When selling your business, reaching out to the right buyers is critical. A targeted buyer universe focuses on qualified buyers who understand your business, have the financial capacity to close the deal, and see strategic value in the acquisition. Instead of reaching out to everyone, this approach prioritizes precision, ensuring better offers, confidentiality, and faster transactions.

Key Takeaways:

- Higher Offers: Targeted outreach creates competition among buyers, driving up valuations.

- Confidentiality: Avoid leaks by vetting buyers and sharing sensitive details only with serious prospects.

- Efficiency: Focused efforts reduce delays and attract buyers ready to act.

This method isn’t about quantity – it’s about quality. By carefully selecting and vetting buyers, you can protect your business while maximizing its value during the sale process.

Benefits of a Targeted Buyer Universe

Focusing on a well-curated buyer list can lead to higher deal valuations, greater confidentiality, and speedier transactions. These advantages often set successful exits apart from underwhelming ones. Let’s break down these benefits.

Higher Valuations Through Buyer Competition

A carefully targeted buyer list creates competition among potential buyers, driving up offers. When multiple qualified buyers bid simultaneously, it creates a "private auction" effect, compelling buyers to present their strongest offers upfront. This dynamic also minimizes the chances of price renegotiations during due diligence.

"It’s only through this competitive bidding process that you maximize the price. The more LOIs you receive, the higher you drive up the price." – Jacob Orosz, President, Morgan & Westfield

Data supports this: a list of 100 potential buyers typically results in 11 signed NDAs, while a list of 400 can yield 39 NDAs. However, the quality of the list matters even more than its size. Strategic buyers often pay higher multiples than financial buyers because they value synergies like proprietary technology, market share, or customer access – advantages that are hard to duplicate. Additionally, targeting buyers who have completed multiple acquisitions in the past 1–5 years increases your chances, as these buyers are proven to be active and capable of closing deals.

Having multiple Letters of Intent (LOIs) also strengthens your negotiating position. It prevents you from being dependent on a single buyer who might attempt to renegotiate the price during due diligence.

Lower Confidentiality Risks

Casting a wide net with an unvetted buyer list can expose your business to unnecessary risks. If word of a potential sale leaks, employees might seek new jobs, customers could look for alternative suppliers, and competitors might exploit the uncertainty. These factors can harm your company’s valuation before the deal even closes.

A targeted buyer list reduces these risks through thorough vetting and a phased approach to sharing information. For instance, in one transaction, careful screening reduced a broad inquiry pool to just 20% who were eligible to receive confidential materials.

The process typically starts with an anonymous "teaser" that highlights key financials and growth potential without revealing your company’s identity. Only buyers who sign an NDA receive the full Confidential Information Memorandum (CIM). Additionally, serialized CIMs can trace potential leaks back to their source, adding another layer of security.

"Your broker is there to safeguard this information and qualify the buyer, not the other way around." – Jonah Pollone, MidStreet

Faster Transaction Timelines

Delays can derail deals. Prolonged timelines often frustrate buyers, who may lose interest as new opportunities arise. By minimizing confidentiality risks and focusing on qualified buyers, a targeted approach helps streamline the process.

Experienced buyers, such as private equity groups, are already familiar with NDAs, data room protocols, and due diligence, which speeds up the transaction. These groups often operate on strict timelines, aiming for internal rates of return between 20%–30% annually. This urgency drives them to move quickly through acquisitions.

Introducing all qualified buyers at the same time and setting clear deadlines for indications of interest creates momentum. This parallel process ensures that if one lead falls through, others are already advancing at the same stage. In contrast, broad marketing efforts often attract "tire-kickers" or hobbyists who inquire out of curiosity but waste months without closing.

Types of Buyers to Include

Recognizing the different categories of buyers is key to aligning your business sale strategy with your goals. Each buyer type comes with its own motivations, valuation methods, and deal structures. By understanding these distinctions, you can better target the right buyers to achieve the best outcome for your business.

Strategic Buyers

Strategic buyers are typically companies – like competitors, suppliers, or customers – that acquire businesses to create synergies. These buyers aim to streamline operations, eliminate overlap, and explore cross-selling opportunities. Because of these added benefits, they often pay higher multiples than other buyer types.

"Strategic buyers are the holy grail of buyers and may pay a higher multiple than others if they cannot easily replicate what the seller’s company has to offer." – Jacob Orosz, President, Morgan & Westfield

However, strategic buyers are selective, targeting less than 5% of middle-market companies. They usually focus on acquisitions that are between 5% and 20% of their own company’s size and are more likely to act if they have a history of closing deals. To maximize your chances, focus on companies actively pursuing acquisitions rather than those casually exploring growth opportunities.

