When selling a business, buyers will ask questions to assess risks, growth potential, and operational stability. Sellers who prepare detailed answers and documents ahead of time can avoid deal delays or losing buyer interest. Key areas buyers focus on include:

- Reason for Sale: Buyers want to know why you’re selling. Personal reasons like retirement are less concerning than financial distress.

- Post-Sale Transition: Will you stay for a handover period to train staff and introduce clients? A sudden exit can raise doubts.

- Financial Health: Buyers scrutinize revenue, profitability (SDE/EBITDA), and cash flow. They’ll request 3–5 years of financial records, tax returns, and bank statements.

- Customer Base: High client concentration (e.g., one client >15% of revenue) signals risk. Buyers also check customer retention and contracts.

- Operational Independence: Can the business run without you? Owner-dependent businesses are less attractive.

- Assets and Liabilities: Buyers evaluate tangible (equipment, inventory) and intangible assets (trademarks, goodwill) while identifying hidden liabilities like debts or lawsuits.

- Growth Potential: Buyers assess market trends, competition, and scalability.

Preparation is key. A Confidential Information Memorandum (CIM) helps address these questions upfront, ensuring buyers see value and reducing negotiation hurdles.

10 Questions Smart Buyers Ask

Why Are You Selling the Business?

This is one of the most critical questions for any potential buyer. It helps determine whether they are stepping into a thriving, well-managed operation or walking into a situation riddled with hidden challenges. The answer not only shapes the buyer’s confidence but also aligns with the broader narrative presented in the Confidential Information Memorandum. Buyers need to know: are they acquiring a business ready for growth, or one burdened by issues the seller is eager to offload?

"Knowing why a business is being sold upfront can give buyers confidence or the ability to walk away as soon as possible".

Honesty is key. Reasons like retirement or relocation often reassure buyers, as they suggest personal motivations rather than business troubles. On the other hand, vague or evasive explanations can raise red flags. For instance, if a seller claims "burnout" but the business heavily relies on their daily involvement, buyers may see this as a sign of over-dependency on the owner.

The most concerning scenario? A sale driven by financial distress. Team Acquira cautions:

"If the seller explains that the company’s finances are their main reason for selling, that’s an instant red flag".

Sellers who position the sale as "I’ve taken this as far as I can" often fare better, especially if they can show that the business needs new resources or expertise to reach its next stage. This approach frames the sale as an opportunity for growth rather than a problem to solve.

This naturally leads to another important area of inquiry: the seller’s intentions after the sale.

Seller’s Goals and Post-Sale Plans

Buyers want to know what happens once the deal is done. Will the seller vanish, or will they stay to ensure a smooth transition? A seller willing to stick around for a 90–100-day handover period demonstrates commitment. During this time, they can introduce key customers, train staff, and share those unwritten details that are essential to the business’s success.

Post-sale plans also reveal how much the business depends on the seller’s personal involvement. A sudden departure by an owner who holds key client relationships can lead to a revenue drop of up to 20%. As one business broker explains:

"Typically you will lose 20% revenue in any transition, if the owner is the main reason for sales, then that number grows".

Savvy sellers address this risk upfront. Offering to sign non-compete and non-solicitation agreements can reassure buyers that the business won’t face competition from its former owner. In some cases, sellers even retain a minority stake to show they believe in the company’s future success.

Timeline and Urgency of the Sale

Another key factor is how quickly the seller wants to close the deal. Is there a pressing reason for the sale, or is the timeline flexible? This can reveal the seller’s level of leverage. A seller in a rush – perhaps due to health issues or financial strain – has less negotiating power. Buyers may interpret urgency as desperation, which can lead to lower offers or stricter terms.

Ali Masoud from PCE’s M&A practice highlights this dynamic:

"A buyer with a clear, logical rationale will likely stay committed through due diligence and negotiations".

A reasonable timeline, often 60–90 days, signals confidence and control. On the other hand, overly aggressive or fluctuating deadlines can raise doubts. Clear and honest communication about timing not only helps avoid misunderstandings but also keeps negotiations on track. Sellers who can explain their timeline and show flexibility are in a stronger position to manage the process without appearing desperate.

