When selling your business, retaining key employees is critical to maintaining its value and ensuring a smooth transition. Losing these employees can disrupt operations, reduce your sale price, or even jeopardize the deal. Here’s how you can keep your team engaged during this challenging time:

- Communicate Early and Clearly: Inform key employees about the transition as soon as possible to reduce uncertainty and build trust. Address their concerns directly and provide a clear timeline of events.

- Offer Financial Incentives: Use retention bonuses (paid in stages) and transaction bonuses to motivate employees to stay. Key employees should be compensated at least 115% of market rate.

- Non-Financial Rewards: Provide growth opportunities, leadership roles, and personal support tailored to each employee’s needs. For example, career development plans or family assistance programs can make a big difference.

- Involve Employees in the Process: Assign them roles in transition planning and decision-making. This creates a sense of ownership and commitment to the company’s success.

- Monitor and Adjust: Continuously gather feedback and refine your retention strategies to address concerns and keep employees engaged throughout the transition.

Retention planning isn’t optional – it’s essential to protect your business’s value and ensure a successful sale. Follow these steps to keep your team intact and your transition on track.

How to Sell a Business: Retain Key Employees During a Business Sale

Building Trust Through Clear Communication

Silence creates uncertainty. When employees sense changes happening but aren’t given clear information, they often imagine the worst – especially about their job security. This lack of communication fuels anxiety, causing some of your best employees to quietly look for other jobs. The fix? Share the news earlier than you might think is necessary.

Announce the Transition Early

Start by informing your key employees – your inner circle – before expanding the conversation to the broader team as the deal becomes more concrete. This approach helps transform employees from worried bystanders into active participants in the process. Why does this matter? Replacing an employee can cost anywhere from 0.5x to 2x their annual salary, so retaining your team is far more cost-effective than hiring new talent.

Be upfront about the reasons behind the sale, whether it’s tied to retirement, health, or scaling resources. Being clear about your motivations can help ease uncertainty and build trust.

"A good reason to sell will go a long way to addressing employees’ concerns and build their confidence in the future." – Curtis Kroeker, Group General Manager, BizBuySell.com

Address Employee Concerns Directly

A one-size-fits-all announcement won’t cut it. Employees have real, specific worries – like changes to healthcare benefits or shifts in company culture. To address these, hold both one-on-one meetings to discuss personal career paths and group sessions for broader updates.

"The new owner should meet with employees individually or in groups so employees can express their concerns and get to know their new boss on a more personal level." – Curtis Kroeker, Group General Manager, BizBuySell.com

Be honest about any mandatory changes to things like 401(k) plans, compensation, or benefits. When 41% of employees say they’d improve their company’s engagement or culture if given the chance, it’s clear that creating space for open dialogue shows them their voices matter.

Share the Transition Timeline

A detailed timeline of what’s happening and when helps employees feel grounded during uncertain times. Craft a formal communication plan that outlines how updates will be shared and stick to it. This consistency is key – companies with strong communication practices are 3.5 times more likely to outperform their competitors. Plus, transparency pays off: organizations with open communication see 17% higher productivity and 21% higher profitability.

When sharing updates, follow a clear order: start with why the change is happening and what it means for individuals before diving into the how and when. Stick to your schedule, even if there aren’t major updates. Regular communication reassures employees and stops rumors from spreading. Early and consistent updates can make all the difference in retaining your team.

"No one says they learned about a change too early. But many people say they’ve learned about a change too late." – Michelle Haggerty, Chief Operating Officer, Prosci

Repetition matters, too. Research shows employees need to hear key messages five to seven times through different channels before they fully absorb them. Use tools like town halls, email updates, and personal check-ins to ensure everyone gets the message.

Clear communication isn’t just about sharing information – it’s about building trust. And trust is the foundation for keeping your team intact, which we’ll explore further in the next section.

