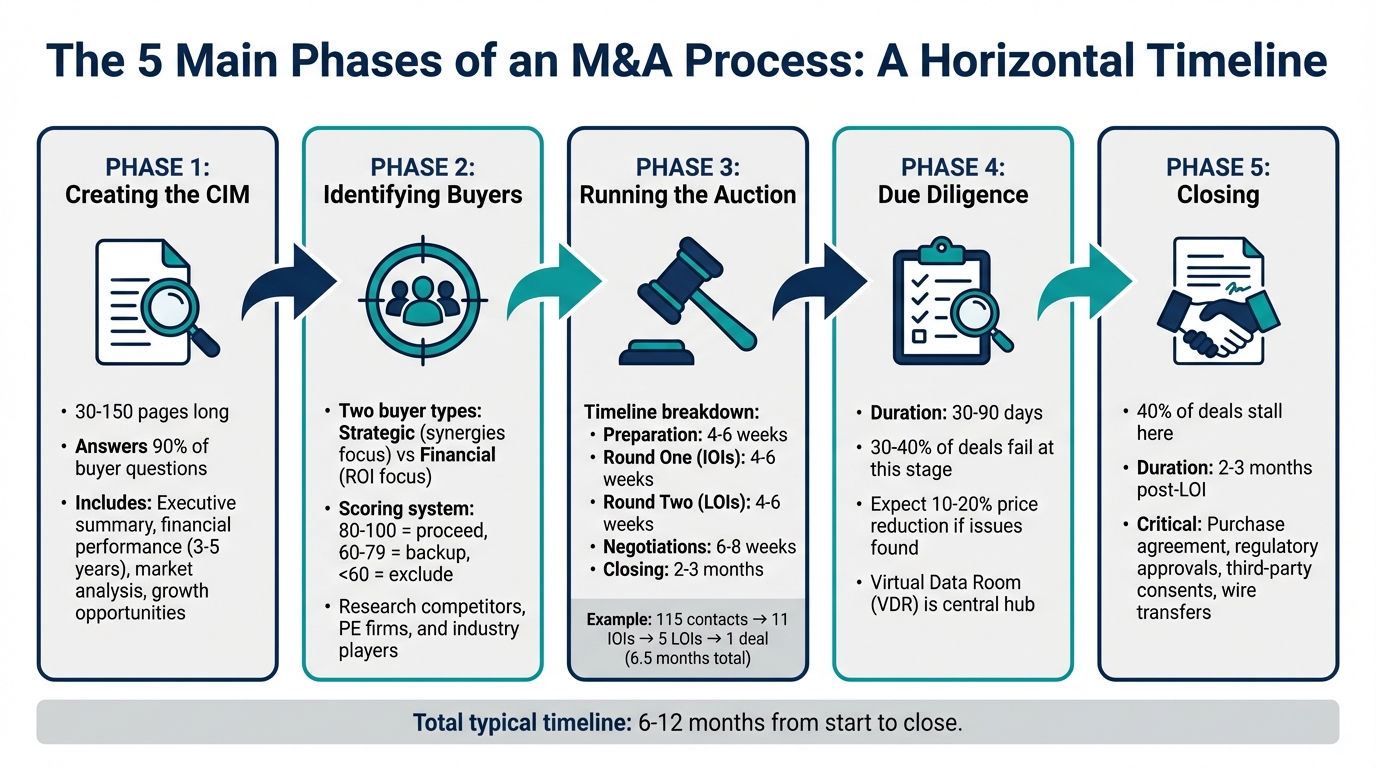

When selling your business, a structured M&A process can significantly impact the outcome. Following a disciplined approach ensures higher valuations, protects sensitive data, and builds trust among stakeholders. Here’s a simplified breakdown of the key steps:

- Prepare a Confidential Information Memorandum (CIM): A detailed document that answers potential buyer questions and highlights your business’s strengths.

