Mergers and acquisitions (M&A) are complex and often chaotic. Without proper tools, teams rely on scattered spreadsheets and email threads, leading to missed opportunities and inefficiencies. That’s where M&A-specific CRM systems come in, offering tailored solutions to manage deal pipelines, secure sensitive data, and automate workflows.

Key Takeaways:

- Centralized Data: M&A CRMs consolidate investor, advisor, and regulator information in one place.

- Automation: Advanced tools reduce manual tasks like data entry and follow-ups, saving time.

- Security: Role-based permissions and audit trails protect sensitive deal information.

- Pipeline Tracking: Real-time visibility into deal stages helps prioritize and avoid bottlenecks.

- Relationship Insights: Map existing connections for better outreach and faster negotiations.

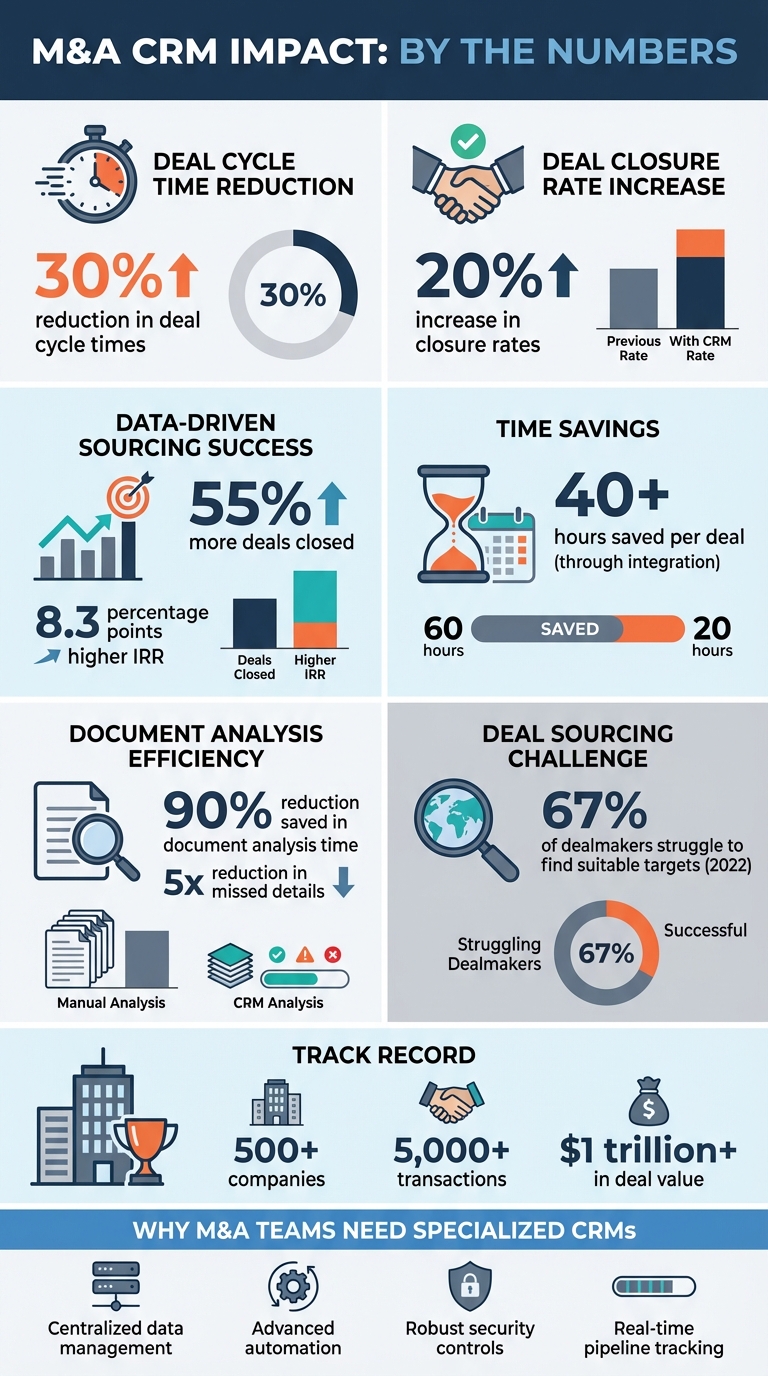

Firms using these tools report up to a 30% reduction in deal cycle times and a 20% increase in closure rates, making them essential for modern M&A workflows.