Financial and Non-Financial Retention Strategies

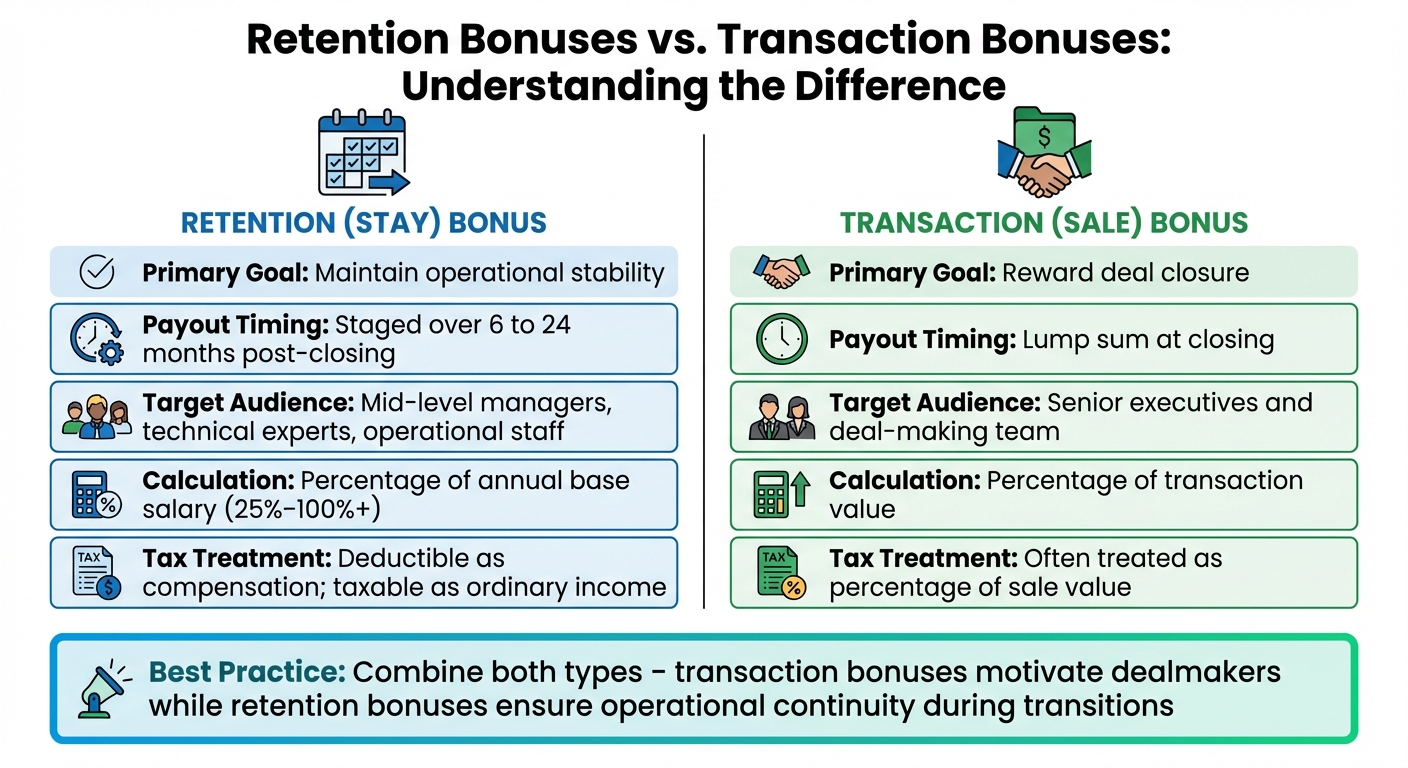

Retention vs Transaction Bonuses: Key Differences for Employee Retention

Building on the foundation of clear communication, a combination of financial and non-financial strategies can play a crucial role in retaining key employees.

Offer Retention Bonuses

Retention bonuses are structured cash payments designed to keep essential employees engaged over a set period. Instead of a single lump sum, these bonuses are distributed in stages. Typically, they range from 25% to 100% (or more) of an employee’s annual salary. To truly discourage career changes, these bonuses should amount to one to two times the manager’s yearly pay.

A staged approach works well – paying out in increments, such as one-third at closing, another third after 12 months, and the final third at 24 months. This method ensures employees remain committed over time rather than viewing the bonus as a finish line.

"I’ve observed individuals staying just long enough to receive their retention bonuses, which ultimately becomes their finish line rather than a milestone in the race." – John Dahlgren, VP of Talent at SBJ Capital

Quarterly payments can also help maintain momentum and build trust by showing consistent follow-through. Additionally, critical employees should earn at least 115% of the market rate, reflecting their value to the organization.

"They are difficult to replace." – Doug Circle, President and CEO of Circle Vision

This approach is particularly relevant given that employees who switched jobs in 2021 saw an average wage increase of 6.6%, compared to just 3.3% for those who stayed.