- Identify and Target Buyers: Research and categorize buyers into strategic (focused on synergies) and financial (focused on ROI) groups.

- Run a Competitive Auction: Use a phased process to create urgency among buyers while maintaining confidentiality.

- Manage Due Diligence and Negotiations: Organize a Virtual Data Room (VDR), respond quickly to buyer questions, and evaluate Letters of Intent (LOIs) for terms beyond just price.

- Close the Deal: Finalize the purchase agreement, meet regulatory requirements, and ensure smooth financial logistics.

A professional M&A process increases the likelihood of securing a fair deal while minimizing risks. The right preparation and tools, like VDRs or external advisors, can streamline this complex journey.

5-Step Professional M&A Process Timeline and Key Phases

Sell-Side M&A Masterclass | Structuring a Formal Sale Process for Maximum Value | Private Equity

1. Creating the Confidential Information Memorandum (CIM)

The CIM is your business’s first in-depth introduction to serious buyers. Once potential buyers have signed an NDA and reviewed the teaser, this document becomes the key link between their initial interest and their decision to submit a Letter of Intent. Essentially, it’s a marketing tool that answers 90% of buyer questions, offering a clear overview of your company’s past, present, and future.

Core Sections of a CIM

A typical CIM is 30–150 pages long and is structured to present a comprehensive view of your business. It begins with an executive summary, which condenses your investment thesis into a few engaging pages. Next, the investment highlights section showcases your competitive advantages, strategic partnerships, and potential for synergy.

The market and industry analysis dives into market size, growth trends, and your company’s position relative to competitors. The financial performance section should outline key metrics like revenue, EBITDA, and gross margins for the past three to five years, along with projections for the next three to five years.

You’ll also need to include an operations and products/services section to detail your daily operations, proprietary technology, and revenue breakdown by offering. The management and personnel section introduces leadership and highlights their ability to sustain operations after the sale. Lastly, the growth opportunities section should propose three to five scalable strategies, such as expanding geographically or launching new products.

How to Write an Effective CIM

A strong CIM tells a cohesive story. Think of it as narrating your company’s journey rather than presenting a list of disconnected facts. Be specific – replace vague claims like "strong customer relationships" with concrete data, such as "90% customer retention rate". This level of detail not only builds credibility but also helps buyers create accurate financial models.

It’s also essential to address weaknesses upfront. For example, if you have customer concentration risks or legal challenges, acknowledge them and provide a brief mitigation plan. This approach builds trust and allows you to control the narrative before buyers uncover these issues during due diligence.

Tailor your message based on the buyer type. Strategic buyers are typically interested in synergies and operational efficiencies, while financial buyers prioritize ROI and risk management. As John Hinckley, CEO of Modern Message, shared:

I was really impressed with how SEG helped us analyze our business… They discovered strengths about my customer retention that I wasn’t even fully aware of, and they knew how to put the story together the right way.

Finally, ensure all data is accurate and defensible. Financial projections should align with historical trends and industry standards to withstand scrutiny when buyers start asking tough questions. For those looking to streamline the process, specialized tools can help elevate the quality of your CIM.

Using Deal Memo for CIM Development

For M&A advisors and business brokers, Deal Memo provides white-labeled CIM services tailored to streamline the process. Their service delivers a polished CIM within 72 hours, including unlimited revisions to ensure the document meets your exact needs. The process includes seller interviews to capture your business’s unique strengths, along with customized sell-side materials and branding. Deal Memo also offers a dedicated team to handle everything from data room organization to final revisions, ensuring no detail is overlooked.

2. Identifying and Targeting Potential Buyers

The quality and depth of your buyer list can significantly influence the final sale price and the terms of your deal. A well-researched list creates competition, which can drive up offers, while a poorly developed one might leave money on the table. The goal is to pinpoint buyers who not only have the financial resources but also the strategic motivation to pay top dollar for your business. Building a focused buyer pool is key to attracting competitive bids and maximizing value. This initial step lays the groundwork for a structured ranking and outreach process.

