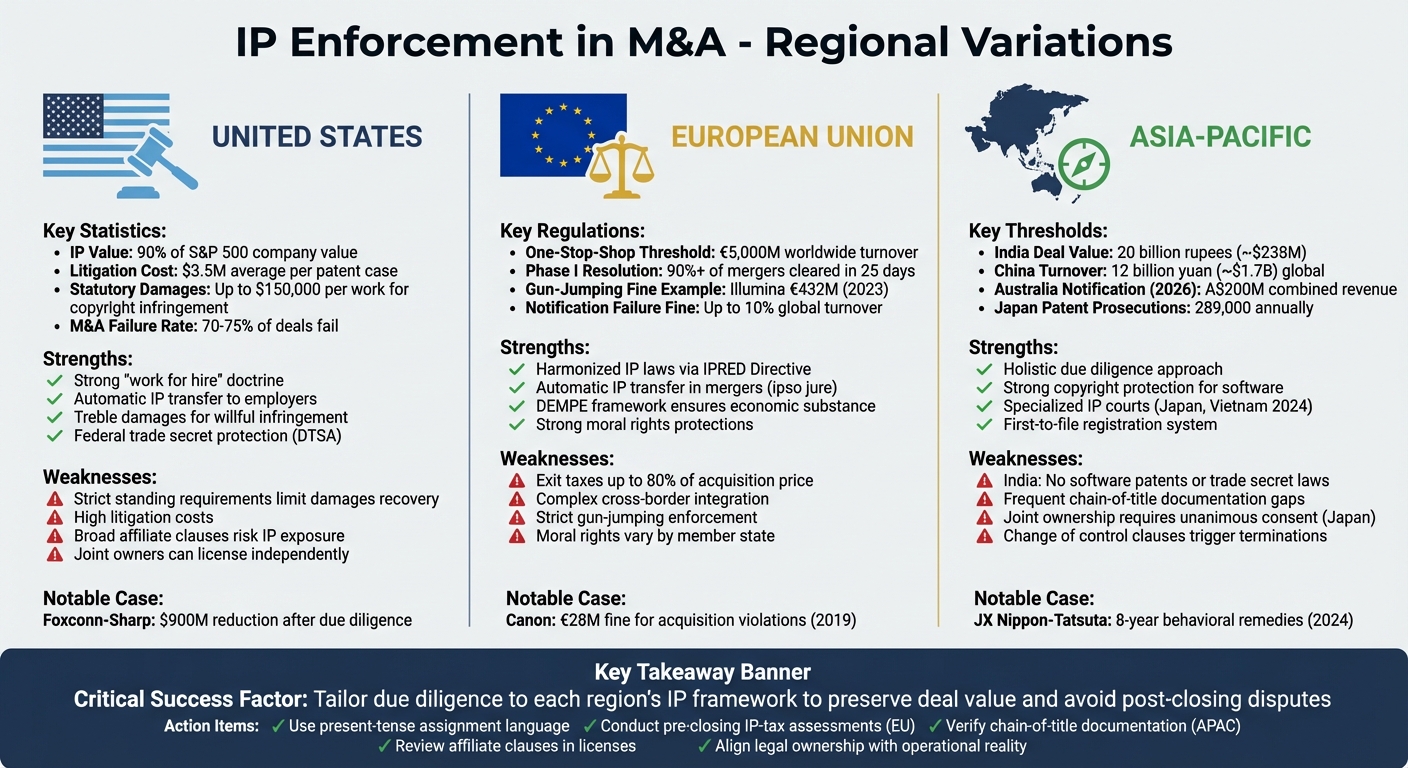

Navigating intellectual property (IP) enforcement in mergers and acquisitions (M&A) is critical, especially for cross-border deals. Regional differences in IP laws, enforcement mechanisms, and legal frameworks can directly impact deal valuations, risk assessments, and transaction structures. Here’s what you need to know:

- United States: Strong IP protections like the "work for hire" doctrine and statutory damages up to $150,000 per work. However, litigation costs are high (around $3.5M per case), and strict standing requirements can limit damages recovery.