Retention Bonuses vs. Transaction Bonuses

Understanding the differences between retention and transaction bonuses is essential, as each serves a distinct purpose.

| Feature | Retention (Stay) Bonus | Transaction (Sale) Bonus |

|---|---|---|

| Primary Goal | Maintain operational stability | Reward deal closure |

| Payout Timing | Staged over 6 to 24 months post-closing | Lump sum at closing |

| Target Audience | Mid-level managers, technical experts, operational staff | Senior executives and deal-making team |

| Calculation | Percentage of annual base salary (25%–100%+) | Percentage of transaction value |

| Tax Treatment | Deductible as compensation; taxable as ordinary income | Often treated as percentage of sale value |

While transaction bonuses reward those directly involved in closing a deal, retention bonuses ensure operational continuity during transitions. Many companies find that combining both types of incentives works best – transaction bonuses motivate dealmakers, while retention bonuses keep key managers and specialists engaged during uncertain times.

Non-Financial Incentives: Career Growth and Development

Non-financial incentives can be just as impactful, if not more so. According to a 2009 McKinsey Quarterly survey, factors like manager recognition, leadership attention, and opportunities to lead projects rank among the top motivators for retention – often outperforming financial perks. For employees at various career stages, these incentives can make the difference between staying and leaving.

Take the example of a 2010 pharmaceutical merger. The company invited 50 middle managers from the acquired organization to join trans-Atlantic integration teams for two years. Through this program, participants gained exposure to senior executives and developed leadership skills. As a result, financial retention bonuses were only needed for 750 out of 50,000 employees, as the leadership opportunities created a sense of long-term potential for high-performing talent.

Another example comes from a European industrial company facing relocation challenges. The company identified 44 critical employees and tailored incentives to their individual needs. For family-focused staff, they provided career counseling for spouses and language training. For career-driven employees, they outlined new responsibilities and leadership opportunities. A year later, 80% of these employees remained, and the unit achieved a 30% increase in sales and a 90% boost in EBIT – all at just 25% of the cost of previous cash-based programs.

Assigning key managers to lead transition projects can also foster a sense of ownership and skill development. Private equity ownership transitions, for instance, often allow employees to attend board meetings, refine their communication skills in boardroom settings, and receive mentorship from external advisors. For early-career employees, these growth opportunities can outweigh the appeal of immediate financial rewards.

The key is understanding what drives each employee. One-on-one career discussions can help uncover their goals and align incentives with their aspirations – whether that’s career advancement, flexibility, or family support. By tailoring incentives to individual needs, you provide reasons for employees to stay that go beyond just a paycheck.

These personalized approaches not only retain talent but also actively involve employees in the transition process, making them feel valued and invested in the company’s future.

Involving Employees in the Transition Process

When employees are actively involved in a transition, they shift from being passive onlookers to engaged participants who are committed to its success. Including them in planning and decision-making builds on earlier communication efforts, ensuring their long-term dedication.

Assign Roles in Transition Planning

Assigning specific responsibilities to key employees during the transition fosters an "owner mindset" – encouraging them to think and act with the same care and accountability as an owner. Leading integration projects, for example, allows employees to see firsthand how operational changes can directly enhance profitability.

"Involving senior management in the transition planning process also helps to secure their buy-in and commitment." – 3P Partners

Middle management plays a pivotal role during this stage, acting as the vital link between senior leadership and frontline teams. By involving middle managers in process improvement committees or task forces, you not only demonstrate trust but also instill a sense of accountability for the company’s mission.

To further motivate employees, consider structuring "integration bonuses" tied to specific achievements, such as completing a system merger or hitting a process improvement milestone. This approach clearly connects their efforts to measurable outcomes, reinforcing the value of their contributions.

Include Employees in Decision-Making

Beyond assigning roles, involving employees in decision-making strengthens their commitment to the transition’s success. Employees who feel heard are more likely to embrace change. Before implementing major decisions, seek their input through focus groups or surveys. This inclusive approach gives employees a sense of control over their future, easing anxieties about the unknown.

"When employees feel they have a voice and their input is valued, they are more likely to support the changes." – Assembly

Start transition discussions by listening rather than making announcements. Invite key employees to evaluate their readiness for change and identify potential obstacles. These conversations can uncover concerns early, enabling proactive solutions.

For employees critical to the transition’s success, explore offering equity ownership or co-investment opportunities. When individuals invest their own money into the organization, their commitment often deepens, as they now have "skin in the game." Research shows that companies with highly engaged employees are 21% more profitable, and targeted engagement strategies can reduce absenteeism by 41%. These figures highlight the real business advantages of treating employees as partners rather than just workers.

