final closing. That said, starting your exit strategy 1 to 2 years ahead of time can make a world of difference. It gives you the chance to maximize the value of your business and steer clear of any unexpected hiccups. As Cortney Sells, President of The Firm Advisors, wisely advises:

"If you want to sell your business and retire at age 65, don’t call us when you’re 65 – call when you’re 62."

To recap, a successful sale hinges on solid preparation, professional-grade documentation, and smart execution. This means keeping your financial records in order, creating a compelling Confidential Information Memorandum (CIM), managing selling expenses effectively, and ensuring a smooth transition. Surround yourself with a team of experts – brokers, attorneys, and accountants – who can guide you through the complexities and help you avoid costly missteps. Their expertise not only protects your investment but also ensures the process stays on track.

And remember, the journey doesn’t end with signing the purchase agreement. A well-structured post-sale transition is just as important. It helps preserve the value of your business and ensures you meet any obligations to the buyer. Use these insights to refine your sale strategy and achieve the best possible outcome.

FAQs

How can I keep my business information confidential when sharing it with potential buyers?

To safeguard sensitive business information while engaging with potential buyers, start by having them sign a non-disclosure agreement (NDA). This legal document protects your data by ensuring that buyers cannot share or misuse the information you provide. But don’t stop there – be selective about what you share. Provide only the most crucial details and limit access to individuals you trust.

Another effective approach is using a phased disclosure process. This means sharing information gradually, giving more access as trust develops. Partnering with seasoned advisors can also make a big difference – they can guide you in securely managing the flow of information. These measures work together to protect your business’s value and maintain confidence throughout the sale process.

What are the biggest mistakes to avoid during the due diligence process when selling a business?

During the due diligence process, sellers often stumble into mistakes that can derail the sale of their business. One major misstep? Poorly prepared documents. Missing or inaccurate financial statements, legal agreements, or operational records can create delays and make buyers uneasy about the deal.

Another common issue is a lack of transparency. Misrepresenting or withholding important details not only erodes trust but can also lead to legal troubles – or even cause the entire sale to collapse. On top of that, sellers who fail to anticipate buyer questions or don’t organize their business data properly often face drawn-out negotiations and higher expenses.

To steer clear of these problems, focus on getting your documentation in order. Make sure every piece of information – like financials or legal records – is accurate, complete, and easy to access. Preparing materials such as a Confidential Information Memorandum (CIM) and fostering open, honest communication with buyers can go a long way in smoothing the process and building trust.

How can I figure out the value of my business before selling it?

Determining your business’s worth is a key step before putting it up for sale. Start with a professional business valuation to get an accurate picture of its value. This process typically takes into account factors like financial performance, industry trends, and current market conditions. Common methods include analyzing cash flow, using earnings multiples, or taking an asset-based approach.

To get ready, gather essential financial documents and put together a Confidential Information Memorandum (CIM). This document should showcase your business’s strengths, operations, and growth potential, giving potential buyers a clear understanding of its value. Working with a valuation expert or business broker can also be a wise choice. They can ensure your valuation aligns with market expectations, positioning you for a smoother and more successful sale.