Financial Buyers

Financial buyers, such as private equity groups and family offices, approach acquisitions as standalone investments. Their primary focus is on cash flow, Return on Investment (ROI), and Internal Rate of Return (IRR), with expectations of annual returns between 20% and 30%. Unlike strategic buyers, they aren’t looking for operational synergies but instead base their valuations on EBITDA and a business’s ability to generate consistent cash flow.

These buyers typically hold onto businesses for 3 to 7 years before exiting through a sale or IPO. Many private equity firms have a minimum threshold, often requiring businesses to generate at least $1.2 million in EBITDA. Smaller deals demand the same level of due diligence and operational work but don’t deliver proportional returns.

"For private equity, it takes the same amount of work to analyze a company’s financials and re-do its operations for a company that is making $10 million per year in profit as it does to do the same work for a company that is making $1 million per year in profit." – Team Acquira

For added flexibility, consider buyers who blend financial resources with strategic intent.

Sponsor-Backed Strategic Buyers

Sponsor-backed strategic buyers combine the strengths of strategic and financial buyers. In this model, a private equity firm uses one of its portfolio companies as a platform for further acquisitions. These buyers bring the operational focus of a strategic buyer alongside the financial backing of institutional capital.

For instance, a smaller competitor might have private equity support, giving it access to significant resources. These buyers can act quickly, offer competitive pricing, and aim to scale through economies of scale or market expansion. This hybrid approach not only enhances deal value but also strengthens competitive dynamics in the buyer pool.

How to Build a Targeted Buyer Universe

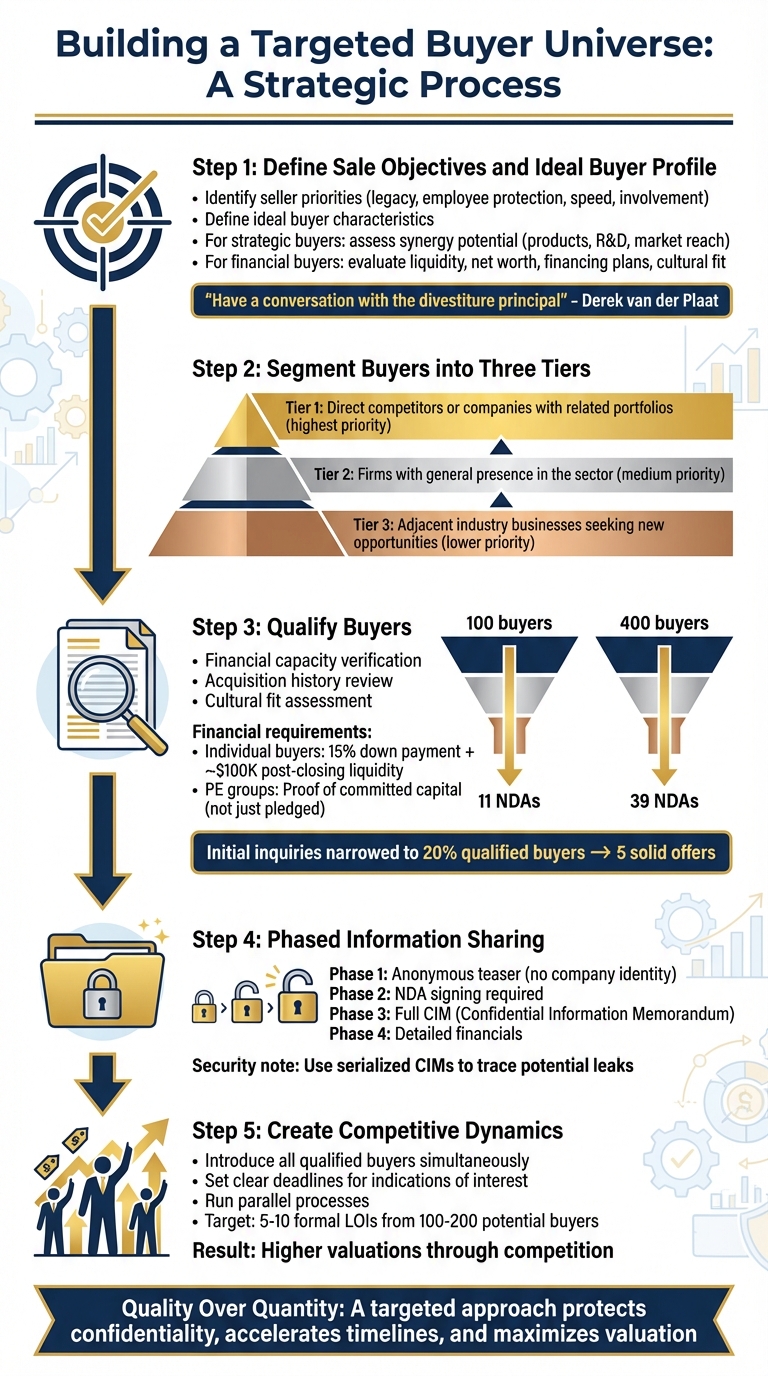

How to Build a Targeted Buyer Universe for Business Sales

Define Sale Objectives and Ideal Buyer Profile

Creating a targeted buyer universe starts with understanding the seller’s priorities beyond just the sale price. Some sellers may want to preserve their company’s legacy, protect employees, or maintain the brand’s reputation. Others might seek a quick exit or prefer to stay involved through earnouts or equity arrangements.