Strategic vs. Financial Buyers

Start by categorizing potential buyers into two main groups: strategic buyers and financial buyers.

- Strategic buyers are typically competitors or companies in related industries looking for ways to enhance their operations. They might be interested in your customer base, proprietary technology, or geographic presence.

- Financial buyers, on the other hand, are usually institutional investors like private equity firms. Their goal is to generate returns through leveraged buyouts and eventual resale.

To identify the right candidates, analyze factors such as profit margins, geographic reach, customer demographics, and product compatibility. For strategic buyers, focus on companies that have recently made similar acquisitions or have publicly stated growth plans that align with your business. For financial buyers, look for firms actively investing in your industry and ensure their fund size aligns with the scale of your business.

Use an initial screening process to answer critical questions: Does the buyer align with your strategic goals? Do they have the financial capacity to close the deal? Could the transaction face regulatory hurdles, such as antitrust concerns? After narrowing down the list, implement a weighted scoring system. Assign percentages to various factors, such as synergy potential (25%), growth opportunities (15%), and ease of integration (10%), and score each buyer on a 1-to-5 scale to create a clear, defensible ranking.

When reaching out to potential buyers, avoid directly asking if their company is for sale. Instead, steer the conversation toward broader strategic opportunities. Once the buyers are categorized, the next step is to rank them based on specific criteria.

Prioritizing Potential Buyers

With detailed profiles in hand, the next focus is on prioritizing the buyers. Rank them based on factors like their motivation, valuation methods, and preferred deal structures. Strategic buyers often offer higher premiums because they can realize operational synergies that financial buyers may not. Establish clear thresholds for action: buyers scoring 80–100 should move forward to NDA and CIM distribution, those scoring 60–79 can serve as backup options, and buyers scoring below 60 can be excluded.

Geography is another important consideration. Local buyers may value regional market knowledge, while international buyers might be more interested in scalability and global reach.

Financial buyers tend to focus on standalone cash flow due to their reliance on leverage, while strategic buyers are often willing to pay more when they see clear opportunities for synergy. Additionally, strategic buyers frequently use a mix of cash and stock in their offers, while financial buyers lean toward leveraged buyouts.

Comparing Strategic and Financial Buyers

| Factor | Strategic Buyers | Financial Buyers |

|---|---|---|

| Primary Motivation | Synergies and market expansion | Financial returns, IRR thresholds, exit profitability |

| Valuation Approach | Often pays a higher premium due to synergies | Focused on standalone cash flow and leverage potential |

| Deal Structure | Cash or stock; focuses on long-term integration | LBOs with higher debt-to-equity ratios |

| Post-Close Role | Direct operation and integration | Monitors management without direct involvement |

For M&A advisors handling multiple transactions, platforms like Deal Memo can streamline the process by offering white-labeled services. These include researching, categorizing, and prioritizing buyers based on industry specifics and deal size. This helps advisors create a competitive auction process right from the start, ensuring optimal results for their clients.

3. Running the Auction Process

After identifying and prioritizing your potential buyers, the next step is to launch a competitive auction. A well-organized auction not only boosts valuations but also ensures confidentiality is maintained throughout the process. The success of this stage depends on setting clear rules upfront and managing the flow of information and timing with precision.

Setting Up the Process Letter and Timeline

The process letter, often referred to as the bid procedure letter, serves as a guide for potential buyers. It accompanies the Confidential Information Memorandum (CIM) and lays out the auction’s timeline, submission guidelines, and key contacts for communication.

A typical auction unfolds in several phases:

- Preparation (4–6 weeks): This phase includes defining strategies, creating teasers and the CIM, and drafting NDAs.

- Round One (4–6 weeks): Activities include contacting buyers, signing NDAs, distributing the CIM, and collecting Indications of Interest (IOIs).

- Round Two (4–6 weeks): This stage involves management presentations, granting access to the Virtual Data Room (VDR), and finalizing bid instructions.