Finally, involve key employees in high-level meetings to expose them to strategic decision-making and prepare them for leadership roles. These efforts not only help retain top talent but also align the workforce with the broader goals of the ownership transition.

sbb-itb-798d089

How Deal Memo Supports Ownership Transitions

A well-prepared Confidential Information Memorandum (CIM) goes beyond just presenting financial data – it captures the essence of your business, its value, and the strength of its leadership. During ownership transitions, delivering a detailed CIM within 72 hours can streamline the process, ensuring clear communication with both buyers and employees. This quick turnaround connects strategic planning with effective messaging, reducing uncertainty and fostering trust.

Custom CIMs/OMs Delivered in 72 Hours

Deal Memo specializes in creating CIMs and Offering Memorandums (OMs) that emphasize your company’s organizational structure, key personnel, and operational workflows. The "Operations and Team" sections are particularly impactful, addressing buyer concerns early and simplifying due diligence. By highlighting not just titles but the strategic roles of your leadership team, these documents demonstrate the depth of your management, a quality buyers actively seek.

"A well-prepared CIM can elevate perceived value, accelerate buyer interest, and reduce friction throughout the transaction." – 10X Business Broker

For transactions valued up to $70,000,000, buyers often prioritize the continuity of the management team above all else. Professional documentation that underscores your team’s expertise can directly support higher valuations. Quick delivery of these materials ensures you can clearly communicate your transition plans, avoiding speculation or anxiety among employees. Additionally, by showcasing established retention measures, you further strengthen buyer confidence and demonstrate operational stability.

Strengthening Employee Retention Strategies with Deal Memo

Retention incentives play a key role in successful ownership transitions, and Deal Memo ensures these are clearly documented in your CIM. Programs like stay bonuses and phantom stock are presented in a way that highlights their effectiveness in maintaining stability post-transition. When buyers see that these measures are already in place, it signals reduced risk and reassures them about the continuity of operations.

"Motivated employees are an additional attraction for a purchaser and if concerns about the retention of staff are addressed by the seller, the risk of transaction failure falls dramatically and a premium valuation becomes more likely." – Paris Aden, Founding Partner, Valitas Capital Partners

Retention programs typically have a minimal impact on sale proceeds, often reducing them by 1% or less. However, including these arrangements in your CIM acts as a form of "transaction insurance", making your business more appealing to buyers. By providing documented continuity plans, you not only justify your asking price but also demonstrate foresight and preparation.

Monitoring and Adjusting Retention Strategies

Retention plans are not a "set-it-and-forget-it" solution – they need ongoing review and fine-tuning as your organization navigates through a transition. Strategies that work well during the announcement phase may lose their effectiveness as integration progresses, potentially causing even the most secure employees to question their future. By continuously monitoring the situation, you can identify problems early and address them before they lead to key departures. This process also creates an opportunity to actively involve employees in refining retention efforts.

Use Employee Feedback for Improvements

Employee feedback is a goldmine for understanding concerns that might not surface through standard surveys. Tools like one-on-one conversations and pulse surveys can reveal personal worries – whether it’s about relocating a family or uncertainty over career growth under new management. With this insight, you can tailor your incentives to meet individual needs. Line managers play a crucial role here, as they often spot employees with unique institutional knowledge who might otherwise be overlooked. For example, a financial accountant managing the first post-deal report may not hold a senior position but could be indispensable during the transition.

"Creating that clarity requires significant hands-on effort from managers, including the ongoing work of tracking progress so that companies can quickly intervene when problems arise." – Sabine Cosack, Matt Guthridge, and Emily Lawson, McKinsey & Company

Using workforce segmentation based on feedback allows you to offer incentives that resonate. For instance, employees with families might value flexible work options or help with school arrangements, while those focused on career growth may prioritize clarity about their roles and leadership opportunities. A great example of this approach comes from a European industrial company during a 2010 reorganization. By conducting targeted one-on-one sessions, they addressed specific concerns and retained 80% of their 44 critical at-risk employees. This personalized approach also cut their retention budget by 75% compared to a cash-only strategy, while the unit’s sales grew by over 30% and EBIT by more than 90%. Aligning individual feedback with broader company goals can be a game-changer in retaining talent during uncertain times.

Adjust Incentives Based on Transition Milestones

Employee feedback doesn’t just uncover concerns – it also provides the insights needed to adjust incentives as the transition unfolds. Both financial and non-financial rewards should evolve to match the priorities of each phase. For example, during particularly challenging periods, offering quarterly bonuses instead of annual payouts can help maintain morale and foster trust in the new leadership.