"The first step in constructing a buyer list is having a conversation with the divestiture principal. He/she will know the immediate competitors they face every day and why or why not they will be ‘good’ buyers." – Derek van der Plaat, Managing Director, Veracap M&A International Inc.

Once the seller’s goals are clear, the next step is defining the ideal buyer profile. For strategic buyers, this means identifying how the acquisition aligns with their goals – whether it’s through complementary products, shared R&D efforts, or expanding market reach. For financial buyers, it’s essential to evaluate their liquidity, net worth, and financing plans. Equally important is ensuring their management style and values align with the company’s existing culture.

By clarifying the seller’s objectives and establishing a detailed buyer profile, you can create a more focused and precise buyer universe. The next step is to segment and assess potential buyers systematically.

Segment and Qualify Buyers

After defining the ideal buyer profile, organize potential buyers into three tiers based on their likelihood of interest and strategic compatibility.

- Tier 1 includes direct competitors or companies with related portfolios.

- Tier 2 covers firms with a general presence in the sector.

- Tier 3 consists of businesses in adjacent industries seeking new opportunities.

This tiered approach ensures outreach efforts are targeted and efficient.

Next, it’s time to qualify buyers. Assess their financial capacity, acquisition history, and cultural fit. For instance, in one case, initial inquiries were narrowed down to 20% qualified buyers, leading to five solid offers. This process ensures that only serious buyers gain access to confidential materials.

"Your business broker should require [individual buyers] to have cash on hand for at least a 15% down payment plus ≈$100k of post-closing liquidity before sending them a non-disclosure agreement (NDA)." – Jonah Pollone, MidStreet

Recent data from 2023 emphasizes the importance of quality over quantity. A buyer list of 100 names resulted in an average of 11 signed NDAs, whereas a list of 400 names generated about 39 NDAs. To further ensure financial readiness, request proof of funds or committed capital disclosures from private equity groups.

This method not only streamlines the process but also creates competitive dynamics among qualified buyers, ultimately leading to better valuations.

Use Deal Memo for Buyer Universe Development

Developing a buyer universe involves thorough research, outreach, and qualification. Deal Memo simplifies this process by offering a white-labeled service to create tailored buyer lists that align with the seller’s goals. With a dedicated account team and a turnaround time of 72 hours, Deal Memo provides efficient, customized results. This service saves valuable time, allowing you to focus on managing the transaction while maximizing value for your client.

sbb-itb-798d089

Common Mistakes in Buyer Targeting and How to Avoid Them

Creating Over-Broad Buyer Lists

Casting too wide a net when targeting buyers can backfire. Including too many parties – especially competitors – puts your business at risk of sensitive information leaks and exploitation by rivals. For instance, one firm received over 170 inquiries and reached out to 52 groups, but only 34 (around 15%) were deemed qualified to access confidential marketing materials. Managing such a large pool of unqualified buyers often leads to delays and drains the management team’s energy, ultimately stalling the transaction process.

"The success of any auction is directly proportional to the number of qualified participants." – Jacob Orosz, President, Morgan & Westfield

How to fix it: Introduce a tiered screening process. Start with an initial interview, require a Non-Disclosure Agreement (NDA), and have potential buyers complete a questionnaire before sharing sensitive materials. For individual buyers, verify they have sufficient liquid assets – typically at least 15% cash for a down payment plus about $100,000 in post-closing liquidity. For private equity groups, confirm they have "committed capital" rather than just "pledged" funds. To secure 5-10 formal Letters of Intent (LOIs), aim for a targeted list of 100-200 potential buyers, which should result in 30-40 serious conversations.

Once your list is refined, understanding buyer motivations becomes the next critical step.

Ignoring Buyer Motivations

Knowing why a buyer is interested in your client’s business is just as important as knowing who they are. Buyer motivation directly impacts the price – those with a high strategic need or clear synergies often pay a premium. Failing to assess motivation can attract "tire-kickers" or "perennial buyers" who waste time without any real intent to close.

"The greater the need for an asset, the more a buyer will be willing to pay." – Axial

Overlooking a buyer’s long-term goals can also derail deals late in the process. For example, if a buyer’s plans – such as relocating the business, cutting staff, or rebranding – clash with the seller’s legacy goals, the seller might reject an offer after weeks of negotiations. Even seemingly ideal buyers can become unsuitable if they’re currently bogged down with transaction delays, raising a new fund, or integrating a recent acquisition.