M&A CRM Benefits: Key Statistics and Performance Metrics

M&A CRM

Core CRM Features for M&A Deal Management

The right CRM features can make a significant difference in managing your M&A workflow. Unlike general-purpose sales tools, M&A-specific CRMs are tailored for the unpredictable nature of deal-making – where deals can stall, restart, or require repeated follow-ups. These platforms excel by offering three key capabilities: automation to reduce manual tasks, robust security to safeguard sensitive data, and pipeline tracking to manage complex transactions effectively. Together, these features streamline every stage of the process – from deal origination to closing – addressing challenges that traditional CRMs and spreadsheets often fail to solve. Let’s dive into these core features.

Automation and Workflow Tools

Automation in M&A CRMs is far more advanced than simple task reminders. These systems can automatically create new deal records, update statuses, and send notifications based on specific triggers. For example, if a target company replies to an outreach email, the CRM can log the interaction, move the deal to the next stage, and notify the appropriate team member – all without manual input.

These platforms also integrate seamlessly with emails, calendars, and contact management tools, automatically capturing interactions and contact details. This level of automation can save teams hundreds of hours annually. Notifications triggered by events keep users informed about platform activity, upcoming tasks, and critical dates. Some CRMs even use AI to summarize deals and evaluate relationship strength, helping teams focus their outreach efforts.

"Historically, Progress Software used spreadsheets to manage its deal flow, and it’s just not effective. With the DealCloud tool, not only can we manage our deal activity, but we can report out with really cool graphics and data that our board and executive team really appreciate."

– Jeremy Segal, Executive Vice President of Corporate Development, Progress Software

Automation doesn’t stop at data capture. These tools push deals forward by closing tasks automatically when prerequisites are met. Teams can also generate reports in formats like Microsoft Word or PDF, ensuring stakeholders receive timely updates without manual effort.

Next, let’s look at how these systems protect the sensitive data they handle.

Secure Document Storage and Access Controls

M&A transactions involve highly sensitive materials – financial data, strategic plans, and intellectual property – that demand rigorous protection. Role-based access controls allow administrators to restrict access to specific data and features based on user roles, ensuring only authorized personnel can view or edit sensitive information. Audit trails and activity logs provide a complete record of who accessed or modified documents, supporting compliance and accountability. Some systems even include permissions-based deletion logs, enabling authorized users to reverse changes if needed.

For the most sensitive information, many CRMs integrate with Virtual Data Rooms. These add extra layers of protection, such as encryption, two-factor authentication, and detailed permission settings. While the CRM manages relationships and communications, these integrated tools ensure critical documents remain secure during due diligence.

"DealCloud has a fully configurable platform that is able to assist us with our strong growth in a fast-moving environment where structured process and data management is paramount."

– Sascha Wagner, Partner, Caldera Pacific

Deal Pipeline and Progress Tracking

Rounding out the core features, real-time pipeline tracking keeps deals on track by offering visibility into every stage of the process. This transparency helps teams prioritize opportunities and spot potential bottlenecks before they escalate. For example, if a target company is slow to respond, the CRM dashboard can flag the deal as "at risk", prompting immediate follow-up.

Pipeline tracking also boosts accountability and coordination across departments. Teams from legal, IT, and accounting can align on critical deadlines and milestones, ensuring nothing falls through the cracks. As deal volumes increase, the ability to visualize the pipeline becomes even more critical.

Another advantage is the preservation of institutional knowledge. CRMs store historical deal data and relationship insights, ensuring that even if team members leave, the organization retains access to valuable deal history and context. This continuity is crucial for long-term success in M&A.

Using CRM Throughout the M&A Deal Lifecycle

M&A transactions rarely follow a straight path. Deals can stall, restart, and demand different tools at every stage. A well-set-up CRM can handle these twists, supporting your team from the first conversation with a potential target all the way to post-merger integration. The trick lies in using the right CRM features at the right time – whether you’re building a list of prospects, managing due diligence, or tracking integration milestones long after the deal is done.

Finding and Originating Deals

The origination phase often trips up M&A teams. In 2022, 67% of M&A dealmakers said they struggled to find suitable target companies. CRMs simplify this process by serving as a centralized hub for market intelligence, consolidating scattered spreadsheets into a single, organized database for potential targets, investor contacts, and market insights.

What sets M&A CRMs apart is relationship intelligence. These tools map out your firm’s network to uncover existing connections that could lead to key decision-makers at target companies. It’s a far cry from cold calling. For instance, if a colleague met a CFO at a conference two years ago, the CRM flags that connection, giving your team an inside track.