Financial Performance Questions

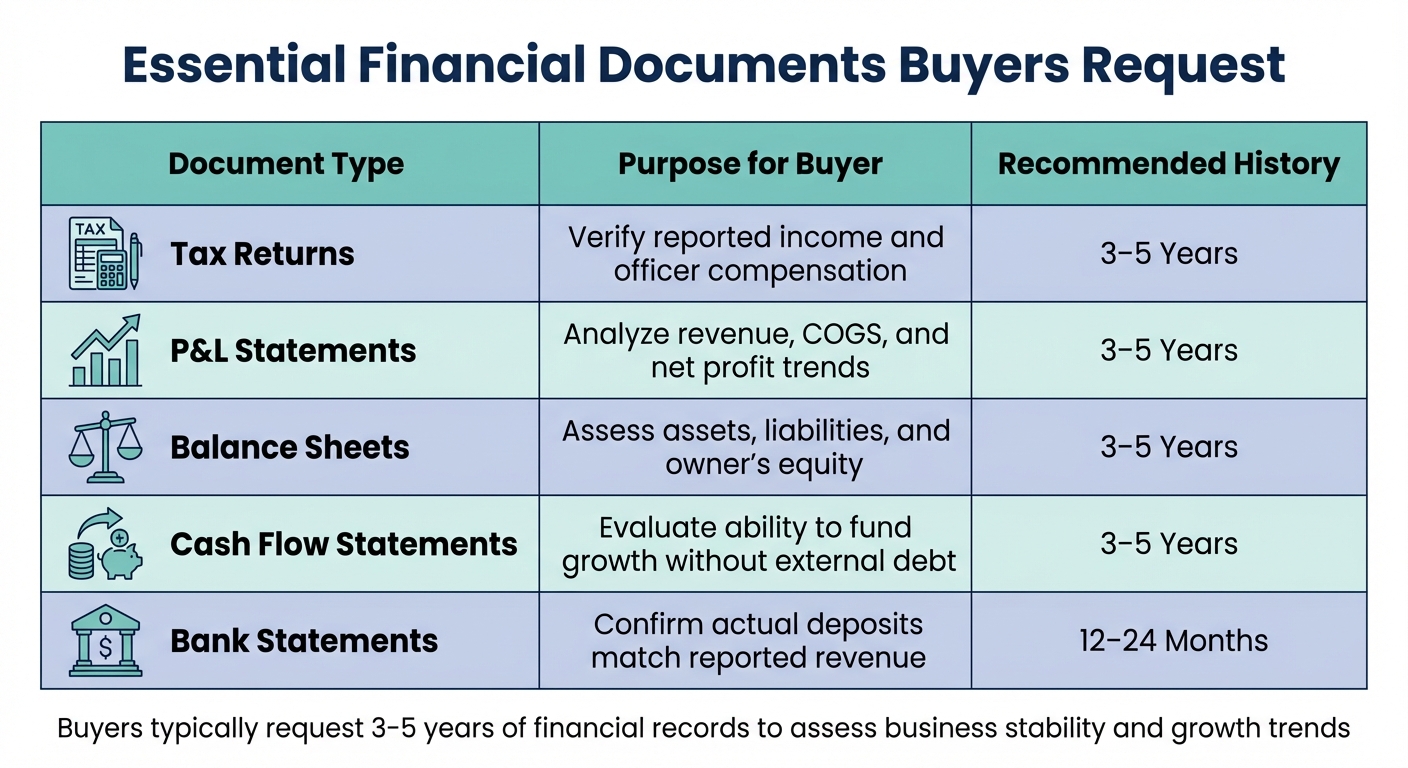

Essential Documents Buyers Request During Business Due Diligence

When buyers start looking into a business, one of their primary concerns is its financial health. They want to know if the business generates steady revenue, maintains solid profit margins, and produces enough cash to keep operations running smoothly. Clear and accurate financial data is a must.

But buyers don’t just glance at high-level numbers. They dig deep – comparing monthly metrics, Profit and Loss statements, tax returns, and bank statements to spot any inconsistencies in reported income. As Sidharth Ramsinghaney, Director of Corporate Strategy and Operations at Twilio, puts it:

"The most revealing red flags often appear in month-over-month operational metrics rather than annual statements. Subtle variations in working capital patterns reveal underlying business weaknesses".