- Negotiations (6–8 weeks): This phase covers selecting Letters of Intent (LOIs), granting exclusivity, conducting final due diligence, and obtaining board approvals.

- Closing (2–3 months): The final stage includes signing the definitive agreement, regulatory filings, and securing funding.

The number of participants narrows significantly as the process advances. For instance, in a deal managed by Exit Strategies Group, Inc., advisors initially contacted 115 potential buyers. This outreach resulted in 11 IOIs during the first round and 5 LOIs in the second round. The entire process, from market launch to closing an eight-figure deal, was completed in just 6.5 months. This demonstrates how a broad auction can help maximize the purchase price while maintaining momentum.

To keep the process on track, establish firm deadlines for each phase. Ambiguous timelines can lead to delays and buyer fatigue. Additionally, limit LOI exclusivity to 60 to 90 days to avoid one buyer monopolizing the process. Your process letter should detail specific dates for teaser distribution, NDA execution, CIM access, management presentations, and LOI submissions.

Once timelines are set, the focus shifts to maintaining clear and consistent communication with all involved parties.

Communicating with All Parties

"Equally informing all bidders is critical to a successful auction."

– Al Statz, Senior M&A Advisor, Exit Strategies Group, Inc.

Your investment banker or M&A advisor should act as the single point of contact for all buyer communications. This ensures consistent messaging and prevents confusion. They can also manage the Q&A process, addressing questions from multiple buyers simultaneously while maintaining fairness.

Information should be released in stages to protect confidentiality and minimize disruption. Start with a teaser that provides high-level details without naming the company. Only share the full CIM after a Non-Disclosure Agreement (NDA) has been signed. Management presentations and site visits should be reserved for top-tier bidders who have submitted competitive IOIs.

Prompt responses to document requests are crucial. Delays can give the impression of disorganization. Additionally, both NDAs and process letters should explicitly prohibit bidders from discussing the deal with each other to prevent collusion that could harm competitive dynamics.

Moving Between Process Stages

Most auctions follow a two-stage bidding process. The first round uses non-binding IOIs to narrow down the field, while the second round involves deeper due diligence, management presentations, and submission of formal LOIs.

Grant management meetings and site visits only to bidders who have submitted strong IOIs. These interactions allow buyers to evaluate your team and provide an opportunity to highlight the strategic value of the business. Given the time commitment required from your leadership team, these meetings should be reserved for serious contenders.

"The time immediately before final bids are submitted is when an auction process lets the best buyer come to the forefront."

– Jim Lisy, Managing Director, Cohen & Co Advisory, LLC

To streamline the closing process, provide a seller-friendly draft purchase agreement early in the second round. This "stapled" agreement sets the baseline terms and minimizes last-minute negotiations. Require bidders to submit a marked-up version of this agreement along with their final bid.

Engaging a small group of 3 to 5 buyers concurrently can create a sense of urgency, improve leverage, and avoid delays. For example, during Microsoft’s acquisition of LinkedIn, the seller and their banker, Qatalyst Partners, invited only five specific parties – Microsoft, Salesforce, Google, Facebook, and one undisclosed bidder – to participate in a targeted auction.

Finally, use your VDR to monitor which documents each buyer views and how often. This data provides valuable insights into their level of interest and any specific concerns they may have.

sbb-itb-798d089

4. Managing Due Diligence and Negotiations

Once you’ve identified serious bidders, the due diligence phase begins. This crucial step, which usually spans 30 to 90 days, is all about sharing critical details while safeguarding sensitive information and guiding negotiations.

Setting Up the Data Room

Building on your earlier preparation, your Virtual Data Room (VDR) becomes the foundation for due diligence. A well-organized VDR ensures secure access, maintains confidentiality, and tracks buyer activity.

Start by structuring the data room into clear categories. Before granting access, double-check for missing signatures, expired contracts, or outdated capitalization tables. Everything in the data room must align with your Confidential Information Memorandum (CIM); any inconsistencies could damage trust and jeopardize the deal.