CRMs also keep your data fresh. Automated data enrichment updates contact and company profiles, while AI tools monitor news, funding events, executive moves, and press mentions to surface new leads without the need for manual research.

The results speak for themselves: dealmakers who rely on data-driven sourcing close 55% more deals and achieve an IRR that’s 8.3 percentage points higher. Scorecards built into the CRM help you filter and prioritize targets based on your investment criteria, like financial health, market position, or even alignment with your firm’s goals.

Due Diligence and Negotiation

When a deal enters due diligence, the CRM becomes a central command center. Version control is a must during negotiations, and CRMs make it easy to track deal terms and manage multiple agreement drafts. If legal proposes changes to an earn-out structure or finance adjusts valuation models, the system logs what changed and when, ensuring everyone stays on the same page.

Specialized M&A platforms can save time and reduce errors. For example, they can cut document analysis time by up to 90% and reduce missed details fivefold during high-pressure negotiations. Cross-functional teams – legal, financial, IT, and HR – can collaborate through the CRM, managing tasks and deadlines within a single platform.

"DealCloud has been critical in helping us to organize, monitor, and manage this pipeline."

– Sean Alford, Senior Vice President of Corporate Development, Ziff Davis

CRMs also provide a clearer picture of the target company’s health. Metrics like customer concentration, retention rates, and potential revenue synergies are easier to analyze when structured data is in place. Before diving into due diligence, cleaning up CRM records – removing duplicates and updating outdated contact details – can boost buyer confidence and even improve the valuation process.

With due diligence wrapped up, the focus shifts to closing the deal and ensuring a smooth integration.

Closing Deals and Post-Merger Integration

Once the deal is signed, the CRM transitions into integration mode. Custom dashboards offer a clear view of integration milestones and synergy targets, keeping everything on track. Task management tools ensure no review item is overlooked during this critical phase.

Many M&A-focused CRMs come with standardized playbooks – ready-made templates that outline integration steps for repeatable acquisitions. Over 500 large and mid-sized companies have used these playbooks to complete more than 5,000 transactions valued at over $1 trillion. These templates help streamline processes, reduce risks, and ensure consistency across multiple deals.

During integration, communication is key. By logging all interactions tied to specific tasks, the CRM maintains a complete audit trail, ensuring team alignment. It can also identify the best internal experts for specific integration tasks by analyzing firm-wide experience and past deal involvement.

But the work doesn’t stop there. Advanced CRM tools allow teams to measure actual synergies against initial projections and generate reports to refine future strategies. This creates a feedback loop, turning each deal into an opportunity to improve the next one.

sbb-itb-798d089

Connecting CRM with M&A Services like Deal Memo

Integrating Deal Memo with your CRM takes M&A transaction management to the next level. By pairing your CRM with Deal Memo’s white-labeled CIM and OM packages, you can centralize deal materials, streamline client communications, and organize seller interviews. Instead of juggling scattered spreadsheets and buried email threads, your CRM becomes the single source of truth for your transactions.

Specialized M&A CRMs also connect directly with Virtual Data Rooms (VDRs) to securely store important documents. For example, when Deal Memo delivers a completed CIM within 72 hours, your CRM can automatically sync those details with your VDR. This ensures the right buyers gain access with proper permissions – no manual data entry, no errors, even during high-stakes negotiations. This integration can save more than 40 hours per deal by eliminating redundant tasks. On top of that, it lays the groundwork for smarter relationship management.

With advanced relationship intelligence built into your CRM, you can map your firm’s network to find warm introductions. This data-driven approach enables dealmakers to close 55% more transactions and achieve an IRR that’s 8.3 percentage points higher.

Managing CIMs and OMs in Your CRM

Once Deal Memo delivers a completed CIM, your CRM transforms into a hub for organizing and sharing it. Transaction documents like NDAs, term sheets, and legal agreements can be centralized and indexed, making them instantly searchable. Say goodbye to endless folder searches or asking colleagues for the latest version.

Your CRM also offers role-based access controls to protect sensitive information. When you upload a CIM, you can set specific permissions so only authorized individuals can view confidential financials or strategic plans. This is especially useful when managing multiple buyers at different stages – some might only receive a teaser, while others gain access to the full CIM. Your CRM keeps track of who viewed what and when.

Automated workflows add another layer of efficiency. For instance, when a new CIM is uploaded or a deal progresses, the system can trigger alerts and assign tasks. If a buyer requests updated financials during due diligence, the CRM logs the request, notifies the relevant analyst, and tracks the task’s completion – eliminating the need for long email chains.