This level of scrutiny means sellers need to prepare their financials early. Buyers won’t settle for vague answers or incomplete records. They expect solid documentation that proves the business can generate consistent earnings under new ownership.

Revenue, Profitability, and Cash Flow

Buyers carefully examine revenue trends to understand if the business is expanding, holding steady, or declining. A steady increase in revenue over several years is a positive sign. However, revenue alone doesn’t tell the full story. A company can bring in millions but still lose money if its fixed costs are too high or if its profit margins are too slim.

To get a clearer picture, buyers focus on profitability metrics like Seller’s Discretionary Earnings (SDE) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). These numbers reveal how much money the business actually keeps after covering expenses. A Quality of Earnings (QoE) analysis can further refine these figures by excluding one-time or non-recurring costs, highlighting the business’s reliable earning potential.

Cash flow is another critical factor. Buyers review cash flow statements to separate operating, investing, and financing activities. They want to see that the business generates enough cash from its core operations to meet obligations without depending on outside financing. A company with strong revenue but weak cash flow might struggle to handle immediate needs after a sale. Additionally, a high percentage of overdue accounts receivable can signal poor collection practices or revenue that may not convert to cash.

Historical Financials and Projections

Beyond evaluating current performance, buyers rely on historical financial records to build confidence in the business. Typically, they request three to five years of financial data, including tax returns, balance sheets, and Profit and Loss statements. These documents provide a foundation for assessing the business’s track record. Tax returns, in particular, are critical because they verify reported income and officer compensation. Buyers also ask for 12 to 24 months of bank statements to ensure reported revenue matches actual deposits.

| Document Type | Purpose for Buyer | Recommended History |

|---|---|---|

| Tax Returns | Verify reported income and officer compensation | 3–5 Years |

| P&L Statements | Analyze revenue, COGS, and net profit trends | 3–5 Years |

| Balance Sheets | Assess assets, liabilities, and owner’s equity | 3–5 Years |

| Cash Flow Statements | Evaluate ability to fund growth without external debt | 3–5 Years |

| Bank Statements | Confirm actual deposits match reported revenue | 12–24 Months |

In addition to historical data, buyers closely review financial projections to gauge future potential. These projections must be realistic and backed by clear growth drivers, such as new clients, market opportunities, or proprietary technology. Buyers compare projections with historical performance and current market trends, including interest rates and industry-specific factors. Overly optimistic forecasts without solid justification can undermine a seller’s credibility.

Add-Backs and Adjustments

To present a clearer picture of profitability, sellers often adjust financials by adding back discretionary or personal expenses that won’t apply to the new owner. Common add-backs include excessive owner compensation, personal travel, vehicle expenses, one-time legal fees, and costs unrelated to the business’s core operations. These adjustments are used to calculate SDE or EBITDA, which play a key role in determining the business’s valuation.

However, buyers carefully scrutinize these adjustments. If an add-back is deemed invalid, it directly reduces the valuation by the adjustment amount multiplied by the deal’s earnings multiple.

As M&A Science explains:

"A quality of earnings report is a good indicator of a company’s profitability under new ownership. This process removes one-time events from their income statement and focuses on EBITDA".

Sellers should ensure their financials are normalized well ahead of the sale. Providing detailed documentation – like a debt schedule and a list of long-term assets with purchase dates and depreciation – can strengthen valuation claims and reassure buyers.

Customer and Market Questions

Beyond crunching the numbers, buyers dig deep into the customer base and market dynamics to ensure consistent growth is achievable. Once they’ve reviewed the financials, their attention shifts to the people and markets fueling those figures. Buyers want to know who the customers are, how loyal they remain, and whether the industry has room to grow. Even a company with strong earnings today can look risky if it relies too heavily on a small group of clients or operates in a shrinking market.

Customer Concentration and Retention

A detailed breakdown of revenue by customer is non-negotiable for buyers – they want to pinpoint which accounts drive the business. High customer concentration, where a single client contributes more than 15% of revenue, often raises red flags for acquisition entrepreneurs. Troy Frank from Indiana Equity Brokers explains it well:

"If a small number of clients or suppliers account for a large portion of revenue or inventory, losing one could have a dramatic impact on the business’s bottom line".