How to fix it: Present the opportunity in a way that resonates with the buyer’s specific needs, such as market entry, filling technology gaps, or achieving vertical integration. For corporate buyers, focus on division managers who would directly benefit from the synergies of the acquisition, rather than just contacting the corporate development office. Use a phased screening process that requires buyers to provide a detailed profile, including their background, timeline, and goals, before granting access to sensitive details.

Keeping your buyer list relevant is equally important for a successful transaction.

Failing to Update the Buyer List

The buyer landscape changes quickly. A company that wasn’t ready six months ago could now be a prime candidate after securing funding or completing a prior acquisition. Conversely, a buyer who was actively seeking deals a few months ago might now be facing budget constraints or transaction delays.

"The buyer list is an evolving document. While an advisor has tremendous resources and many relationships at his/her disposal, they will never identify all potential buyers before engaging in the process." – Derek van der Plaat, Managing Director, Veracap M&A International Inc.

When distributing a "teaser", private equity groups often suggest additional interested parties or reveal connections that weren’t initially obvious. This feedback can help refine and expand the list. Additionally, if a buyer passes on the deal, their reasons can provide valuable insights into messaging flaws or market conditions that might require adjustments.

How to fix it: Regularly monitor buyer activity and confirm whether potential acquirers are still active in your segment. Share information in stages – starting with an NDA, followed by the Confidential Information Memorandum (CIM), and then financials – to weed out unqualified or uncooperative buyers while keeping the list focused on serious contenders. Additionally, engage private equity groups to identify "add-on" opportunities for their portfolio companies, which might not be immediately obvious. Frequent updates ensure your buyer list stays aligned with the goals of the sale and reflects current market dynamics.

Conclusion

Building a well-defined buyer universe is a cornerstone of any successful M&A transaction. By concentrating on qualified and motivated buyers, you create the competitive dynamics necessary to drive up the purchase price while safeguarding your client’s sensitive information. Instead of casting a wide net, a targeted approach ensures stronger offers and reduces the risks tied to managing inquiries from unqualified parties. This strategy not only increases deal value but also aligns perfectly with the key principles outlined earlier.

Carefully segmenting and vetting potential buyers based on their financial ability and genuine intent ensures that sensitive business details are shared only with those who have the capability to close the deal. This approach helps protect your client’s stakeholders from the disruptions that can arise from premature leaks or unnecessary exposure.

"Selling your business is not like listing a used car… If you want a premium outcome, you need to build the right buyer universe: intentionally, methodically, and strategically." – Bryan Hunsinger, Acquiring Alpha

FAQs

How does creating a targeted buyer universe help protect confidentiality during a business sale?

A well-defined buyer audience is key to maintaining confidentiality during a sale process. By reaching out only to a carefully chosen group of qualified buyers, you can control who gains access to sensitive information. The initial outreach typically involves a non-identifying teaser – just enough to spark interest without giving away critical details.

Detailed, confidential information is reserved for buyers who meet specific qualifications and show genuine intent to proceed. This strategy not only limits unnecessary exposure but also reduces the chances of sensitive data falling into the wrong hands, ensuring discretion remains intact throughout the process.

What’s the difference between strategic and financial buyers when selling a business?

Strategic buyers are typically companies operating in your industry, seeking acquisitions that align with their broader goals. Their focus is on creating synergies – whether that’s by broadening their product offerings, breaking into new markets, or strengthening their competitive position. Because these acquisitions play a key role in their long-term plans, strategic buyers often place a premium on the value of your business, sometimes offering higher prices than other buyer types.

On the other hand, financial buyers, such as private equity firms, are primarily driven by investment returns. They target businesses with stable, predictable earnings – usually over $1,200,000 annually – and aim to enhance their value before selling them for a profit. Unlike strategic buyers, they’re not as focused on integrating the business into their operations. Instead, they concentrate on improving financial performance and positioning the business for a lucrative resale down the road.

Why is it important to keep the buyer list updated during the business sale process?

Keeping your buyer list current is essential to maintaining a competitive edge and staying aligned with your objectives. Over time, some buyers may lose interest, fail to meet financial qualifications, or even transition into competitors. By regularly reviewing and updating your list, you can remove these less viable prospects and replace them with new, qualified buyers who emerge along the way. This ensures your list stays relevant and improves your chances of securing the best possible deal.

An updated buyer list also makes the sales process more efficient by focusing your efforts on serious, qualified prospects. Instead of wasting time on outdated leads, you can concentrate on candidates who are most likely to move forward. This targeted approach not only speeds up negotiations but can also lead to better valuations and a smoother overall transaction.