- European Union: Harmonized IP laws simplify ownership transfers, but "exit taxes" and regulatory scrutiny (e.g., gun-jumping fines) can complicate deals. The DEMPE framework emphasizes economic substance over legal ownership.

- Asia-Pacific: Varied legal frameworks; India lacks trade secret laws, while Japan enforces strict joint ownership rules. Licensing clauses and chain-of-title documentation often create hurdles.

Key takeaway: Successful M&A transactions require tailored due diligence for each region, ensuring IP ownership aligns with operational realities to preserve deal value and avoid post-closing disputes.

IP Enforcement in M&A: Regional Comparison of US, EU, and Asia-Pacific

1. United States

IP Enforcement Mechanisms

In the U.S., intellectual property rights are primarily upheld through two key avenues: U.S. District Courts and the U.S. Patent and Trademark Office (USPTO), which handles post-issuance proceedings. One standout feature of the U.S. system is its extensive discovery process, allowing litigants to access detailed records during disputes. However, this robust enforcement comes with a hefty price tag – patent litigation costs average around $3.5 million per case.

"Patent litigation costs – estimations in the U.S. are around $3.5 million per patent litigated – and we reach a crucial reality: Thorough IP due diligence can determine not just the success of a transaction but your company’s future market position."

- Keegan Caldwell, PhD, Founder, Caldwell Law

These mechanisms operate within a broader legal framework that directly influences intellectual property (IP) considerations in mergers and acquisitions (M&A).

Legal Frameworks

The U.S. legal system incorporates several provisions that shape IP ownership. For instance, the "work for hire" doctrine ensures that employee-created IP is automatically transferred to the employer. This stands in stark contrast to countries like Canada, where creators retain certain moral rights. Additionally, cross-border transactions involving sensitive technologies are subject to review by the Committee on Foreign Investment in the United States (CFIUS). CFIUS has the authority to block deals or impose conditions if national security risks are identified, particularly in cases involving advanced technology, data privacy, or military applications.

Practical Challenges

Clear ownership of IP is critical in M&A transactions, and any break in the chain of title can severely impact deal valuation. For example, in Core Optical Techs., LLC v. Nokia Corp., the Federal Circuit ruled that an exception in an employment contract left ownership of an invention with the employee rather than the employer. Similarly, in Whitewater W. Indus., Ltd. v. Alleshouse, California law invalidated a patent assignment provision, causing a successor company to lose ownership of three patents it believed it had acquired.

Another emerging issue is the use of AI-generated content. Such content often fails to qualify for copyright protection, potentially diminishing the value of IP assets. Advisors must also watch for "upward-reaching" affiliate clauses in existing licenses. These broadly defined terms can unintentionally expose an entire IP portfolio to competitors once a deal is finalized.

Impact on M&A Valuation

Intellectual property now accounts for a staggering 90% of the value of companies in the S&P 500. As a result, IP due diligence has become a non-negotiable step in M&A transactions. It’s worth noting that 70% to 75% of M&A deals fail, with poor pre-deal analysis and misaligned objectives – particularly around IP – being major contributors.

A case in point is Cisco‘s 2023 acquisition of Splunk for $28 billion. Splunk‘s data analytics IP allowed Cisco to bolster its security infrastructure and compete more effectively with Microsoft. On the flip side, inadequate due diligence can have costly consequences. In 2016, Foxconn slashed its acquisition offer for Sharp by nearly $900 million after discovering previously undisclosed liabilities. These examples highlight how IP can either drive or derail the success of a transaction.