This kind of dependency can lower a company’s valuation, as businesses with limited client diversity are seen as riskier investments. The risks spike even further when any single customer exceeds 20% of revenue.

Buyers also scrutinize the strength of customer relationships. Are clients tied to the company through long-term contracts, or can they leave at any moment?. Another key factor is whether customer loyalty is linked to the business itself or primarily to the owner. If the owner plays a central role in maintaining top accounts, buyers will worry about losing those relationships after the sale.

Retention metrics are equally critical. Buyers analyze churn rates over the past two years, aiming to understand why customers left and how the business replaced that lost revenue. A business with a diverse, loyal customer base signals stability, while high churn – especially if it’s due to poor service or losing out to competitors – raises serious concerns.

| Customer Metric | Buyer Concern | Risk Level |

|---|---|---|

| Concentration | Single client >15% of total revenue | High |

| Retention | High churn rate in the last 24 months | High |

| Contract Status | Month-to-month or verbal agreements | Medium-High |

| Relationship | Client loyalty tied to the owner | High |

| Diversification | Revenue spread across many small accounts | Low |

Industry Trends and Growth Potential

Buyers don’t just evaluate the present – they also look ahead. They analyze sales forecasts, client acquisition strategies, and product pipelines to gauge growth potential.

The company’s position within its industry matters just as much. Buyers look for competitive advantages, often called a "brand moat", such as intellectual property, trademarks, or patents that make it harder for competitors to replicate the business model. They also assess whether the industry is growing or facing potential disruption, like emerging technologies that could render the business model outdated.

The 2025 M&A landscape offers some interesting trends. Favorable macroeconomic conditions, including lower borrowing costs and flexible regulatory frameworks, are fueling value-driven deals. Private equity firms are behind nearly 30% of global M&A transactions, often targeting businesses with strong technology or digital capabilities. Additionally, the retirement of nearly 80 million baby boomers over the next decade is expected to trigger a massive transfer of small business assets.

Buyers often ask sellers what growth opportunities they would pursue if they weren’t exiting the business. Sellers typically have valuable insights into untapped potential. Alongside these conversations, buyers review market research, advertising budgets, and strategic plans to ensure that growth projections are rooted in data rather than wishful thinking. As ExitAdvisor puts it:

"no fixed rules or formulas apply to value how much your business is worth. Its value will always be what you are willing to sell for and what the potential buyer is willing to pay".

These market insights, combined with solid financials, help sellers address buyer concerns with clarity and confidence in follow-up discussions.

sbb-itb-798d089

Operations and Employee Questions

Once buyers complete their financial and market evaluations, their attention shifts to the nuts and bolts of the business – its operations and the team running it. The goal? To ensure the business can stand on its own, even without the current owner.

Key Personnel and Leadership Structure

A big question buyers ask is whether the business depends too heavily on the owner. There’s a stark difference between an "owner-dependent" business – where the owner is the lifeline – and a "management-led" business, where a capable team runs the show. Michelle Casper from The Retail Law Group doesn’t mince words:

"If operations fall apart without [the owner], you’re not buying a business – you’re buying a person’s job".

This issue becomes even more pressing when the owner holds critical licenses, like a General Contractor’s license, that the buyer might not have. Since SBA regulations restrict a seller’s involvement after the sale, buyers need confidence that the business can function without the owner. Josh Moore from MidStreet puts it plainly:

"Ideally, the owner is not the hardest working/most important person in the business".

A strong leadership team, rather than a one-person show, reassures buyers and minimizes risks.