Instead of storing documents in a general repository, attach them directly to specific tasks. For example, if your due diligence checklist includes reviewing customer contracts, link those files to the relevant checklist item. This focused organization reduces the time spent searching for documents during critical moments.

Improving Client Communication and Brand Consistency

CRMs automatically log every email, call, and meeting note related to a deal. When your team conducts seller interviews for a CIM, those notes are stored alongside contact records and timelines. This ensures everyone on your team has access to a complete, up-to-date conversation history.

This centralized communication system eliminates gaps. For example, if a colleague had a conversation with a CFO at a conference, the CRM flags that relationship when it’s time to distribute an OM. This way, you can build on existing trust rather than starting from scratch.

Maintaining brand consistency is another benefit. CRM-based email templates ensure every communication – whether it’s distributing a CIM or sending follow-ups – adheres to your firm’s branding. Instead of drafting unique messages, team members can rely on professionally designed templates that reflect your firm’s style and standards. By integrating with marketing automation tools, you can ensure that every client interaction – from the first teaser to the final closing documents – reinforces your firm’s polished image.

Deal Memo’s white-labeled packages fit seamlessly into this process. Since the CIMs and OMs carry your firm’s branding, your CRM ensures consistency across all client interactions. Whether you’re sending a follow-up email or scheduling a buyer meeting, the materials and messaging stay perfectly aligned with your professional image.

With mobile access, you can manage deals on the go. If a buyer calls while you’re traveling, you can quickly pull up the CIM, review seller interview notes, and provide a confident response – all from your phone or tablet.

How to Implement CRM in Your M&A Firm

Bringing a CRM system into your M&A firm can revolutionize how you manage deals and relationships. However, the process requires careful planning, especially when it comes to customization, training, and integration. Without proper execution, you risk running into costly data issues – 88% of data integration projects fail or exceed budgets because of poor data quality. A well-implemented CRM is the backbone of the streamlined deal management and efficiency gains highlighted throughout this guide.

Customizing CRM for M&A Requirements

To get the most out of a CRM, align it with your firm’s actual workflows – not generic sales processes. As Clyde Christian Anderson, CEO of GrowthFactor.ai, explains:

"Traditional sales funnel software is not suitable for modern investment banking M&A processes"

M&A deals are rarely linear. They often involve pauses, setbacks, and multiple stakeholders over long periods. This complexity means your CRM must reflect the unique stages of your buy-side and sell-side activities, including sourcing, due diligence, LOI, closing, and post-merger integration. Consider using Kanban boards to visually track transactions, which can help prevent overlooked deal details by up to fivefold.

Automated audit trails are another must-have. These record all actions and communications, ensuring nothing slips through the cracks. Set up automated reminders for critical deadlines, such as regulatory filings or document submissions, to maintain compliance. If your firm operates internationally, customize the system to handle varying approval processes across jurisdictions.

Integrating your CRM with tools like email (Outlook or Gmail) and calendars can automatically log interactions and attachments. This reduces manual errors, a crucial improvement given that only 46% of sales reps trust their pipeline data. Correcting bulk data errors later can cost up to 10 times more than getting it right initially – and up to 100 times more if left unaddressed.

Once your CRM mirrors your workflow, the next step is equipping your team to use it effectively.

Training Your Team on CRM Usage

Training is what turns CRM software into a true asset for your firm. It’s worth noting that 70% to 90% of M&A deals fail, with integration issues often playing a major role.

"Because CRM involves change management, training is essential for users and requires a customized approach for groups and individuals."

- Christina R. Fritsch, President and Client Success Consultant, CLIENTSFirst Consulting

Tailor your training to specific roles. For example, marketing teams should focus on contact segmentation and list building, while sales teams need to learn productivity tools and closing techniques. Administrative staff should master updating records, and managers should focus on extracting insights from metrics and reports.

Rather than just showing software features, teach your team how to execute business processes within the CRM. Make training an ongoing effort by scheduling refresher sessions as the system evolves and your firm’s goals shift. Involving frontline professionals in system development and training can foster a sense of ownership and reduce resistance to change.

After implementation, review CRM performance at 6–12 months and survey staff within the first 3–6 months to identify any challenges. These training efforts can lead to impressive results: M&A teams using specialized CRM solutions report deal cycle times decreasing by nearly 30% and deal closure rates increasing by up to 20%.

Once your team is trained, ensure your CRM works seamlessly with other tools to maximize its potential.