2. European Union

IP Enforcement Mechanisms

The European Union’s approach to intellectual property (IP) enforcement plays a major role in shaping cross-border mergers and acquisitions (M&A). The EU employs a harmonized framework to ensure consistent IP protection across its member states. A cornerstone of this system is the IP Rights Enforcement Directive (IPRED, Directive 2004/48/EC), which sets uniform enforcement standards across the internal market. Other directives, such as InfoSoc, Software, and Database, also contribute to this standardized approach.

The Court of Justice of the European Union (CJEU) is instrumental in interpreting these directives, ensuring they are applied consistently across member states. However, enforcement is not always seamless. For example, in June 2025, the European Commission issued a reasoned opinion to Romania for failing to comply with rules on extended collective licensing under Directive 2001/29/EC and Directive (EU) 2019/790. This highlights a persistent issue: while the framework is harmonized in theory, enforcement gaps remain in practice.

For M&A transactions, the EU offers a unique "one-stop-shop" principle. If certain turnover thresholds are met – typically a combined worldwide turnover exceeding €5,000 million and EU-wide turnover of at least two firms surpassing €250 million – notification is required only to the European Commission, bypassing individual member states. Notably, over 90% of mergers are resolved during a 25-day Phase I investigation without the need for remedies. This streamlined process is a key feature of the EU’s regulatory landscape.

Legal Frameworks

Under Directive 2011/35/EU, all IP rights automatically transfer in a merger. This ipso jure transfer simplifies the process of ownership transfer but underscores the importance of thorough due diligence to ensure clean and undisputed title chains.

Beyond competition law, M&A advisors must also navigate additional layers of regulation. The Foreign Subsidies Regulation (2022/2560) mandates notification for deals involving financial contributions from non-EU governments. Meanwhile, the Digital Markets Act (DMA) introduces extra obligations for "gatekeeper" platforms, reflecting heightened scrutiny of IP-heavy digital assets. Non-compliance with these rules can lead to severe penalties. For instance, the European Commission can impose fines of up to 10% of a company’s global turnover for failing to properly notify a transaction. Past cases highlight the stakes: in 2009 and 2014, the Commission imposed €20 million fines on acquirers who failed to notify transactions that conferred de facto sole control.

Practical Challenges

Despite these robust frameworks, challenges often arise during implementation. One significant issue is "gun-jumping", where a deal is implemented before receiving regulatory clearance. In July 2023, the European Commission fined Illumina €432 million for violating the standstill obligation during its GRAIL acquisition. Although the fine was annulled by the Court of Justice in September 2024 due to unmet notification thresholds, the case underscores the Commission’s aggressive enforcement approach. Similarly, Canon faced a €28 million fine in 2019 for violations during its acquisition of Toshiba Medical Systems.

"If the product-selling affiliates lack standing, the company won’t be able to recover lost profits or obtain an injunction."

- James R. Ferguson, Partner, Mayer Brown

Another challenge involves the distinction between economic and legal ownership. EU tax authorities assess ownership based on DEMPE factors (Development, Enhancement, Maintenance, Protection, and Exploitation). If IP is licensed from a domestic subsidiary to a foreign affiliate after an acquisition, unexpected "exit" taxes may be triggered. To avoid such surprises, advisors should conduct pre-closing IP-tax assessments. These evaluations can help identify which affiliates will hold legal ownership versus licensing rights and account for potential transfer pricing liabilities in deal costs.

These enforcement and compliance challenges have a direct impact on deal valuations.

Impact on M&A Valuation

Certain EU member states have introduced "call-in" powers for transactions that fall below traditional notification thresholds. These powers are often used to scrutinize "killer acquisitions" in the digital and pharmaceutical sectors, where targets may have modest turnover but significant competitive potential. This trend reflects growing concerns about acquisitions that stifle future competition before it can emerge. Advisors must stay vigilant, particularly in jurisdictions that have recently adopted such measures, as they can lead to extended review timelines and inject additional uncertainty into deal valuations.