Buyers also dig into other personnel details, such as whether family members on the payroll might leave or receive special treatment. To safeguard the business’s value, they’ll check for signed agreements, like non-disclosure, non-compete, and non-solicitation contracts, with key employees. If the owner’s personal relationships drive most of the sales, buyers may view the business as less stable after a change in ownership.

| Factor | Attractive | Risky |

|---|---|---|

| Leadership | Management team in place; owner focuses on strategy. | Owner is the primary operator; business halts without them. |

| Key Personnel | Multiple employees hold key knowledge/licenses. | Only one "key-man" or the owner holds critical licenses. |

| Staff Stability | Long-term employees with non-compete agreements. | High turnover or staff likely to leave with the owner. |

| Owner Role | Owner works minimal hours or is semi-absentee. | Owner works 60+ hours/week in daily operations. |

Supplier Relationships and Dependencies

Buyers don’t just focus on internal operations – they also look at the business’s external partnerships. Supplier concentration is a major concern, similar to customer concentration. If a business relies heavily on one or two suppliers, it’s a red flag. Losing a key supplier could have a devastating impact, as Troy Frank from Indiana Equity Brokers has pointed out.

Another key factor is whether supplier contracts and favorable terms can be transferred to the new owner. Michelle Casper advises buyers to ask:

"Long-standing vendor relationships matter. Are they reliable, exclusive, or replaceable?"

With the seller’s permission, buyers often reach out to key suppliers directly to confirm the business’s good standing and ensure no price increases or contract changes are on the horizon. During the transition period – typically lasting up to six months – formal introductions to key vendors can help maintain trust and continuity.

Scalability and Operational Risks

For buyers, scalability is the ultimate test of a business’s potential. Can the business grow without hitting major roadblocks or requiring a fortune in new investments? Overdependence on the owner or outdated systems can stifle growth. Buyers are especially interested in automation, streamlined processes, and diversified supply chains that can support future expansion.

Sellers should be ready to discuss areas of improvement they’d tackle with unlimited resources. As Green & Co. Business Brokers explains:

"Buyers pay for the past, but buy it for the future".

This means identifying areas where the business is poised for growth but needs additional funding or expertise to get there. Buyers also examine inventory levels closely. Too much inventory can hint at inefficient spending or difficulties in moving products, which can hurt cash flow and slow growth.

Assets, Liabilities, and Risk Questions

Once buyers have examined financial, customer, and operational performance, their attention shifts to evaluating the balance sheet. Here, they focus on distinguishing valuable assets from liabilities that could pose future challenges.

Tangible and Intangible Assets

Buyers need clarity on both physical and non-physical assets. Tangible assets – like real estate, machinery, equipment, inventory, vehicles, and furniture – are evaluated based on their original purchase prices, adjusted for depreciation, and their remaining useful life.

Intangible assets, though harder to value, often represent significant long-term value. These include patents, trademarks, copyrights, trade secrets, proprietary software, brand names, and goodwill[41, 43]. Such assets are key drivers of future economic returns.

Sellers should conduct an intellectual property (IP) audit to confirm ownership, validity, and transferability of all IP assets. This includes reviewing any existing licensing agreements. A clear understanding of these assets lays the groundwork for identifying potential liabilities.

Legal and Financial Liabilities

Hidden liabilities can derail a deal. Buyers pay close attention to outstanding loans, lines of credit, accounts payable, and tax obligations. Contingent liabilities, like pending lawsuits, product warranties, or environmental cleanup costs, are particularly concerning.

A Uniform Commercial Code (UCC) filing search is critical for uncovering unpaid loans or vendor liens that might transfer with the business. As attorneys J. Gerard Legagneur and Amanda Hayes from Nolo explain:

"Due diligence is the process by which the buyer requests from the seller any documents, data, and other information… to identify any potential liabilities or roadblocks that could affect the transaction".

Employment-related risks are also reviewed, including past labor disputes, wrongful termination claims, and underfunded pensions. For industrial companies, environmental audits and hazardous material disclosures can uncover potential cleanup liabilities. Rick Smith of Forbes Burton advises caution:

"If the selling party is trying to offload a problem business, then they’re unlikely to be completely upfront about that, but watch for any apprehension in their answers and investigate every angle that could be an issue".

To protect against undisclosed liabilities, buyers often negotiate a purchase price hold-back. This involves retaining a portion of the payment for 6–12 months post-closing to cover any surprises that may arise later.