"The selling company should not grant access to the online data room until the site has been fully populated, except in rare circumstances." – AllBusiness

Key categories to organize include Corporate/Legal, Financial, Tax, Sales/Marketing, HR, Intellectual Property, and Technology/Operations. Financial records should cover a three-year lookback period, while tax filings typically need the last five years. Add security measures like two-factor authentication and watermarks on documents to trace potential leaks.

Avoid dumping all files at once. Instead, release sensitive materials, such as trade secrets or customer lists, in stages, ensuring the buyer shows genuine commitment first. Many sellers also commission a Quality of Earnings Report (QER) to validate EBITDA and working capital calculations before including this analysis in the data room.

Once the data room is ready, focus on addressing buyer questions promptly and thoroughly.

Responding to Buyer Questions

With your VDR in place, communication becomes the next priority. The VDR should act as the central hub for managing inquiries, providing all parties with a single source of truth. Use a Q&A log within your diligence software to track and streamline responses in real time.

Bring in subject matter experts to ensure responses are accurate and consistent with your CIM. Address key risks proactively – like customer concentration or reliance on specific personnel – to establish credibility. Buyers will inevitably raise these concerns.

"In our preliminary non-binding bid, we have a long list of assumptions… That’s gonna impact your underlying valuation if you come in and you’re paying 25% more on a large third party contract." – Keith Crawford, Global Head of Corporate Development, State Street Corporation

Organize buyer questions by severity to prioritize critical issues that could influence valuation. Since due diligence typically takes 30 to 60 days, quick responses to document requests are essential. Delays can signal disorganization and weaken your negotiating stance.

Comparing LOI Terms

When evaluating Letters of Intent (LOIs), consider more than just the purchase price. Look at deal structure, contingencies, and post-closing obligations.

The purchase price structure plays a major role. While cash offers immediate liquidity, stock options and earn-outs carry future risks tied to performance. Be prepared for a 10–20% price reduction if significant issues arise during due diligence. It’s worth noting that 30–40% of M&A deals fall apart at this stage due to undisclosed problems.

Exclusivity provisions can limit your ability to negotiate with other buyers. While buyers often push for 90–120 days, sellers should aim for shorter periods – ideally 30–45 days – to maintain leverage. Escrow holdbacks, typically 10–20% of the purchase price, are held for 12–24 months. To minimize holdbacks, suggest Representation and Warranty Insurance (RWI) for a smoother exit.

| Term | Seller-Favorable | Buyer-Favorable |

|---|---|---|

| Exclusivity Period | Short (30–45 days) | Long (90–120 days) |

| Indemnification Cap | Low (e.g., 10% of price) | High (e.g., 25% or no cap) |

| Indemnification Basket | Deductible (seller only pays excess) | Tipping/Dollar-one (seller pays all once met) |

| Earn-out Metrics | Revenue-based (harder to manipulate) | EBITDA-based (subject to cost allocations) |

| Closing Conditions | Specific, objective milestones | Subjective "satisfactory diligence" |

| Escrow Amount | Low (5–10%) | High (15–20%+) |

Be cautious with "Material Adverse Change" (MAC) clauses, ensuring they clearly define what counts as a material decline in business performance. This prevents buyers from backing out too easily. You might also include a provision limiting the management team’s involvement in due diligence – typically 10–20% of their time – to avoid disrupting daily operations.

"The LOI serves as a blueprint for the prospective deal and encapsulates the primary terms mutually agreed upon by the buyer and seller." – Ryan Yergensen, Member of Corporate Practice, Greenberg Traurig

5. Completing the Transaction

Once due diligence is complete and the LOI (Letter of Intent) is agreed upon, the final phase of an M&A deal kicks off. But don’t underestimate its importance – almost 40% of transactions stall at this stage, with delays often stretching beyond three months.