3. Asia-Pacific Region

IP Enforcement Mechanisms

The Asia-Pacific region employs a wide range of enforcement strategies to protect intellectual property (IP). In Vietnam, authorities such as the Market Surveillance Authority and Ministerial Inspectorates carry out market inspections and seize counterfeit goods as part of administrative actions. Meanwhile, Japan relies on specialized IP divisions, including its Intellectual Property High Court, which manages approximately 289,000 patent prosecutions annually, with cases typically resolved within 12–15 months.

Criminal prosecution is an option throughout the region but is generally reserved for large-scale trademark counterfeiting and piracy. Additionally, most jurisdictions allow rights holders to record their IP with customs authorities to intercept infringing imports and exports. Vietnam has also taken steps to improve its judicial expertise by establishing specialized IP courts under its 2024 legal amendments, reflecting a broader shift toward more professional enforcement systems.

This variety in enforcement approaches highlights the diverse legal landscapes across the region.

Legal Frameworks

Most countries in the Asia-Pacific region operate under a "first-to-file" IP registration system, meaning foreign registrations from the U.S. or EU do not automatically hold precedence. Vietnam’s 2022 amendment to its IP Law marked the most extensive revision in over 15 years, aligning the country’s regulations with Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EU-Vietnam Free Trade Agreement (EVFTA) standards. Notably, this amendment introduced protection for sound marks for the first time. In Japan, the legal framework is shaped by the Patent Act and the Unfair Competition Prevention Act (UCPA), which safeguards both traditional trade secrets and "shared data with limited access".

India presents unique challenges. Software is protected under copyright law but is not eligible for patent protection, and the country lacks specific trade secret laws, relying instead on confidentiality clauses in contracts. In Australia, starting January 1, 2026, mandatory merger notifications will apply to IP asset acquisitions involving combined revenues of at least A$200 million and attributable revenues of A$50 million or more. The Australian Competition and Consumer Commission (ACCC) will oversee these notifications, with Phase 1 fees set at A$56,800 and Phase 2 fees ranging from A$475,000 to A$1,595,000.

Practical Challenges

Intellectual property transactions in the region often face hurdles due to licensing and ownership complexities. One common issue involves change of control (COC) clauses in license agreements. In many Asia-Pacific countries, including Japan, licensors can terminate agreements if the ownership of a licensee company changes. This can create significant risks in mergers and acquisitions (M&A), as share acquisitions – while not altering the legal entity – may still trigger termination. To mitigate this, M&A advisors should identify licenses with COC clauses early in the process and secure licensor consent as a condition for completing the deal.

Another frequent challenge is chain of title documentation, especially in India. Advisors must ensure invention assignment agreements use "present-tense" language, such as "hereby assigns", to satisfy local legal requirements and guarantee proper ownership transfer from inventors to companies. Joint ownership arrangements add further complexity. For example, in Japan, a joint owner of a patent or copyright cannot assign their share or grant a license without the consent of all other joint owners.

These challenges can significantly impact the valuation and feasibility of transactions in the region.

Impact on M&A Valuation

Operational and contractual issues related to IP can directly influence M&A valuations and regulatory scrutiny in cross-border deals. Regulators in the region are increasingly paying attention to "killer acquisitions", particularly those involving smaller companies with valuable IP. For instance, India introduced a deal value threshold of 20 billion rupees (approximately $238 million) in September 2024 for transactions involving targets with "substantial business operations" in the country, even if traditional asset or turnover thresholds are not met. Similarly, China updated its merger notification thresholds in January 2024, requiring disclosure when combined global turnover exceeds 12 billion yuan (around $1.7 billion) and China-specific turnover exceeds 4 billion yuan (approximately $567.76 million).