Competitive Landscape and Threats

Beyond internal assets and liabilities, buyers also assess external risks that could impact the business’s future. This includes analyzing whether the target market is contracting, the industry is in decline, or competitors are outperforming with stronger growth or larger market shares[13, 38]. A high dependency on a few customers is another red flag – if the top three customers generate more than 30% of sales, the business could be vulnerable.

| Risk Category | Specific Vulnerabilities to Investigate |

|---|---|

| Financial | Tax liens, undisclosed debts, bad debt write-offs, shrinking profit margins [13, 46] |

| Legal | Pending litigation, zoning violations, regulatory penalties, patent disputes [13, 38, 46] |

| Market | Customer attrition, competitor expansion, industry decline, seasonal fluctuations [13, 38, 12] |

| Operational | High employee turnover, outdated systems, expiring supplier contracts, equipment breakdowns [45, 38, 12] |

| Intangible | Brand reputation issues, loss of proprietary expertise, data breaches, expired licenses [13, 38, 34] |

Buyers also scrutinize contracts for expiration dates, potential cost increases, and "change of control" clauses that might lead to termination upon the sale[45, 34]. In technology-focused businesses, technical debt – stemming from outdated code or infrastructure – can be a significant hidden challenge.

Sellers should be transparent about vulnerabilities and demonstrate how risks are managed. Buyers understand that no business is flawless, but they need confidence that existing threats are under control and won’t jeopardize their investment.

How Deal Memo Helps Sellers Answer Buyer Questions

Deal Memo provides tailored tools and services to help sellers confidently address buyer questions, ensuring every stage of the presentation process is clear and effective.

White-Labeled CIM/OM Preparation

A strong Confidential Information Memorandum (CIM) is key to addressing buyer concerns about financial health, operations, and growth potential. By focusing on metrics like EBITDA and excluding one-time events, sellers can justify their asking price more effectively. This is crucial, considering that nearly 75% of businesses on the market fail to sell, often due to incorrect pricing or unsubstantiated valuations.

Deal Memo’s CIMs are designed to tackle common obstacles that derail deals. For example, they address areas like customer concentration and supplier dependencies – factors buyers closely examine to assess the risks of losing key clients or partners. These documents also outline the management structure and identify key personnel, helping reassure buyers that the business can operate smoothly under absentee or semi-absentee ownership. Additionally, they provide a clear breakdown of both tangible assets (like equipment, inventory, and real estate) and intangible assets (such as intellectual property, trademarks, and goodwill), offering a comprehensive view that supports the asking price.

As Shep Campbell, an M&A Agent at Merger & Acquisition Specialists, puts it:

The true value of a business is found in between the top line and bottom line of a tax return. That is where the cash flow is.

Deal Memo builds on this foundation by conducting thorough interviews and managing data securely to refine the seller’s narrative.

Seller Interviews and Data Room Setup

Structured seller interviews are another critical step in Deal Memo’s process. These conversations extract key insights that buyers often seek during due diligence. Sellers can clearly articulate their reasons for selling in a way that doesn’t deter potential buyers. This process also identifies potential red flags, such as owner dependency – a major concern for buyers who fear the business may not thrive without the current owner.

The interviews uncover growth opportunities and provide insider knowledge that helps buyers envision potential returns on investment. They also surface hidden risks, like pending litigation or supplier dependencies, which should be disclosed early – ideally before the 60- to 90-day due diligence period begins. Using this information, Deal Memo sets up a secure data room, giving buyers immediate access to critical documents such as customer lists, supplier contracts, intellectual property filings, and at least three years of audited financial statements and tax returns. This streamlined access is vital, as over 50% of M&A deals fail due to inefficiencies in the process.

As buyer inquiries evolve, Deal Memo ensures the seller’s story remains consistent and aligned with expectations through ongoing updates.

Unlimited Revisions for Precision

Buyers often have extensive questions about financials, operations, and growth potential. Deal Memo’s unlimited revision policy allows sellers to update materials in real time, addressing concerns like customer concentration or intellectual property as they arise. This ongoing refinement ensures risks are clarified or mitigated before they become deal-breakers during negotiations.

Accurate financial data is critical. Buyers expect up-to-date information, including the last four quarters of activity and current-year projections. Revisions help sellers keep the CIM current, reflecting the latest EBITDA adjustments and add-backs – key elements in justifying the asking price. As Ali Masoud, Director in PCE’s M&A practice, notes:

A buyer with a clear, logical rationale will likely stay committed through due diligence and negotiations. Vague or overly opportunistic answers can signal a lack of focus or intent to lowball later.