"The closing stage is where most M&A deals fail – not during diligence or valuation." – Joe Anto, Managing Director, PCE

This step requires meticulous coordination across legal, financial, and operational teams. Typically, it takes two to three months after signing the LOI to reach the finish line.

Completing the Purchase Agreement

The purchase agreement is the cornerstone of the transaction. It locks in the purchase price, spells out representations and warranties, and defines indemnification terms, including caps, baskets, and survival periods.

One critical element is the disclosure schedules, which outline exceptions to the representations and warranties. These schedules must be accurate and tied back to your due diligence findings to avoid post-closing disputes or indemnification claims. Overlooking these details can lead to significant headaches later.

Additionally, ancillary documents like a Bill of Sale, Assignment and Assumption Agreements, intellectual property assignments, and, if applicable, a Transition Services Agreement (TSA), should be prepared and included.

"Trust is the glue that holds the deal together until closing and you must do everything you can to build and maintain it." – Jacob Orosz, President, Morgan & Westfield

Post-closing adjustments, such as net working capital true-ups, earn-out calculations, and escrow release schedules, should be clearly documented. Include exact formulas and timelines to minimize disputes. Many sellers aim for month-end closings, as it simplifies the preparation of the closing balance sheet and streamlines working capital calculations.

Once the purchase agreement is finalized, the focus shifts to satisfying all closing conditions.

Managing Closing Requirements

Key closing requirements include securing regulatory approvals, such as Hart-Scott-Rodino antitrust filings for larger deals, and obtaining any necessary industry-specific permits or licenses. Third-party consents from landlords, key customers, and vendors should be secured 30–60 days before the closing date.

Appointing a "deal captain" or closing project manager is essential. This person ensures all moving parts – like signature sets, wire instructions, board resolutions, and title transfers – are tracked and completed without oversight.

| Component | Key Activities | Risk of Failure |

|---|---|---|

| Purchase Agreement | Finalize reps, warranties, indemnities, and escrow terms | Misalignment in indemnity exposure or buyer exit |

| Third-Party Consents | Obtain lease assignments and key vendor/customer consents | Holdouts or higher consent costs causing delays |

| Regulatory Compliance | Secure antitrust filings and industry-specific approvals | Denials or unexpected divestiture demands |

| Financial Closing | Arrange wire instructions, lender agreements, and funding | Financing issues or fluctuating interest rates |

| Final Tasks | Complete closing binders, board resolutions, and signatures | Missing signatures or mismatched wire accounts |

Conducting a "dry run" or pre-closing rehearsal 30–60 days before the target date helps identify potential issues, such as incomplete signature sets or incorrect wire instructions.

"The goal is to have no surprises, so being transparent throughout the process and having documents ready in advance helps both sides." – Joe Hellman, CPA, Redpath CPAs

Final confirmatory diligence is often performed just before closing. This includes a last walk-through, inventory count, and equipment inspection to ensure the business is handed over as agreed. During this interim period, sellers must maintain normal operations – this means avoiding actions like accelerating accounts receivable collections, delaying accounts payable, or making major capital investments without buyer approval.

Financial logistics also play a key role. Confirm financing arrangements, set up escrow accounts for holdbacks, and execute wire instructions for the purchase price. An escrow agent acts as a neutral party, holding funds and documents until all conditions are met before releasing payment and transferring ownership.

Modern closings are frequently virtual, with electronic signatures and funds released upon confirmation of all documents. Whether you choose a same-day sign-and-close or opt for a short gap between signing and closing, keeping this period brief helps reduce the risk of unexpected issues.

Using Deal Memo for Closing Support

Deal Memo’s platform offers a centralized, secure repository for all closing documents. It tracks uploads, downloads, and completed diligence requests, while also flagging any missing documents. This ensures a smooth and organized process.

Their dedicated account team collaborates with all parties to manage signature sets, ancillary documents, and folder organization for items like officer certificates, IP assignments, bills of sale, and escrow agreements. With unlimited updates, you can make adjustments during negotiations without worrying about version conflicts.