Connecting CRM with Other Business Tools

To fully unlock your CRM’s potential, integrate it with the tools your team uses daily. A staggering 81% of business leaders cite disconnected internal systems as a primary source of operational challenges.

For instance, link your CRM with Virtual Data Rooms (VDRs) to securely transition from the pitch phase to due diligence. Clearly define access levels early on to control who can view or edit sensitive documents.

Integrate market intelligence platforms like PitchBook or Crunchbase to automatically update contact and company profiles. This two-way sync keeps records accurate without requiring manual updates.

Communication tools like Slack or Microsoft Teams can be connected for real-time updates and stakeholder alignment. Similarly, marketing automation platforms such as Marketo or ActiveCampaign can help streamline follow-ups and nurture leads.

Adopt standardized naming conventions for files across all integrated platforms to ensure easy access during due diligence. Start with a small transaction to test the integration and resolve any technical issues before scaling up. Firms that embrace a data-driven approach in deal sourcing complete 55% more transactions than their peers and achieve an IRR 8.3 percentage points higher.

Conclusion and Key Takeaways

An M&A-focused CRM isn’t just a tool – it’s the backbone that turns disorganized deal pipelines into streamlined, data-driven processes. As we’ve explored, the right CRM centralizes relationship intelligence, takes care of repetitive tasks automatically, and adapts to the unpredictable nature of M&A workflows. Generic CRMs simply can’t handle the relationship-heavy and non-linear demands of M&A transactions.

The benefits are clear. Teams using purpose-built CRM solutions report shorter deal cycles and higher closure rates. Firms that adopt data-driven sourcing strategies often achieve better transaction success rates and greater returns. Over time, these advantages create a ripple effect, strengthening their competitive edge.

The results speak for themselves. In 2022, corporate development teams leveraged specialized CRMs to evaluate hundreds of deals each quarter, giving leadership real-time insights into deal progress and performance metrics. By ditching spreadsheets and disconnected tools, these firms completely redefined how they source, manage, and close deals.

FAQs

How do M&A CRMs ensure data security during transactions?

M&A CRMs prioritize security to ensure sensitive deal information remains protected. One key feature is role-based permissions, which control who can view, edit, or download documents. This ensures that only authorized individuals handle confidential data. On top of that, encryption is used to secure information during both transmission and storage.

For added transparency and oversight, these systems maintain detailed activity logs. These logs track who accessed files, what changes were made, and when, making it easier to identify unauthorized actions and assist with compliance during due diligence. Features like deduplication and bulk-edit safeguards also help minimize the chances of accidental data mishandling.

When paired with secure Virtual Data Rooms (VDRs), CRMs take file sharing to the next level by eliminating the need for risky email attachments. VDRs enforce strict permissions, apply watermarks, and provide secure viewing environments. Meanwhile, the CRM ensures all deal-related data remains centralized, protected, and monitored within a secure system.

What are the main advantages of using automation in M&A CRM systems?

Automation in M&A-specific CRM systems takes the hassle out of complex, manual processes by turning them into smooth, efficient workflows. Tasks like logging emails, tracking meetings, and managing document uploads are handled automatically, eliminating the need for repetitive data entry. This ensures records stay accurate and up-to-date while freeing up dealmakers to concentrate on high-priority activities – evaluating targets, negotiating terms, and structuring deals.

Beyond saving time, automation brings consistency and real-time visibility to the entire deal pipeline. It centralizes due diligence, compliance tasks, and communication into one searchable platform, cutting down on the chances of missed deadlines or lost documents. Features like automated alerts and updates keep teams aligned, fostering better collaboration and faster decision-making. Plus, with advanced tools like AI-driven insights for risk analysis and target scoring, these systems don’t just simplify workflows – they also support smarter, more strategic decisions, helping close deals faster and with greater confidence.

How do M&A CRMs streamline the deal process from origination to closing?

M&A-specific CRMs streamline the deal-making process by bringing together all essential data, relationships, and communications into one easily searchable platform. These tools assist deal teams in spotting potential acquisition targets by automatically enriching records with details like company profiles, recent news, and prior interactions. They also evaluate targets based on strategic criteria, allowing teams to concentrate on the most promising opportunities while avoiding redundant outreach efforts.

As deals move forward, the CRM serves as a central hub, connecting due diligence checklists, data room access, and approval milestones directly to the target’s record. Automated reminders ensure deadlines stay on track, and dashboards highlight any bottlenecks in the process. By organizing critical documents and providing a comprehensive history of interactions, CRMs improve collaboration, accelerate decision-making, and cut down the time needed to finalize deals.