This flexibility also allows sellers to customize their presentations to highlight synergies that align with a specific buyer’s goals, such as entering a new market or acquiring proprietary technology. By ensuring transparency and addressing potential concerns proactively, sellers build trust and credibility. They can also correct errors or provide additional details – on topics like employee turnover or supplier dependencies – before these issues are flagged independently.

Conclusion

Selling a business successfully hinges on preparation and transparency. Buyers typically ask between 50 and 70 due diligence questions, covering everything from legal history to supplier relationships. Organizing key documents early not only keeps the deal moving but also builds trust with potential buyers. As ExitGuide highlights, sellers are legally obligated to provide accurate information in business purchase agreements, making honesty both a practical and contractual necessity.

Being upfront and well-organized fosters trust and lays the groundwork for a productive buyer-seller relationship. Thorough preparation also helps avoid delays. Blake Taylor, Managing Director at Synergy Business Brokers, underscores this point:

"The best transactions occur when both buyers and sellers develop a relationship with the common interest of making the transaction effective".

This trust often starts with acknowledging business weaknesses, which can enhance credibility by showing a clear, realistic understanding of operations.

Deal Memo simplifies this process. Its white-labeled CIM preparation ensures financials are presented clearly, with EBITDA adjustments and add-backs that justify the asking price. Seller interviews and data room setup streamline document organization, allowing sellers to respond promptly during due diligence. Plus, an unlimited revisions policy ensures materials stay updated as buyer questions arise, keeping negotiations on track.

Preparation like this can make or break a deal. With over half of M&A deals failing due to inefficiencies in the process, professional tools and planning are critical. Sellers who position weaknesses as growth opportunities, develop transition plans to address owner dependency, and maintain concise, organized documentation set themselves up for success.

Given that selling a business often takes one to two years, having the right tools and support can mean the difference between closing a deal and watching it fall apart.

FAQs

What are the key warning signs buyers should watch for when evaluating a business for sale?

When you’re considering buying a business, it’s crucial to keep an eye out for warning signs that might signal trouble ahead. For instance, if the seller’s reasons for selling seem unclear or vague, it could hint at underlying problems like financial struggles or operational headaches. Another big red flag? Inconsistent or inaccurate financial records – these could point to mismanagement or even attempts to hide poor performance.

You should also be cautious of businesses with heavy reliance on a single customer or supplier. If those relationships were to change, the business could face serious challenges. Similarly, frequent management turnover might indicate internal instability, making it worth investigating further. Other potential issues include outdated equipment, failure to comply with regulations, or hidden liabilities like unresolved lawsuits or significant debts.

The bottom line? Conducting thorough due diligence is key. Dig deep to uncover any potential risks and ensure the business is a good fit before committing to the purchase.

How can sellers showcase the growth potential of their business to attract buyers?

Sellers can showcase their business’s growth potential by presenting clear, data-driven insights that resonate with potential buyers. Start with detailed financial records that highlight consistent revenue growth, strong profit margins, and steady cash flow. These numbers paint a picture of stability and pave the way for future success.

Next, outline specific growth opportunities. This might include expanding into new markets, launching additional products, or tapping into underserved customer segments. Sharing insights into industry trends, competitive strengths, and upcoming projects can further demonstrate the business’s potential. Transparency about operational efficiencies and the loyalty of your customer base also helps build trust with buyers. By combining strong financial performance, strategic growth plans, and open communication, sellers can attract serious and qualified buyers.

Why should a seller create a Confidential Information Memorandum (CIM) before selling their business?

Creating a Confidential Information Memorandum (CIM) is a crucial step in selling a business. This document gives potential buyers a professional and detailed snapshot of the company. It covers essential aspects like financial performance, growth potential, operational structure, and competitive strengths. By addressing these key areas, a CIM not only instills confidence in buyers but also simplifies the sales process by tackling common questions early on.

When crafted with accuracy and transparency, a CIM minimizes misunderstandings and ensures smoother negotiations. It also enhances the business’s appeal as an investment, helping sellers secure a fair valuation and close the deal successfully.