In 2024, China’s State Administration for Market Regulation (SAMR) conditionally approved JX Nippon Mining & Metals’ acquisition of Tatsuta Electric Wire and Cable. Concerns were raised about competition in the flexible printed circuit market, leading to eight-year behavioral remedies, such as bans on tying or bundling and requirements to supply Chinese customers on fair, reasonable, and non-discriminatory (FRAND) terms. Additionally, SAMR investigated Nvidia Corporation in 2024 for alleged violations of behavioral commitments tied to its 2020 acquisition of Mellanox Technologies. These commitments included non-tying and interoperability requirements.

These cases demonstrate that regulators in the region often prefer behavioral remedies over structural divestitures for transactions involving IP-heavy companies. However, compliance monitoring remains rigorous, adding another layer of complexity to M&A risk assessments.

sbb-itb-798d089

Pros and Cons

This section pulls together the key strengths and weaknesses shaping M&A valuations across different regions, focusing on how regional IP frameworks impact deal structures and value.

In the United States, IP laws provide strong protections. The "work for hire" doctrine ensures that IP created by employees automatically belongs to their employers. Statutory damages for willful copyright infringement can go as high as $150,000 per work, while patent law allows for treble damages – tripling the actual damages – when infringement is proven willful. However, strict standing requirements can limit the ability to recover damages. For example, in the October 2017 Janssen Biotech, Inc. v. Celltrion case, a non-exclusive licensee was found to lack standing to sue.

The European Union takes a different approach, prioritizing economic substance through the OECD DEMPE framework. This framework ensures that tax treatment reflects where IP development actually happens. Misalignment between legal ownership and economic substance can lead to hefty "exit taxes", sometimes up to 80% of the acquisition price.

The Asia-Pacific region presents a mixed picture. While a thorough due diligence process can simplify transactions, there are notable gaps. For instance, India does not have specific trade secret laws and prohibits software patents, leaving software protection to copyright laws alone. As Sabri Tuzcu explains:

"In India, for example, intellectual property in software is handled only by copyright and cannot be patented".

Additionally, poor maintenance of chain of title documentation – especially for software IP – can erode value.

Here’s a quick look at the strengths and weaknesses across these regions:

| Region | Key Strengths | Key Weaknesses |

|---|---|---|

| United States | Strong "work for hire" doctrine; statutory damages up to $150,000 per work; treble damages for willful infringement; federal trade secret protection (DTSA) | Strict standing requirements limit non-exclusive licensees; joint owners can license independently; broad "affiliate" clauses may unintentionally benefit competitors |

| European Union | OECD DEMPE framework aligns tax and IP ownership; strong moral rights protections; long copyright terms via international treaties | Exit tax liability can exceed 80% of the acquisition price if IP is misaligned; complex cross-border integrations; moral rights vary by member state |

| Asia-Pacific (India) | Holistic due diligence approach; strong copyright protection for software | No "work for hire" concept (moral rights stay with creators); no patent protection for software; no specific trade secret laws; chain of title issues are common |

To avoid risks, advisors should ensure assignment agreements use present-tense language like "hereby assigns" to prevent title gaps and unexpected tax issues. It’s also crucial to confirm that the affiliate owning the IP is actively performing the DEMPE functions, ensuring compliance and reducing potential tax liabilities.

Conclusion

Regional intellectual property (IP) enforcement frameworks create unique risks for cross-border mergers and acquisitions (M&A). In the United States, robust statutory protections and the work-for-hire doctrine simplify ownership transfers. However, non-exclusive licensees often face hurdles in recovering damages due to strict standing requirements. In Europe, the DEMPE framework emphasizes economic substance over legal ownership, which can lead to exit tax liabilities if IP ownership and operational functions are misaligned. The Asia-Pacific region, particularly India, presents its own set of challenges, such as the lack of software patents, absence of specific trade secret laws, and frequent chain-of-title documentation gaps.

To navigate these complexities, M&A advisors must adapt their due diligence processes to each region. For U.S. transactions, using present-tense assignment language and ensuring the IP owner actively utilizes the asset can mitigate risks. In Europe, pre-closing IP-tax assessments are critical to ensure the entity holding the IP also performs the DEMPE functions – development, enhancement, maintenance, protection, and exploitation – thereby avoiding unexpected tax liabilities.