"A smooth signing and closing is key to the success of any merger or acquisition. Although it may seem routine, the signing and closing of a transaction involves attention to detail and careful preparation." – Practical Law Corporate & Securities

This streamlined approach minimizes risks like missing signatures, mismatched wire accounts, or incomplete disclosure schedules – common pitfalls that can derail a deal at the last moment.

Conclusion

Navigating a professional M&A process demands a structured and disciplined approach. From creating a compelling CIM to managing the closing stages, success hinges on preparation, clear communication, and the right tools. Ultimately, the difference between a fruitful acquisition and a costly misstep isn’t just about having a polished pitch deck – it’s about ensuring every transaction aligns seamlessly with your overarching enterprise strategy. This disciplined alignment is the cornerstone of successful deals.

As Don Harrison, VP of Corporate Development at Google, points out:

M&A will never be 100% successful and we learn from every deal we do […] I’ve learned [to make] sure the strategy drives the M&A, as opposed to the M&A driving the strategy.

Buyers who evaluate targets against well-defined criteria consistently secure better results. Leveraging a data-driven scorecard – rating factors like strategic alignment and cultural fit on a 1-to-5 scale – helps identify the right opportunities while quickly filtering out mismatches.

Creating competitive tension among buyers is another key factor that influences deal value. Sellers who attract multiple buyers, particularly strategic ones capable of unlocking synergies, often achieve higher valuations. This approach allows sellers to avoid settling for the first offer and instead secure premium pricing. Modern platforms play a crucial role in supporting these strategies by simplifying execution and enhancing efficiency.

Professional tools like Deal Memo streamline the entire M&A process, especially during the closing phase. It’s no surprise that most Fortune 500 companies rely on advanced work management platforms to handle the complexity of these transactions.

FAQs

What’s the difference between strategic and financial buyers in an M&A process?

The key distinction between strategic buyers and financial buyers in the M&A process lies in their objectives and how they approach acquisitions.

Strategic buyers are usually companies operating within the same or a related industry. Their primary goal is to strengthen their business by leveraging synergies. This could mean cutting costs, expanding into new markets, or boosting revenue. For them, the acquisition is about aligning with their long-term business plans and seamlessly integrating operations.

On the other hand, financial buyers, such as private equity firms or investment funds, focus on generating financial returns. They often look for undervalued or fast-growing companies they can improve and eventually sell at a profit, typically within a specific timeframe. Their priority is financial performance, valuation, and planning for a profitable exit, rather than merging operations.

Recognizing these differences is essential for shaping your M&A strategy, from structuring the deal to planning what happens after the acquisition.

What impact does a well-organized auction have on the success of an M&A deal?

A well-run auction can significantly boost the success of an M&A deal by creating a competitive atmosphere among potential buyers. This competition often pushes bidders to present their strongest offers, helping sellers achieve higher valuations and better deal terms.

Beyond driving competition, auctions offer a structured approach to negotiations. This structure minimizes misunderstandings and promotes transparency throughout the process. Auctions also tend to attract serious buyers who are ready to dive into thorough due diligence, which can save both time and resources. By assembling a solid group of interested buyers, a carefully managed auction increases the chances of reaching the best possible deal and aligning with the seller’s strategic objectives.

What is the purpose of a Virtual Data Room (VDR) in M&A due diligence?

A Virtual Data Room (VDR) is a must-have tool during the due diligence phase of an M&A deal. It serves as a secure, centralized hub where sellers can share sensitive documents with potential buyers. This setup not only ensures confidentiality but also allows buyers to review critical information in a controlled and efficient manner.

What makes VDRs so effective are features like activity tracking, audit logs, and Q&A tools. These tools help sellers monitor buyer engagement and gauge their level of interest. By providing secure access, streamlining communication, and maintaining transparency, a VDR becomes an essential part of ensuring the due diligence process runs smoothly and efficiently.