John Dahlgren has pointed out that bonuses tied solely to a final target can backfire, as employees might leave once they hit that goal. To avoid this, structure bonuses around successive milestones. For instance, link incentives to integration achievements, such as reaching synergy targets in production or completing IT system migrations. This keeps employees motivated throughout the entire process.

Non-financial rewards are just as impactful. During a merger aimed at expanding a North American pharmaceutical company’s European footprint, the organization invited 50 middle managers from the acquired firm to join trans-Atlantic integration teams. This move not only showcased the managers’ value but also gave senior executives a chance to assess their potential. As a result, the company only needed to offer financial retention bonuses to 750 employees out of a 50,000-strong workforce. These kinds of non-financial incentives can strengthen employees’ commitment and ensure a smoother transition.

Conclusion

Keeping key employees on board during an ownership transition isn’t just about preventing departures – it’s about safeguarding your business’s value. Losing critical team members can lower your company’s valuation or even jeopardize the entire deal. The strategies shared in this guide – open communication, balanced financial and non-financial incentives, and regular monitoring – are designed to bring stability to what can be a turbulent time.

Employee turnover can have a serious impact on profitability. Following a merger, turnover rates average 47% in the first year, climbing to 75% within three years. Each departure can cost anywhere from 0.5 to 2 times the employee’s annual salary. On the other hand, companies with strong retention rates enjoy up to 21% higher profitability. These numbers highlight why retention planning must be a priority during transitions, not an afterthought.

Building trust through clear communication, personalized financial incentives, and career development opportunities helps keep employees engaged and committed. These essential steps pave the way for professional tools and support that reinforce retention efforts.

Deal Memo’s 72-hour CIM and OM delivery plays a crucial role in presenting your organizational story effectively. Clear, professional documentation and consistent messaging foster the trust needed to retain your team throughout the transition and beyond.

As the process unfolds, retention strategies should adapt. Adjust financial incentives, gather employee feedback, and align with key milestones to maintain engagement and ensure your team remains dedicated to the company’s success under its new ownership.

FAQs

How does clear communication help retain key employees during an ownership transition?

Clear and timely communication plays a vital role in keeping key employees onboard during an ownership transition. When leadership openly explains the reasons for the sale, outlines the new owner’s vision, and clarifies how each employee’s role fits into the future, it helps reduce uncertainty and foster trust. This level of openness makes employees feel appreciated and involved, easing any concerns they may have about upcoming changes.

Engaging key employees early in the process and addressing their questions creates a sense of collaboration rather than leaving them on the sidelines. This proactive approach helps alleviate fears of sudden layoffs or major shifts in workplace dynamics, encouraging employees to remain loyal and focused. When employees are informed about the timeline, anticipated changes, and any offered incentives, they’re more likely to stay motivated and committed during the transition.

What’s the difference between retention bonuses and transaction bonuses?

Retention bonuses, often referred to as stay bonuses, are financial incentives aimed at motivating employees to stick with a company during and after an ownership change. These bonuses are typically contingent on the employee remaining with the organization for a set period, whether it’s leading up to, during, or following the transition.

On the other hand, transaction bonuses are tied specifically to the successful completion of an ownership transfer or an M&A deal. Unlike retention bonuses, these are usually one-time payments made when the deal is finalized, and they don’t depend on whether the employee stays with the company afterward.

While these bonuses serve distinct purposes, both play a critical role in retaining key employees and ensuring the transition process goes as smoothly as possible.

What are effective non-financial ways to keep employees motivated during an ownership transition?

Non-financial incentives play a crucial role in keeping employees engaged and committed during ownership transitions. By addressing core needs like purpose, recognition, and growth, companies can foster loyalty and trust. One effective approach is maintaining open and early communication about the company’s direction and each employee’s role. This transparency helps ease uncertainty and strengthens trust. Additionally, involving employees in the transition – whether by seeking their feedback or giving them a platform to share their thoughts – makes them feel valued and invested in the process.

Another way to keep motivation high is by offering career development opportunities. This could include mentorship programs, challenging new assignments, or clear paths for professional growth. Flexible work options, wellness resources, and regular updates on benefits further demonstrate that the company cares about its employees’ well-being. These thoughtful efforts help create a meaningful connection, inspiring employees to remain engaged and contribute to the company’s ongoing success.