In Asia-Pacific deals, localized due diligence is essential. Engaging local counsel to verify clear chain-of-title documentation is especially important, as gaps in this area frequently arise. This is particularly true in India, where chain-of-title integrity remains a significant transactional risk.

Across all regions, aligning legal ownership with operational reality is essential to maintaining IP value. Advisors should use region-specific checklists to address key issues, such as assignment enforceability, registration requirements (e.g., Vietnam’s mandatory IP assignment registration), and moral rights waivers in countries like Canada, where creators retain these rights even after assignment.

Additionally, deal structures must account for jurisdictional nuances. For instance, reviewing target licenses for overly broad "affiliate" clauses can help avoid unintentionally exposing the entire IP portfolio post-closing. In jurisdictions without trade secret statutes, strong contractual confidentiality provisions can substitute for statutory protections. Addressing these regional IP intricacies early in the process safeguards deal value and minimizes the risk of post-closing disputes.

For transaction materials that tackle these IP challenges, consider Deal Memo‘s (https://dealmemo.com) on-demand white-labeled CIMs and OMs. Each draft is delivered within 72 hours, offering timely support for cross-border transactions.

FAQs

How do regional differences in IP enforcement affect M&A valuations?

Regional differences in intellectual property (IP) enforcement can play a big role in shaping M&A valuations. Take the United States, for example. With its well-defined legal frameworks and strong IP protections, buyers tend to place a higher value on assets like patents, trademarks, and trade secrets. These assets are viewed as dependable tools for preserving a competitive edge and ensuring steady cash flow.

On the flip side, regions where IP enforcement is less predictable or bogged down by complicated legal procedures often see more cautious valuations. Buyers might adjust for the increased risks by using deal structures like earn-outs or escrow holdbacks. Adapting valuation models to account for these regional enforcement disparities is crucial to pricing deals accurately and addressing potential risks upfront.

What are the essential IP due diligence steps for cross-border M&A transactions?

When handling IP due diligence for cross-border M&A transactions, the first step is to compile a comprehensive inventory of the target company’s intellectual property. This includes patents, trademarks, copyrights, trade secrets, domain names, and licensed technologies. Make sure to verify ownership or confirm valid assignments for each asset in the relevant jurisdictions. It’s also important to check the status of registrations, renewals, and any pending applications.

The next step involves reviewing licensing agreements. Pay close attention to carve-outs, sublicensing rights, and change-of-control clauses. Additionally, assess any third-party dependencies that could impact the use of the IP post-closing. It’s equally important to examine ongoing or potential IP litigation, oppositions, and enforcement actions. Performing a freedom-to-operate analysis is also crucial to identify any potential infringement risks in the target’s primary markets.

Lastly, evaluate the enforceability of the IP portfolio under the applicable foreign legal systems. Consider differences in laws, such as those related to moral rights or the availability of injunctive relief. Conduct a valuation to determine how the IP contributes to the target company’s overall value. These insights can then be compiled into a well-organized Confidential Information Memorandum (CIM), providing prospective buyers with a clear understanding of both the risks and opportunities associated with the IP portfolio.

Why is the DEMPE framework important for mergers and acquisitions in the EU?

The DEMPE framework – short for Development, Enhancement, Maintenance, Protection, and Exploitation of intellectual property – serves as a key tool in mergers and acquisitions across the European Union. This framework helps M&A advisors and businesses evaluate how intellectual property assets are managed and valued, ensuring they align with local tax laws and transfer pricing requirements.

Grasping the DEMPE framework is crucial when handling cross-border transactions. It sheds light on regional differences in intellectual property enforcement and tax considerations. Addressing DEMPE factors effectively can help safeguard IP rights, streamline deal structures, and minimize risks throughout the transaction process.